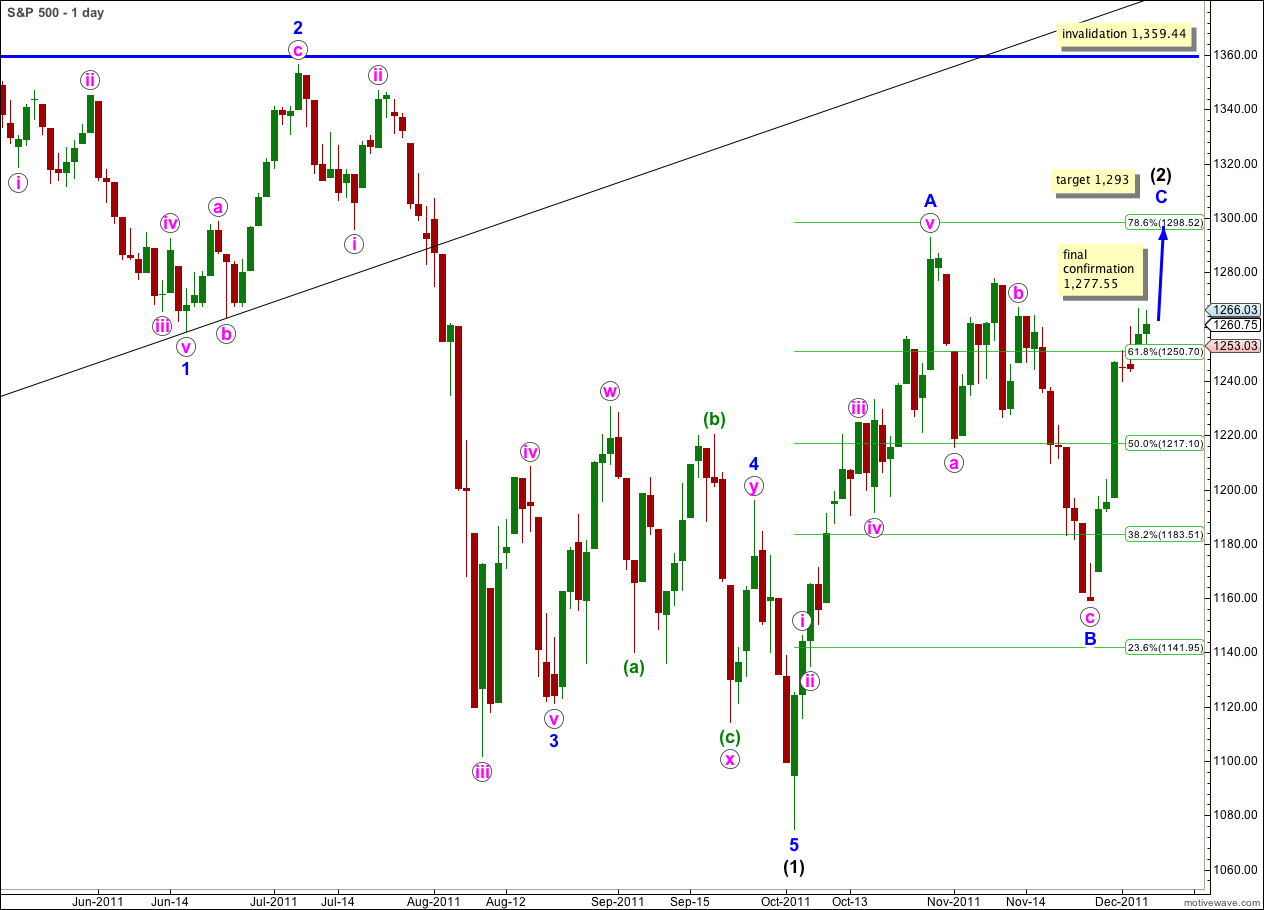

Elliott Wave chart analysis for the S&P 500 for 6th December, 2011. Please click on the charts below to enlarge.

Price has moved sideways within a very small range for Tuesday’s session and the situation is unchanged from yesterday.

If this wave count is correct then movement above 1,292.66 would be highly likely and wave C blue would avoid a truncation.

At 1,293 wave C blue would reach 0.618 the length of wave A blue.

Wave (2) black may not move beyond the start of wave (1) black. This wave count is invalidated with movement above 1,359.44.

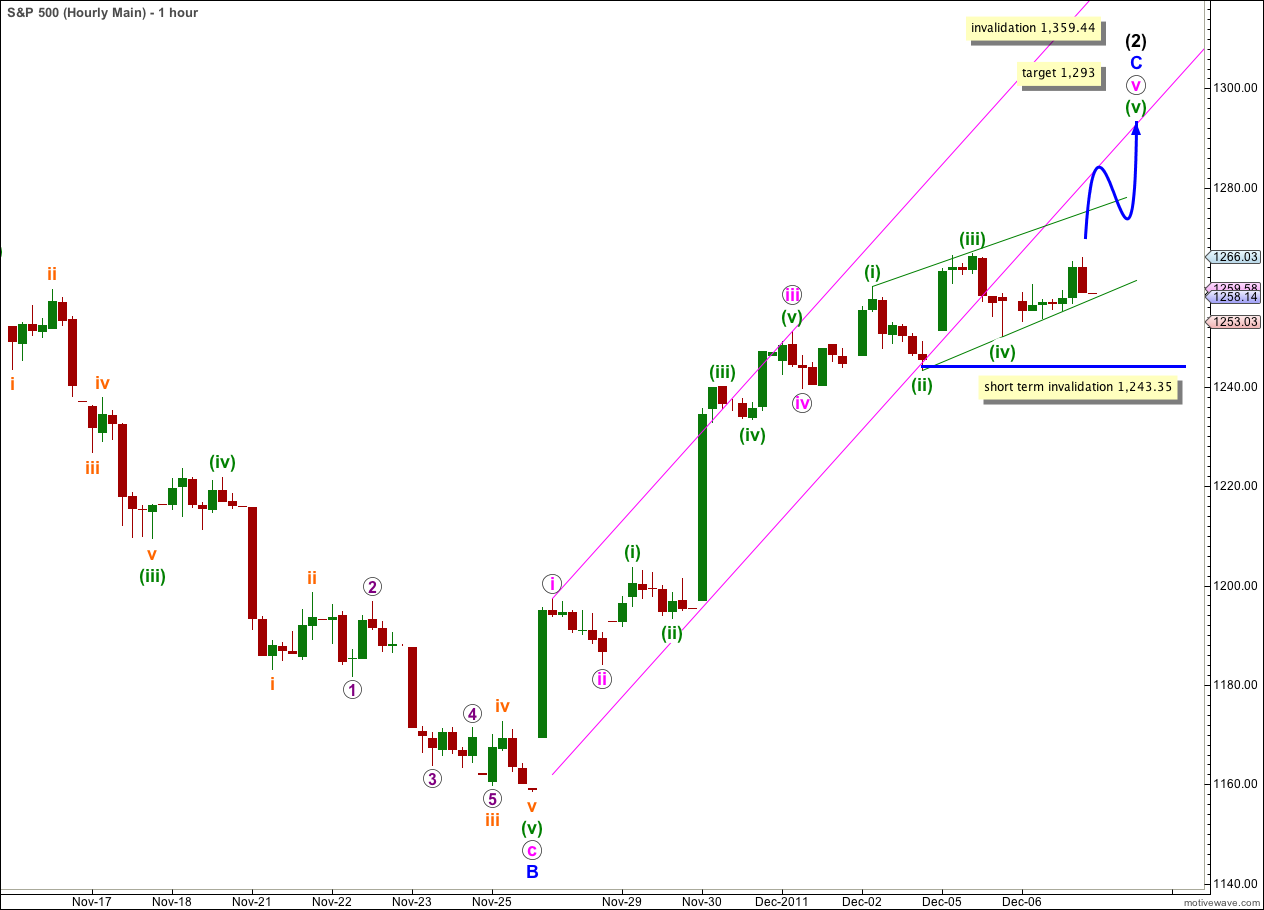

Wave C blue is unfolding as an impulse, and wave v pink within it is unfolding as an ending diagonal.

An ending diagonal requires all subwaves to subdivide into zigzags and wave (v) green must be a zigzag.

If the diagonal is expanding wave (v) green should be longer than wave (iii) green and it reaches equality with wave (iii) green at 1,273. However, the diagonal may be contracting but with a third wave which is still the longest. Price may fail to reach 1,273.

Wave C blue does not have to move beyond the end of wave A blue at 1,292.66 but it is highly likely that it would.

Wave (iv) green of the possible ending diagonal has overlapped wave (i) green price territory as it should. It may not move beyond the end of wave (ii) green. This wave count is invalidated with movement below 1,243.35.

If this wave count is invalidated with downwards movement prior to a new high being made then the alternate wave count below should be used.

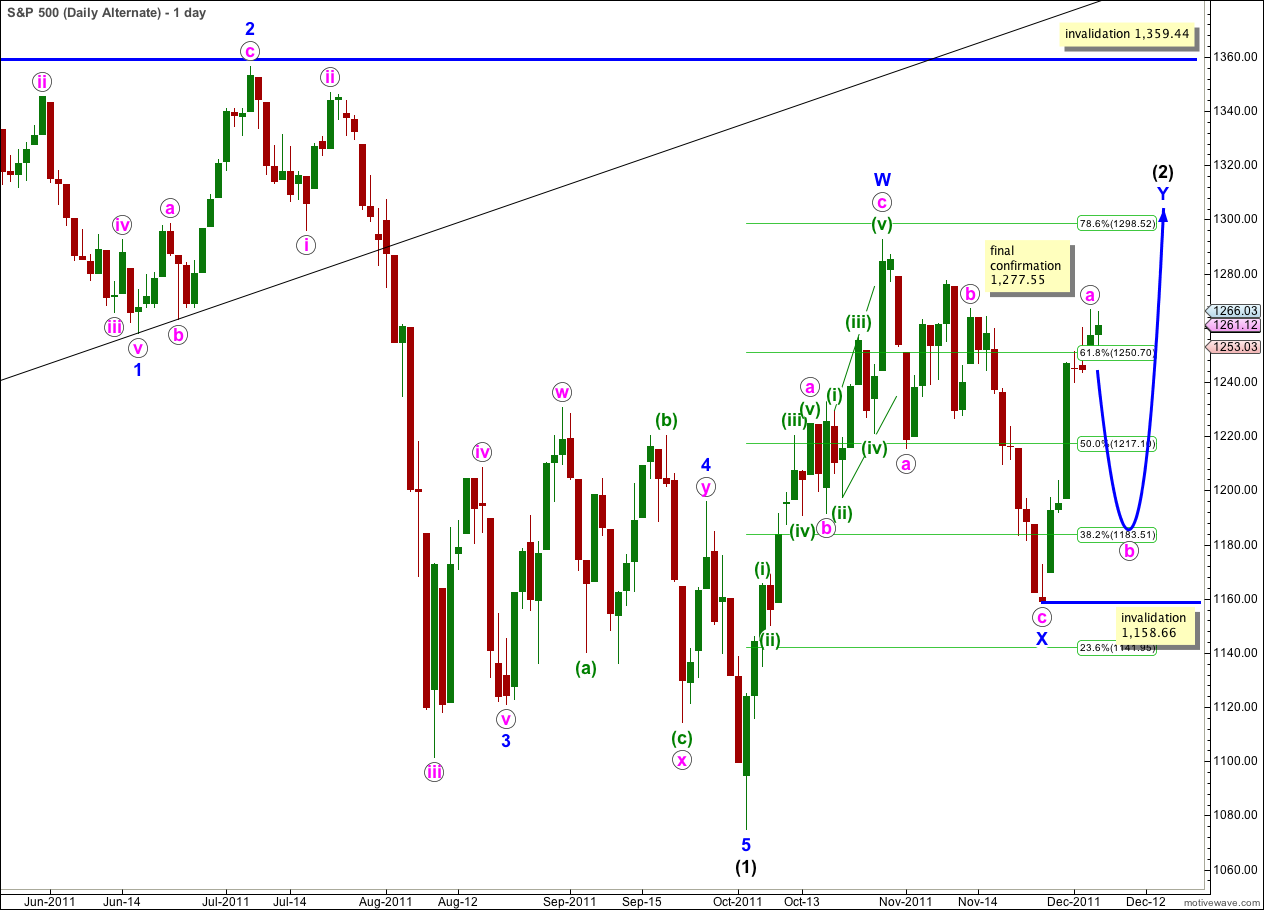

Alternate Wave Count.

If price fails to reach above 1,292.66 and turns back downwards then this will be my preferred wave count, as it would have the best look. Wave a pink within wave Y blue is almost a fully complete impulsive structure. If this wave count is correct then wave b pink should start very soon, or may already have just begun.

Wave (2) black may be unfolding as a double zigzag or double combination structure. If wave Y blue is a zigzag, and wave a pink within it is a five wave impulse so a zigzag is most likely, then wave b pink may not move beyond the start of wave a pink. This wave count is invalidated with movement below 1,158.66.

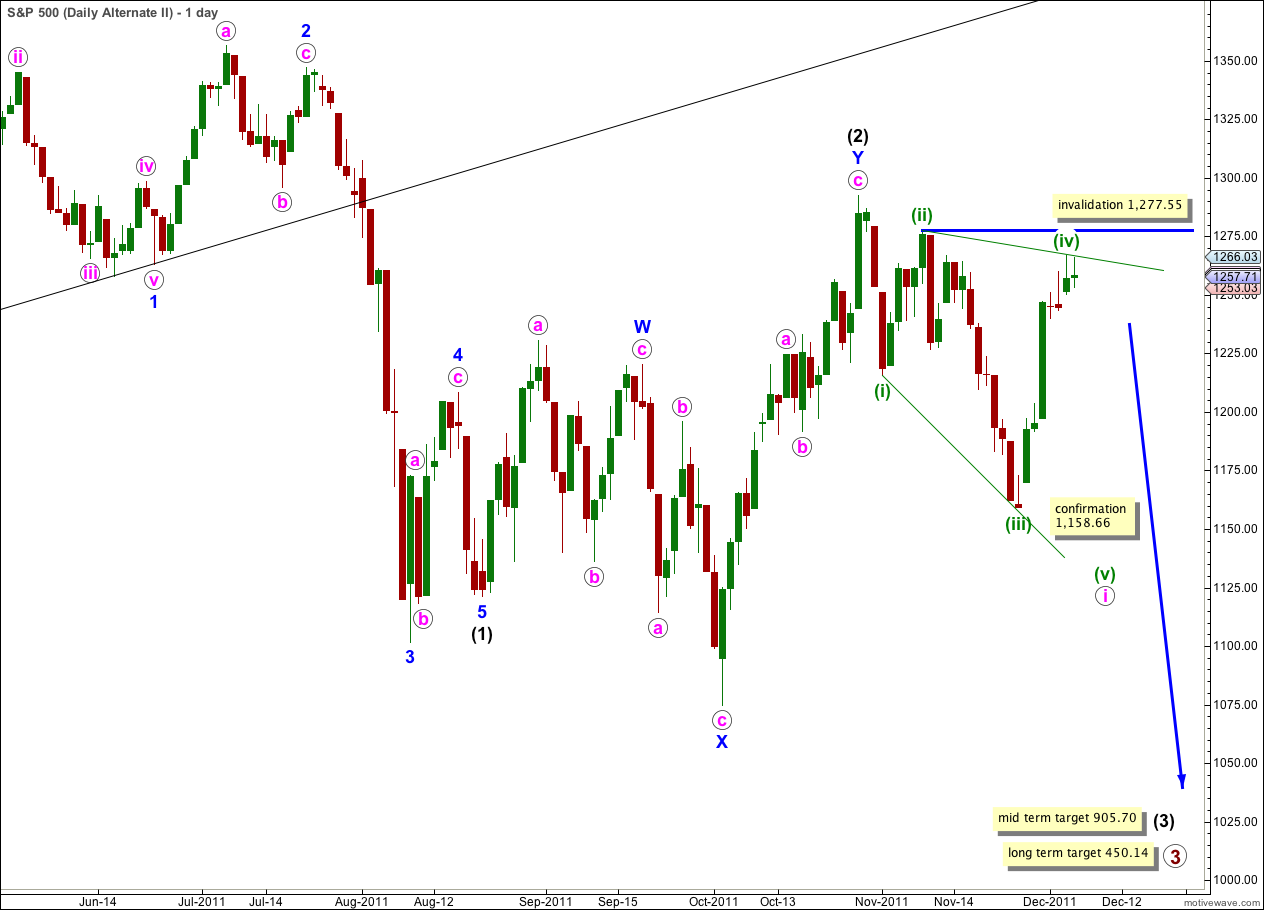

Second Alternate Wave Count.

Wave i pink within wave 1 blue may be unfolding as a leading expanding diagonal. All the subdivisions fit well here.

A leading diagonal may not have a truncated fifth wave and for this wave count to remain valid we must see movement to a new low below the low of (iii) green at 1,158.66. This would also invalidate the main wave count and provide us with clarity.

Following a leading diagonal in a first wave position we should expect a very deep second wave correction. If this wave count is confirmed we will expect wave ii pink to reach about 0.786 of wave i pink.

The only problem I can see with this wave count is the extremely deep correction of wave iv green. It gives the diagonal a slightly odd look, but it does not violate any Elliott wave rules.

Wave (iv) green of this diagonal may not move beyond the end of wave (ii) green. This wave count is invalidated with movement above 1,277.55.