Last week’s analysis expected a correction to end and then further downwards movement. The triangle structure was invalidated and I expected at that stage the correction was possibly a combination.

With the correction over I am now able to calculate targets.

I still have only one daily and one hourly wave count, which so far has been explaining price action reasonably well.

Click on the charts below to enlarge.

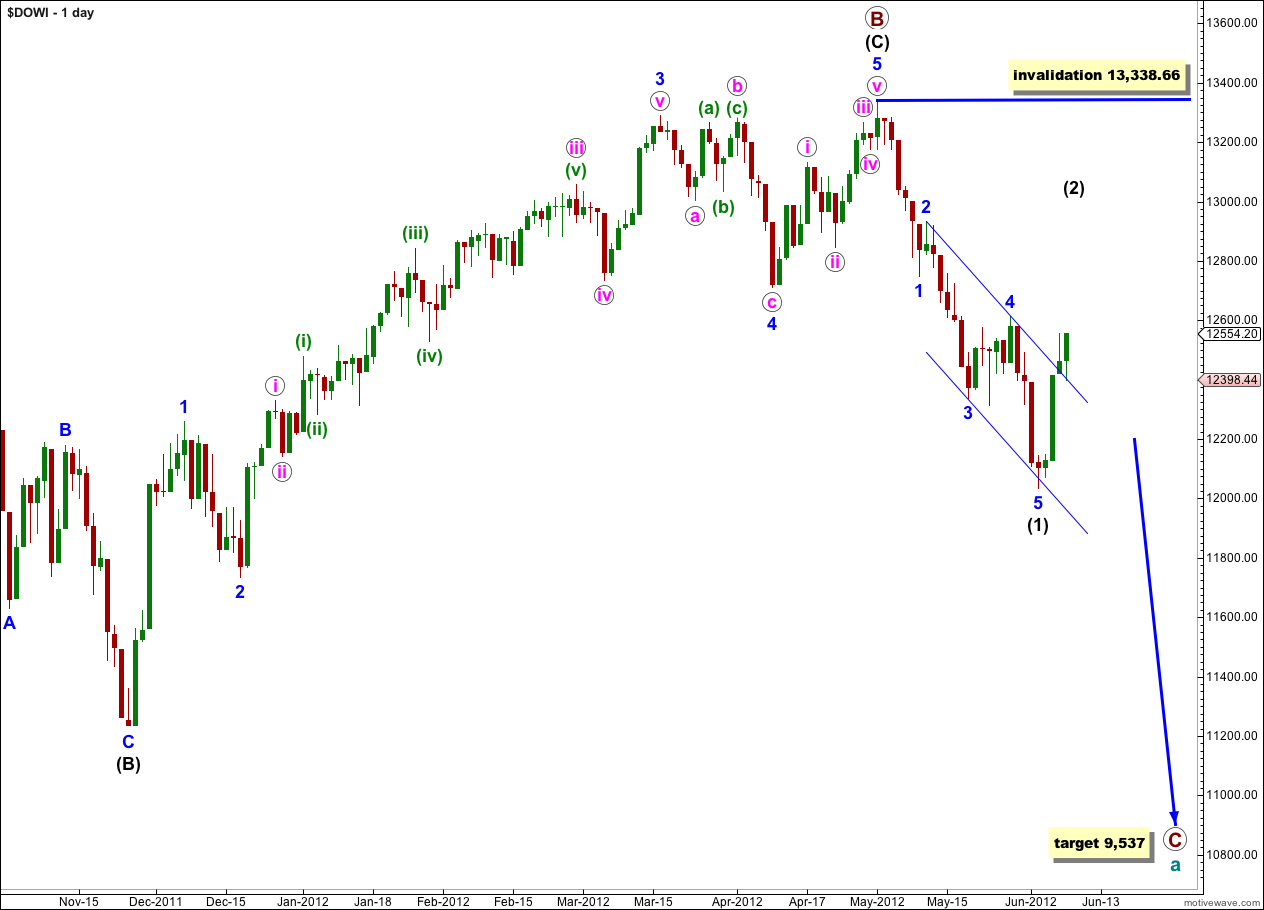

I expect that the Dow is within a five wave structure downwards for primary wave C (maroon) to complete cycle wave a (teal green).

Cycle wave a is an expanded flat because primary wave B within it is over 105% the length of primary wave A. An expanded flat expects a C wave to move substantially beyond the end of the A wave. At 9,537 primary wave C would achieve this and would be a typical 1.618 the length of primary wave A.

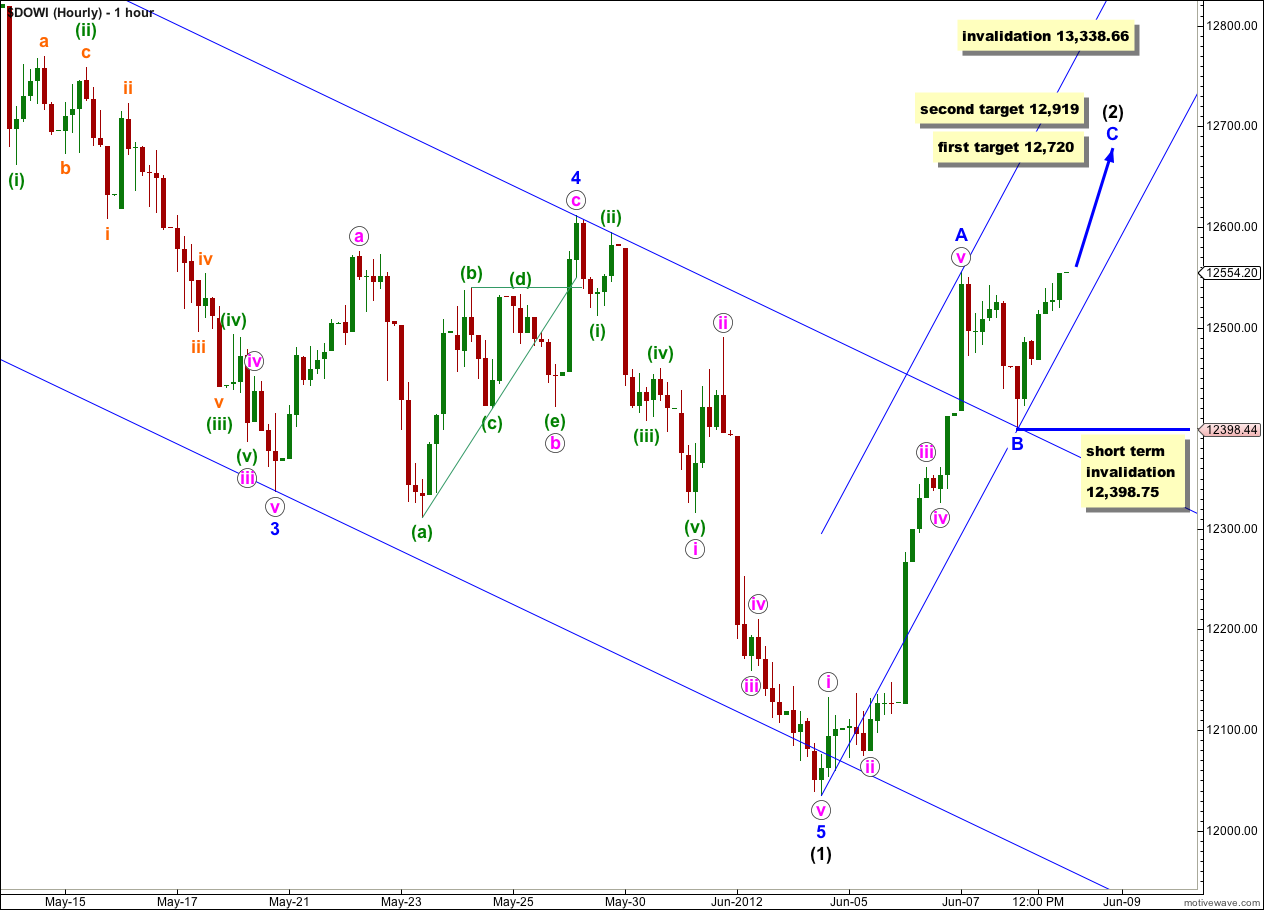

I have reanalysed the downwards movement labeled now 1 blue. I expect the correction which ended last week was not 4 blue, but 2 blue. This is because for my previous analysis the third wave would now be the shortest, violating a core Elliott wave rule.

When wave (1) black (intermediate) is complete wave (2) black may not move beyond its start. This wave count is invalidated with movement above 13,338.66.

Friday’s downwards movement has made a new extreme for MACD, which is exactly what we would expect from a third wave. This wave count fits very nicely with MACD.

Ratios within wave 1 blue are: wave iii pink has no Fibonacci ratio to wave i pink and wave v pink is 13.72 points short of 4.236 the length of wave i pink.

Wave 2 blue was a single zigzag correction and shallow at only 29% of wave 1 blue. We may expect the upcoming fourth wave correction to be deeper and either a flat, double, combination or triangle.

The channel I have drawn about wave (1) black so far is an acceleration channel and we may expect wave 3 blue downwards to breach the lower edge.

At 12,020 wave iii pink would reach 1.618 the length of wave i pink. If price falls through this first target, or it gets there and the structure of wave iii pink is incomplete, then a second target would be at 11,730 where it would reach 2.618 the length of wave i pink.

At 11,579 wave 3 blue would reach equality with wave 1 blue. If price continues through this first target, or it gets there and the structure of wave 3 blue is incomplete, then a second target would be at 10,945 where it would reach 1.618 the length of wave 1 blue. If that is where this third wave ends then I would move everything from the start of primary wave C up one degree, and would expect that wave (3) black was over.

Within wave iii pink no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement above 12,489.87. When wave iii pink is over we may move the invalidation point down to the low of wave i pink at 12,316.48.