Last analysis expected strong upwards movement from the S&P 500 which is what happened. The wave count remains the same and the invalidation point on the hourly chart can be moved closer.

Click on the charts below to enlarge.

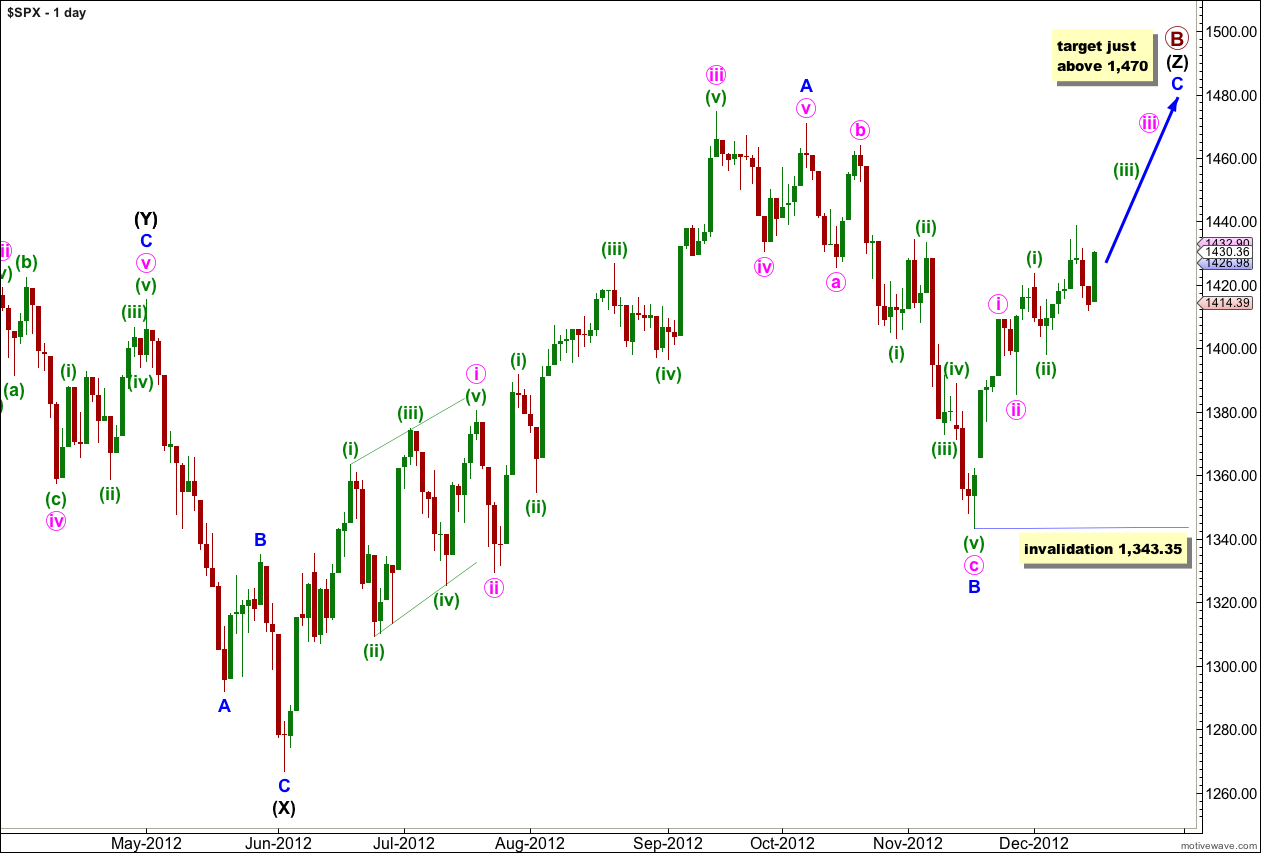

The structure for primary wave B is a triple zigzag, and price is now within the third zigzag in the triple labeled wave (Z) black.

Wave (Z) black is incomplete and is unfolding as an exaggerated zigzag.

Wave A blue must be truncated to subdivide into a five wave structure.

At 1,470 wave C blue would reach 0.618 the length of wave A blue. About this point primary wave B would also be only 139% of primary wave A. Movement to slightly above 1,470 would avoid a truncation and keep the length of primary wave B closer to the common maximum of 138%.

There is no upper invalidation point for this wave count, but significant movement above 1,470 has a low probability.

Wave A blue lasted 87 days (2 short of a Fibonacci 89). Wave B blue lasted 28 days. I would expect wave C blue to be about 34 days in duration. So far it has only lasted 20 days and it should continue for another couple of weeks or so.

Wave C blue must subdivide into a five wave structure as either an ending diagonal or an impulse. An ending diagonal requires all subwaves to subdivide as zigzags and because the first wave upwards labeled i pink is a five wave impulse an ending diagonal may be eliminated. Wave C blue must be unfolding as an impulse. The structure is incomplete and requires further upwards movement.

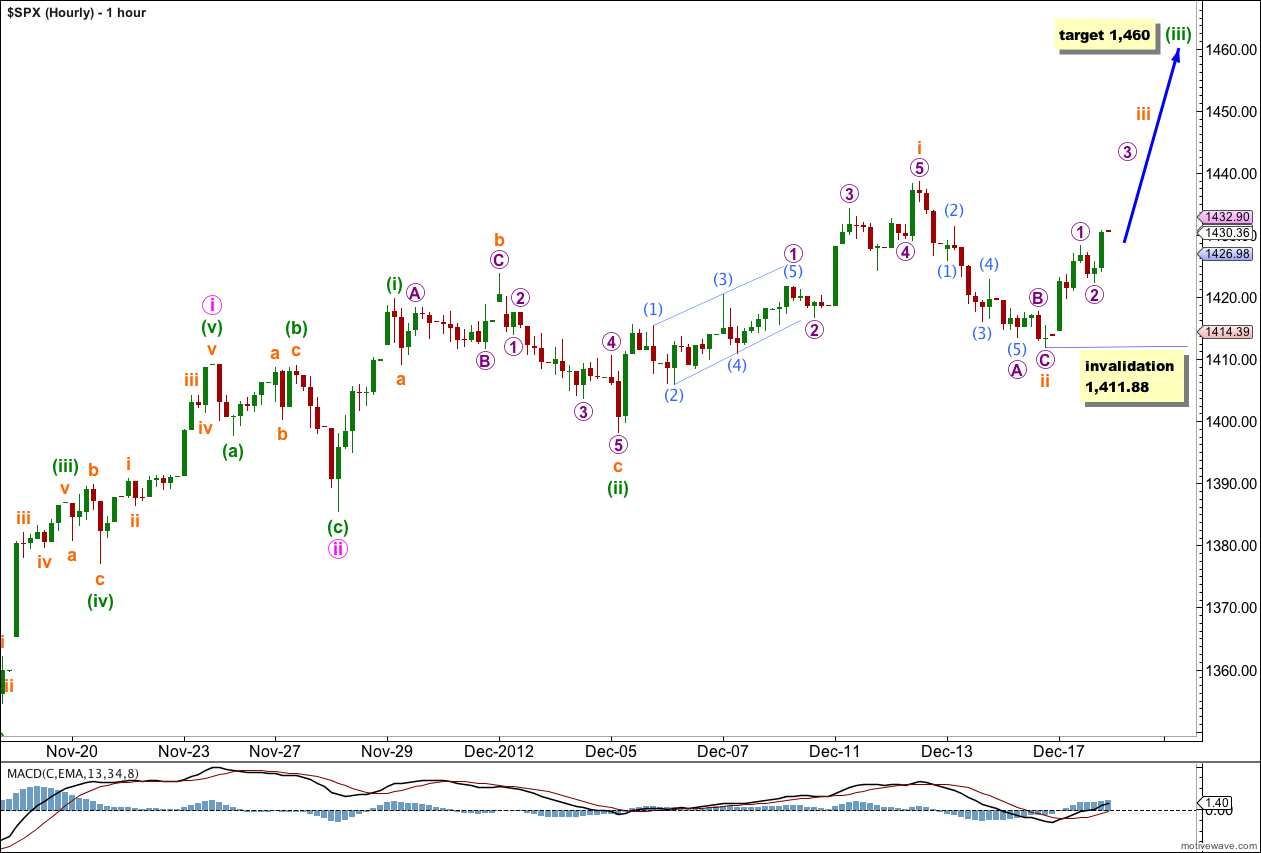

Upwards movement needs to show an increase in momentum beyond that seen for the high of wave i pink. Using MACD as a guide for momentum indicates that the strongest piece of upwards movement is yet to unfold.

Monday’s upwards movement subdivides nicely into a five wave impulse for wave 1 purple, a zigzag for wave 2 purple, and an incomplete impulse for wave 3 purple. Tomorrow’s session should see an increase in upwards momentum.

Wave iii orange must move beyond the end of wave i orange to a new high above 1,438.59.

Thereafter, wave iv orange may not move back into wave i orange price territory.

At 1,460 wave (iii) green would reach 1.618 the length of wave (i) green.

Within wave iii orange wave 2 purple may not move beyond the start of wave 1 purple. This wave count is invalidated with movement below 1,411.88.