The main hourly wave count of last analysis expected Friday’s session to begin with downwards movement to end between 1,344 to 1,343. Thereafter, upwards movement was expected.

Downwards movement during Friday’s session reached to 1,343.35 before price turned higher as expected.

At this stage I have just the one daily and hourly chart for you.

Click on the charts below to enlarge.

It looks highly likely that we have recently seen a major trend change in the S&P 500 and the DJIA. For both markets this trend change is confirmed.

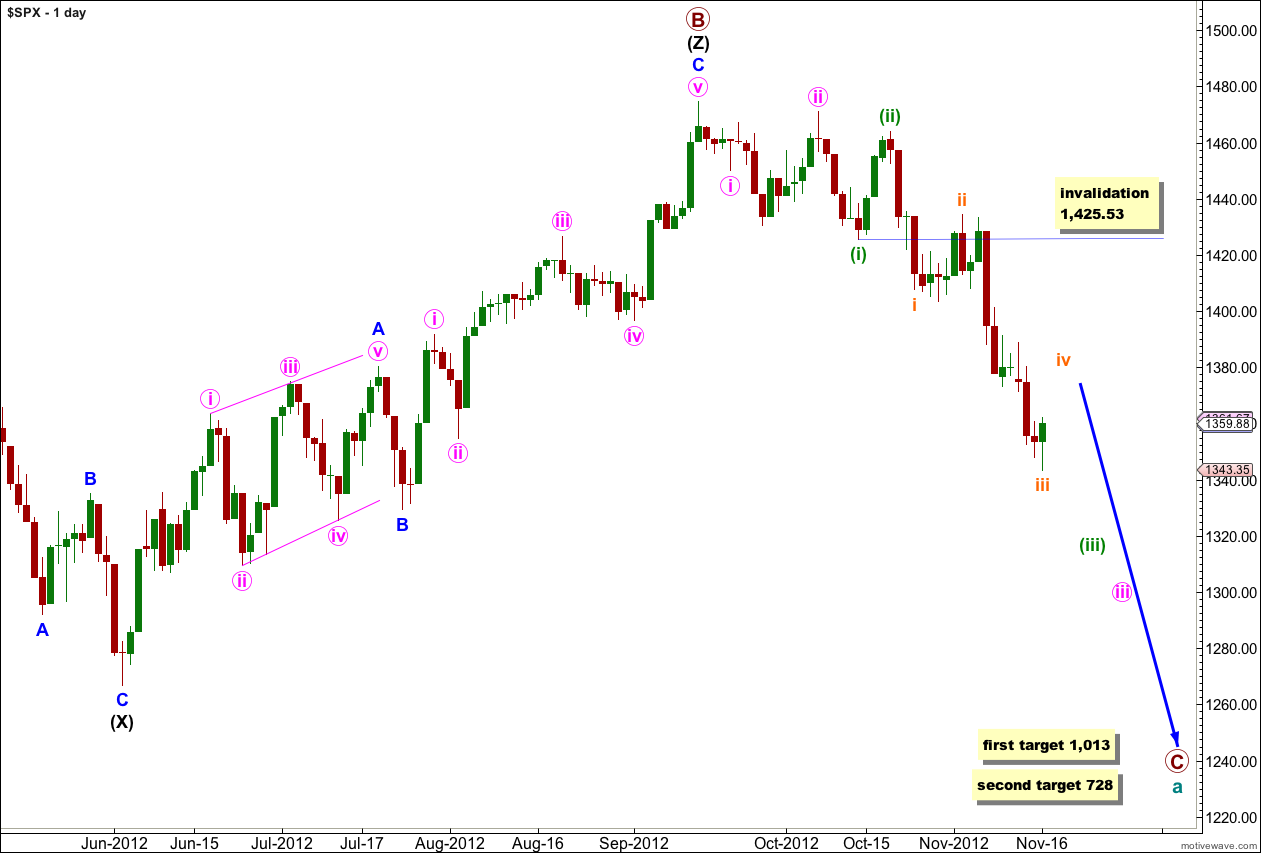

Within the new downwards trend the upcoming wave (iv) green may not move into wave (i) green price territory. This wave count is invalidated at this stage with movement above 1,425.53.

Downwards movement looks most likely to be a series of overlapping first and second waves, with the middle of the third wave complete. We shall expect overall downwards movement with fourth wave corrections to come.

Cycle wave a is an expanded flat correction: primary wave A was a three wave structure, and primary wave B was a triple zigzag and 140% the length of primary wave A.

At 1,013 primary wave C would reach 1.618 the length of primary wave A. If price continues downwards through this first target then the next target is at 728 where primary wave C would reach 2.618 the length of primary wave A.

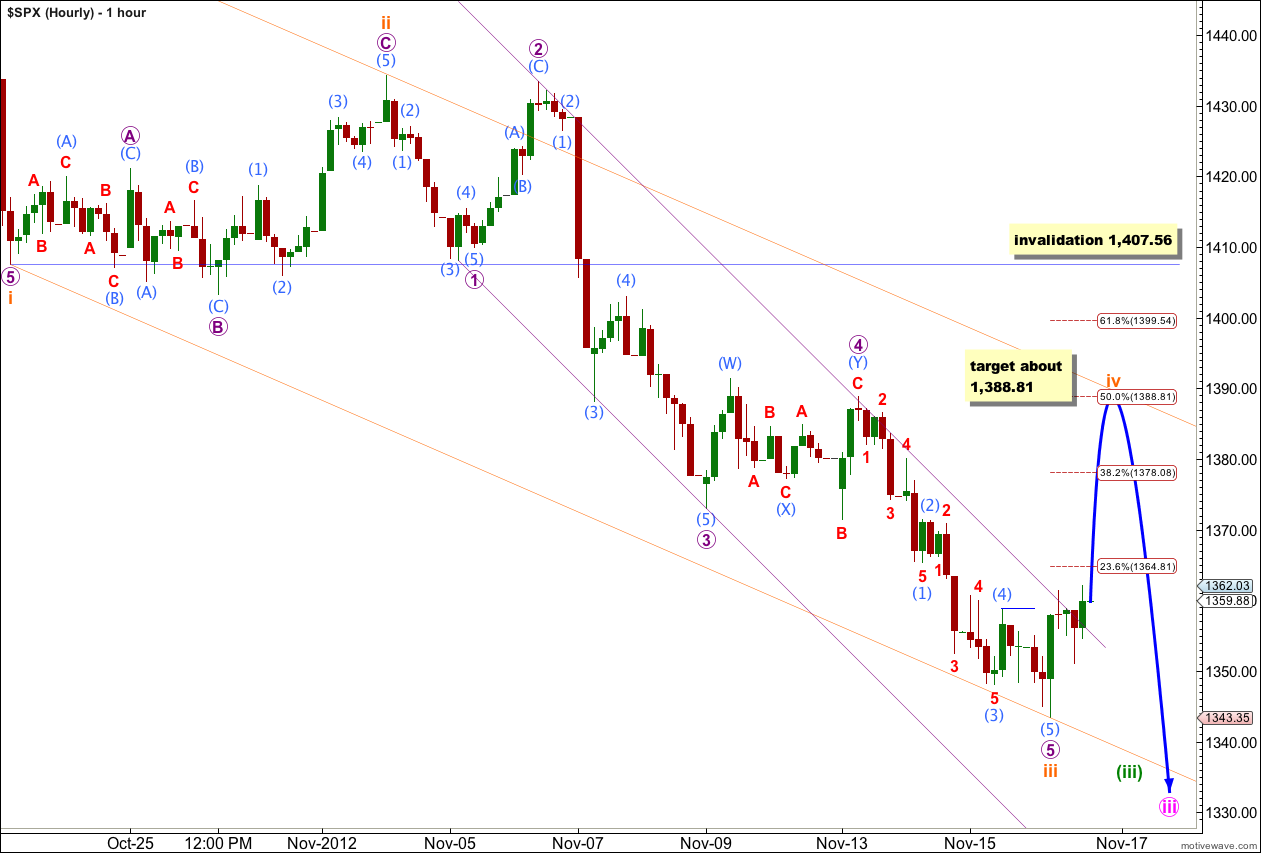

It looks like the middle of the third wave within (iii) green may have ended on Friday. Movement above 1,358.65 increases this probability.

Wave iii orange is just 1.03 points short of 1.618 the length of wave i orange.

Ratios within wave iii orange are: wave 3 purple is 3.4 points short of 2.618 the length of wave 1 purple, and wave 5 purple has no Fibonacci ratio to either of waves 3 or 1 purple.

Ratios within wave 5 purple are: wave (3) aqua is 0.33 points short of equality with wave (1) aqua, and wave (5) aqua 0.97 points longer than 0.618 the length of wave (3) aqua.

We may use a parallel channel about wave iii orange using Elliott’s technique to further confirm an end to wave iii orange and the start of wave (iv) orange. When this steeper purple channel is clearly breached by a full candle outside and not touching it we may have more confidence in a short term trend change.

Wave ii orange was a shallow sideways moving flat correction. We may expect wave iv orange to most likely be a sharp deep zigzag, reaching to over 50% of wave iii orange above 1,388.81. Also at 1,388.81 the fourth wave of one lesser degree, wave 4 purple, ends which is another likely place for wave iv orange to reach.

Wave iv orange may find some resistance about the upper edge of the parallel channel drawn here using Elliott’s technique about wave (iii) green.

Wave ii orange lasted 6 sessions. Wave iv orange may last about 6 sessions also.

Wave iv orange may not move into wave i orange price territory. This wave count is invalidated with movement above 1,407.56.