Last week’s analysis for the Dow expected more upwards movement which has happened.

This week I have the same main wave count for you with an alternate. At this stage the main and alternate wave counts objectively (considering the Dow as its own stand alone market, a pure EW approach) have about an even probability. We may use invalidation / confirmation points to work with these two wave counts next week.

However, the alternate wave count is the wave count which is in line with the S&P 500 and it may be more likely.

Click on the charts below to enlarge.

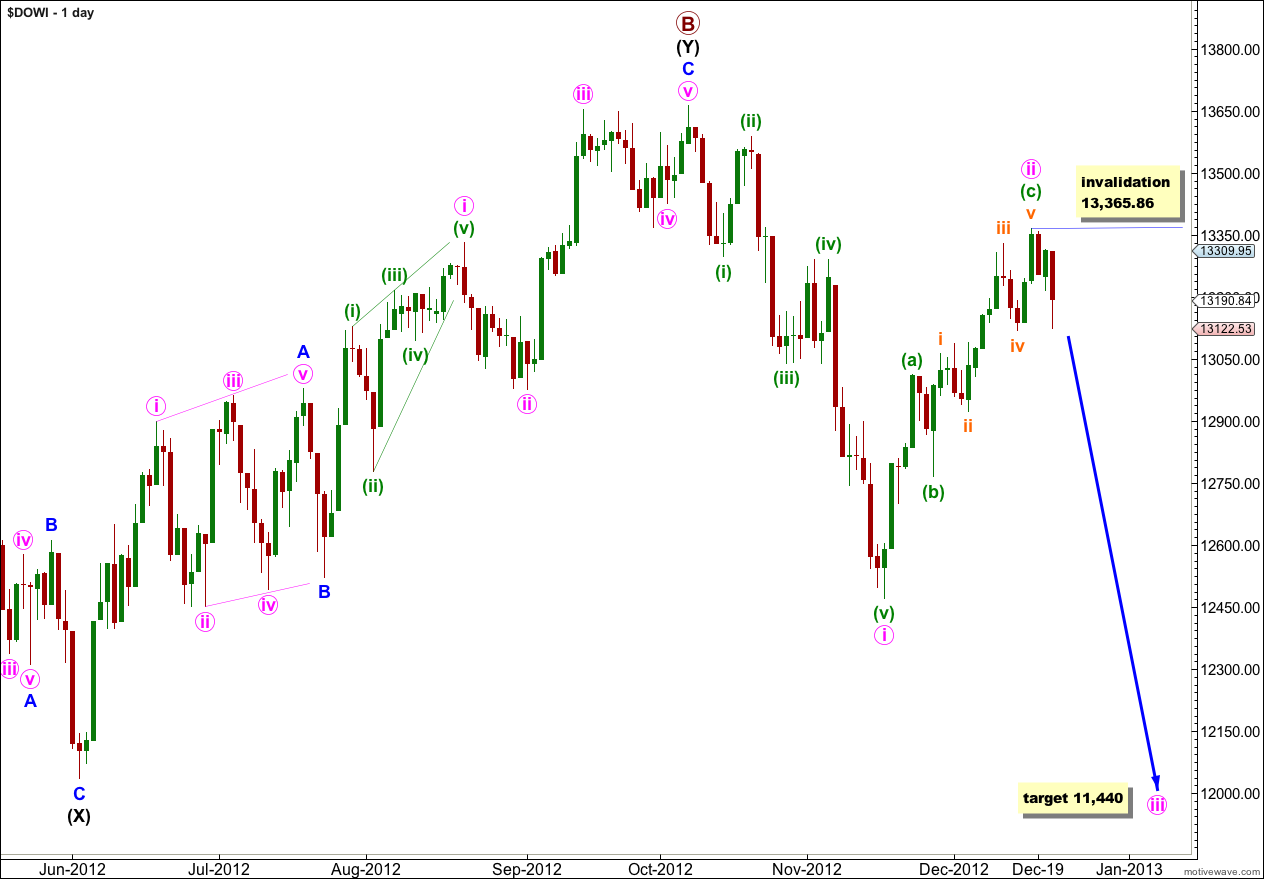

Main Wave Count.

At the monthly chart level this wave count sees a common structure of a double flat unfolding at super cycle degree, and within the second flat primary waves A and B are complete. Primary wave B is a 139% correction of primary wave A.

Upwards movement may be a completed wave ii pink.

Wave i pink lasted 28 days. Wave ii pink may have completed as a zigzag in 21 days.

Waves (a) and (c) green have no Fibonacci ratio between them.

Wave iii pink would reach 1.618 the length of wave i pink at 11,440. Wave iii pink should last about two to three weeks.

If this wave count is invalidated with upwards movement we may use the alternate below.

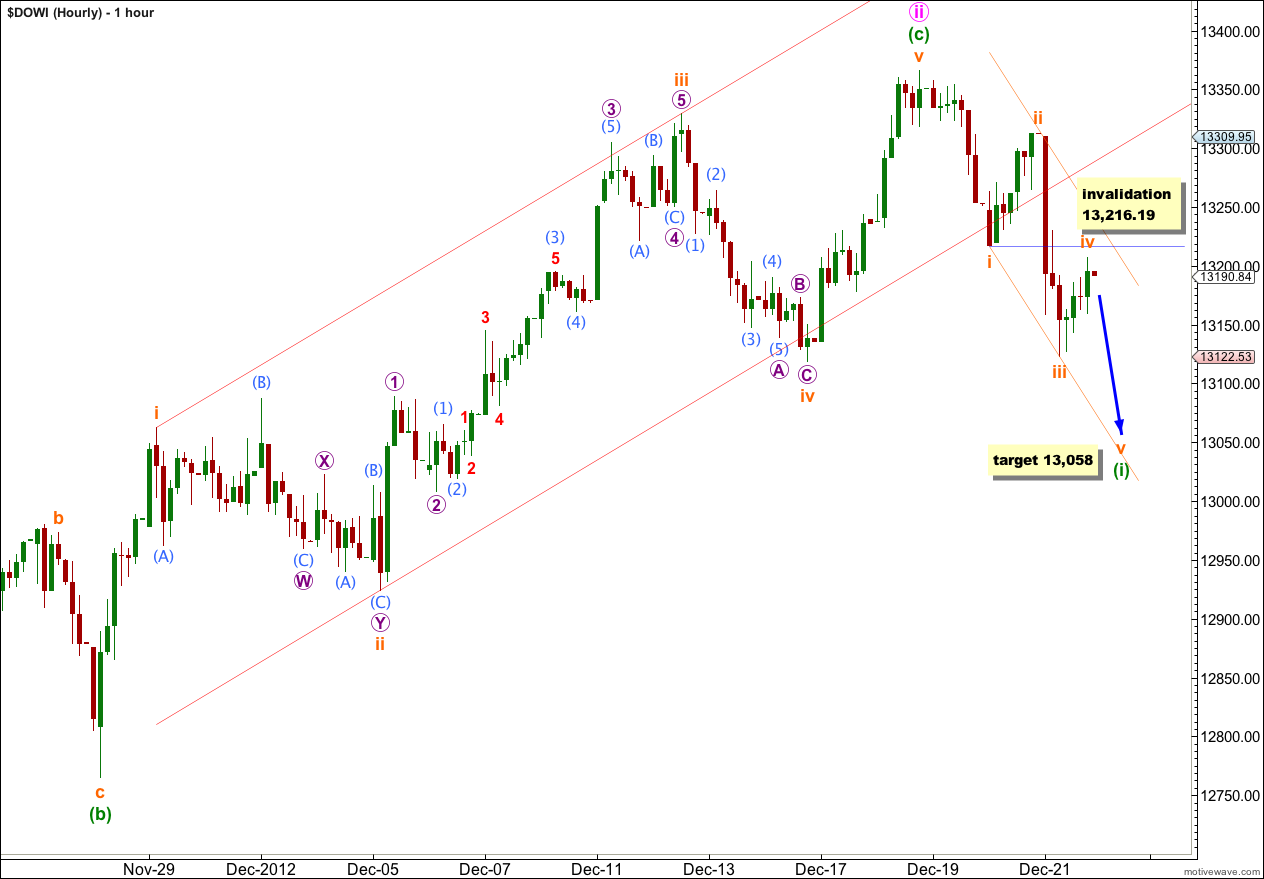

Upwards movement subdivides into a completed zigzag structure. The channel drawn using Elliott’s channeling technique about the impulse for wave (c) green is clearly breached to the downside.

Ratios within wave (c) green are: wave iii orange has no Fibonacci ratio to wave i orange, and wave v orange is just 3.6 points short of 0.618 the length of wave iii orange.

Within downwards movement so far it may be an unfolding impulse for a first wave. Within wave (i) green there is no Fibonacci ratio between waves i and iii orange. At 13,058 wave v orange would reach equality with wave i orange.

If wave (i) green is an impulse as labeled then any further upwards movement of wave iv orange may not move into wave i orange price territory. The impulse is invalidated with movement above 13,216.19.

If price moves above 13,216.19 wave (i) green may possibly be unfolding as a leading diagonal. Only movement above the invalidation point on the daily chart at 13,365.86 would confirm the alternate wave count below.

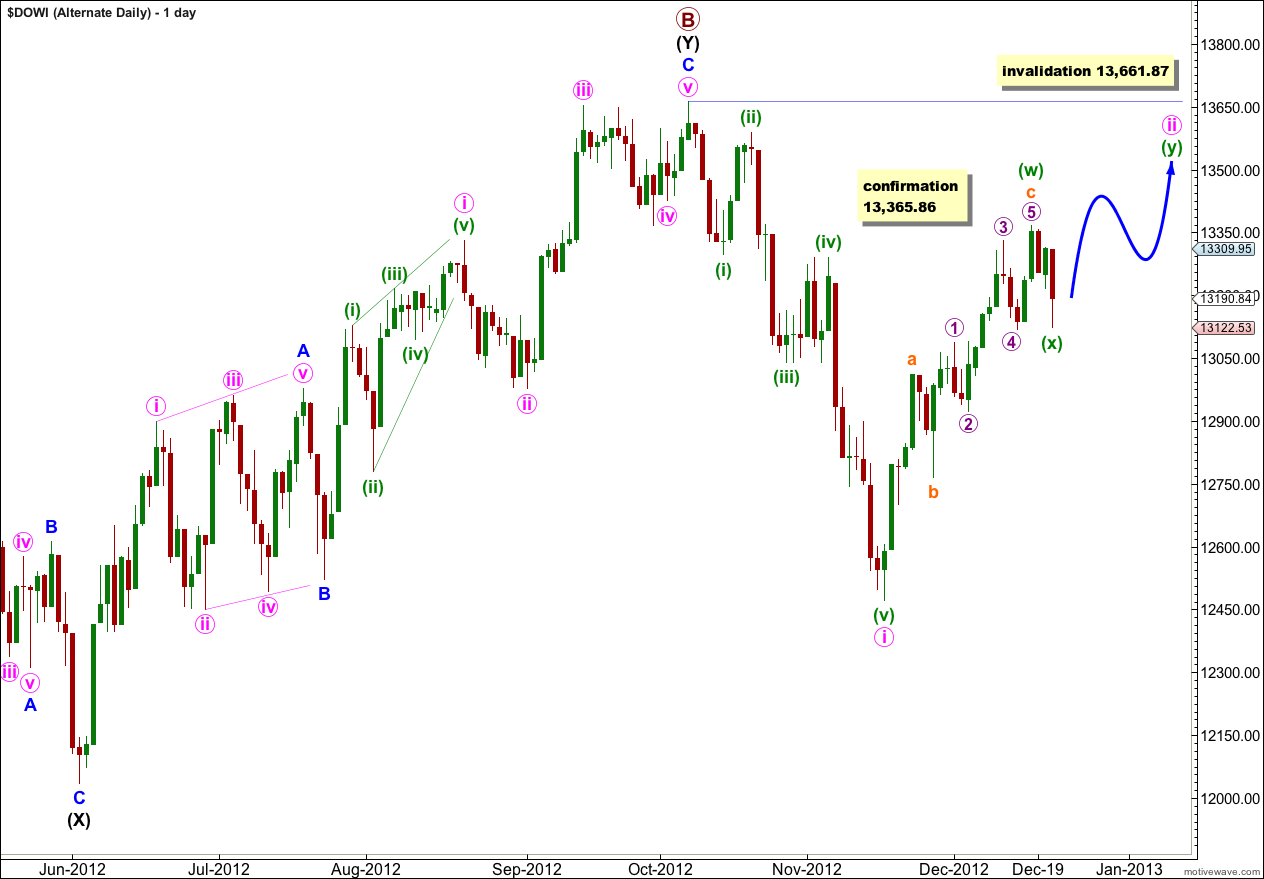

Alternate Wave Count.

It is possible that wave ii pink may continue further as a double zigzag or double combination correction.

If we move the degree of labeling within recent upwards movement within wave ii pink down one degree this zigzag may be only the first corrective structure in a double.

Downwards movement at the end of the week so far subdivides into a three and may be a zigzag for wave (x) green joining the two structures in a double.

Unfortunately wave (x) green could continue further to be longer in duration and it would still be nicely in proportion for this structure. Wave (x) green may move beyond the start of wave (w) green to a new low so there can be no downwards invalidation point for this alternate. We must pay careful attention to the structure of any further downwards movement. If it is a three then this alternate wave count must be considered. If it is a clear five then this alternate wave count may be discarded.

If this alternate wave count is confirmed with movement above 13,365.86 then we should expect choppy overlapping upwards trending movement for another two to three weeks as the second structure in a double unfolds.

Wave ii pink may not move beyond the start of wave i pink. This wave count is invalidated with movement above 13,661.87.

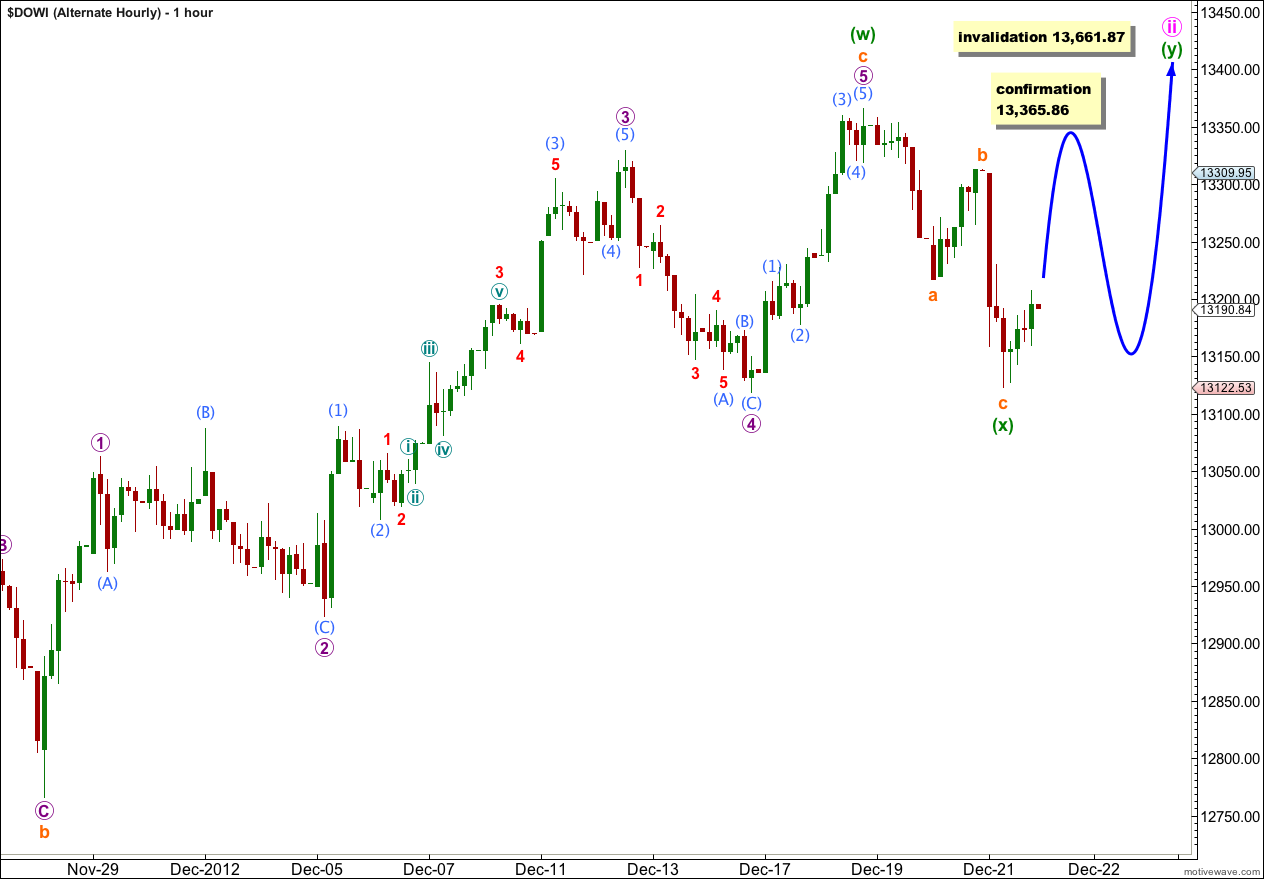

This wave count is the same as the main hourly wave count except the degree of labeling for upwards movement has all been moved down one degree, and downwards movement during Friday’s session is labeled as a completed three rather than an incomplete five.

If wave ii pink does continue further as a double zigzag then we would expect significant upwards movement.

If wave ii pink continues further as a double combination we should expect mostly sideways movement for wave (y) green as the purpose of combinations is to move price sideways and take up time.

Wave (y) green may unfold as a zigzag, flat or triangle. It should last about two to three weeks.