Movement below 12,977.57 early last week invalidated the first wave count and confirmed the second wave count. We now have some clarity and just one wave count.

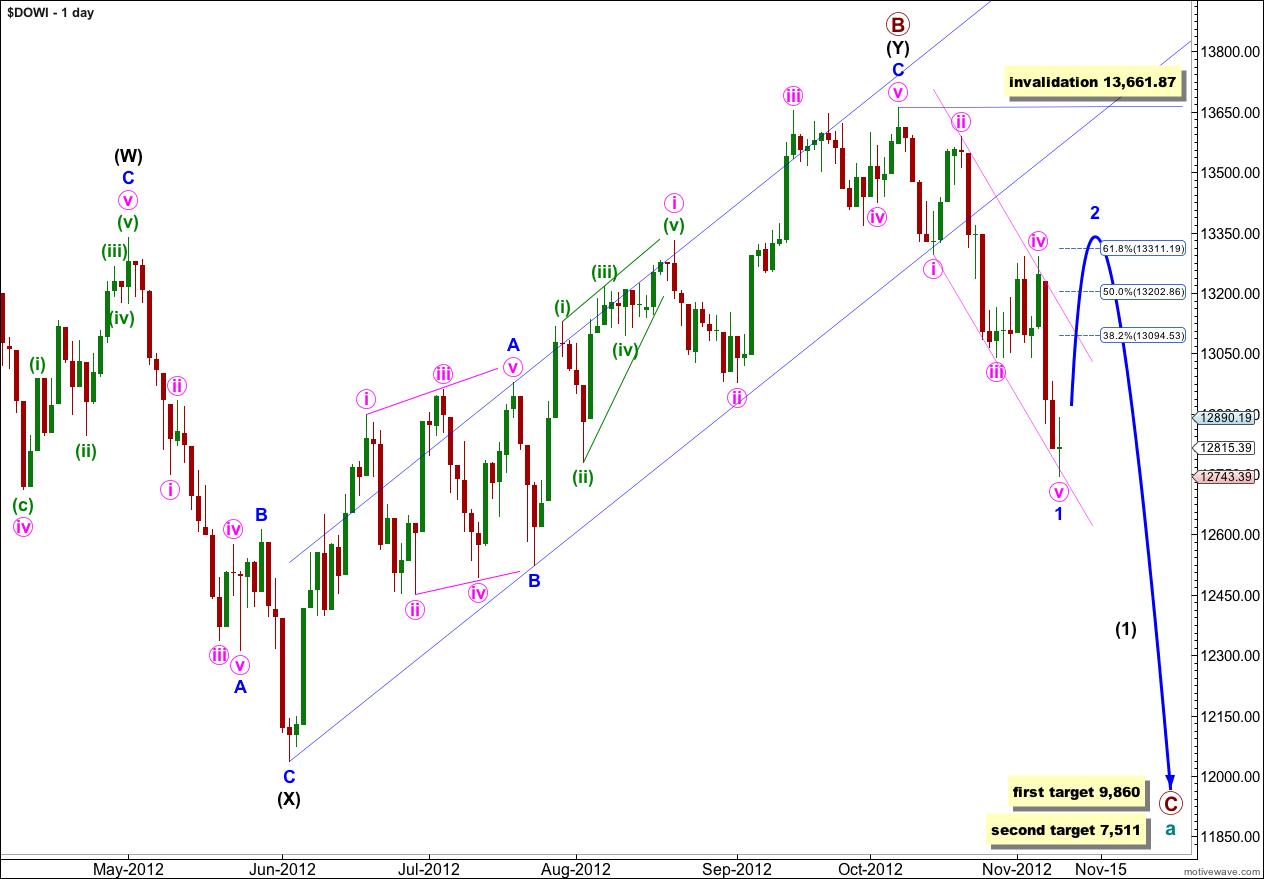

With confirmation of this wave count I can now calculate long term targets.

Click on the charts below to enlarge.

At the monthly chart level this wave count sees a more common structure of a double flat unfolding at super cycle degree, and within the second flat primary waves A and B are complete. Primary wave B is a 139% correction of primary wave A.

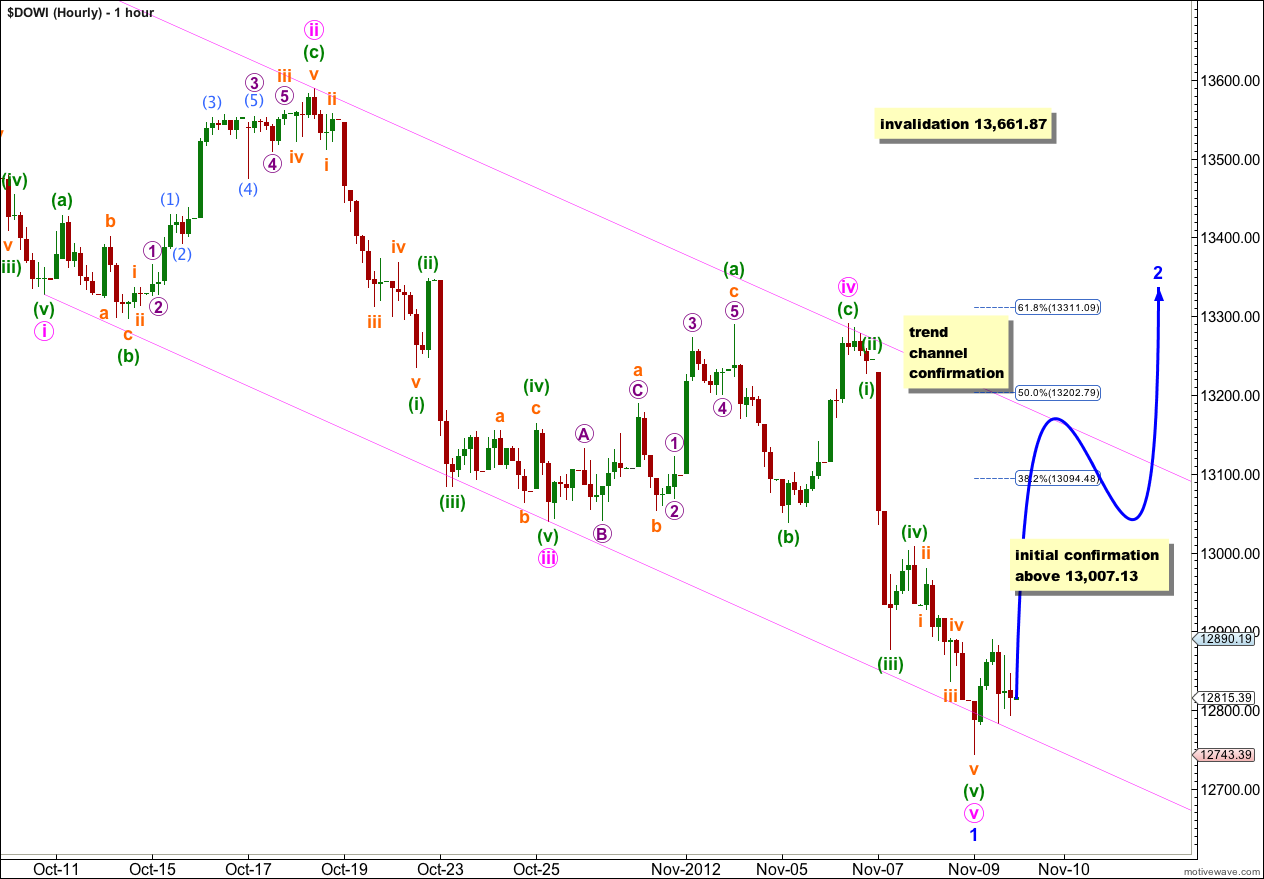

I have moved recent downwards movement all up one wave degree.

Wave 1 blue (minor) may be complete, or the final fifth wave of v pink within it may yet move a little lower.

Ratios within wave 1 blue are: wave iii pink has no Fibonacci ratio to wave i pink, and wave v pink is just 1.97 points shorter than equality with wave iii pink.

We may use Elliott’s channeling technique to draw a channel about wave 1 blue: draw the first trend line from the lows of waves i to iii pink then place a parallel copy upon the high of wave iv pink. Wave v pink ends with only a very slight overshoot of the channel. When the channel is breached by upwards movement we shall have confirmation that wave 1 blue is over and wave 2 blue is underway.

Wave 1 blue lasted 23 days. I would expect wave 2 blue to last 21 or 34 days (give or take a day either side).

I would expect wave 2 blue to be deep, about 0.618 of wave 1 blue at 13,311.19.

Main Hourly Wave Count.

If wave 1 blue is complete then we may see choppy, overlapping upwards movement for wave 2 blue for weeks.

We would have confirmation that wave 1 blue is complete first when price moves above 13,007.13 as at that stage upwards movement may not be a second wave correction within wave (v) green of wave v pink, and wave v pink would be likely to be over. Movement above the parallel channel would provide a lot of confidence that wave 2 blue would be underway.

Prior to confirmation that wave 1 blue is over we must accept the possibility that wave v pink may yet move price lower.

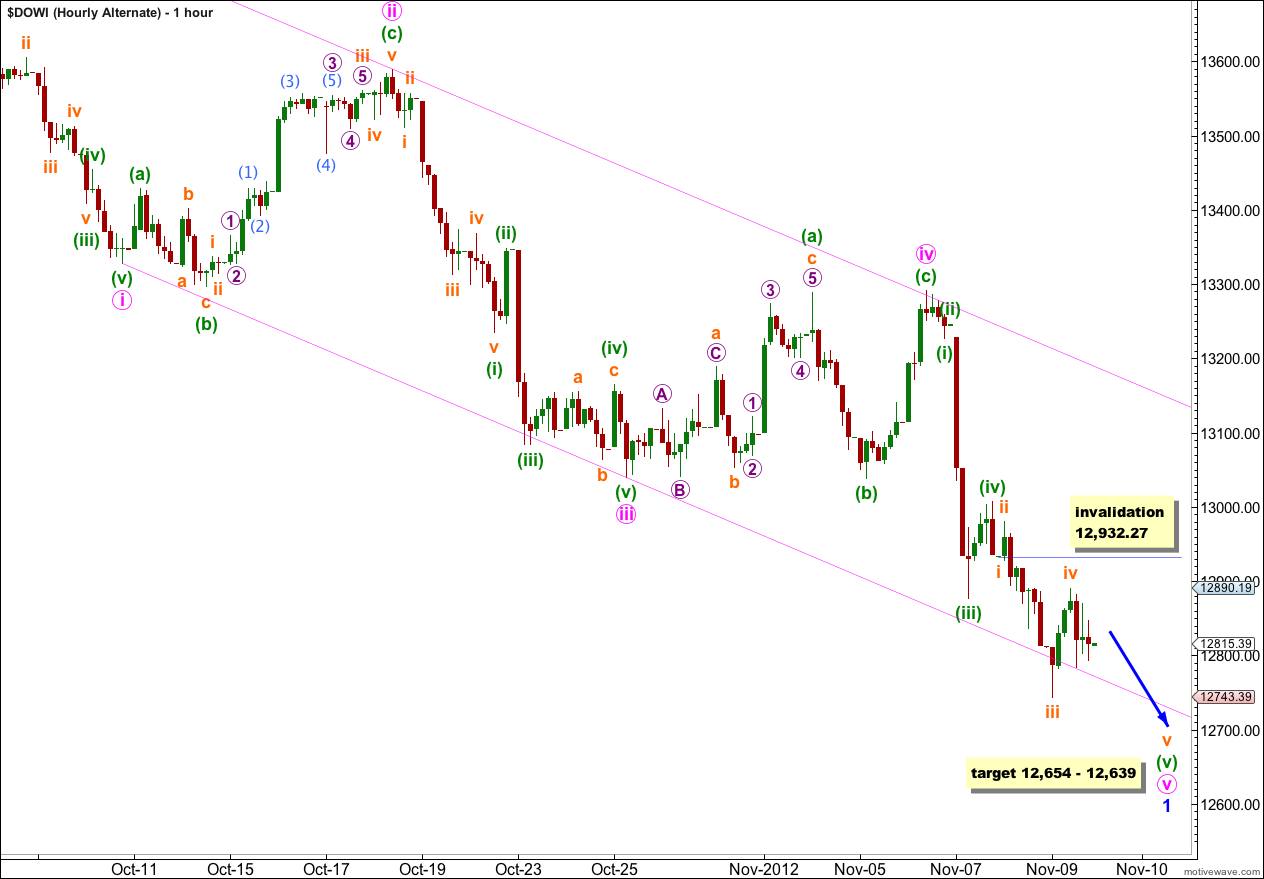

Alternate Hourly Wave Count.

If price moves lower to start next week then wave v pink of wave 1 blue is extending lower.

Within wave 1 blue this alternate wave count is identical as the main hourly wave count up to the high labeled wave ii orange within wave (v) green.

If wave iii orange ended at the low of Friday’s session rather then earlier then wave v orange, the final fifth wave, may be incomplete.

At 12,639 wave (v) green would reach equality in length with wave (i) green.

At 12,654 wave v orange would reach equality with wave iii orange. This gives us a 15 point target zone.

I would expect downwards movement to follow about the lower edge of the parallel channel.

Wave iv orange may not move into wave i orange price territory. This wave count is invalidated with movement above 12,932.27.