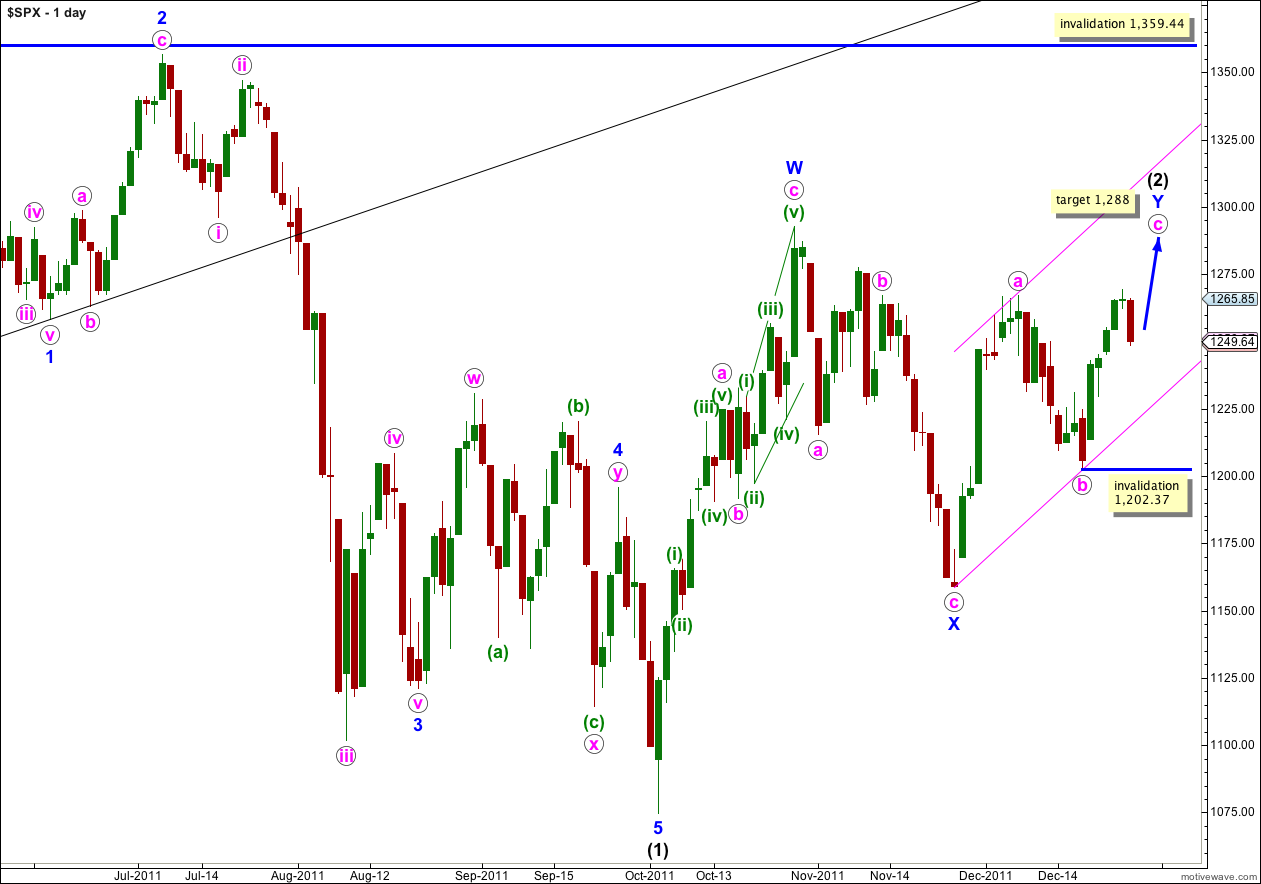

Elliott Wave chart analysis for the S&P 500 for 28th December, 2011. Please click on the charts below to enlarge.

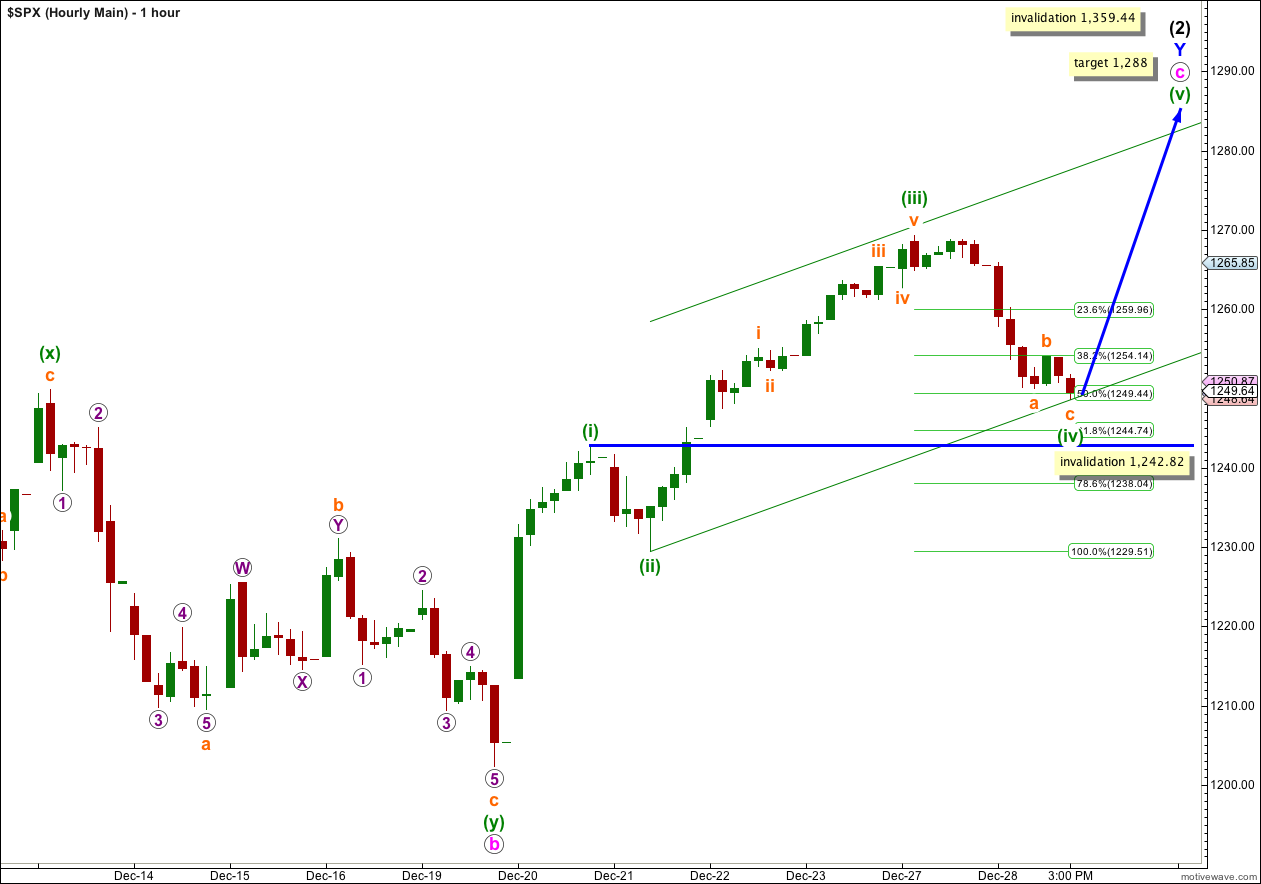

I had expected mostly sideways movement for Wednesday’s session but this fourth wave correction is turning out to be deeper than anticipated. However, price remains above the invalidation point and wave (iv) green remains outside of wave (i) green price territory.

The purpose of a double zigzag structure is to deepen a correction. However, this is not a rule which must be met. At this stage it looks like price will fail to reach above the high of wave W blue at 1,292.66 and wave Y blue will mostly move price sideways taking up time.

Already price has moved above the high of wave a pink at 1,267.06 and wave c pink has avoided a truncation.

The new target calculated for wave c pink to end is at 1,288.

Waves a and b pink both lasted a Fibonacci 8 days. If wave c pink continues this pattern it will continue higher for another three trading sessions, ending on Friday 30th December.

Within wave c pink no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,202.37.

Wave (2) black may not move beyond the start of wave (1) black. This wave count is invalidated with movement above 1,359.44.

We may use Elliott’s channeling technique to draw a parallel channel about the zigzag of wave Y blue. Wave c pink may end about the upper edge of this parallel channel, or it may end mid way within the channel. When this channel is breached by downwards movement we may take that as confirmation that wave Y blue is complete and wave (3) black is underway.

Wave (iv) green has moved a lot deeper than anticipated from last analysis. At this stage it may be a complete zigzag structure, or only wave a orange within it may be complete. We may see a little further downwards movement before it is over.

Wave (v) green may take two trading days to unfold. At 1,288 wave (v) green would reach its maximum length which is equality with wave (iii) green. Wave (iii) green is 0.59 points shorter than equality with wave (i) green and because wave (iii) green may not be the shortest wave this means wave (v) green is limited.

When Elliott’s first channeling technique does not adequately show us where the fourth wave ends we need to redraw the channel. Draw the first trend line from the lows of (ii) and (iv) green then place a parallel copy on the high of wave (iii) green. Wave (iv) green may end about the upper edge of the channel, or mid way in the channel. If wave (iv) green moves a little lower redraw the channel.

Wave (iv) green may not move into wave (i) green price territory. This wave count is invalidated with movement below 1,242.82.

If this wave count is invalidated by downwards movement then we will have to consider the possibility that wave c pink is a complete five wave structure and we have had an early trend change. If that occurs then wave c pink may have lasted only a Fibonacci 5 days, ending 2 days earlier and lower than originally anticipated. This is possible, but we should only consider it with movement below 1,242.82. At that stage I would want to use the parallel channel on the daily chart to confirm a large trend change.

When wave c pink is complete the next movement should be the start of wave third wave at intermediate degree within a primary third wave. This next downwards movement should be swift and strong taking the S&P to new lows. This may begin on the first new trading day of the new year.

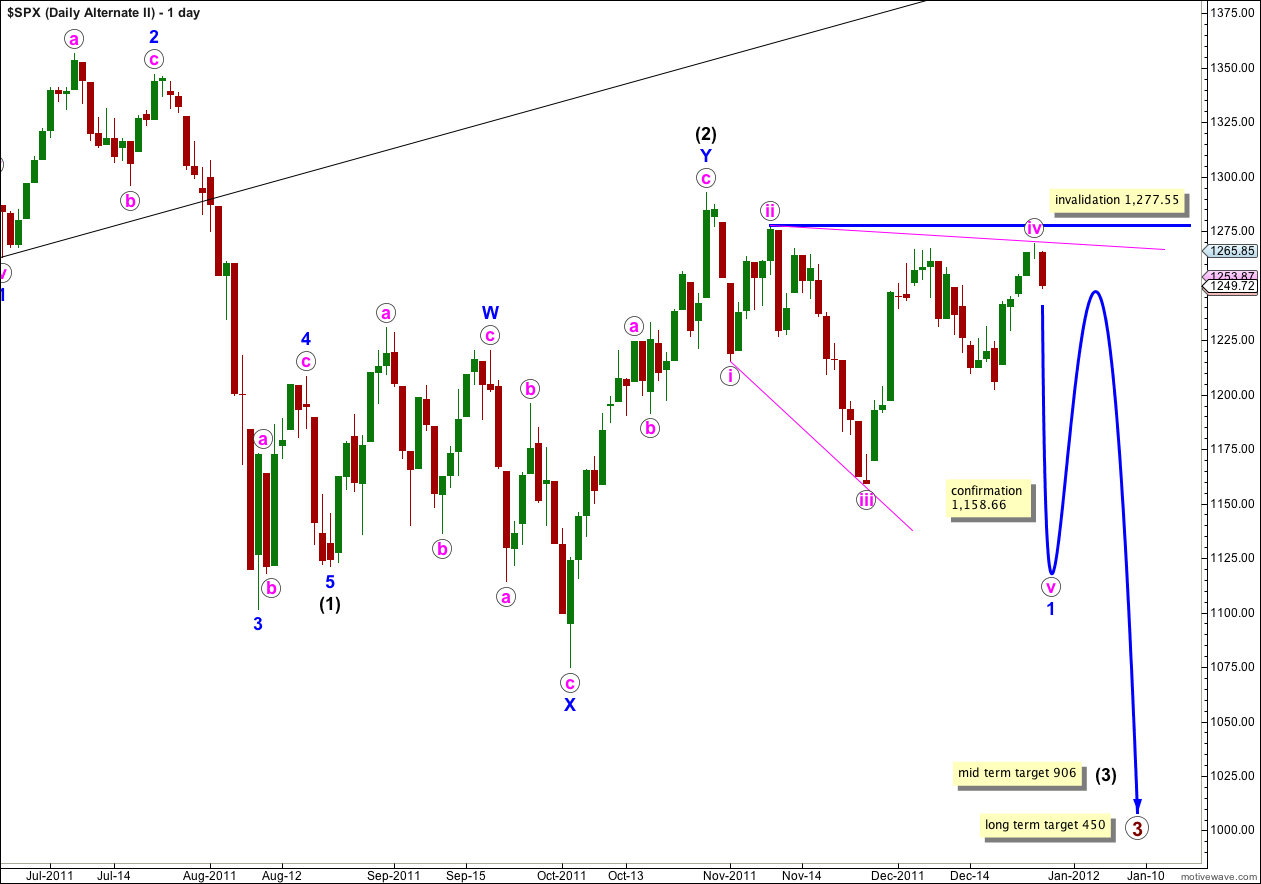

Alternate Wave Count.

There are three reasons why I consider this wave count to have a very low probability:

1. Wave iv pink is already deeper than 0.81 of wave iii pink; this is the maximum common length for wave 4 within a diagonal in relation to wave 3.

2. While leading diagonals are not uncommon, leading expanding diagonals are supposedly less common structures.

3. A similar wave count on the Dow is invalidated; the Dow and S&P 500 have been moving together nicely for some time and it would be highly unusual for them to now diverge.

Within the leading diagonal for wave 1 blue wave iv pink may not move beyond the end of wave ii pink. This wave count is invalidated with movement above 1,277.55.

A leading diagonal may not have a truncated fifth wave. This wave count requires movement below 1,158.66 to remain valid.