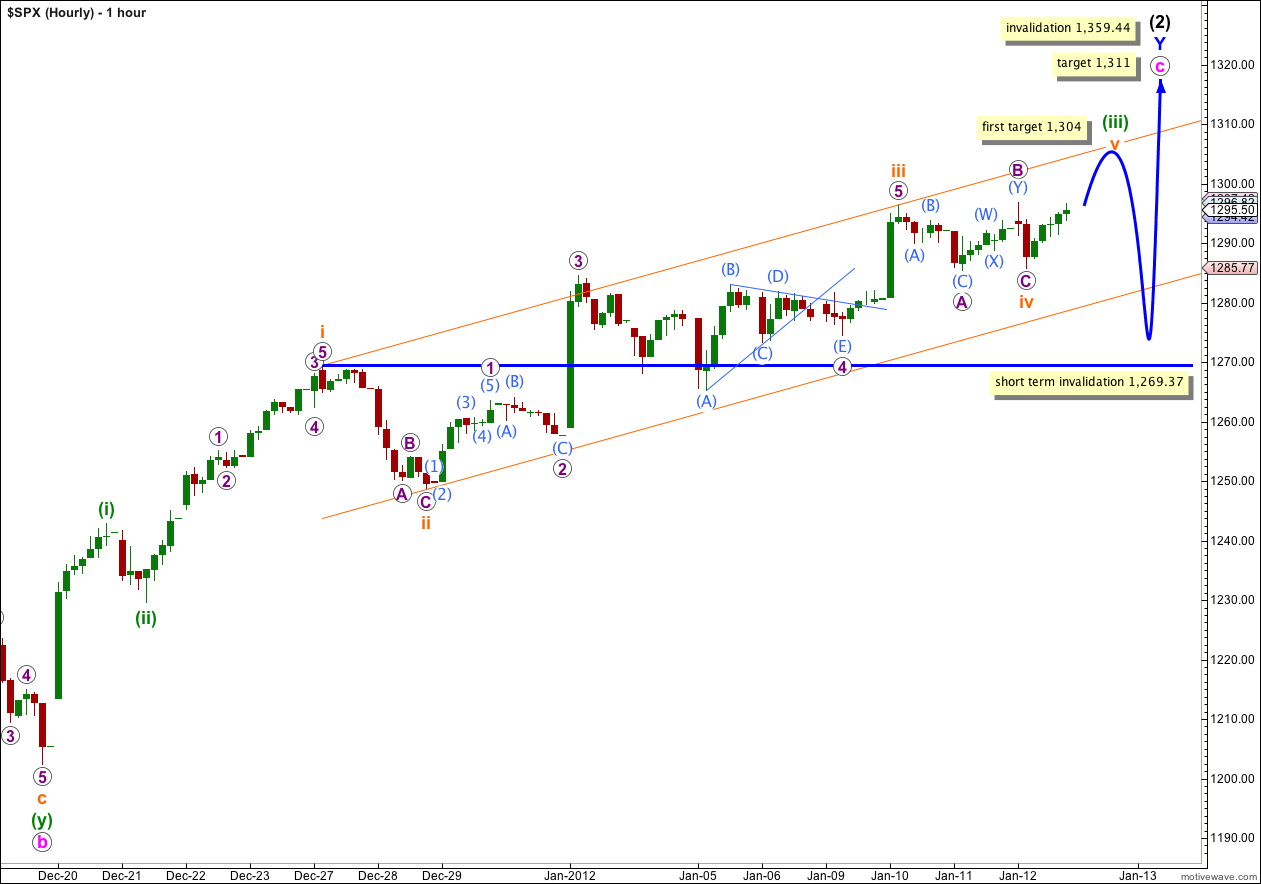

Price has moved mostly sideways, and very slightly higher, during Thursday’s session which fits our hourly alternate wave count best. I expect another fourth wave correction has ended and we are almost at the end of a third wave. There will be one more time consuming fourth wave correction and more upwards movement to end this trend. At this stage our target remains the same, but when the next fourth wave correction is complete the target will be recalculated.

Click on the charts below to enlarge.

The structure of wave c pink is still incomplete. It is still on target to end about 1,311, possibly next Thursday give or take a day either side.

Waves a and b pink both lasted a Fibonacci 8 days. Wave c pink has now lasted 16 days. The next Fibonacci number in the sequence is 21 which would see wave c pink end next Thursday the 19th of January. However, Fibonacci time relationships are not as reliable as Fibonacci price ratios between waves so this date is a rough guide only.

When this parallel channel is breached by downwards movement then we shall have confirmation that wave Y blue zigzag is over and wave (3) black downwards should be underway.

Wave (2) black is a double zigzag, which is a relatively common structure. Triple zigzags are relatively rare structures, and when the second zigzag for wave Y blue is complete the probability that wave (2) is over will be very high.

Wave (2) black may not move beyond the start of wave (1) black. This wave count is invalidated with movement above 1,359.44.

I have only one hourly wave count again for you today. Yesterday’s main hourly wave count was not invalidated by price movement, but the subdivisions do not work on the 5 minute chart.

This was yesterday’s alternate hourly wave count.

Wave iv orange looks like it has moved sideways as a running flat correction. This flat is technically a running flat which is relatively rare, but the subdivisions fit perfectly on the 5 minute chart and it is only very slightly skewed in the main trend direction.

It is possible that wave iv orange could continue further sideways as a double flat or double combination. Because of this possibility the invalidation point must remain at 1,269.37. Wave iv orange may not move into wave i orange price territory.

If wave v orange has begun at 1,285.77 then our first target is at 1,304 where it would reach 0.382 the length of wave iii orange. If price rises through this first target then the next target is at 1,310 where wave v orange would reach 0.618 the length of wave i orange. The third target is at 1,315 where wave v orange would reach 0.618 the length of wave iii orange, and the fourth target at 1,326 where wave v orange would reach equality with wave i orange.

Wave v orange should take about 2 to 3 sessions to unfold. It may find resistance at the upper orange trend line and it may end there.

Wave v orange would end wave (iii) green within wave c pink. At that stage we must move the invalidation point down to the high of wave (i) green at 1,242.82.

Wave (iv) green should take at least a full session to unfold.

The final wave (v) green upwards would end the entire structure for wave c pink, wave Y blue zigzag, and wave (2) black double zigzag.

Lara, Do you have any target for wave iv green yet?

At this very early stage we may expect it to end about the fourth wave of one lesser degree; iv orange may have ended at 1,285.77.

When (iii) green is over we will draw a Fibonacci retracement along it’s length and expect (iv) green to reach down to the 0.618 ratio.