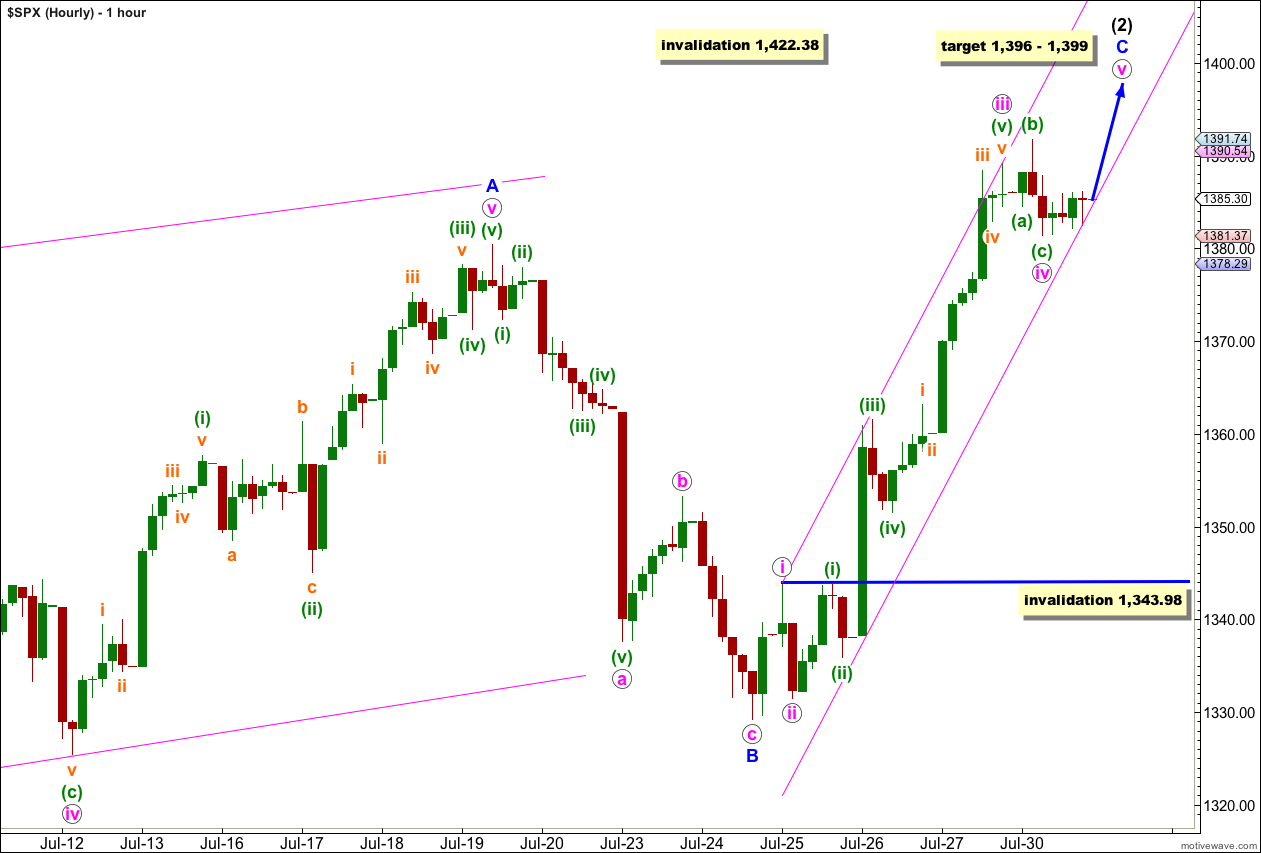

Last analysis expected price to reach up to 1,393 – 1,394 during Monday’s session. Price reached up to 1,391.74, 1.26 points short of the small target zone.

Thereafter, I expected the S&P 500 to move lower for a low degree correction which is exactly what happened.

The target for the next wave can now be calculated at two wave degrees and a parallel channel should show us where price may be contained, and will provide first indication of a trend change.

Click on the charts below to enlarge.

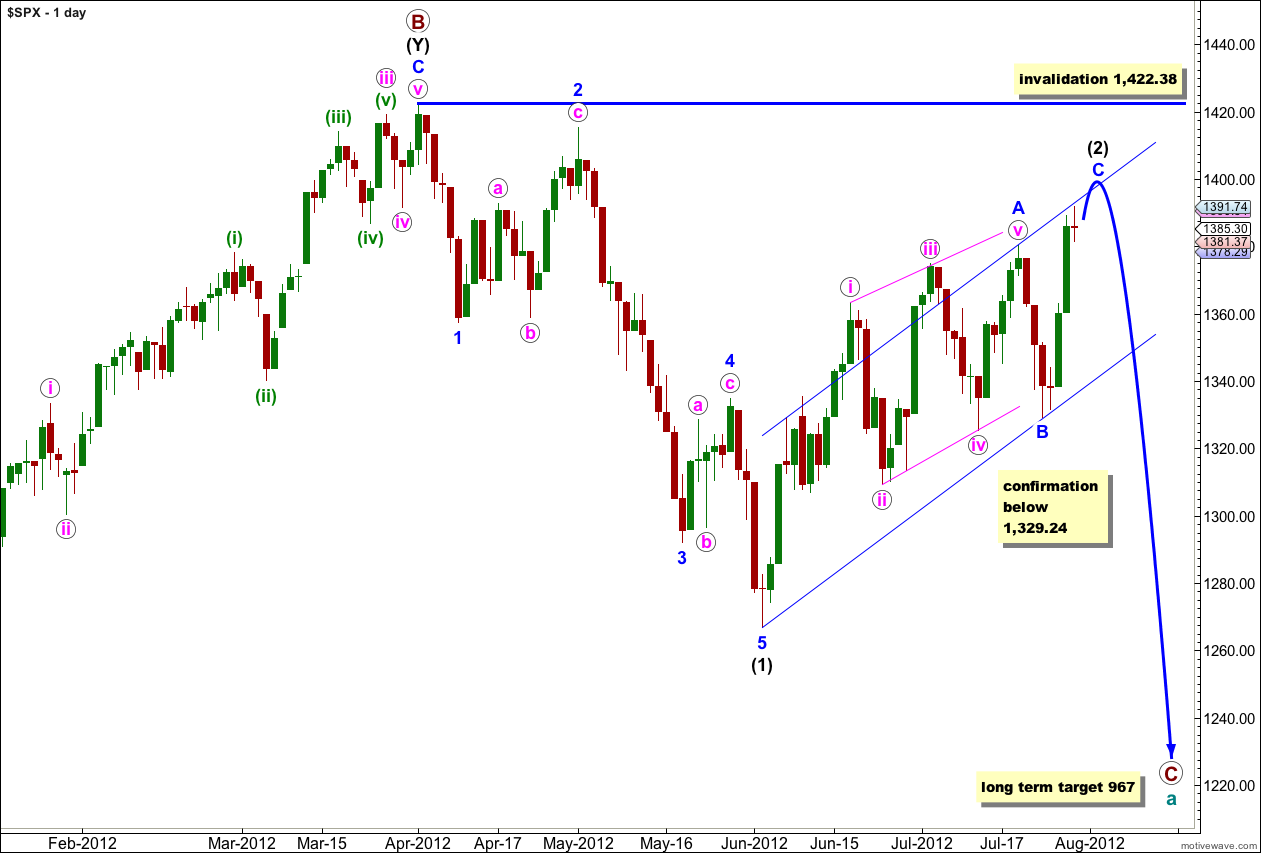

This wave count sees a big trend change at the price high of 1,422.38. Primary wave C should make substantial new lows below the end of primary wave A which had its low at 1,074.77. Primary wave C would reach 1.618 the length of primary wave A at 967, completing a typical expanded flat for cycle wave a.

Within primary wave C wave (1) black is a complete five wave impulse downwards. Wave (2) black may be completing a single zigzag structure. Within wave (2) black wave A blue is a leading contracting diagonal, wave B blue is a sharp zigzag, and wave C blue is a simple impulse. Waves A and C blue have good alternation in structure.

We may use Elliott’s channeling technique to draw a parallel channel about wave (2) black. When this channel is breached by downwards movement we should have confirmation of a trend change.

The only way at this stage that wave (2) black could continue further would be as a very rare triple zigzag. The rarity of triples means the probability of wave (2) black continuing further is extremely low. Also, for the S&P 500 to continue further within this correction it would diverge significantly with the Dow. For the Dow the only corrective structure which fits the upwards movement and meets all rules is a triple zigzag, so when this last movement is over the correction cannot continue further.

Wave (2) black may not move beyond the start of wave (1) black. This wave count is invalidated with movement above 1,422.38.

It looks like waves iv and v orange were over last week as Monday’s movement subdivides into an expanded flat correction (upwards movement labeled wave (b) green does not subdivide as a five and cannot be a fifth wave).

Waves ii and iv pink have perfect alternation: wave ii pink was a deep zigzag and wave iv pink was a shallow expanded flat correction.

Wave iii pink is 4.75 points short of 4.236 the length of wave i pink (an 8.2% variation which is acceptable).

Ratios within wave iii pink are: wave (iii) green has no Fibonacci ratio to wave (i) green, and wave (v) green is 3.75 points short of 1.618 the length of wave (iii) green.

Ratios within wave (iii) green are: wave iii orange is 1.94 points short of 1.618 the length of wave i orange, and wave v orange is 0.43 points short of 0.236 the length of wave iii orange.

Within wave iv pink wave (b) green is a 155% correction of wave (a) green, and wave (c) green has no Fibonacci ratio to wave (a) green.

At the end of Monday’s session upwards movement from the low labeled iv pink is not enough to indicate that wave iv pink is definitely over. It must be accepted at this stage that it is possible for wave iv pink to continue further as a double flat or double combination. If it does then it would most likely move sideways and slightly lower. Wave iv pink may not move into wave i pink price territory. This wave count is invalidated with movement below 1,343.98.

A clear five upwards on the 5 minute chart would indicate that wave iv pink is over and wave v pink is underway. This is not clear at the end of Monday’s session; upwards movement is very choppy and overlapping and may be a continuation of this small correction.

If wave iv pink is over then at 1,396 wave v pink would reach equality with wave i pink.

At 1,399 wave C blue would reach 0.618 the length of wave A blue. This gives us a 3 point target zone and I would favour the lower end.

I have drawn a best fit parallel channel about wave C blue. The first trend line is drawn from the highs of waves i to iii pink, then a parallel copy is placed on the low of wave iv pink and pushed out to contain all this movement. I would expect this channel should contain upwards movement for wave v pink which may end mid way within the channel. When this channel is clearly breached by downwards movement then we shall have our first indication of a possible trend change.

Sure glad we did not change the count like we talked about last week (massive sell volume EOD).

The massive rip in volume at the close (and 5pt drop in ES) suggest plenty of short-term exits ahead of the fun-and-games of the next two days and certainly Treasuries were sending similar derisking signals.

Major end-of-month volume flush at the close to leave ES at the cliff’s edge once more… the 150,000 ES contracts in the last 2 minutes of the day-session equates to around $10.3bn

http://www.zerohedge.com/news/equities-close-weak-heavy-volume-month-ends-1

ES Looks like the end of Wave c of iv pink => 1371.25