Last analysis expected choppy and overlapping downwards movement from the S&P 500 during Tuesday’s session, which is pretty much what has happened as a new low was made in mostly sideways movement.

The wave count remains the same. The daily chart is the same and the two hourly charts are the same with updates.

Click on the charts below to enlarge.

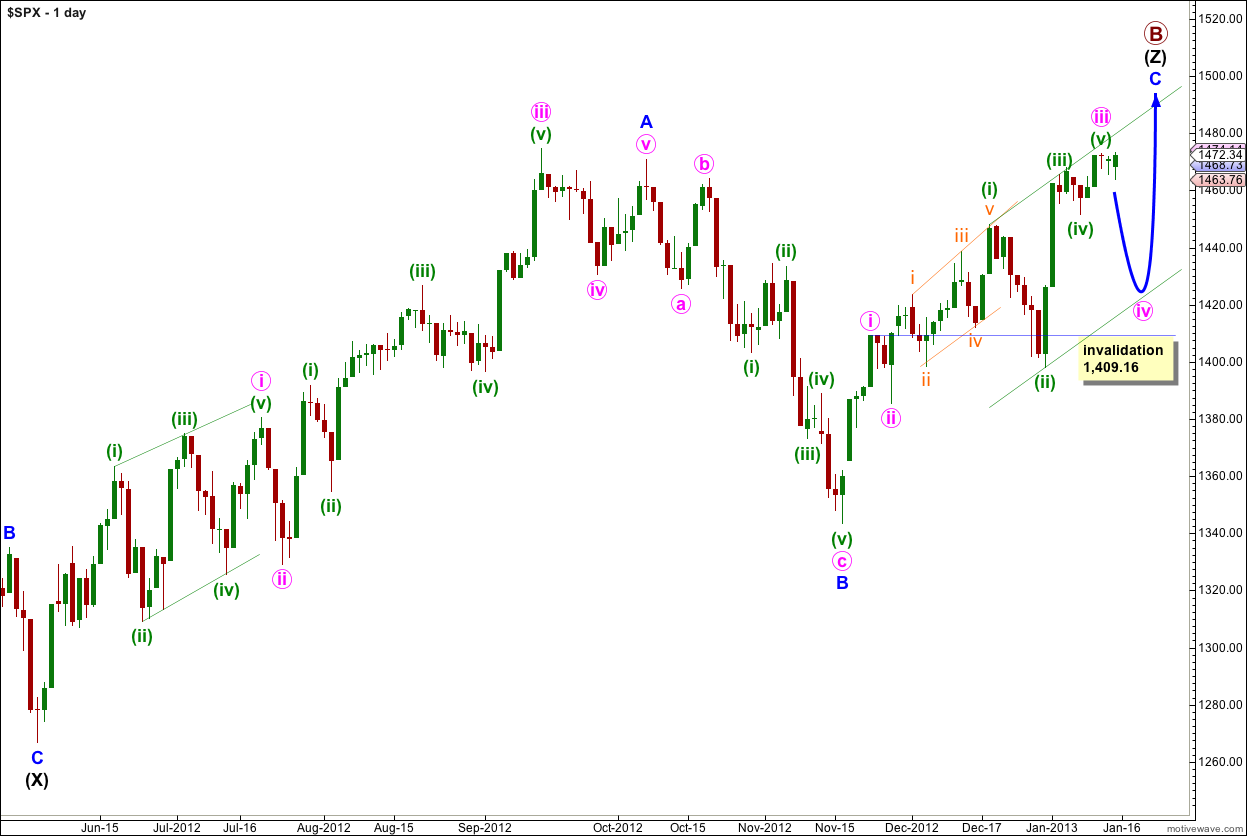

The structure for primary wave B is a triple zigzag, and price is now within the third zigzag in the triple labeled wave (Z) black. Because three is the maximum number of structures within a multiple when this third zigzag is finally complete then the entire correction for primary wave B must be complete. There is no other Elliott wave structure which could allow for upwards movement within this wave count at cycle degree.

Wave (Z) black is incomplete and is unfolding as an exaggerated zigzag.

Wave A blue must be truncated to subdivide into a five wave structure.

At 1,470 wave C blue passed 0.618 the length of wave A blue. Wave C blue has avoided a truncation.

At this time primary wave B has just passed 139% of primary wave A. It is unlikely that price will move too much higher so that primary wave B does not move too far from the common maximum length of 138% the length of primary wave A. When we know the end of waves iii and iv pink within wave C blue then I can use pink wave degree to calculate a target for this upwards movement to end.

There is no upper invalidation point for this wave count, but significant movement above 1,470 has a low probability.

Wave A blue lasted 87 days (2 short of a Fibonacci 89). Wave B blue lasted 28 days. So far wave C blue has lasted 39 days and at this stage I am expecting it to possibly continue for another one to two weeks.

Wave C blue is unfolding as an impulse. The structure is incomplete and requires overall further upwards movement.

Within wave C blue wave iv pink may not move into wave i pink price territory. This wave count is invalidated with movement below 1,409.16.

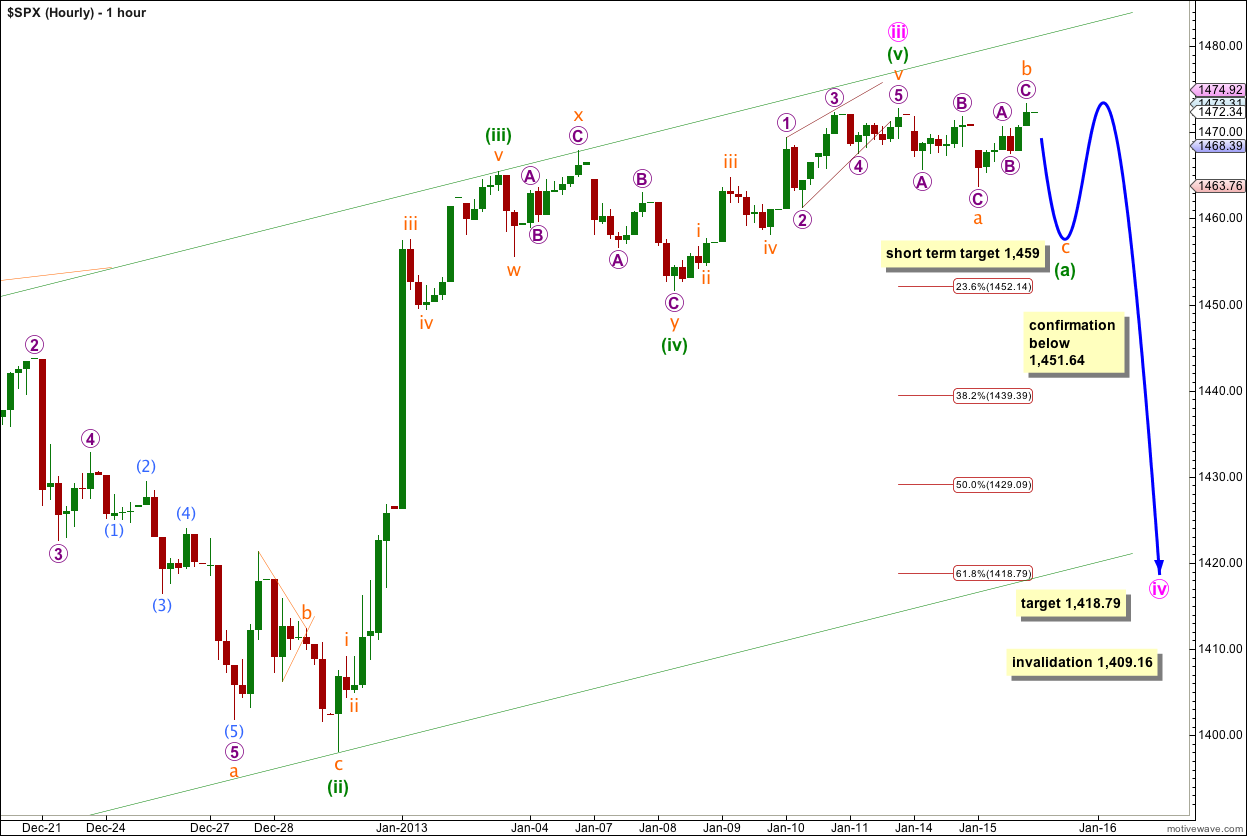

Main Hourly Wave Count.

Wave ii pink was a brief shallow zigzag lasting only three sessions and reaching only 36% of wave i pink. We should expect wave iv pink to show alternation with wave ii pink and so be a deeper correction reaching down to about 1,418.79. It is most likely to be an expanded flat correction, although it may also be a double, combination, triangle or less likely a zigzag.

So far wave (a) green within wave iv pink is likely to be incomplete and looks like it may be unfolding as an expanded flat because wave b orange is a 106% correction of wave a orange and both subdivide into threes. At 1,459 wave c orange would reach 1.618 the length of wave a orange. This may complete wave (a) green.

If wave iv pink is unfolding as an expanded flat (the most common type of flat) then wave (b) green would make a new high beyond the start of wave (a) green at 1,472.75. Wave (b) green would be between 105% to 138% the length of wave (a) green.

Wave (b) green is most likely to subdivide into a zigzag.

Overall I would expect wave iv pink to last another 6 sessions.

This main wave count would be confirmed with movement below 1,451.64.

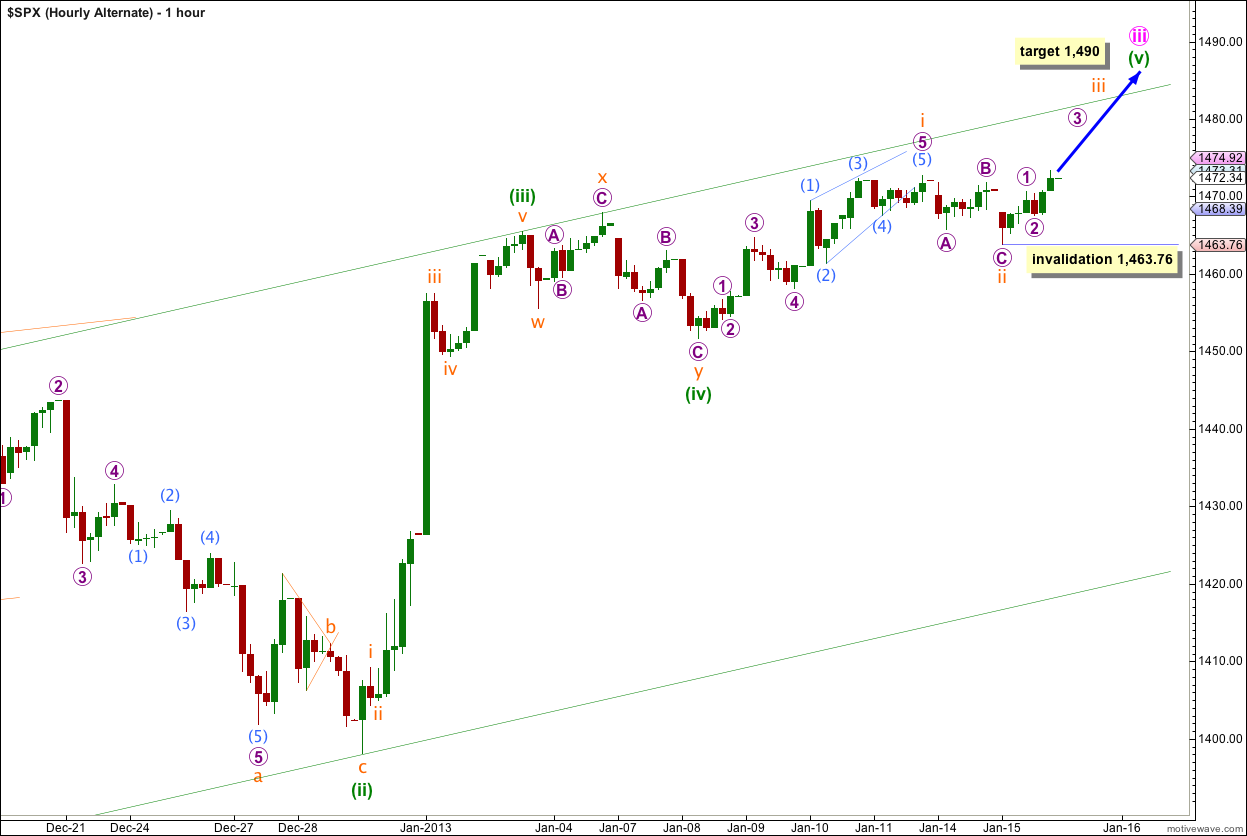

Alternate Hourly Wave Count.

This alternate wave count has a lower probability than the main because it sees more upwards movement and so primary wave B would be longer than 138% the length of primary wave A.

We should only use this alternate wave count if price continues higher in the next few sessions.

At 1,490 wave (v) green would reach 0.618 the length of wave (i) green.

Within wave iii orange no second wave correction may move beyond the start of its first wave. This alternate wave count is initially invalidated with movement below 1,463.76.

If price moves below 1,463.76 then for this alternate downwards movement could possibly be wave ii orange extending as a double or a flat correction. Wave ii orange may not move beyond the start of wave i orange. This wave count is finally invalidated with movement below 1,451.64. However, an extension of wave ii orange would look strange and would severely reduce the probability of this alternate wave count. At that stage I may discard it.