Movement to a new high above 13,297.11 invalidated the main wave count and confirmed the alternate.

I have two wave counts for next week. We have a confirmation / invalidation point to the downside which clearly differentiates the two wave counts. Movement below this point would confirm a large trend change for the Dow.

Click on the charts below to enlarge.

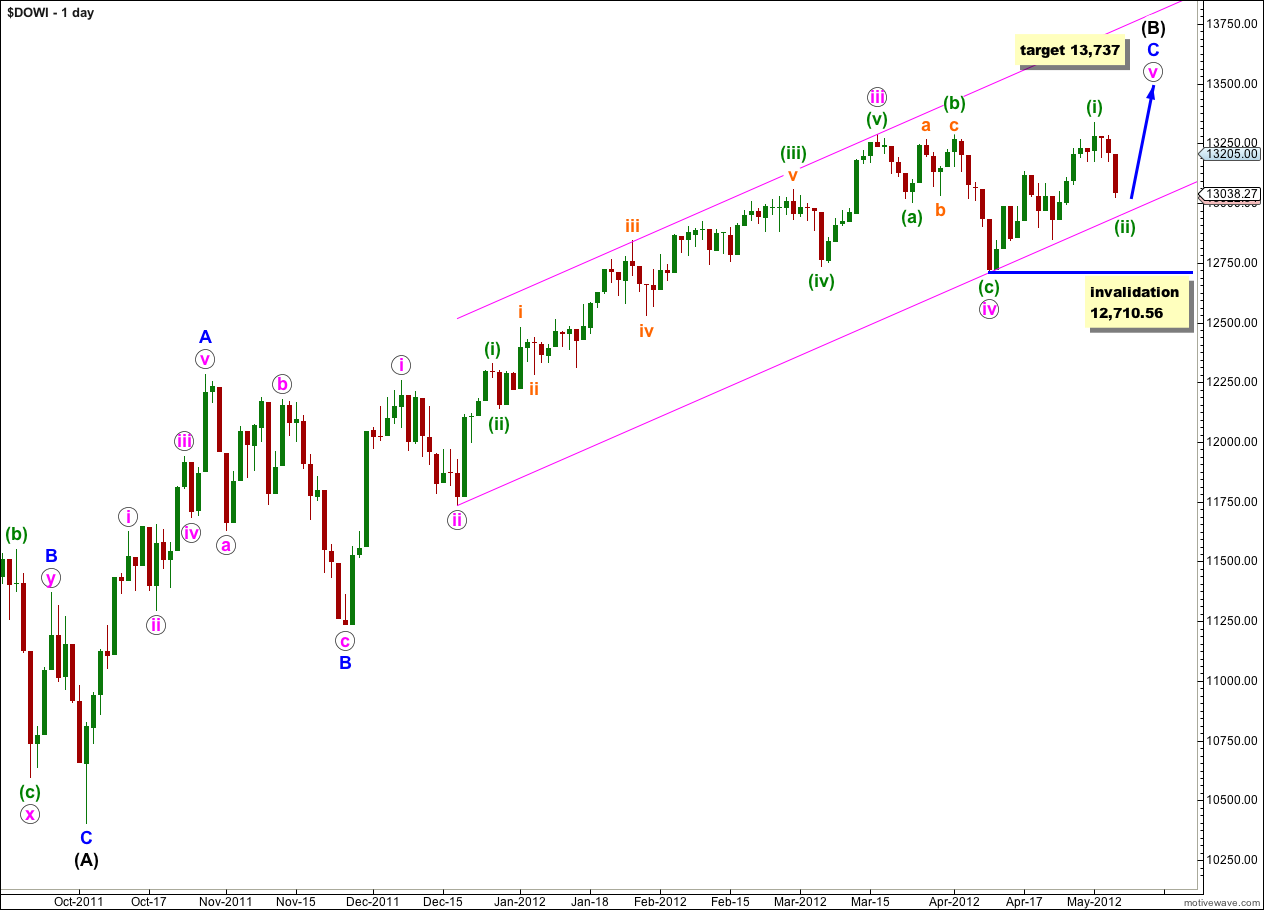

Main Wave Count.

Because we should always assume that the trend remains the same until proven otherwise we should assume that this upwards trend will continue.

Wave (B) black for the Dow can only be a single zigzag structure.

Within this large zigzag wave C blue may be incomplete. At 13,737 wave v pink would reach equality with wave iii pink. At that point wave (B) black would be longer than the longest common length for a B wave within a flat correction, which would be passed at 13,647. This target may be too high and we may see a trend change before this point. As there is further upwards movement to analyse I will recalculate the target at lower wave degrees.

Within wave v pink only wave (i) green may be complete. Wave (ii) green may move lower and would probably find support at the lower edge of this parallel channel, if this wave count is correct. If this channel is breached by downwards movement that shall be our very first indication that this wave count may be incorrect and we should use the alternate.

Within wave v pink wave (ii) green may not move beyond the start of wave (i) green. This wave count is invalidated with movement below 12,710.56.

Upwards movement for wave (i) green is a complete impulsive structure.

Ratios within wave (i) green are: wave iii orange is just 0.19 points longer than equality with wave i orange, and wave v orange is just 2.73 points longer than 0.382 the length of wave iii orange. These are remarkably excellent Fibonacci ratios, particularly for the Dow. This adds confidence that this upwards wave was an impulse and it is over.

Ratios within wave i orange: there are no adequate Fibonacci ratios between waves 1, 3 and 5 purple within wave i orange.

Ratios within wave 5 purple of wave i orange are: wave (3) aqua has no Fibonacci ratio to wave (1) aqua, and wave (5) aqua is just 0.77 points longer than 0.146 the length of wave (1) aqua.

Ratios within wave iii orange are: wave 3 purple has no Fibonacci ratio to wave 1 purple, and wave 5 purple is just 2.78 points longer than 1.618 the length of wave 3 purple.

Ratios within wave 5 purple of wave iii orange are: wave (3) aqua is 2.76 points longer than 1.618 the length of wave (1) aqua, and wave (5) aqua is 4.30 points short of 0.382 the length of wave (3) aqua

Ratios within wave (3) aqua of wave 5 purple of wave iii orange are: wave 3 red is 0.16 points longer than 2.618 the length of wave 1 red, and wave 5 red has no Fibonacci ratio to either 1 or 3 red.

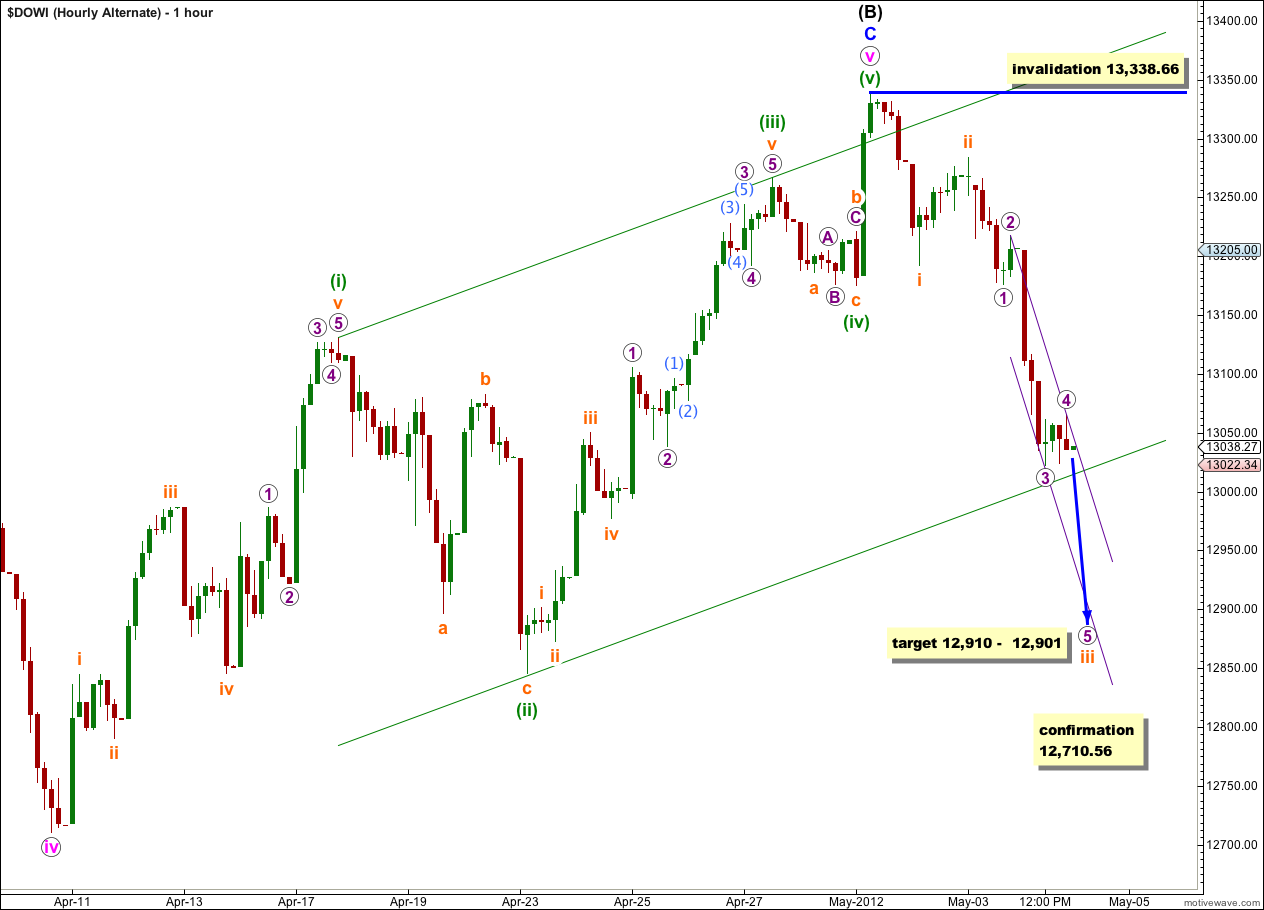

Within wave (ii) green the zigzag structure is probably incomplete. At 12,901 wave c orange would reach 2.618 the length of wave a orange. At 12,910 wave 5 purple would reach 1.618 the length of wave 1 purple. This gives us a 9 point target zone for wave c orange to end.

Price has found some support at the lower edge of the parallel channel drawn here using Elliott’s first technique. If wave (i) green is over and wave (ii) green is underway then this channel should be breached.

Wave (ii) green may not move beyond the start of wave (i) green. This wave count is invalidated with movement below 12,710.56.

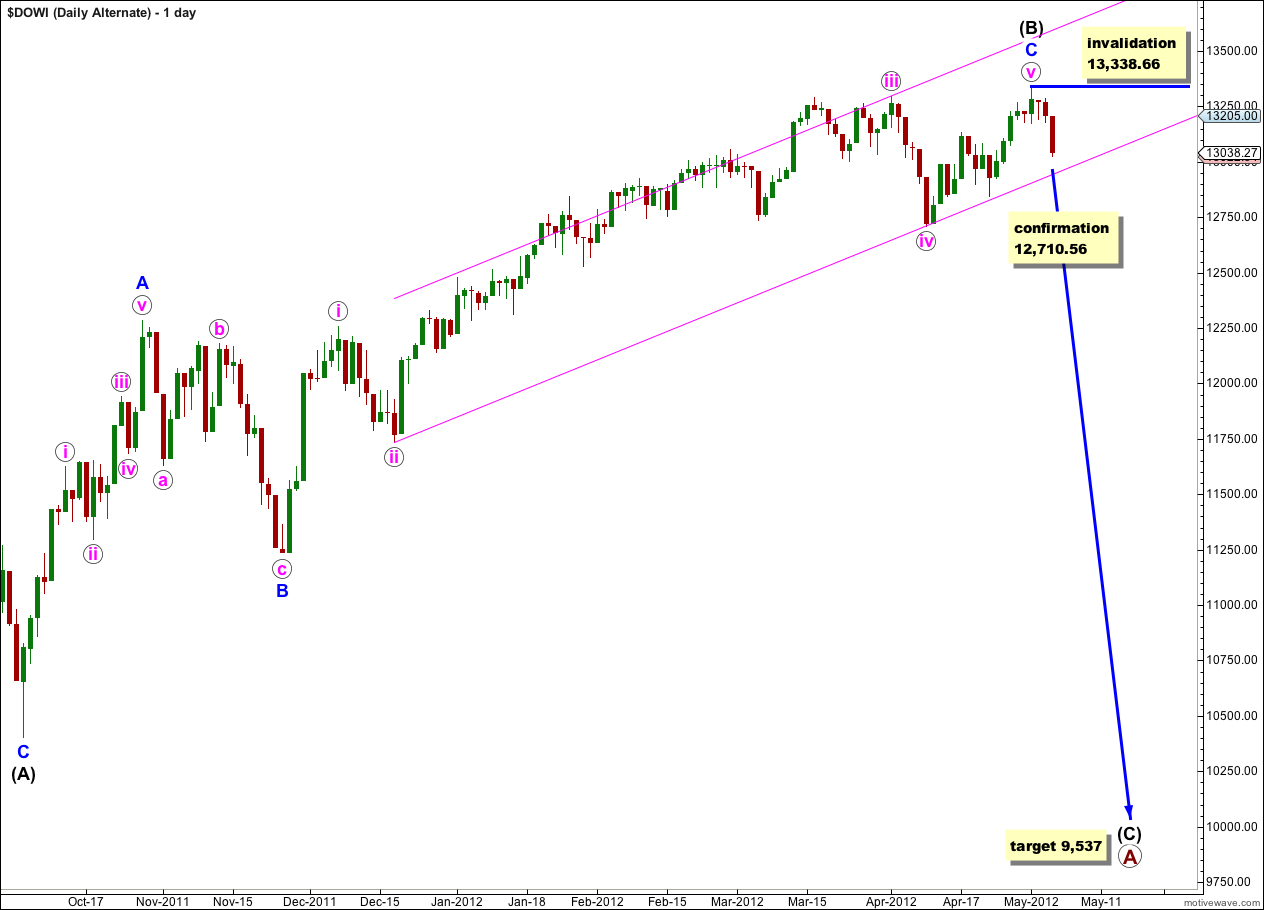

Alternate Wave Count.

If we simply move the degree of labeling within wave v pink all up one degree this structure, and upwards movement, may be over.

There is no Fibonacci ratio between waves A and C blue.

Ratios within wave C blue are: wave iii pink is 98 points shorter than 1.618 the length of wave i pink (a 6% variation which is acceptable), and wave v pink is just 6 points less than 0.618 the length of wave i pink.

Wave (B) black is a 125% correction of wave (A) black which is within the normal common length of up to 138% of wave (A) black.

Within wave (C) black no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement above 13,338.66.

Within the last upwards wave of v pink this wave count is the same as the main hourly wave count, except everything is moved up one degree.

Downwards movement would be the very start of wave (C) black.

Within this new downwards movement, at 12,901 wave iii orange would reach 2.618 the length of wave i orange. At 12,910 wave 5 purple would reach 1.618 the length of wave 1 purple. This gives us a 9 point target zone for wave iii orange to end.

Movement below 12,710.56 would invalidate the main wave count and confirm a big trend change.

For practical purposes at this stage we could use an invalidation point of 13,192.39, the low of i orange, because the upcoming fourth wave for iv orange may not move into wave i orange price territory.

When waves iii, iv and v orange are complete then we should look out for a deep second wave correction. At that stage the invalidation point is as on this chart at 13,338.66.