Yesterday’s analysis expected choppy overlapping sideways movement for Tuesday’s session which is exactly what we have seen.

I still have just one daily wave count. At the hourly chart level I have two wave counts, looking at the most recent sideways movement slightly differently. They both expect exactly the same direction next.

Click on the charts below to enlarge.

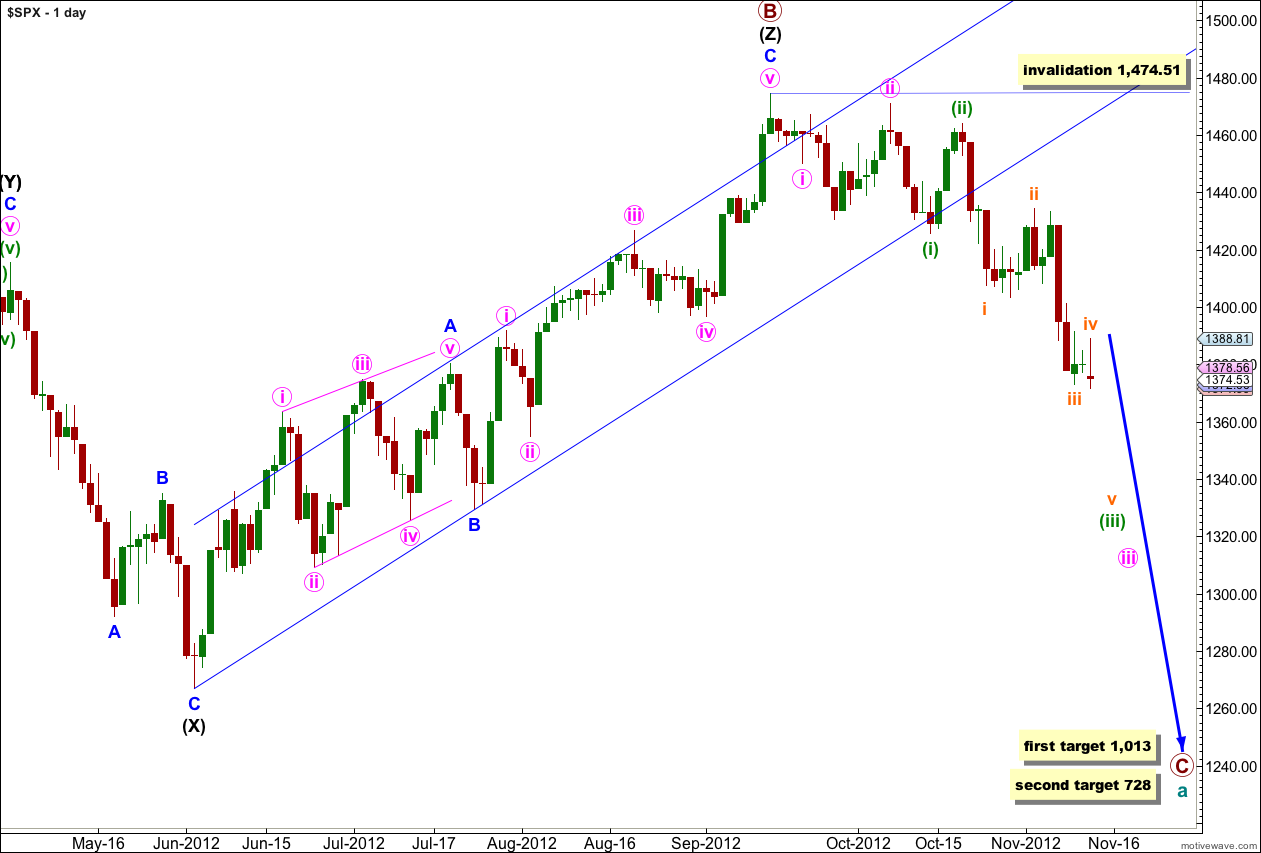

It looks highly likely that we have recently seen a major trend change in the S&P 500 and the DJIA. For both markets this trend change is confirmed.

The upper black line is the upper edge of a parallel channel drawn on the monthly chart. This area may have provided resistance.

The channel drawn about the zigzag of wave (Z) black using Elliott’s technique for a correction is very clearly breached. This is some indication that this wave count may be correct.

Within the new downwards trend no second wave correction may move beyond the start of the first wave. This wave count is invalidated with any movement above 1,474.51.

Downwards movement looks most likely to be a series of overlapping first and second waves, with the middle of the third wave complete. We shall expect overall downwards movement with fourth wave corrections to come.

Cycle wave a is an expanded flat correction: primary wave A was a three wave structure, and primary wave B was a triple zigzag and 140% the length of primary wave A.

At 1,013 primary wave C would reach 1.618 the length of primary wave A. If price continues downwards through this first target then the next target is at 728 where primary wave C would reach 2.618 the length of primary wave A.

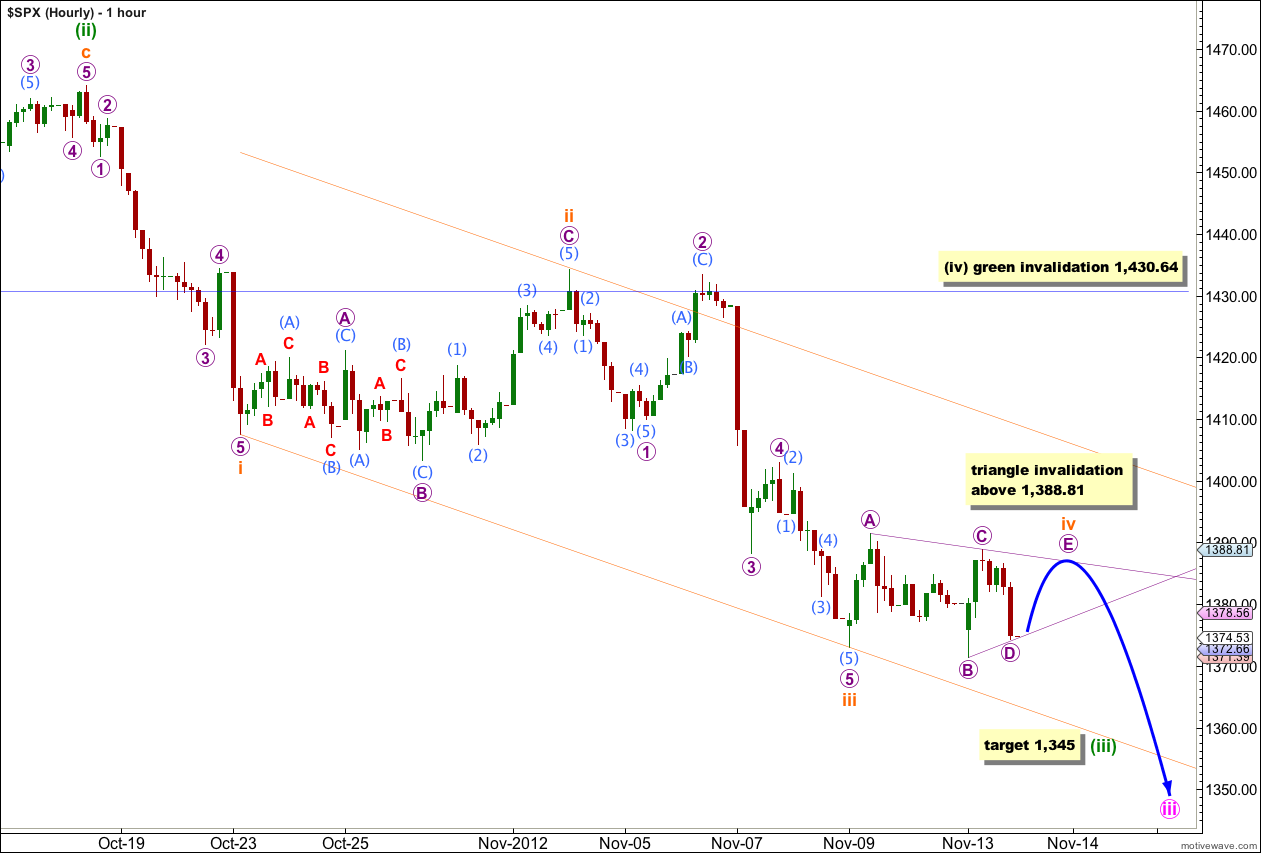

Main Hourly Wave Count.

This was yesterday’s alternate wave count. Today it is my main wave count because sideways movement looks like wave iv orange which is nicely in proportion to wave ii orange.

Wave iv orange at this stage may be unfolding as either a triangle (this wave count) or a combination (the alternate below). For both possibilities the structure is likely incomplete so we would expect more upwards movement tomorrow, the only question is how high. Thereafter, wave iv orange should be complete and we should see new lows as wave v orange completes wave (iii) green.

At 1,345 wave (iii) green would reach 2.618 the length of wave (i) green. At orange wave degree, when I have a known end to wave iv orange, I can refine this target so it may change or widen to a zone.

If wave iv orange completes a running contracted triangle then wave E purple may not move beyond the end of wave C purple. The triangle is invalidated with movement above 1,388.81. If the triangle is invalidated then we should use the alternate wave count below.

I have redrawn the channel using Elliott’s first technique. Draw the first trend line from the lows of waves i to iii orange, then place a parallel copy upon the high of wave ii orange. Wave iv orange may be contained within the channel, and wave v orange may find support at the lower edge of the channel.

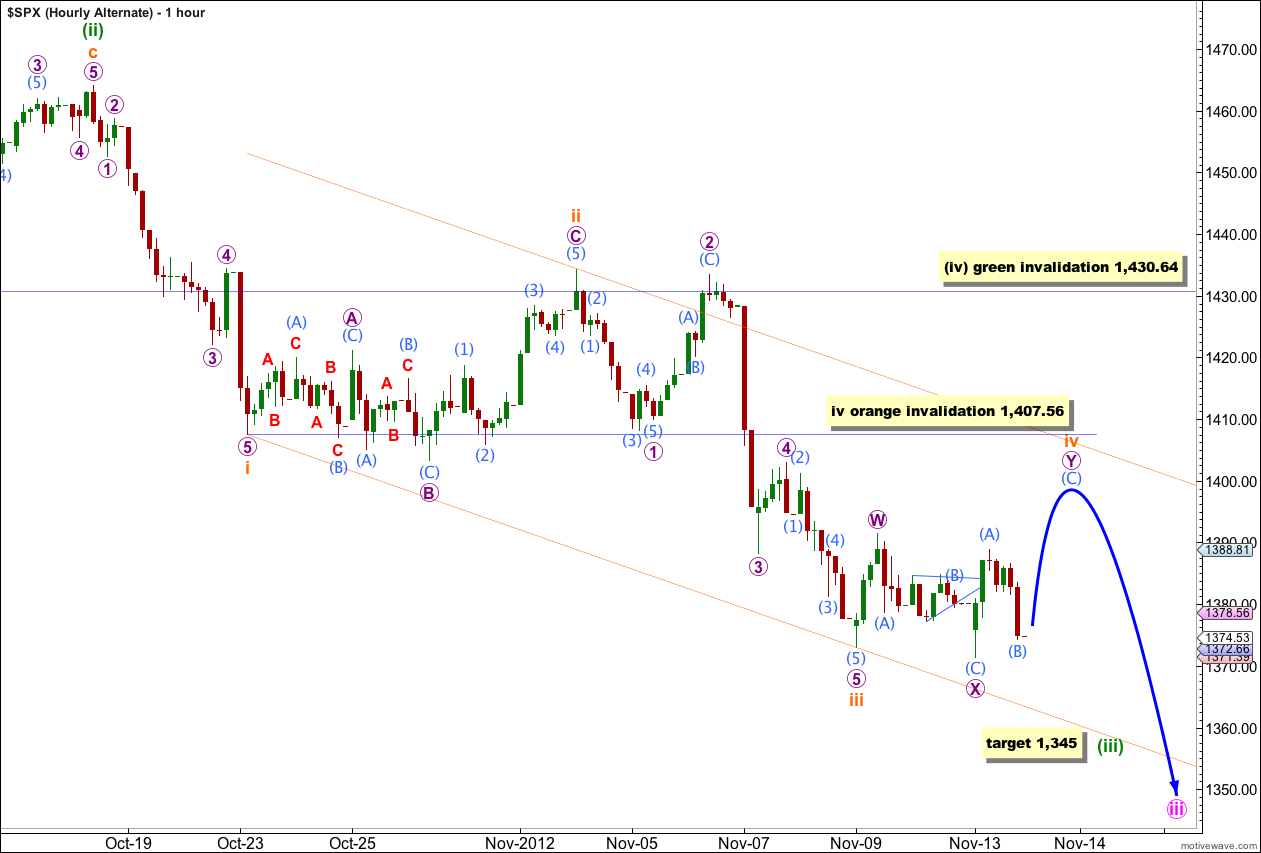

Alternate Hourly Wave Count.

If upwards movement tomorrow moves price above 1,388.81 then we should use this wave count.

This wave count is the same as the main hourly wave count with the exception of the structure of wave iv orange. Wave iv orange may be unfolding as a combination.

Wave W purple subdivides into a zigzag. Wave X purple subdivides into a zigzag with wave (B) aqua within it a running triangle.

Wave Y purple may be unfolding as a flat correction: wave (A) aqua within it subdivides into a three, wave (B) aqua would be incomplete and must reach slightly lower to 1,373 or below. Wave (B) aqua may make a new low below the start of wave (A) aqua at 1,371.39, but probably not lower than 1,365. Thereafter, wave (C) aqua is extremely likely to make a new high above 1,388.81 in order to avoid a truncation and a rare running flat.

Wave iv orange may not move into wave i orange price territory. This wave count is invalidated with movement above 1,407.56.

Wave iv orange may find resistance about the upper edge of the parallel channel.