Movement slightly (1.35 points) above our short term invalidation point on the hourly chart has invalidated the downwards impulse movement we were expecting. Price remains below the invalidation point on the daily chart and the bigger picture remains intact; it’s just the structure of this downwards movement which is not as expected.

Overall I still expect that we have recently seen a major trend change, and price should continue lower.

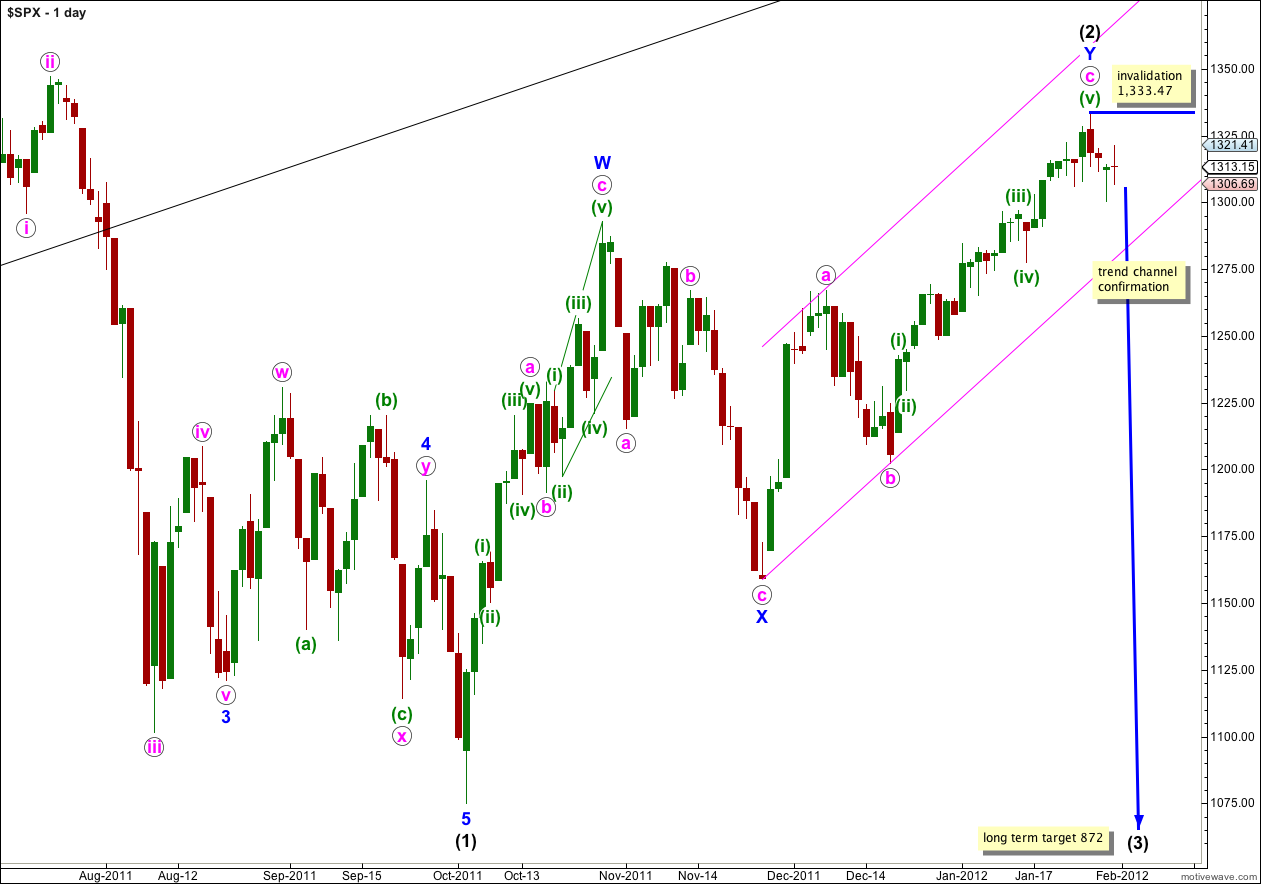

We may use the parallel channel on the daily chart to provide us with final confirmation of this trend change. When we have that confirmation then my confidence in this wave count will significantly increase.

Click on the charts below to enlarge.

Wave (3) black would reach 1.618 the length of wave (1) black at 872 and this long term target is months away. Wave (1) black lasted 4 months and wave (2) black lasted 3 months. We may expect wave (3) black to last at least 2 months and possibly longer.

When the parallel channel containing wave Y blue zigzag is breached by downwards movement then we shall have final confirmation of this big trend change. We may get this confirmation this week or next.

Wave (2) black is labeled here as a double zigzag structure, which is relatively common. The only way wave (2) black could continue further sideways when the second zigzag of Y blue is over is as a rare triple zigzag. The rarity of triples means this has a very low probability. Furthermore, the purpose of triple zigzags is to deepen corrections. Wave (2) black is already a very deep correction of wave (1) black and it does not need to be deepened further.

Last analysis expected an impulse to continue to unfold in a first wave position. With movement to a slight new high above 1,320.06 that structure was invalidated.

We are most likely looking at a leading diagonal unfolding in a first wave position. Within a leading diagonal subwaves 2 and 4 must be zigzags, and subwaves 1, 3 and 5 are most commonly zigzags but may also be impulses. We should expect choppy overlapping but generally trending downwards movement for another week or so.

Within wave i orange zigzag wave C purple is 1.89 points short of equality with wave A purple.

Ratios within wave A purple of wave i orange are: wave (3) aqua is just 0.58 points longer than wave (1) aqua, and wave (5) aqua is just 0.14 short of 0.618 the length of wave (3) aqua.

Ratios within wave A purple of wave ii orange are: wave (3) aqua is just 0.11 points longer than equality with wave (1) aqua, and wave (5) aqua has no Fibonacci ratio to either of (1) or (3) aqua.

Within wave ii orange wave C purple would reach equality with wave A purple at 1,328.

Following a leading diagonal in a first wave position the second wave correction is normally very deep, reaching to about 0.786 of the first wave.

Within this diagonal wave ii orange may not move beyond the start of wave i orange. This wave count is invalidated with movement above 1,333.47.