With price remaining firmly within the parallel channel on our alternate daily chart we must accept today that the possibility of a new high has increased.

The S&P 500 has not given us the confirmation of a trend change that we were waiting for. Without confirmation our alternate wave count remains viable.

Click on the charts below to enlarge.

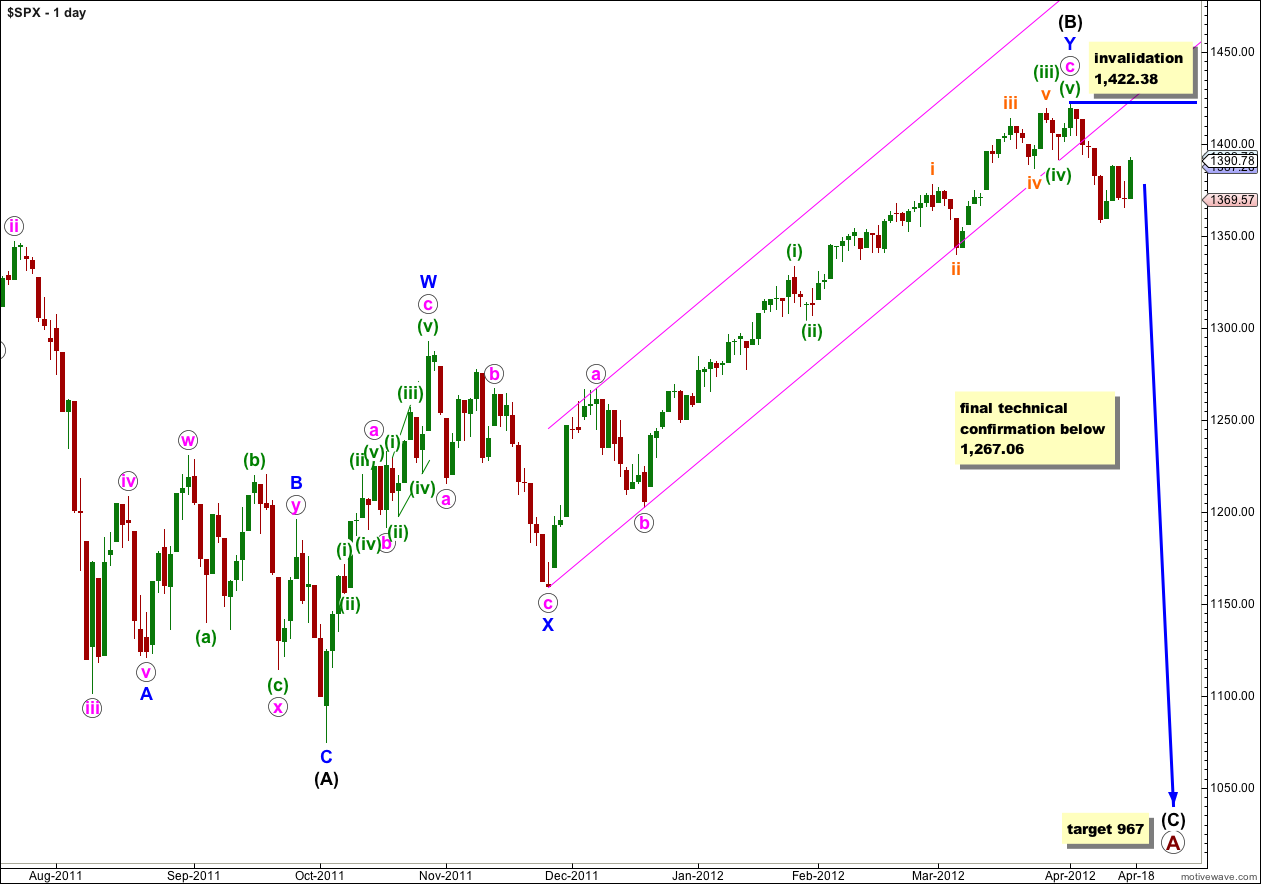

I had wanted to see strong downwards movement from Tuesday’s session to have more confidence in this wave count. At this stage it remains valid, and I still consider it to have a slightly higher probability than our alternate. However, the probability is today reduced.

Upwards movement could be a low degree second wave correction. Only movement above 1,422.38 would invalidate this wave count because a second wave may not move beyond the start of the first wave.

At primary degree wave A would be an expanded flat correction because wave (B) black is a 123% correction of wave (A) black. We would expect wave (C) black to most likely reach 1.618 the length of wave (A) black a 967. If price moves through this first target then the next (less likely) target would be where wave (C) black reaches 2.618 the length of wave (A) black at 685.

This wave count has a typical look for wave c pink. The third wave is extended which is most common, and its subdivisions can be seen clearly on the daily chart which should be expected. It agrees with MACD in that within wave c pink the strongest reading is for the third wave.

Wave (B) black is a double zigzag structure which is a common structure. Within the first zigzag labeled W blue the subdivisions fit most neatly as a zigzag.

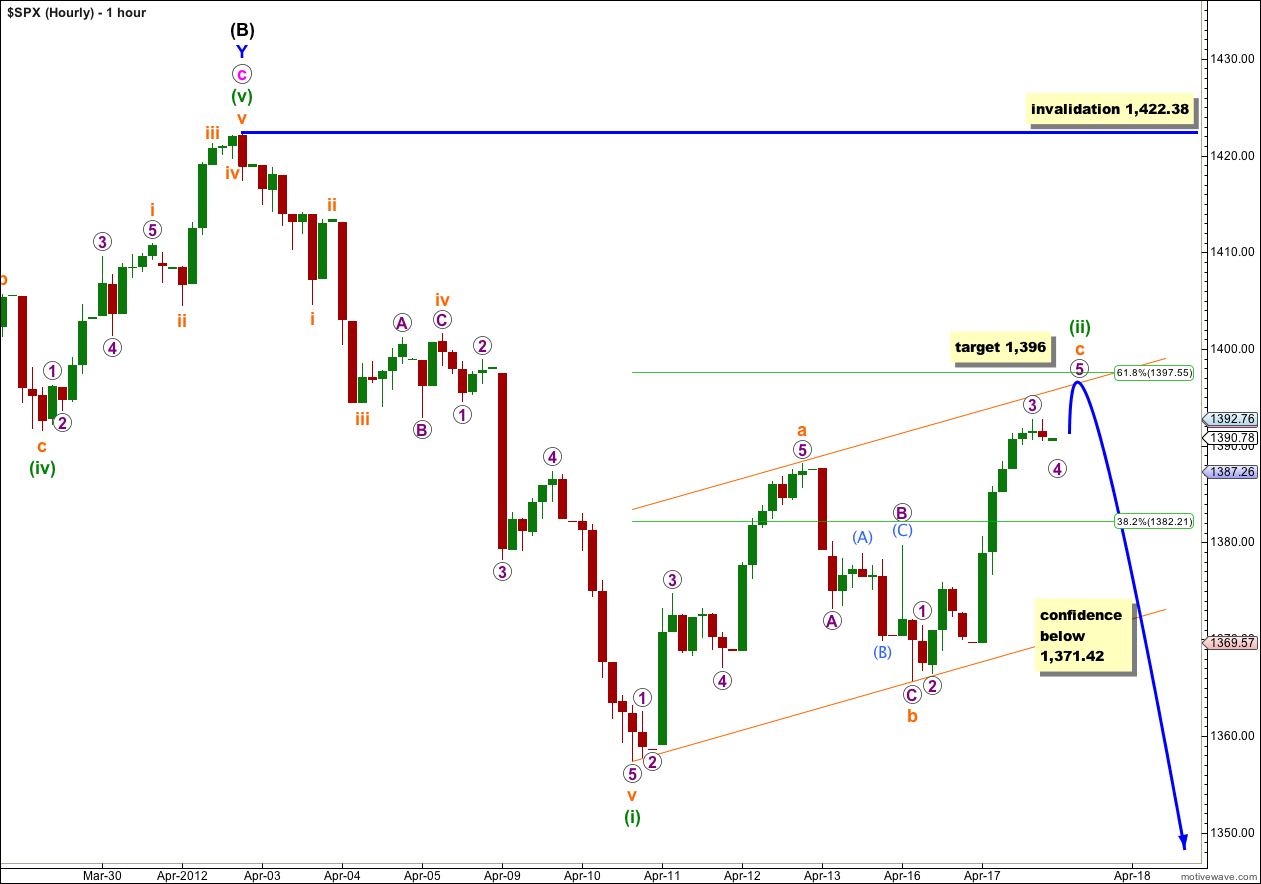

It is possible that wave (ii) green is not over, if the first upwards wave is seen as a five and not a double zigzag. What is most clear about movement within the wave labeled (ii) green is the downwards wave labeled b orange is a three not a five.

At 1,396 wave c orange would reach equality with wave a orange.

Ratios within wave a orange are: wave 3 purple has no Fibonacci ratio to wave 1 purple, and wave 5 purple is just 0.6 short of 4.236 the length of wave 1 purple.

Within wave c orange it is not clear that wave 4 purple is complete. If it moves any lower when markets open tomorrow it may not move into wave 1 purple price territory which has its high at 1,371.42.

If we see a little further upwards movement tomorrow this may be wave c orange finishing. If thereafter price turns back down and moves below 1,371.42 wave c orange must be complete and we may have more confidence in a trend change. At that stage the entire structure for wave (ii) green would be a complete three. With a three up the trend would be most likely downwards.

We may use Elliott’s channeling technique to draw a channel about wave (ii) green. Wave c orange may end about the upper edge of this channel. When the channel is breached by downwards movement this will indicate a trend change to the downside.

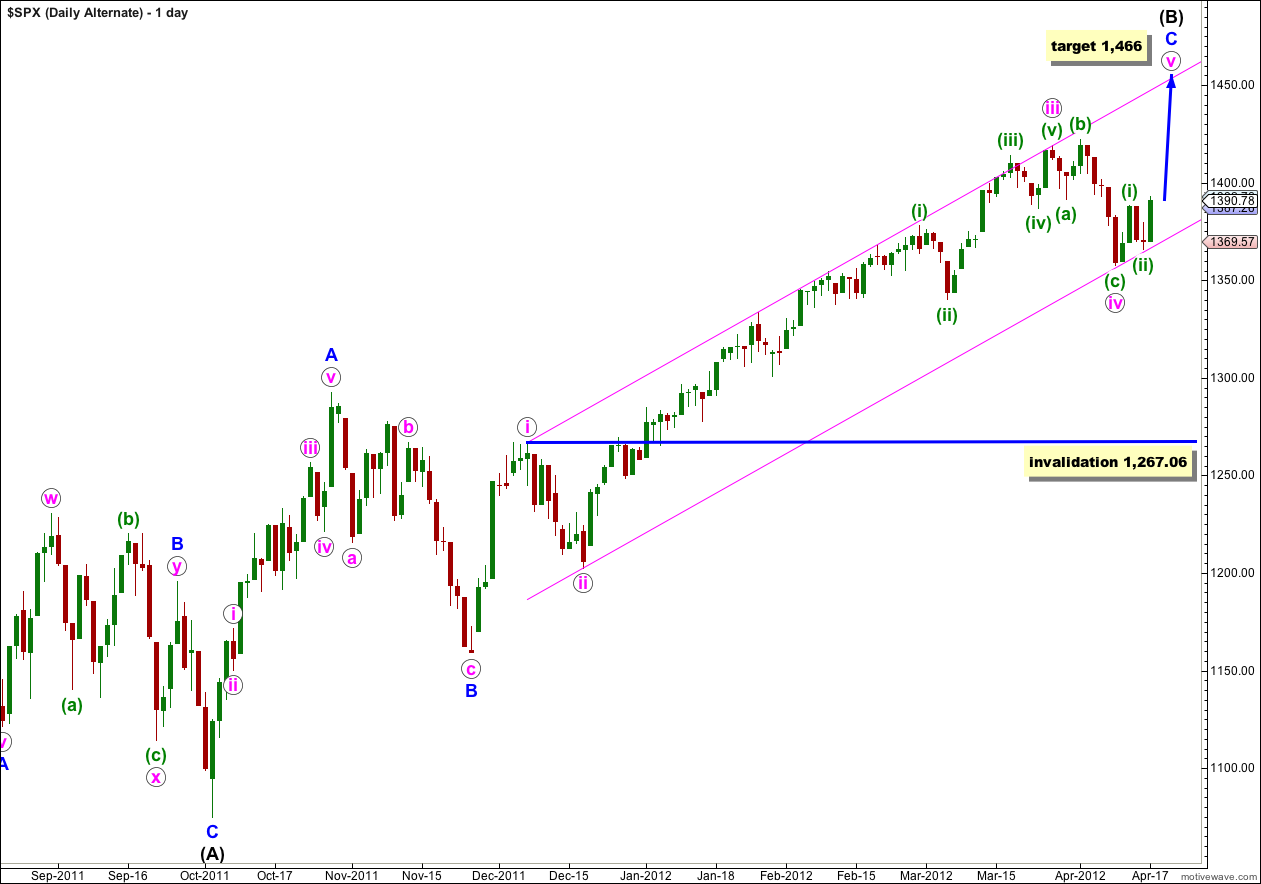

Alternate Daily Wave Count.

Strong upwards movement for Tuesday’s session conforms to what would be expected for this wave count. With price firmly within the parallel channel about wave C blue this wave count looks correct as far as the trend channel goes, but its subdivisions don’t fit as well as the main wave count and it still has a slightly lower probability.

If the upwards wave labeled A blue here subdivides into a five then wave (B) black may be a single zigzag structure. This wave count has a fairly low probability because this wave subdivides most easily into a three, and it is difficult (but possible) to see it as a five. As a five it has a strange looking third wave which reduces the probability of this wave count.

At 1,466 wave v pink would reach equality with wave i pink. Wave (B) black would be almost 138% the length of wave (A) black, the maximum common length for a B wave in relation to an A wave of a flat correction.

Wave iv pink may not move into wave i pink price territory. This wave count is invalidated with movement below 1,267.06. However, in practice I would discard this wave count before price gets that low, as a strong and significant breach of the parallel channel containing wave C blue would reduce the probability of this wave count.