Price has moved mostly sideways for the whole week. I had expected a fourth wave correction to arrive last week, but I expected the third wave to move lower first, which did not happen.

I still have just the one daily and one hourly wave counts this week. The structure unfolding on the hourly chart so far looks so typical and good I have a high level of confidence in my prediction for what should happen when it is complete.

Click on the charts below to enlarge.

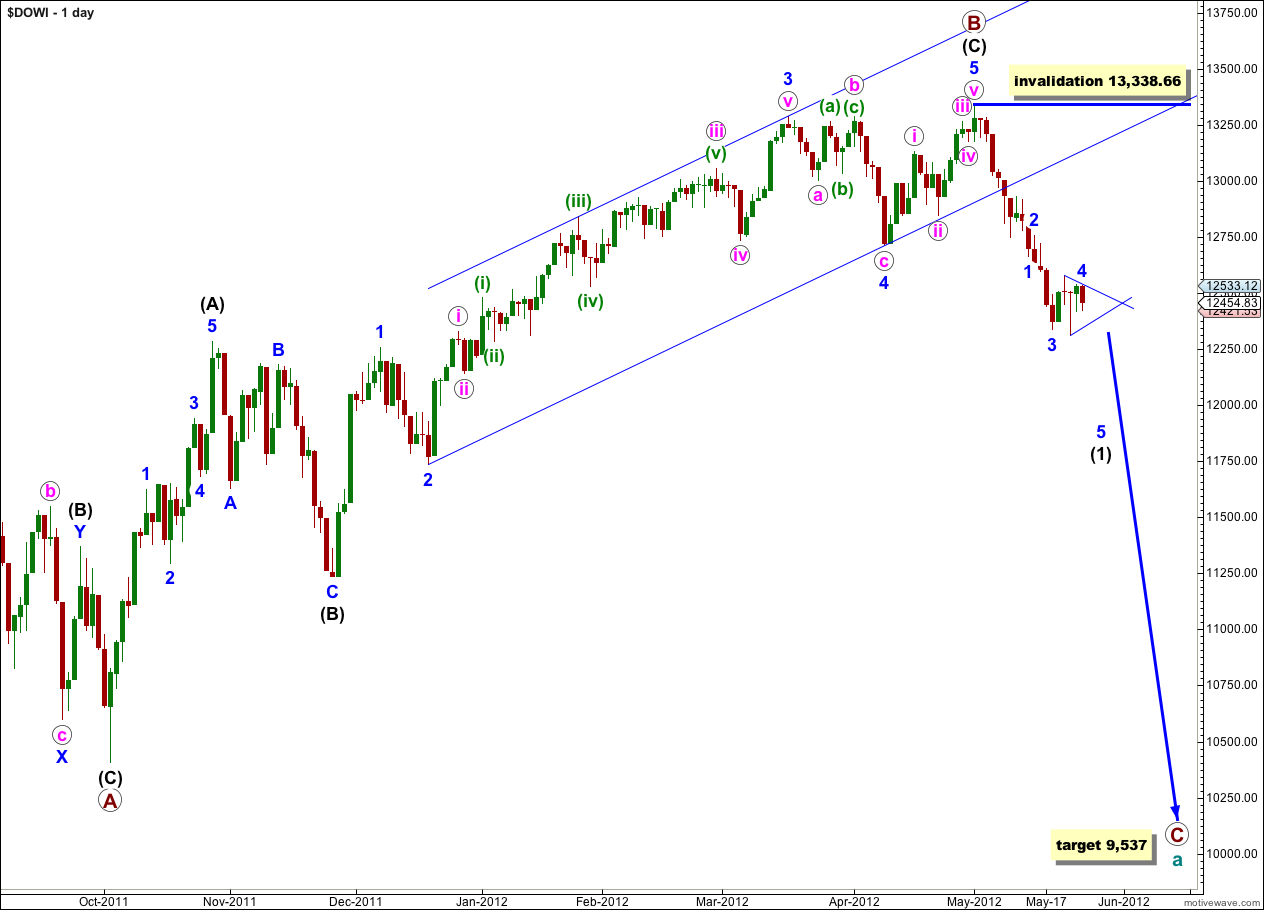

In line with my historic monthly charts I have moved everything on the daily chart up one degree. I expect that the Dow is within a five wave structure downwards for primary wave C (maroon) to complete cycle wave a (teal green).

Cycle wave a is an expanded flat because primary wave B within it is over 105% the length of primary wave A. An expanded flat expects a C wave to move substantially beyond the end of the A wave. At 9,537 primary wave C would achieve this and would be a typical 1.618 the length of primary wave A.

When wave 4 blue (minor) is complete wave 5 blue downwards should complete wave (1) black (intermediate). Thereafter, wave (2) black may not move beyond the start of wave (1) black. This wave count is invalidated with movement above 13,338.66.

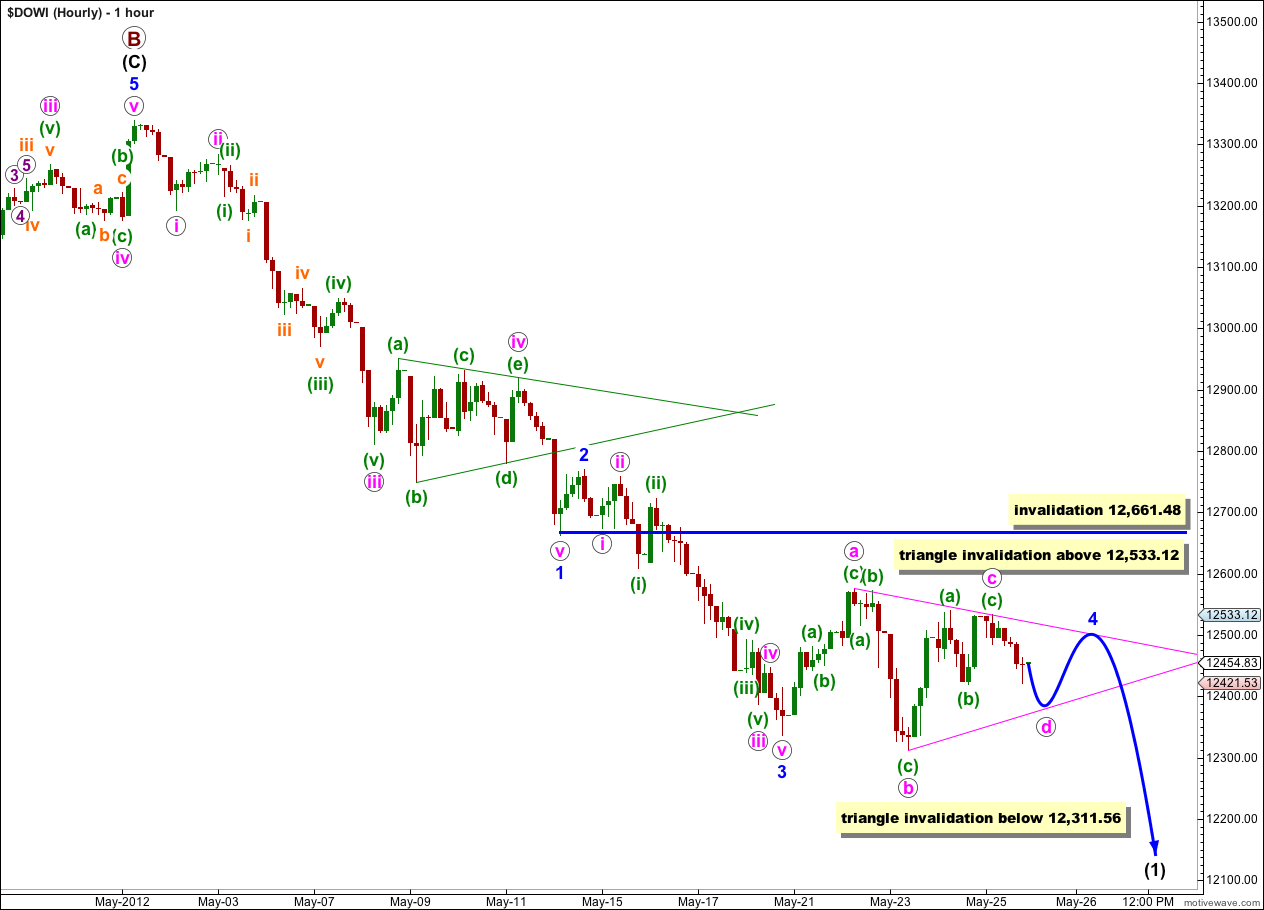

The structure unfolding for the last week looks very much like a contracting running triangle, and it has typical wave lengths.

Wave c pink (minute) is an 84% correction of wave b pink, and this mid 80’s percentage I have found to be very typical of triangles.

About 12,344 wave d pink would reach 85% the length of wave c pink. This would be a typical place for it to end.

Wave d pink may not move beyond the end of wave b pink. A contracting triangle is invalidated with any movement below 12,311.56 (before it is complete).

If this fourth wave turns out to be a barrier triangle (less common than a contracting triangle) then the b-d trend line must be essentially flat. What this means in reality is the wave d pink could move very slightly below the end of wave b pink and the fourth wave would still be a triangle.

Thereafter, wave e pink may not move beyond the end of wave c pink, and this is the case for both a contracting and barrier triangle. The triangle is invalidated with any movement above 12,533.12.

We may expect one of the five sub-waves of a triangle to be longer lasting and more complicated than the others. So far all the sub-waves are simple zigzags when their subdivisions are looked at carefully on the 5 minute chart. We may expect either wave d pink (more likely) or wave e pink (less likely) to be double zigzags.

We may expect wave e pink to either overshoot (more likely) or under shoot (less likely) the upper a-c pink trend line of the triangle.

When the triangle is completed we may expect a strong downwards movement out of it for wave 5 blue.

At this stage because we do not have an end to wave 4 blue I cannot calculate a target for wave 5 blue downwards for you. However, wave 3 blue is slightly shorter than wave 1 blue, and so wave 5 blue is limited to no longer than equality with wave 3 blue at 432.57 points.

Wave 3 blue is 14.07 points longer than 0.618 the length of wave 1 blue.

We may expect wave 5 blue most likely to be about equal to the widest part of the triangle which was 264 points. This length is close to 0.618 the length of wave 3 blue which is 267 points.

If the triangle is invalidated by upwards movement then I would expect that wave 4 blue is unfolding as a complicated double combination correction. At that stage the invalidation point is at 12,661.48 as wave 4 blue may not move into wave 1 blue price territory.

If the triangle holds and completes as expected, then keep drawing the trend lines about it and extend them outwards to cross over. The point in time at which the trend lines cross may see a trend change.

When wave 4 blue is complete we may use Elliott’s second channeling technique to draw a parallel channel about this downwards movement. Draw the first trend line from the highs of wave 2 blue to wherever wave 4 blue has ended, then place a parallel copy upon the low of wave 3 blue. Expect wave 5 blue to end mid way within that channel (more likely) or about the lower edge of the channel (less likely).