The main hourly wave count for last analysis expected price to move higher during last week, which is what happened.

Both the first and second daily wave counts remain the same and have the same mid term target.

I have just one hourly wave count for you this week.

The first and second daily wave counts differ at the monthly chart level. Monthly charts can be reviewed in the historic analysis category here.

Click on the charts below to enlarge.

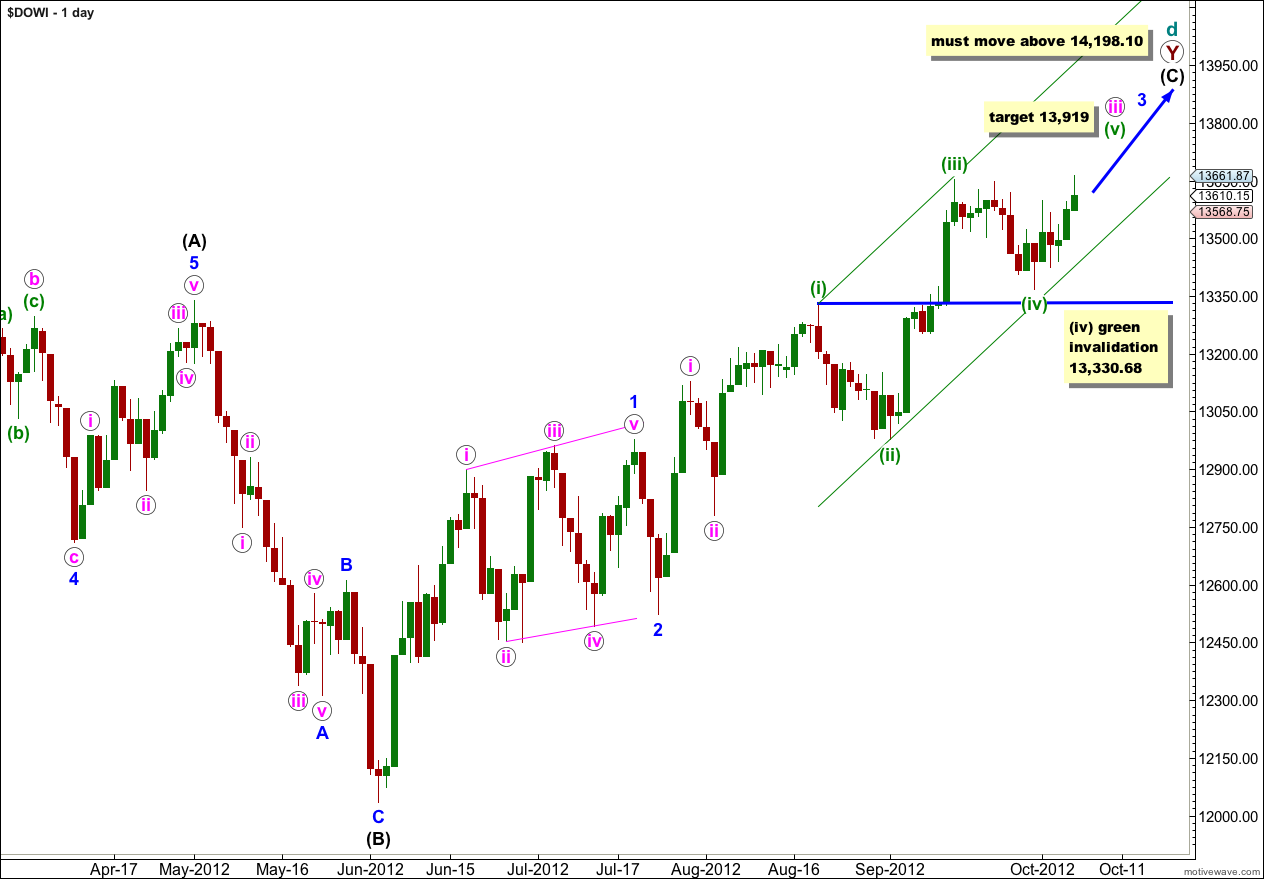

First Daily Wave Count.

This first wave count looks at the possibility that the Dow is in a very large expanding triangle unfolding at super cycle degree. However, expanding triangles are the rarest of all Elliott wave structures.

The daily chart shows the subdivisions of wave (C) black which must subdivide into a five wave structure. It is subdividing as an impulse.

Within wave (C) black wave 3 blue is incomplete.

Within wave 3 blue wave iii pink is incomplete.

At 13,919 wave (v) green would reach equality in length with wave (i) green.

If wave (iv) green is incomplete and moves price sideways and slightly lower then it may not move into wave (i) green price territory. This wave count is invalidated with movement below 13,330.68.

We need to see at least a clear five up on the hourly chart to have confidence that the correction for wave (iv) green is over. However, it is very likely that it is over as if it were to continue further sideways as a flat or triple zigzag it would be out of proportion in terms of duration to wave (ii) green.

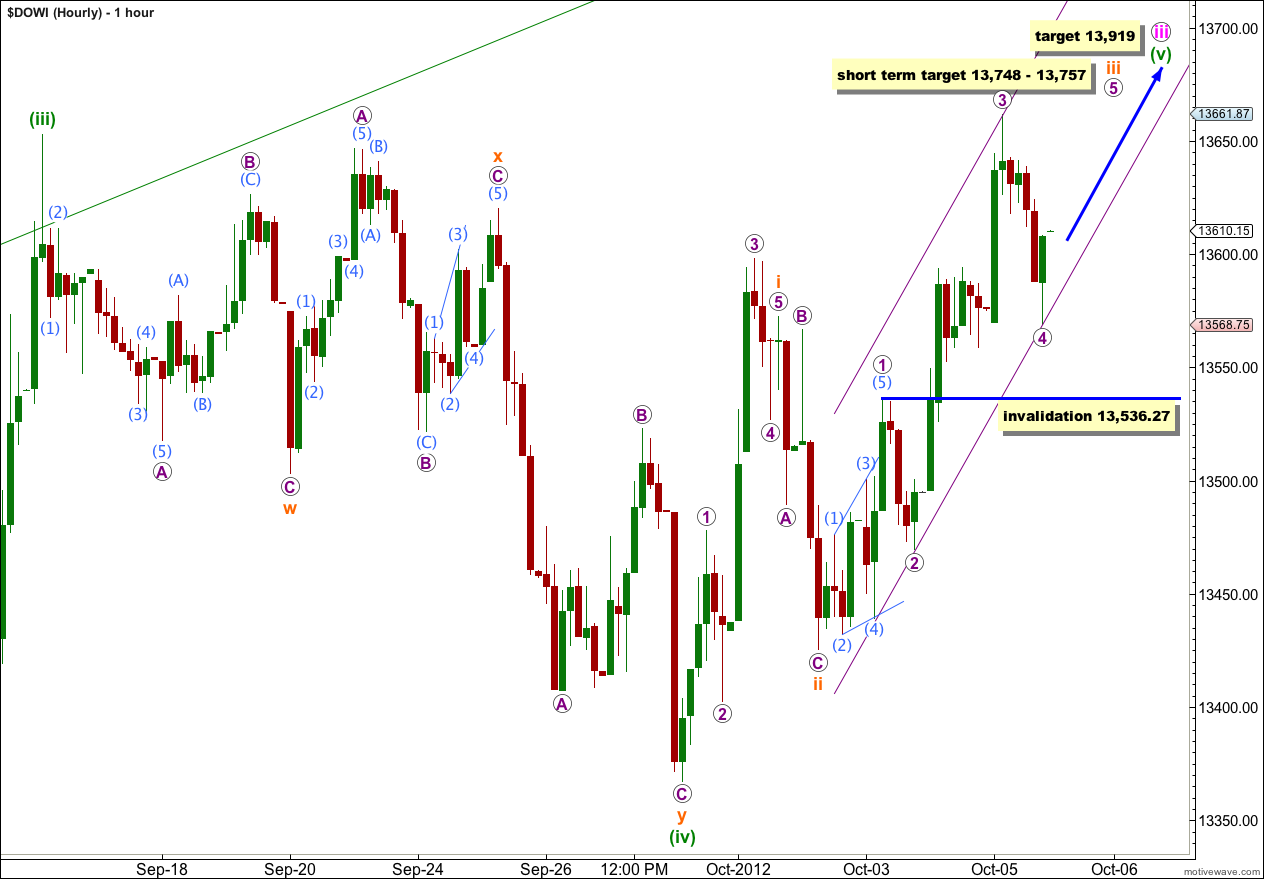

Movement above 13,522.83 early during Monday’s session invalidated the alternate hourly wave count from last analysis leaving only this main wave count.

At that stage the analysis expected overall upwards movement for the week.

Wave (v) green must subdivide into a five wave structure, either an impulse or ending diagonal.

If wave (v) green is an impulse then wave i orange within it is most likely over with a slightly truncated fifth wave. Wave iii orange is an incomplete impulse.

At 13,757 wave iii orange would reach 1.618 the length of wave i orange. At 13,748 wave 5 purple would reach 1.618 the length of wave 1 purple.

When wave iii orange is complete then wave iv orange should move price sideways in a shallow correction. At that stage the invalidation point would move to the price extreme of wave i orange at 13,598.24.

When markets open on Monday if wave 4 purple is incomplete and moves price further sideways and lower it may not move into wave 1 purple price territory. This wave count is invalidated with movement in the short term below 13,536.27.

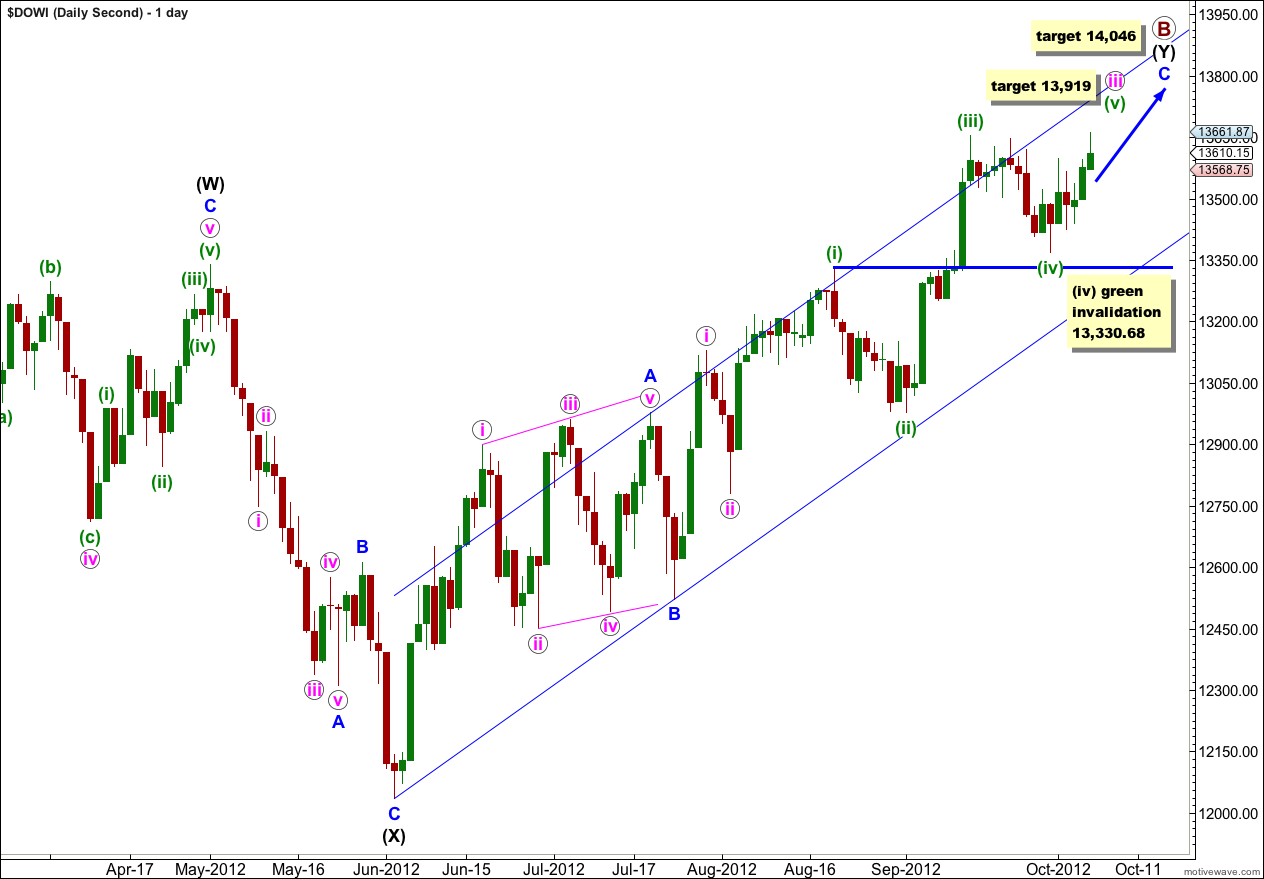

Second Daily Wave Count.

At the daily chart level this wave count has the same short and mid term expectation as the first wave count. It expects more upwards movement for the completion of a third wave. Thereafter, a fourth wave correction and for this wave count a final fifth wave upwards. Thereafter, the wave counts diverge and at that stage I will use an invalidation / confirmation point to differentiate between the two.

Wave C blue has already passed equality in length with wave A blue. The next target is at 14,046 where wave C blue would reach 1.618 the length of wave A blue.

Wave (iv) green may be over or it may continue slightly lower. If it does continue it may not move into wave (i) green price territory. This wave count is invalidated with movement below 13,330.68.

The same hourly chart above will suffice for this daily wave count also as both wave counts are the same at the hourly chart level at this time.