Updated monthly charts are below.

I have still the same three wave counts.

The first, most likely main wave count, sees the S&P 500 in the second structure of a super cycle degree double flat.

There are two alternate monthly wave counts. The first alternate has an extremely low probability because it sees the rarest of all Elliott wave structures, an expanding triangle, unfolding at super cycle degree.

The second alternate sees the start of a new decade long bull market but the many overlaps in the current upward trend and the lack of a clear third wave reduce the probability of this wave count.

Click on the charts below to enlarge.

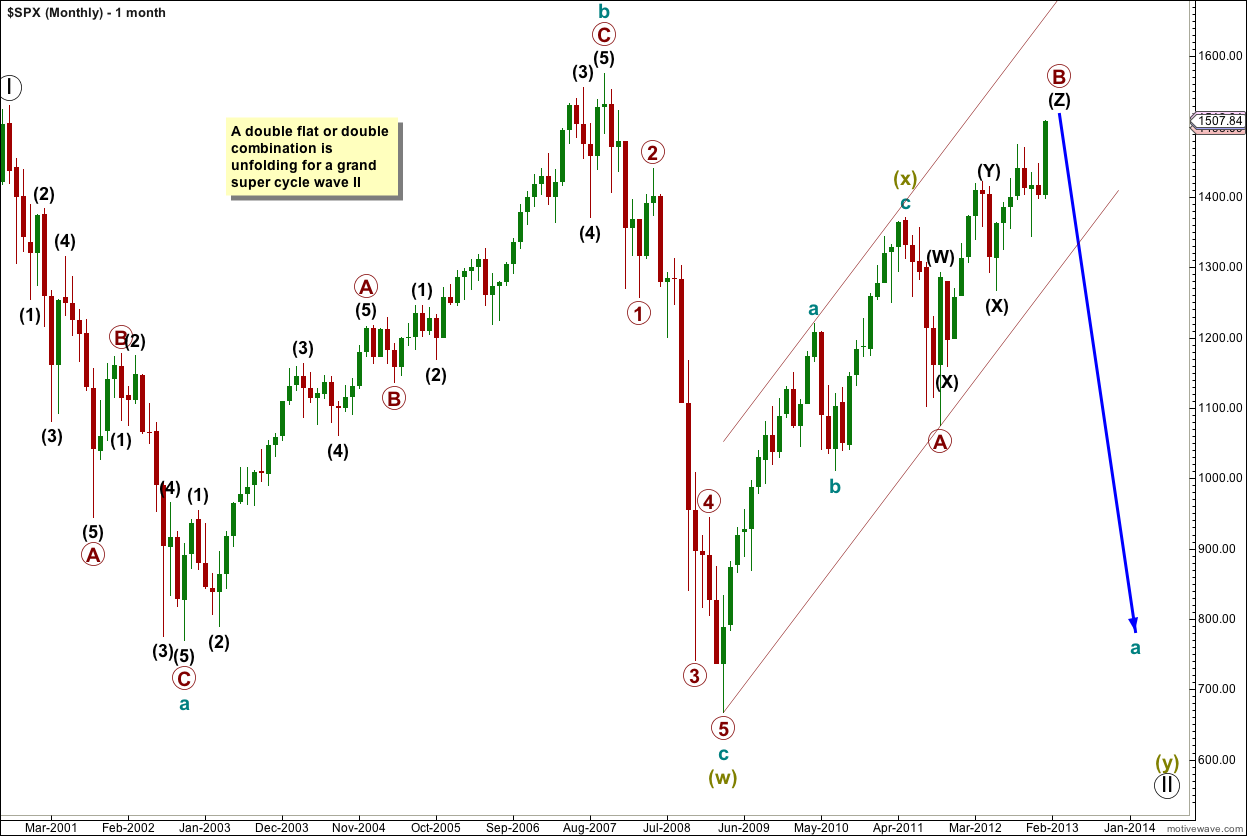

Main Wave Count.

At grand supercycle degree a double flat is unfolding. This is a fairly common structure.

Within the double flat the first structure labeled wave (w) olive green is complete. The three in the opposite direction is a zigzag labeled wave (x) olive green. The second flat in the double labeled wave (y) olive green has begun.

Although super cycle wave (x) lasts only 2.5 years the duration of all other waves fits very well indeed. Overall also it has a typical look. I am prepared to have a main wave count with a brief super cycle X wave for these reasons, particularly as duration for wave degrees is a guideline for form and not a rule.

Within super cycle wave (y) (olive green), cycle wave a is unfolding as a three wave structure, itself a flat correction.

Within cycle wave a primary wave A down was a three and now primary wave B upwards is also a three. Primary wave B is now longer than the maximum common length of 138% of primary wave A. At 1,644 primary wave B would be twice the length of primary wave A. At this point, although the wave count would not technically be invalidated, the probability would be so low that it should be discarded. There is no maximum allowable length of B in relation to A for a flat correction.

Within primary wave B the structure is best seen as a triple zigzag.

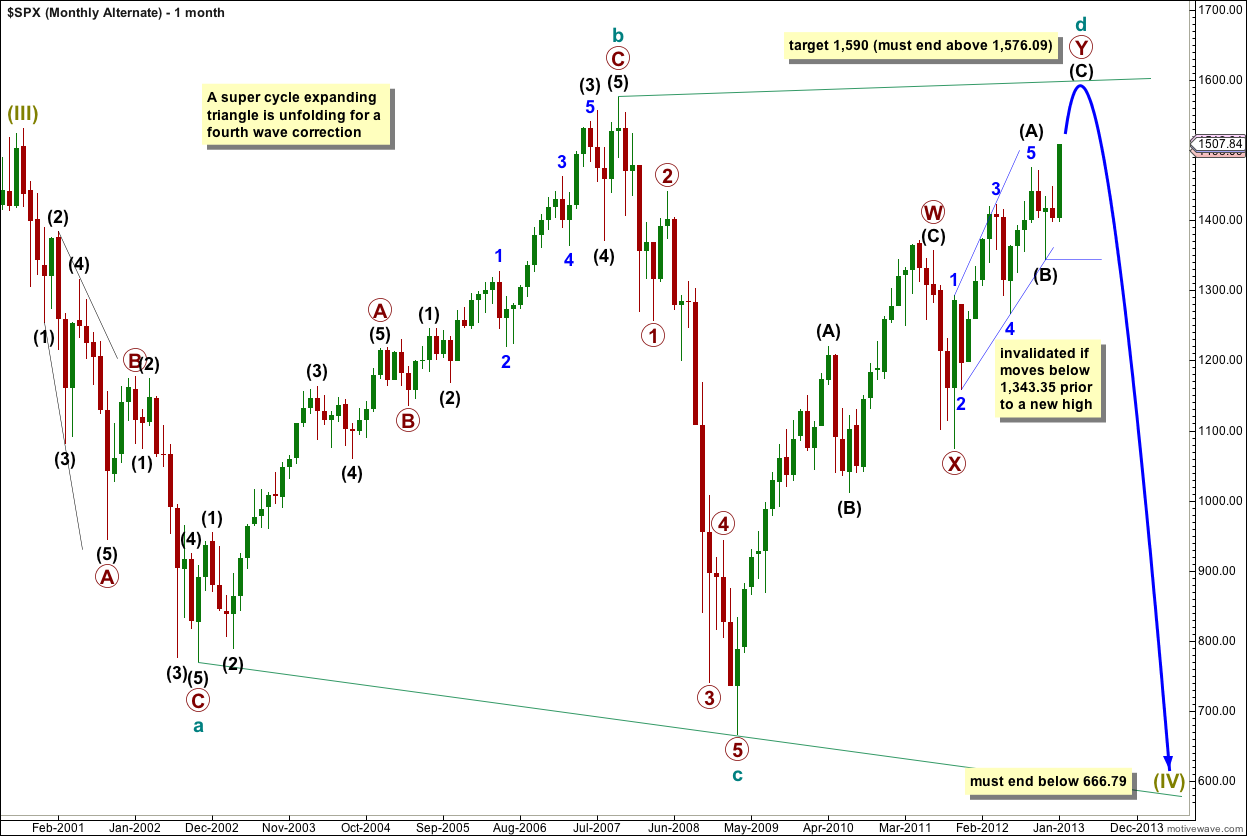

Alternate Wave Count.

Expanding triangles are the rarest of all Elliott wave structures. This reduces the probability of this wave count.

At super cycle degree this wave count sees an expanding triangle unfolding. Within the triangle cycle wave d is unfolding as a longer lasting and more complicated double zigzag structure.

Within this double zigzag the second zigzag labeled primary wave Y is incomplete.

Within primary wave Y wave (C) black is incomplete.

The triangle is expanding because cycle wave c ended below the low of cycle wave a. Within an expanding triangle wave d must move beyond the end of wave b, so cycle wave d must make a new all time high above 1,576.09.

When cycle wave d is complete then cycle wave e should crash to new lows. Cycle wave e must move price below the end of cycle wave c at 666.79.

To the downside within wave (C) black no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement below 1,343.35 in the short term, prior to a new high.

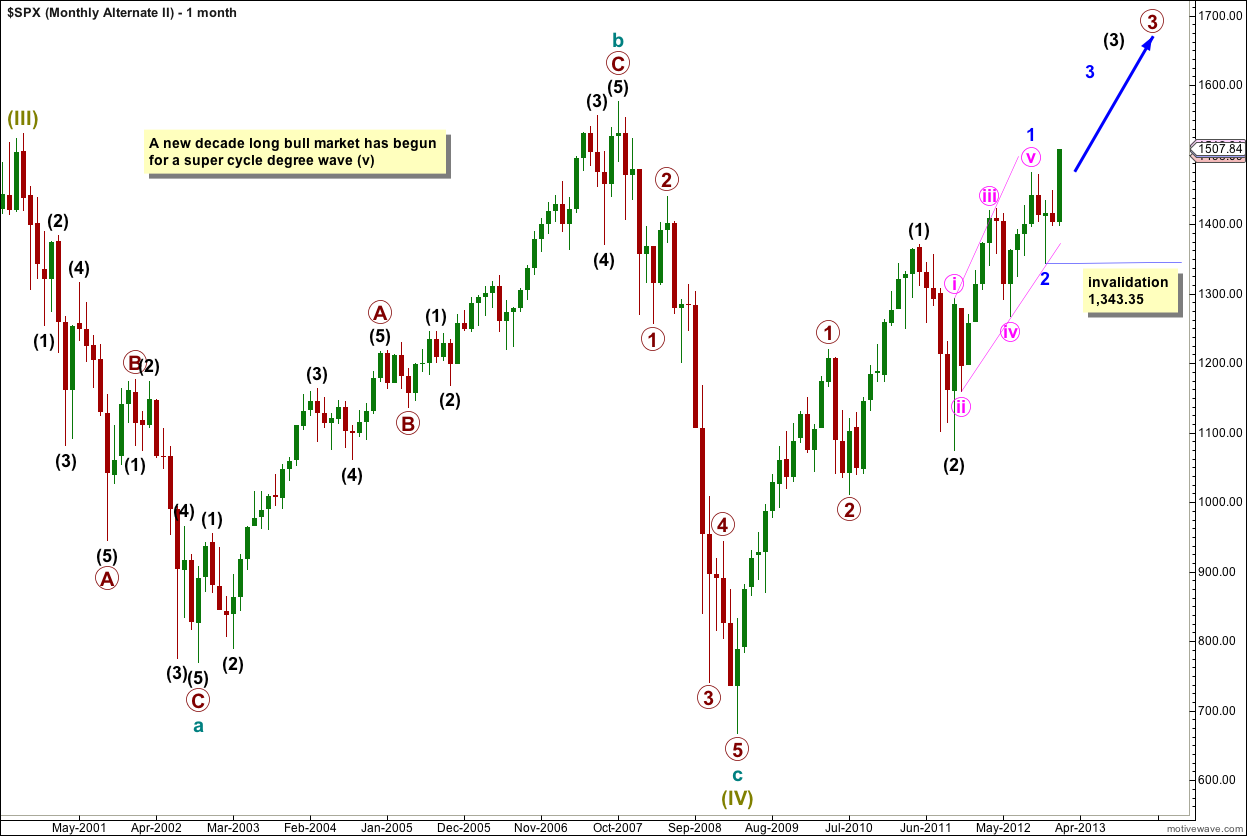

Second Alternate Wave Count.

Finally, it is possible that the big correction ended at the end of the “credit crunch” and the S&P 500 is in a new bull market to last at least a decade.

This wave count does not so far have the right look though. There is so much overlapping in the new upwards trend and the proportions of intermediate (black) waves (1) and (2) are greater then primary waves 1 and 2 of one degree higher. However, this is entirely possible and no rules are broken. It just looks odd.

If this wave count is correct then the S&P 500 is getting ready for some very strong upwards movement as the middle of a third wave begins. A series of overlapping first and second waves is like a coiled up spring; potential energy is released when the third wave unfolds. It should be explosive.

Within wave (3) black wave 1 blue may have begun with a leading diagonal. However, within this diagonal wave v pink is too short. The diagonal is expanding so wave v pink should be longer than wave iii pink but it is not. The third wave is the longest. This reduces the probability of this wave count.

Within wave 3 blue no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement below 1,343.35.