As expected from yesterday’s analysis, there was almost no room left for upwards movement and price had to move lower.

At this stage mid and long term targets remain the same. We may now also use Elliott’s channeling technique to show us where price should be contained within this next structure.

I still have two daily wave counts but they have exactly the same targets and invalidation points, and they do not diverge at this stage.

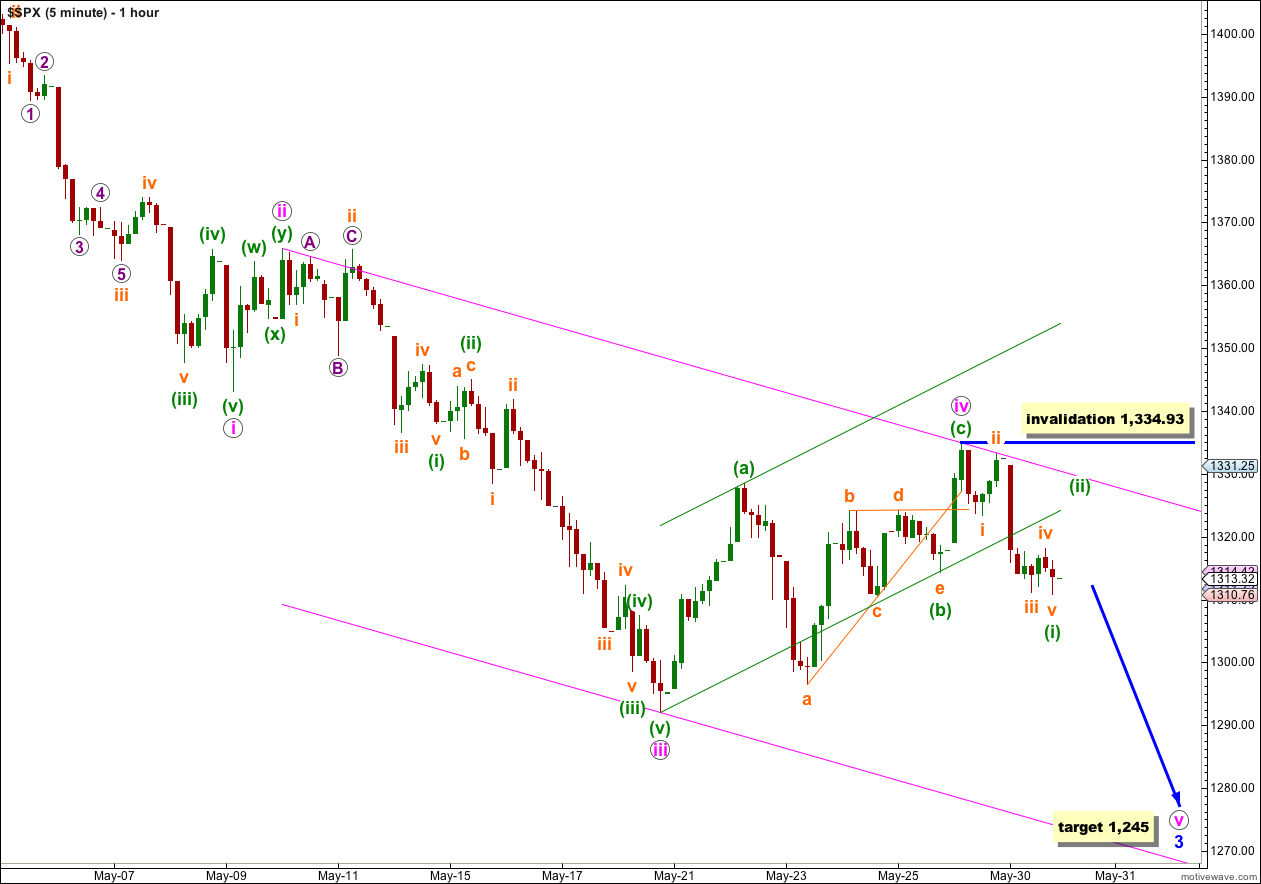

I have only one hourly wave count again today.

Click on the charts below to enlarge.

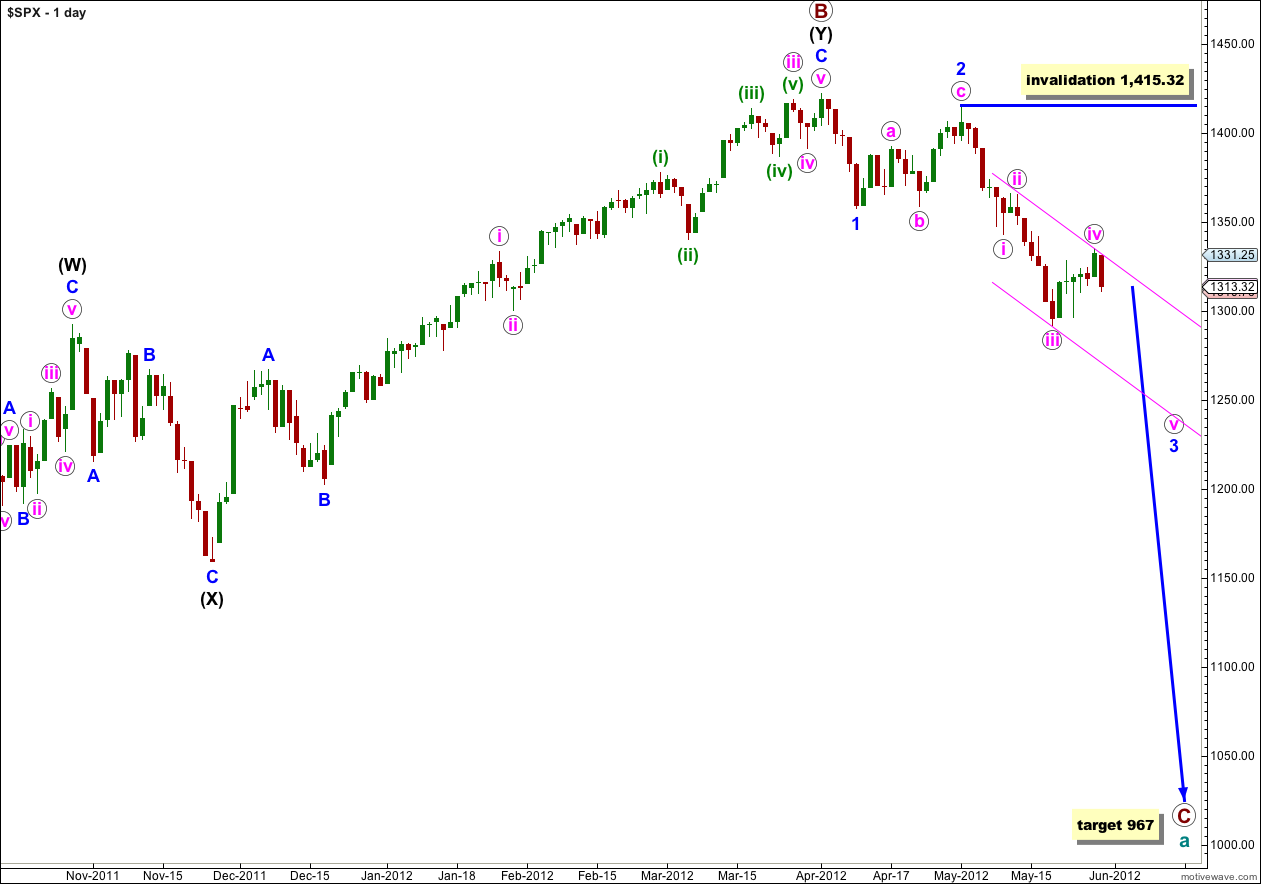

We have recently seen a very large trend change on the S&P 500 and a new downwards trend, to last months, has begun.

At cycle degree wave a (teal green) is an expanded flat correction. Primary wave A (maroon) within it subdivides into a three, and primary wave B is over 105% of primary wave A at 123%. The minimum requirements for an expanded flat are met. We should expect primary wave C to subdivide into a five and move price substantially below the end of primary wave A at 1,074.77.

At 967 primary wave C would reach 1.618 the length of primary wave A. If price continues through this first target, or it gets there and the structure is incomplete, then our second (less likely) target is at 685 where primary wave C would reach 2.618 the length of primary wave A.

Primary wave A lasted 4 months. Primary wave B lasted 6 months. We may expect primary wave C to last at least 4 months, if not longer.

Within wave 3 blue no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement above 1,415.32. When the structure of wave 3 blue is complete then the invalidation point can be moved to the low of wave 1 blue at 1,357.38.

It looks more likely today that wave iv pink is finally over. We have a reasonably clear five down (so far) on the hourly chart and the parallel channel about wave iv pink zigzag has been breached with downwards movement.

Within wave v pink wave (i) green may be complete. Ratios within wave (i) green are: wave iii orange has no Fibonacci ratio to wave i orange, and wave v orange is just 0.77 points short of equality with wave i orange.

To begin tomorrow’s session we may see an upwards correction for wave (ii) green. This could be over during the session and wave (iii) green downwards may begin. Wave (ii) green may find resistance at the upper edge of the pink parallel channel drawn about the entire movement of wave 3 blue.

The target remains at 1,245 where wave 3 blue would reach 2.618 the length of wave 1 blue. When we have waves (i) and (iii) green within wave v pink completed then I will use green wave degrees to calculate an alternative target or refine the existing target, and this target may change.

Wave (ii) green may not move beyond the start of wave (i) green. This wave count is invalidated with movement above 1,334.93.

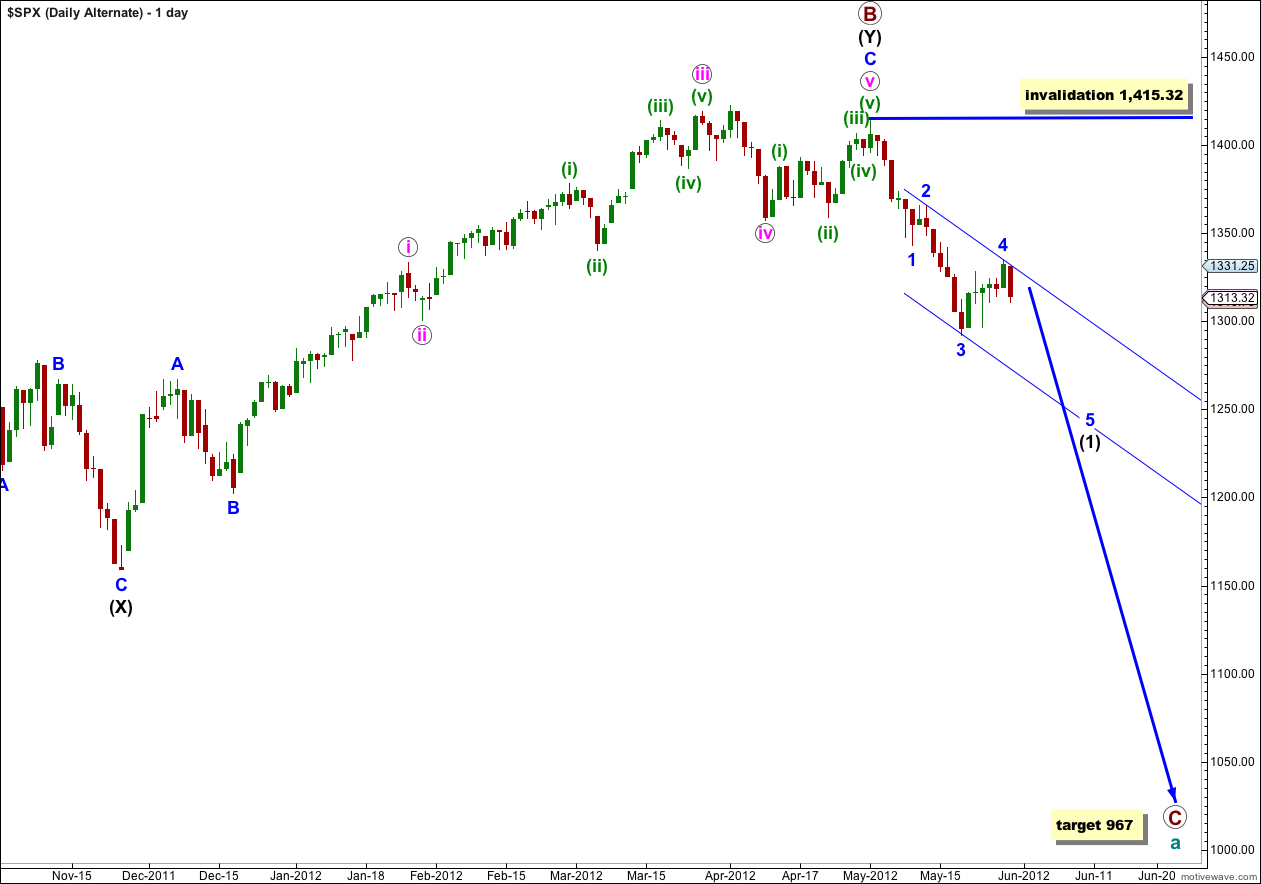

Alternate Daily Wave Count.

Primary wave B may have ended at 1,415.32 with a fifth wave truncation. The truncation reduces the probability of this alternate.

If primary wave C has more recently begun then it is probably within wave (1) black. A fourth wave correction for wave 4 blue would be either just complete or close to completion, and wave (1) black would be incomplete. On the hourly chart this alternate would be mostly the same as our main wave count.

When wave (1) black is complete this alternate would expect a second wave correction for wave (2) black. Wave (2) black can move right up to, but not above, 1,415.32.

At that stage this wave count would diverge from our main wave count. The price point which differentiates the two is 1,357.38. The main wave count would not allow movement above that price point and this alternate would see it as reasonably likely. If price did move above 1,357.38 the main wave count would be invalidated and this alternate would be our sole wave count.

At this stage this alternate does not differ in its expectation of what should happen next. This alternate requires further downwards movement to complete the five wave impulsive structure of wave (1) black.