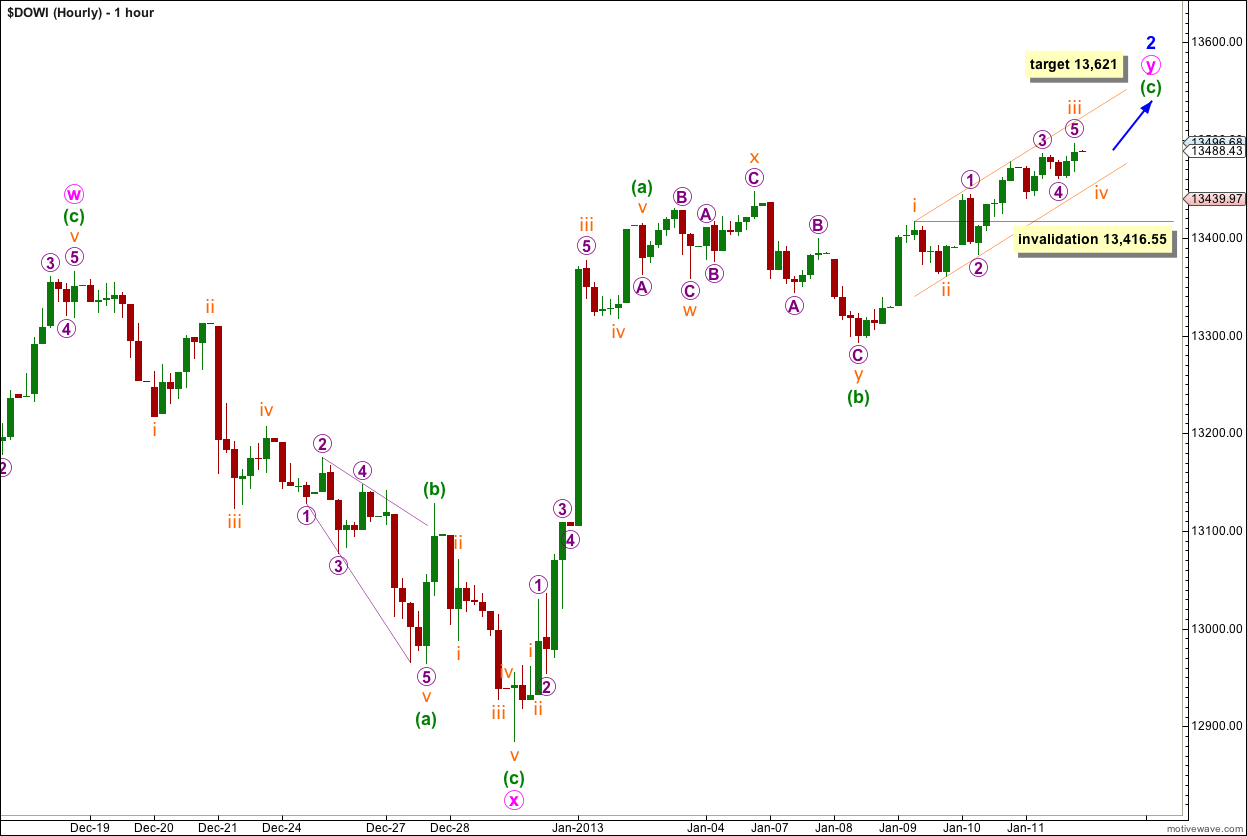

Movement below 13,358.43 invalidated the main hourly wave count and confirmed the alternate. At that stage we had a short term target for downwards movement to end at 13,299. Downwards movement ended just 5.8 points below the target at 13,293.20. Thereafter, price turned higher as expected.

The wave count remains the same.

Click on the charts below to enlarge.

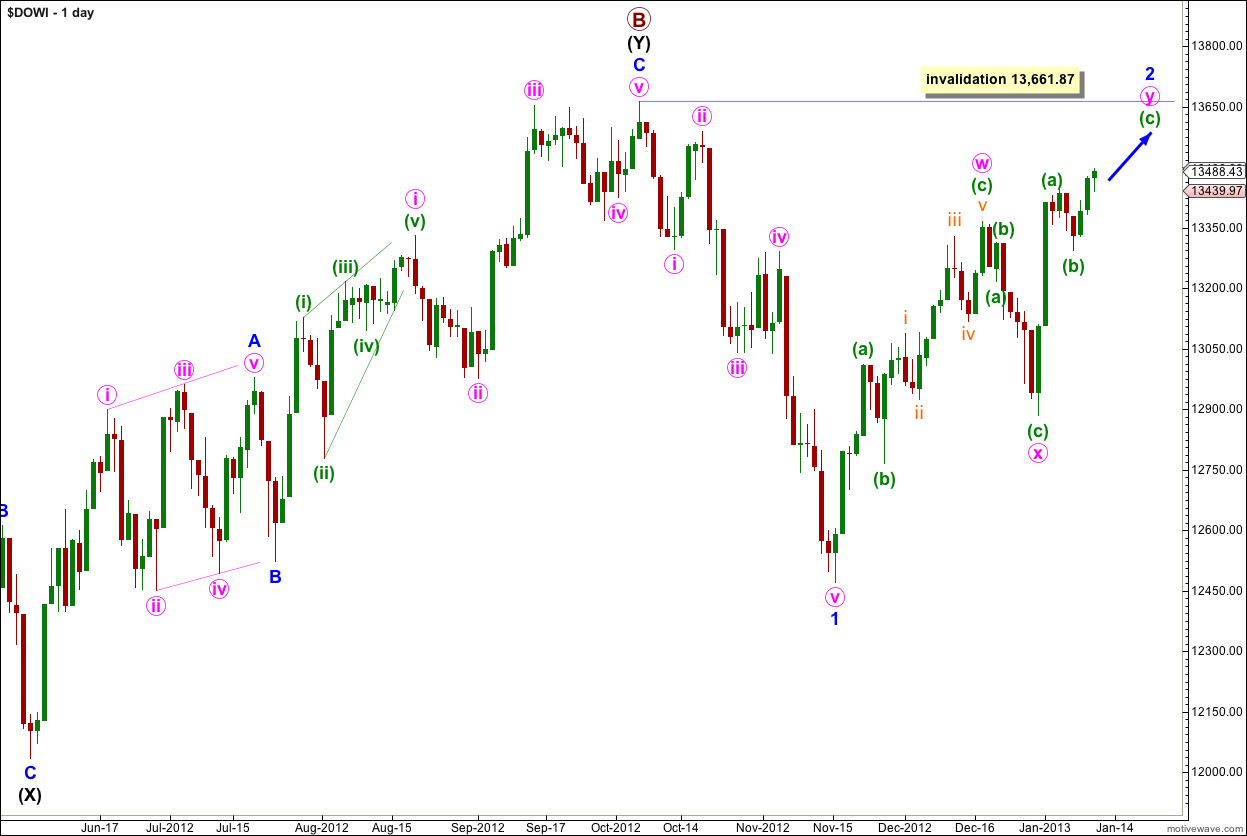

At the monthly chart level this wave count sees a common structure of a double flat unfolding at super cycle degree, and within the second flat primary waves A and B are complete. Primary wave B is a 139% correction of primary wave A.

Upwards movement is an incomplete second wave correction for wave 2 blue which is most likely completing as a double zigzag structure.

Wave 2 blue may not move beyond the start of wave 1 blue. This wave count is invalidated with movement above 13,661.87.

Please keep in mind that we could move the degree of labeling from the high of primary wave B all up one degree. We may have seen intermediate (black) wave (1) complete and this double zigzag may be intermediate wave (2) within primary wave C. We cannot be sure of the degree of labeling until the next third wave is over. Its length and momentum will tell us what degree it is most likely to be.

Wave (b) green ended just 5.8 points below where our target expected it to end, but it was not an expanded flat correction as it subdivided into a double combination: flat – X – zigzag.

Thereafter, a new high beyond the end of wave (a) green indicates wave (b) green is over and wave (c) green has begun.

At 13,621 wave (c) green would reach 0.618 the length of wave (a) green. This target may be reached next week or the week after that.

Within wave (v) green wave iii orange is 13 points longer than equality with wave i orange. We may not see a Fibonacci ratio between wave v orange and either of waves i or iii orange.

When we use Elliott’s channeling technique to draw a parallel channel about the zigzag of wave y pink it does not work. I have drawn a best fit parallel channel about wave (c) green instead. Price may continue to be contained within this channel while wave (c) green completes.

Within wave (v) green wave iv orange may not move into wave i orange price territory. This labeling of wave (v) green is invalidated with movement below 13,416.55.

If we move the degree of labeling within wave iii orange of wave (v) green down one degree then we may only have seen wave 1 purple complete. If that is correct then the invalidation point would be at 13,360.22. If 13,416.55 is breached then the invalidation point moves down to 13,360.22.