Movement early in the week above 13,215.9 invalidated the alternate hourly wave count confirming the main wave count. At that stage the target for upwards movement was 13,250 in the first instance. Price has passed this target during last week.

The main wave count has the highest probability. If it is invalidated I have two possible alternates which may explain what would be most likely to happen next.

Click on the charts below to enlarge.

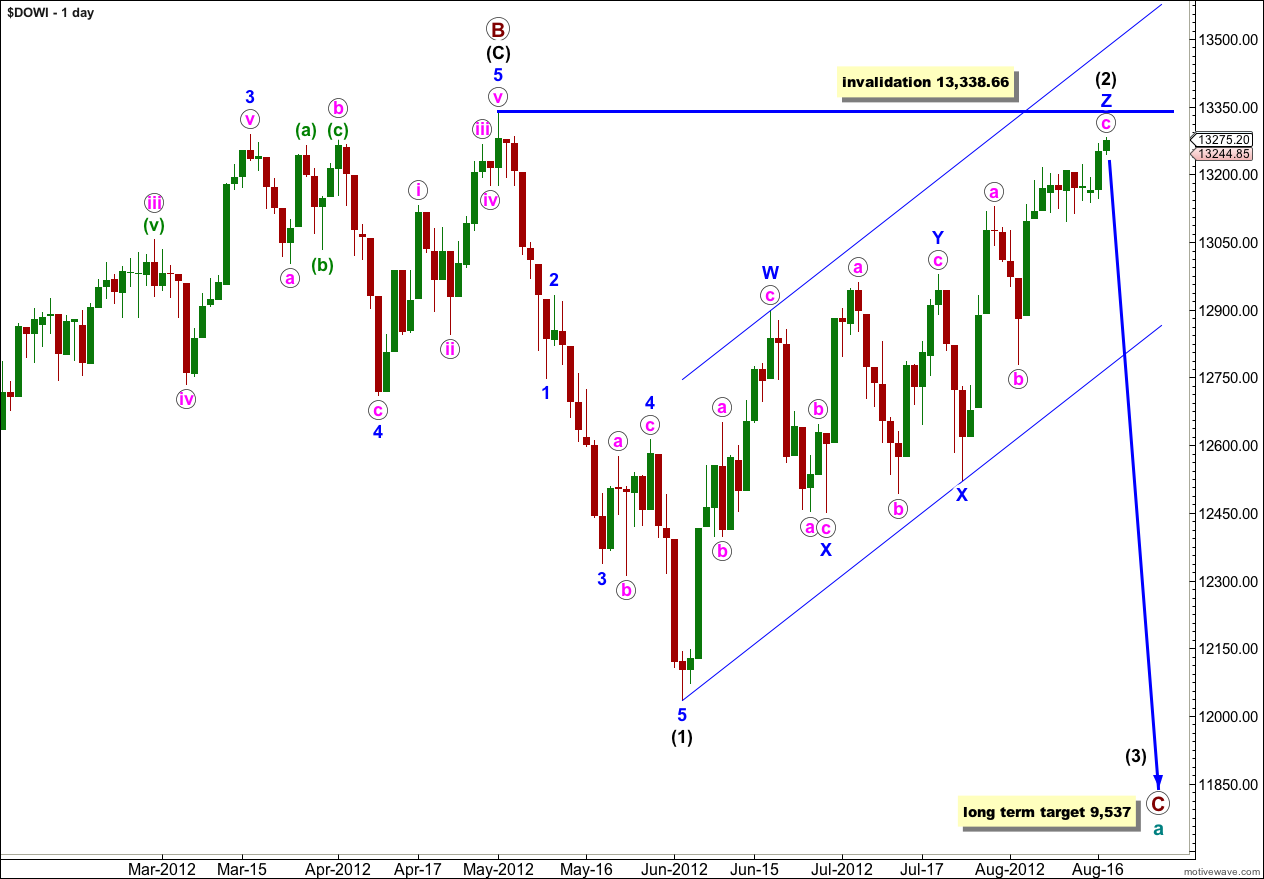

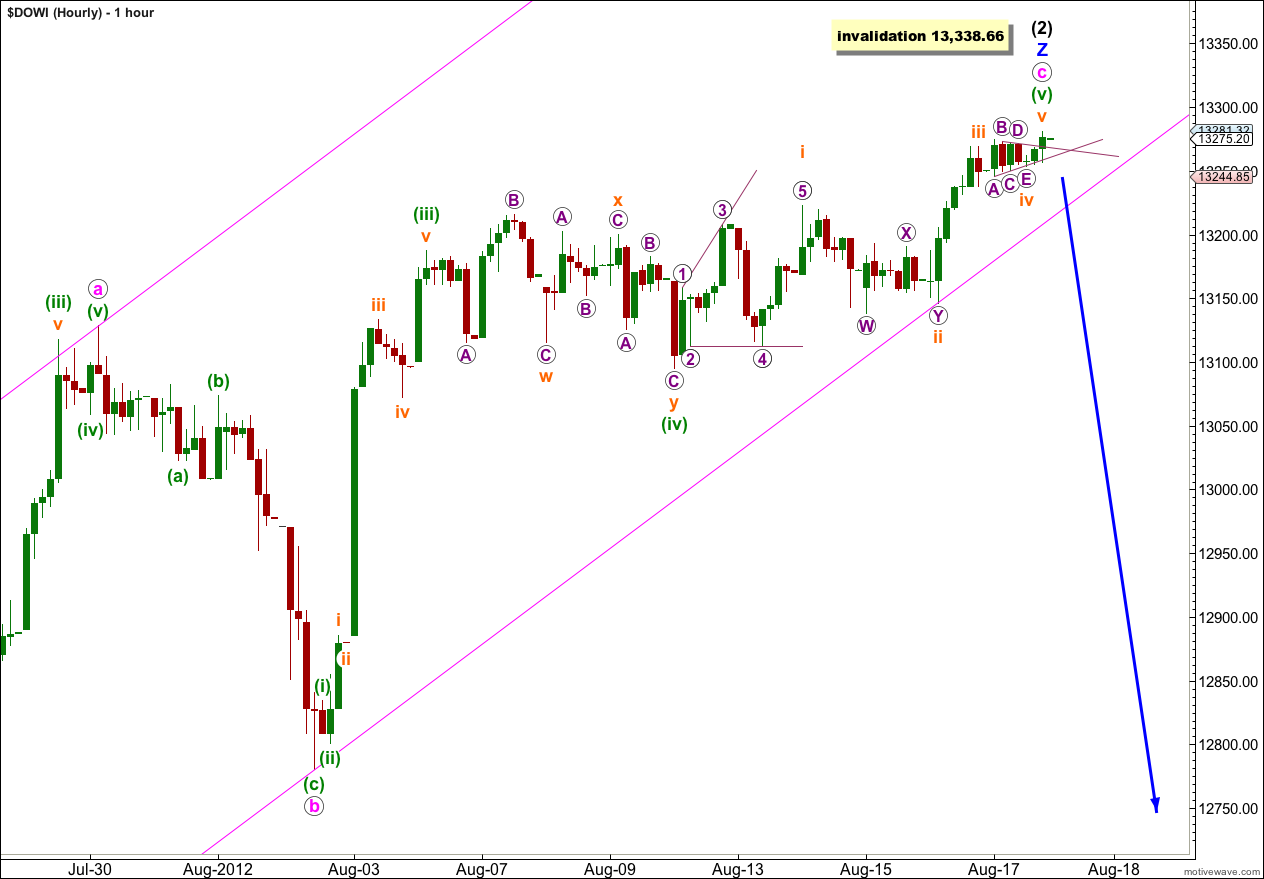

There is almost no room left for upwards movement of wave (2) black. If price does move any higher it should end on Monday if this wave count is correct. At this stage within wave (2) black all structures at all wave degrees may be seen complete, down to the 5 and 1 minute charts. So it would be likely that wave (2) black is now over.

Wave (2) black may have ended on Friday as a very rare triple zigzag. The subdivisions all fit and the purpose of a triple zigzag to deepen a correction is being achieved; movement is clearly upwards and not sideways.

Cycle wave a is an expanded flat because primary wave B within it is over 105% the length of primary wave A. An expanded flat expects a C wave to move substantially beyond the end of the A wave. At 9,537 primary wave C would achieve this and would be a typical 1.618 the length of primary wave A.

The parallel channel drawn here about wave (2) black is a best fit. Movement below this channel would confirm a trend change.

Wave (2) black may not move beyond the start of wave (1) black. This wave count is invalidated with movement above 13,338.66.

Within wave c pink all subdivisions can be seen as complete. Wave (iv) green is longer in duration and out of proportion to wave (ii) green which gives this wave a three wave look.

Within wave c pink there are no Fibonacci ratios between green waves (i), (iii) and (v).

Within wave (iii) green there are no adequate Fibonacci ratios between waves i, iii and v orange.

Ratios within wave (v) green are: wave iii orange is just 4.92 points short of equality with wave i orange, and wave v orange is jut 1.4 points short of 0.236 the length of wave iii orange. Wave ii orange is a deep double combination correction and wave iv orange is a contracting triangle, giving perfect alternation between these two corrections.

There is no Fibonacci ratio between waves a and c pink.

The parallel channel drawn here uses Elliott’s technique for a correction. When this channel is breached by downwards movement then we shall have confirmation of a trend change at least at minute (pink) degree. Movement below the channel on the daily chart will provide confirmation at intermediate degree.

If price does move any higher on Monday with an extension of wave v orange then any movement above 13,338.66 would firmly invalidate this wave count. At that stage we should use the alternate wave count below.

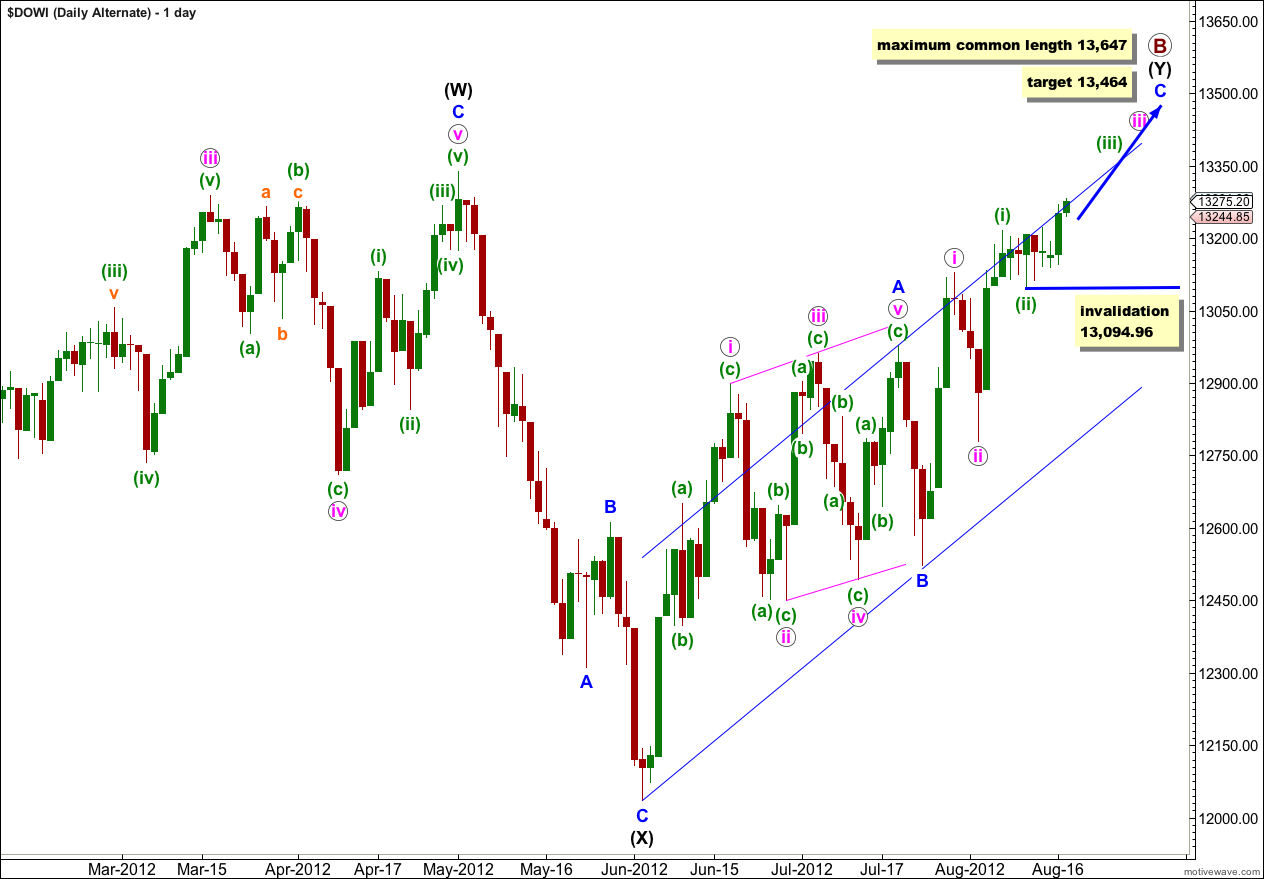

Alternate Wave Count.

It is possible that primary (maroon) wave B is not over as a single zigzag, and may be continuing further as a double zigzag. Unfortunately, with the Dow, downwards movement labeled here wave (X) black is ambiguous and may be seen either as a three or a five, and indeed looks pretty good as a three.

If this is the case then upwards movement could be seen as a single zigzag. However, this is where this wave count encounters problems. The structure upwards does not subdivide nicely into a single zigzag. The possible leading diagonal for wave A blue subdivides into a series of three wave structures but wave iv pink is longer than wave ii pink, while wave iii pink is shorter than wave i pink and wave v pink is shorter than wave iii pink. The actionary waves suggest a contracting diagonal, while the reactionary waves suggest an expanding diagonal. I will consider this possibility even though it does not meet rules for a typical diagonal because the third wave is not the shortest. I have on occasion seen diagonals where the wave lengths are not as expected, but it is rare. This reduces the probability that this wave count is correct.

Wave C blue can only be seen as an impulse, at this stage. There is a fair amount of overlapping and the third wave within wave C blue cannot yet be complete.

This wave count expects an increase in upwards momentum.

At 13,464 wave C blue would reach equality with wave A blue.

At 13,647 primary wave B would reach 138% the length of primary wave A, the maximum common length for a B wave within a flat correction.

Within wave (iii) green no second wave correction may move beyond the start of its first wave. This alternate wave count would be invalidated with movement below 13,094.96.

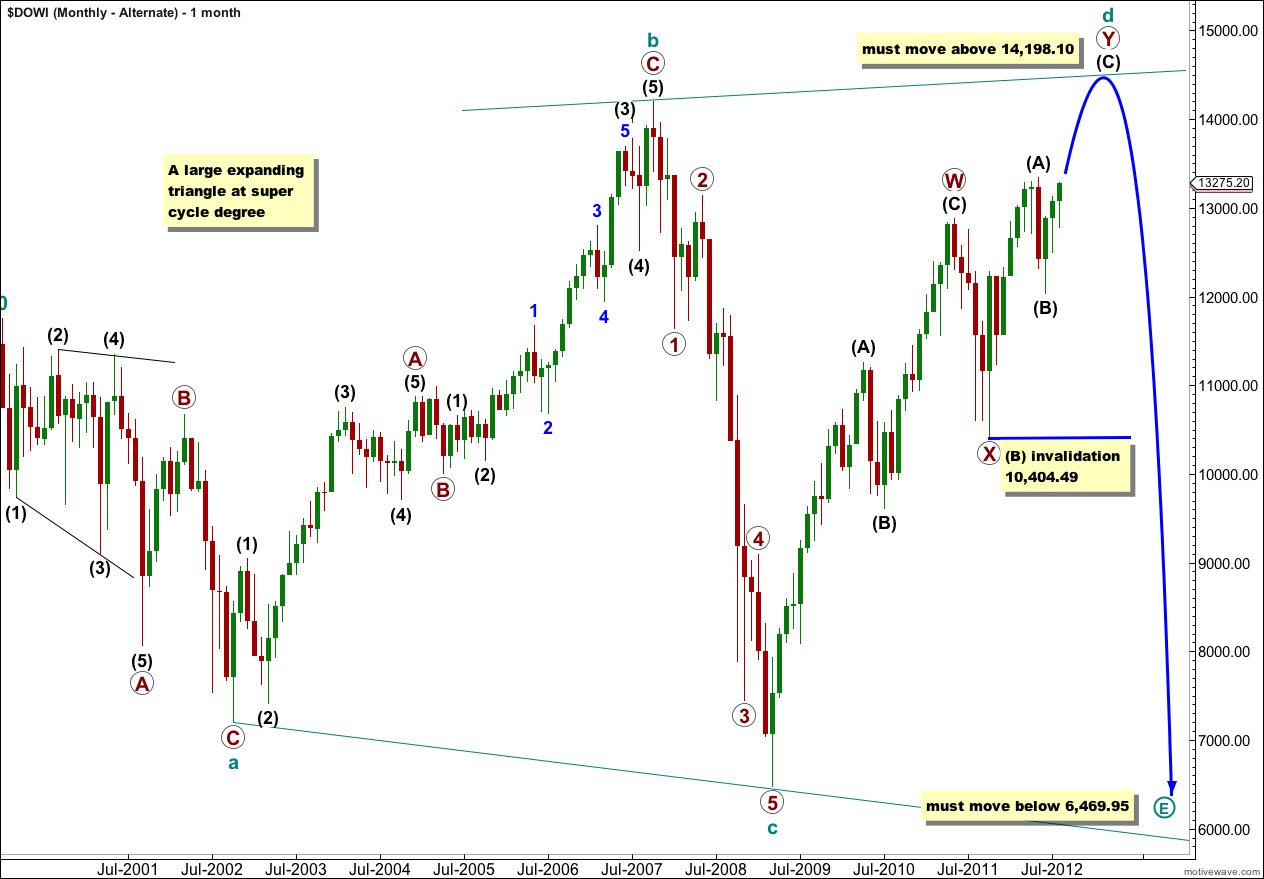

Alternate Monthly Wave Count.

This alternate wave count at the monthly chart level is an alternate which has been published in the historical Dow analysis for some time.

If price moves above 13,338.66 this wave count must be considered.

We may be seeing a very rare expanding triangle unfold at super cycle degree. One of the subwaves of a triangle should be longer lasting and more complicated than the others, and in this case cycle wave d may be unfolding as a double zigzag. Within the second zigzag of the double, primary wave Y, waves (A) and (B) black may be complete and wave (C) black upwards may be unfolding.

For an expanding triangle wave d must move beyond the end of wave b, so price must make a new all time high above 14,198.1.

Thereafter, the market will turn downward with the final wave e of the triangle to make a new low beyond the end of wave c, below 6,469.95.

There are two problems with this wave count:

1. Expanding triangles are the rarest Elliott wave structures in my experience which significantly reduces the probability of this wave count.

2. The three waves at cycle degree labeled a – b – c form a perfect flat correction. In my experience when I see this I would expect any correction to continue further as a double flat or double combination which are both very common structures. If I expect a triangle to continue from that point it is invariably invalidated and turns out to be wrong. Therefore, the main wave count is expecting a double flat to unfold.

Movement below 10,404.49 would invalidate this wave count as wave (B) black may not move beyond the start of wave (A) black.