In line with the S&P 500 analysis I am reverting the main wave count to the most common structure, a double flat.

The alternate wave count is the least common Elliott wave structure, an expanding triangle. The rarity of this structure must mean this alternate has a very low probability.

The second alternate wave count sees the DJIA in a new bull market to last at least a decade.

Click on the charts below to enlarge.

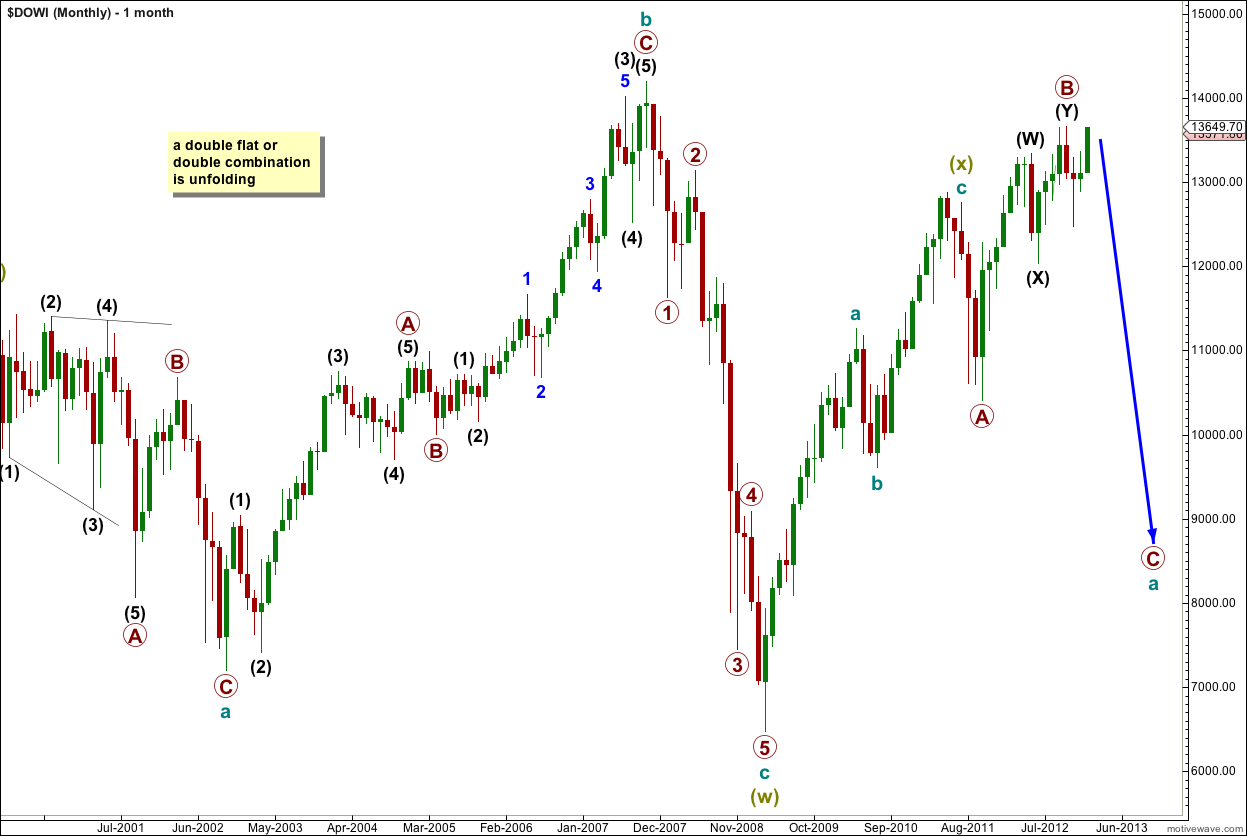

Main Monthly Wave Count.

At grand super cycle degree a double flat may be unfolding.

The first structure in the double labeled wave (w) at super cycle degree (olive green) is a completed expanded flat correction.

The double is joined by a three in the opposite direction labeled super cycle wave (x).

The second structure in the double has begun, labeled super cycle wave (y).

Within super cycle wave (y) wave a at cycle degree is itself unfolding as a flat correction.

Within cycle wave a primary wave A was a three wave structure. Primary wave B has moved beyond the start of primary wave A so this flat would most likely be an expanded flat correction. Primary wave C should make substantial new lows below the end of primary wave A.

The purpose of a double flat is to take up time and move price sideways. Cycle wave (y) would be expected to end about or just below the end of cycle wave (w) at 6,469.95.

Movement below 12,035.09 would invalidate the two alternate wave counts below and so confirm this main monthly wave count.

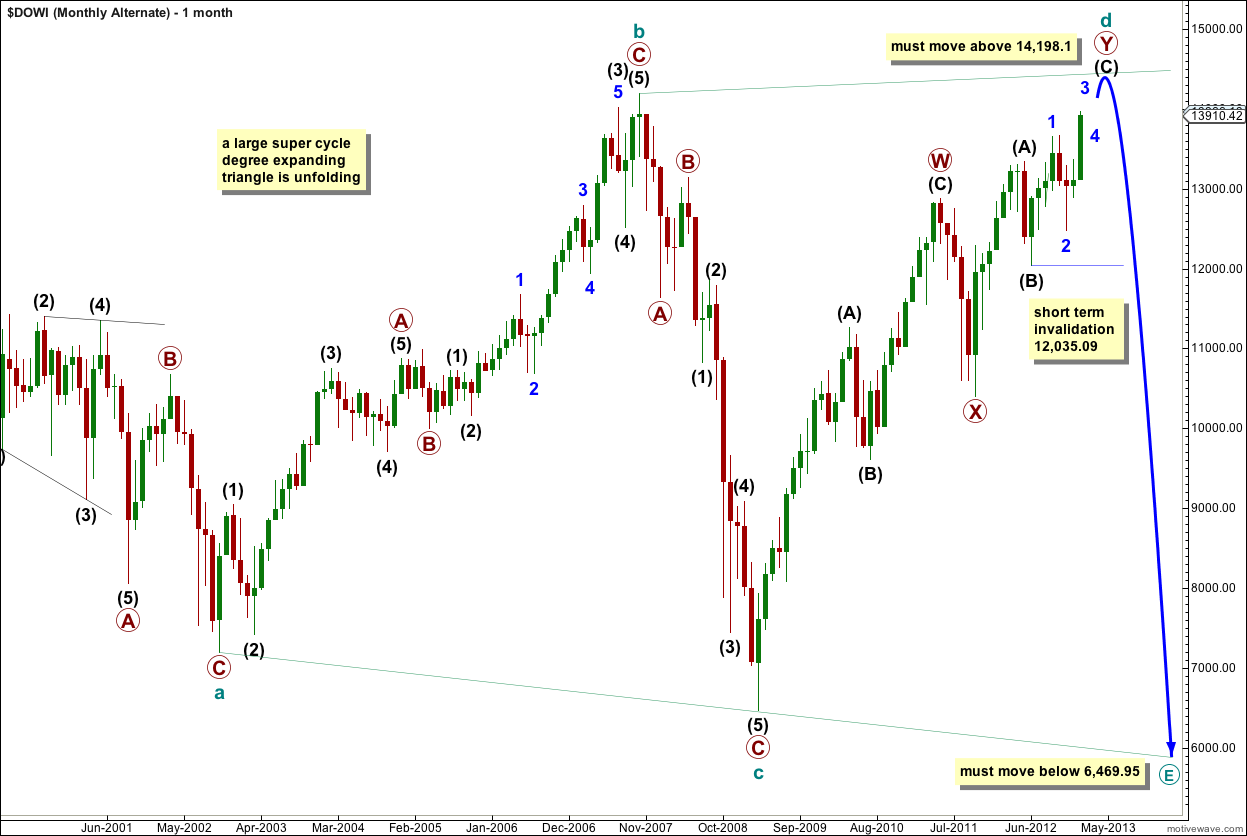

Alternate Monthly Wave Count.

The probability of this alternate must remain very low because this structure is extremely rare. In my years of Elliott wave analysis of up to five markets a day I have only ever seen one (very possibly two) expanding triangles.

A large super cycle expanding triangle may be unfolding. This would be most likely for a super cycle wave IV.

Four of the five subwaves of a triangle must be zigzags or zigzag combinations (doubles). Thus cycle wave c may be an impulse.

Within a triangle one of the five subwaves should be more complicated and longer lasting than the others. This is usually wave c of the triangle, but in this instance it may be cycle wave d which is subdividing into a double zigzag.

Within cycle wave d the first zigzag in the double, primary wave W, is complete. The double is joined by a three in the opposite direction labeled primary wave X. The second zigzag in the double is underway labeled primary wave Y.

An expanding triangle requires cycle wave d to move beyond the end of cycle wave b above 14,198.10.

Within primary wave Y intermediate (black) wave (A) must be seen as a five wave structure.

Within intermediate wave (C) wave 2 may not move beyond the start of wave 1. This wave count is invalidated in the mid term with movement below 12,035.09.

When cycle wave d has made a new high then cycle wave e downwards must complete the triangle. Cycle wave e must subdivide into a zigzag and must take price to a new low below the end of cycle wave c below 6,469.95. Cycle wave e should be another crash as spectacular, or more so, then the “credit crunch” of cycle wave c.

Second Alternate Monthly Wave Count.

This second alternate wave count is the same (in that the subdivisions are the same) as the main monthly wave count up to the low of 6,469.95 here labeled super cycle wave (IV) except it is looking at the possibility that this was the end of a super cycle fourth wave correction, an expanded flat, and that the Dow is now in a new upwards trend to last about a decade for super cycle wave (V).

I have altered the wave count for this second alternate somewhat from last monthly update. Within the new upwards trend it may be more likely that there has been a series of overlapping first and second waves and that cycle wave I is incomplete.

Although intermediate waves (1) and (2) are out of proportion to primary waves 1 and 2, one degree higher, this is less problematic than trying to see the upwards movement from the low at 6,469.95 to the high labeled intermediate wave (1) at 12,876 as a five wave structure.

If this wave count is correct then the Dow is approaching the middle of a third wave which has just begun. It should increase upwards momentum significantly in the coming weeks and couple of months. This does not fit with persistent divergence on MACD and social mood.

Within wave 3 blue no second wave correction may move beyond the start of its first wave. This alternate is invalidated with movement below 12,035.09.