I have three monthly wave counts.

The first two have about an even probability.

The third is at this stage unlikely, but possible.

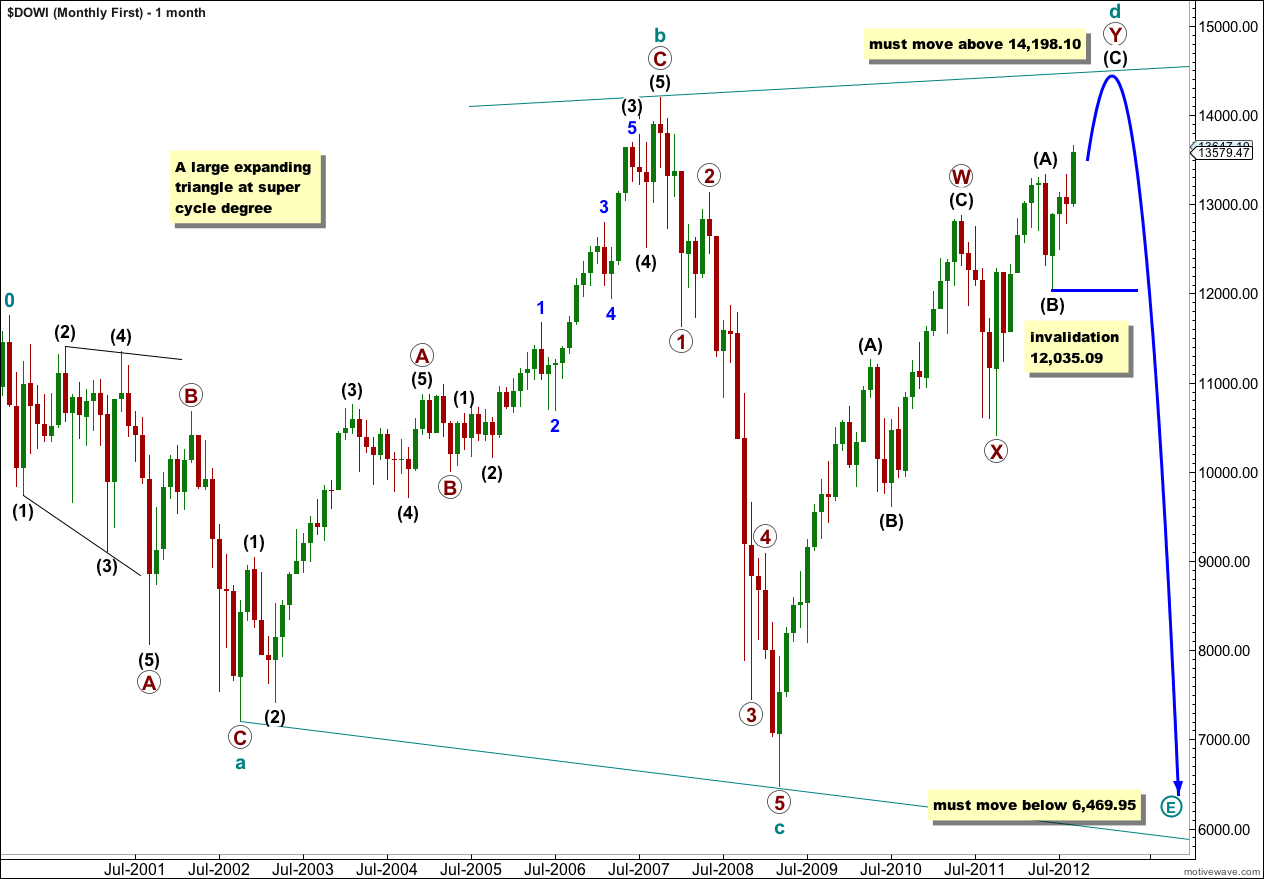

First Wave Count.

This first wave count looks at the possibility that the Dow is in a very large expanding triangle unfolding at super cycle degree. However, expanding triangles are the rarest of all Elliott wave structures.

Four of the five subwaves of a triangle must be zigzags or zigzag combinations (doubles). Thus cycle wave c may be an impulse.

Within a triangle one of the five subwaves should be more complicated and longer lasting than the others. This is usually wave c of the triangle, but in this instance it may be cycle wave d which is subdividing into a double zigzag.

Within cycle wave d the first zigzag in the double, primary wave W, is complete. The double is joined by a three in the opposite direction labeled primary wave X. The second zigzag in the double is underway labeled primary wave Y.

An expanding triangle requires cycle wave d to move beyond the end of cycle wave b above 14,198.10.

Within primary wave Y intermediate (black) wave (A) must be seen as a five wave structure.

Within intermediate wave (C) wave 2 may not move beyond the start of wave 1. This wave count is invalidated in the mid term with movement below 12,035.09.

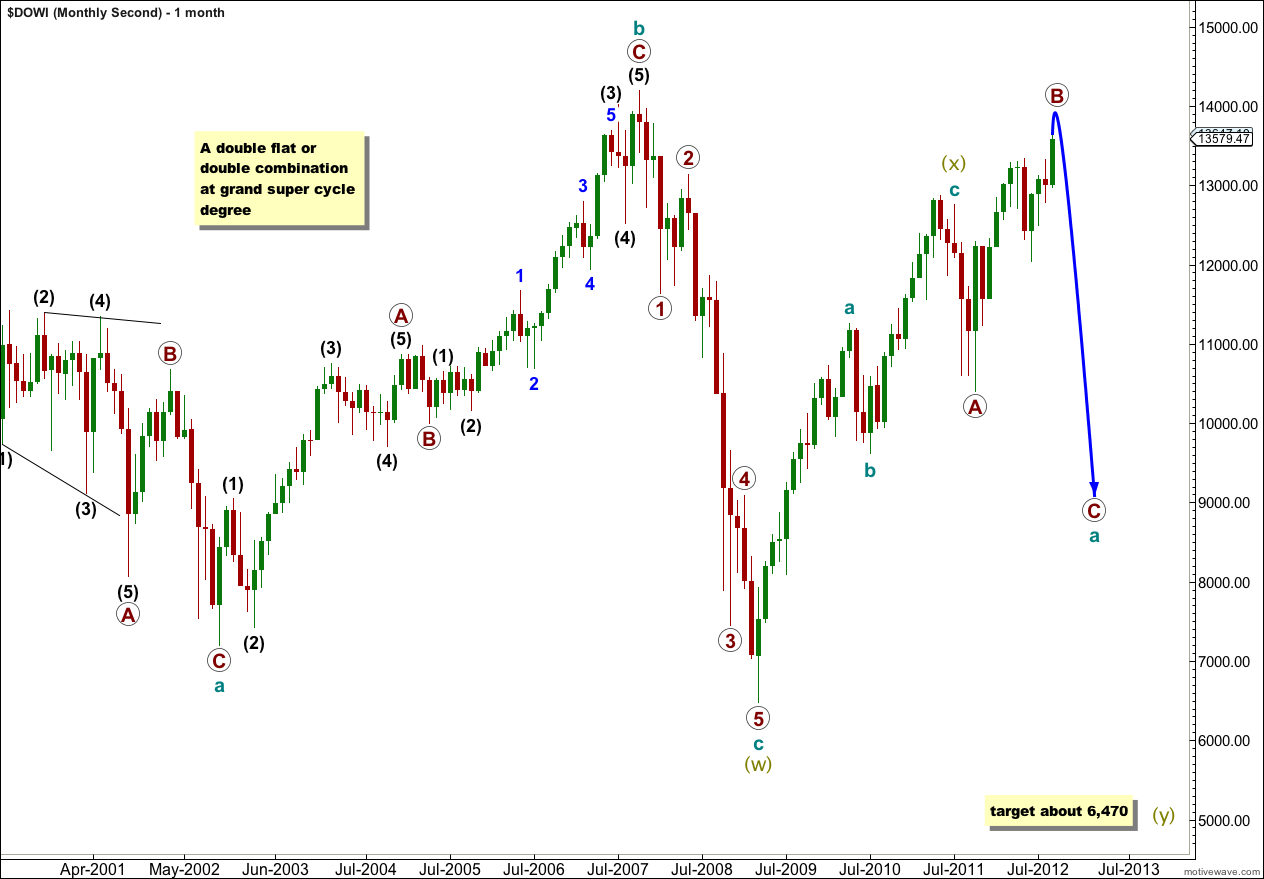

Second Wave Count.

This second wave count looks at the possibility that the Dow is within a very large double flat or double combination correction at grand super cycle degree.

The first structure in the double is an expanded flat correction at super cycle degree labeled (w) olive green. Within wave super cycle wave (w) cycle wave b (teal green) is a 154% correction of cycle wave a, and cycle wave c has no Fibonacci ratio to cycle wave a.

The double is joined by a three in the opposite direction labeled super cycle (x).

The second structure in the double has begun, labeled super cycle wave (y). Super cycle wave (y) may be either a flat correction or a triangle.

Within super cycle wave (y) cycle wave a is subdividing into a three, an expanded flat correction. Primary wave A within it was a three, primary wave B is incomplete. Primary wave B has just passed the maximum common length for a B wave in relation to an A wave for a flat correction at 13,647. This reduces the probability of this wave count and is my primary reason for expecting it now has about an equal probability with the first monthly wave count.

Alternate Monthly Wave Count.

If the movement from the high labeled here super cycle wave (III) to the low labeled super cycle wave (IV) is a complete flat correction, then the entire correction may be over already.

This second alternate looks at the possibility that we are in a new bull market to last years, and that cycle wave I has probably ended.

The biggest problem with this alternate is that upwards movement labeled cycle wave I must be seen as a five wave structure, and it subdivides best into a three and has a very strong three wave look to it on monthly and weekly charts. This reduces the probability of this wave count significantly.

Within the new bull market of super cycle wave (V) cycle wave II may not move beyond the start of cycle wave I. This alternate would be invalidated with movement below 6,469.95.