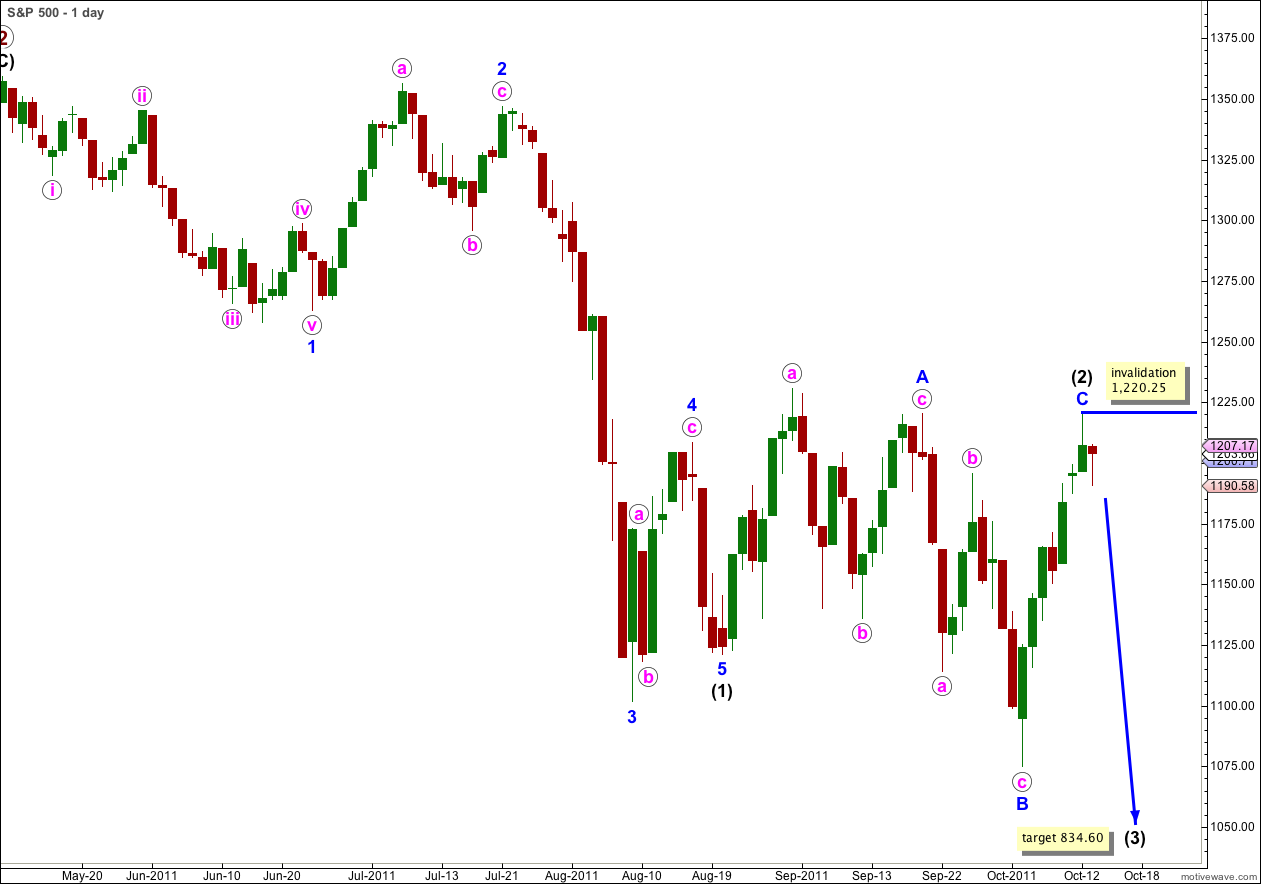

Elliott Wave chart analysis for the S&P 500 for 13th October, 2011. Please click on the charts below to enlarge.

The S&P moved lower as we expected and downwards movement is impulsive. Over half of this downwards movement was retraced by the end of the session.

At 834.60 wave (3) black would reach 1.618 the length of wave (1) black.

Wave (2) black may have been a very rare running flat which would indicate that downwards pressure is strong. Wave C blue is very slightly truncated. The critical thing to check when labeling a running flat is the structure of the B wave within it. Here wave B blue is a perfect zigzag. All these subdivisions fit.

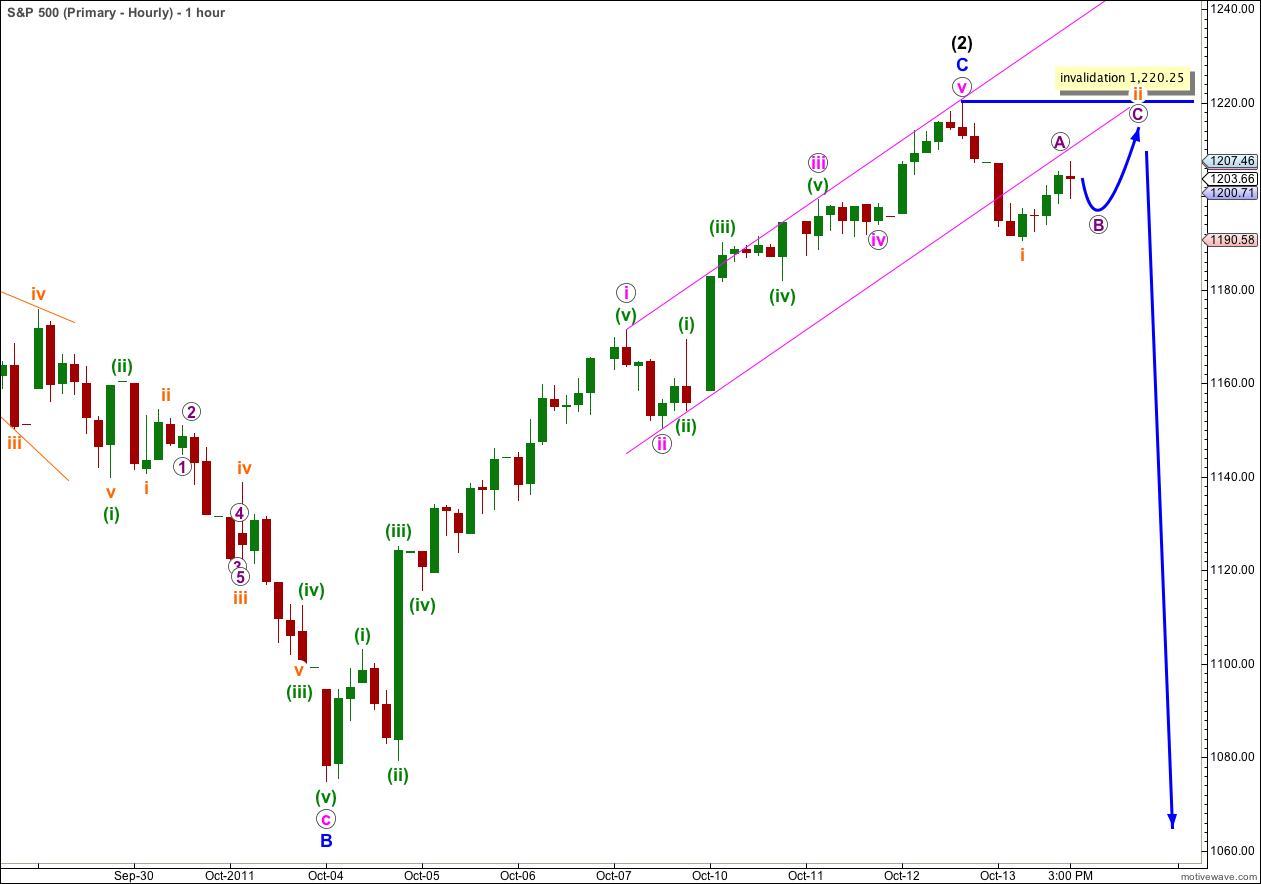

Running flat corrections do not lend themselves to parallel channels. We may use a channel about wave C blue within the flat to indicate a trend change. This channel on the hourly chart has been breached and wave C blue is over and the next wave down should be underway.

Wave (3) black should see an increase in downwards momentum over the next couple of weeks.

Downwards movement labeled i orange is a clear five wave impulse on the five minute chart. Upwards movement which followed may be wave ii orange complete, or it may only be wave A purple within wave ii orange. Any further upwards movement of wave ii orange may not move beyond the start of wave i orange. This wave count is invalidated with movement above 1,220.25.

The parallel channel which contains wave C blue has been clearly breached by downwards movement and the lower edge may continue to now provide support to upwards movement. We may use this channel breach as indication of a trend change. However, at this very early stage I want to see a clear five waves down on the hourly chart to have more confidence in this trend change.

The next session should see a third wave down at subminute degree, or thereabouts. We may need to revise the degree of labeling of this most recent movement in the next few days.

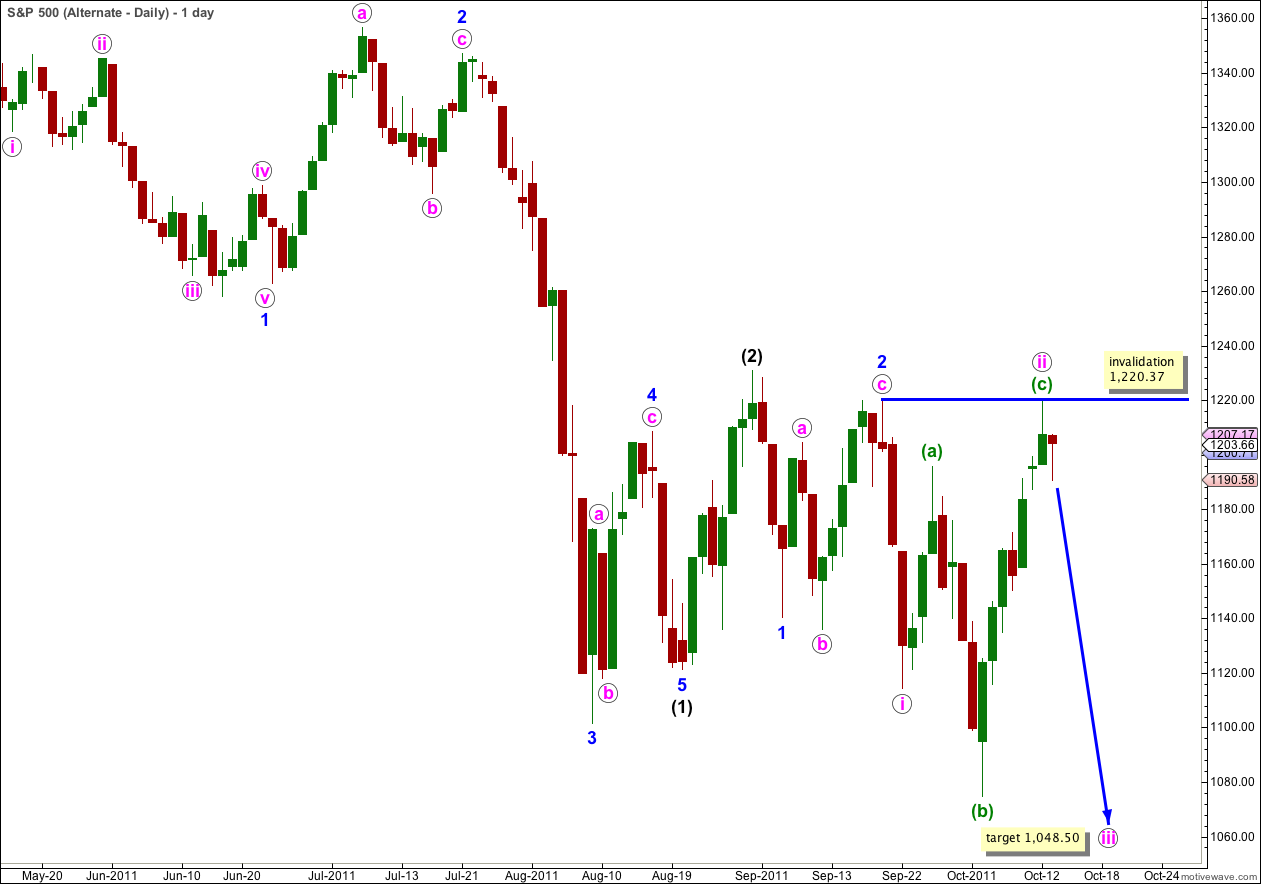

Alternate Daily Wave Count.

It is possible that we have seen a series of first and second wave corrections. Each second wave correction is extremely deep.

If this is the case then the next downwards movement could be especially violent.

Any further upwards movement of wave ii pink may not move beyond the start of wave i pink. This wave count is invalidated with movement above 1,220.37.

This alternate wave count avoids truncations and running flats, but the size of waves i and ii pink look a bit too large in duration for minute degree waves.

At 1,048.50 wave iii pink would reach 1.618 the length of wave i pink.

There is no divergence in our expectations of imminent downwards movement between this alternate and our main wave count. They will however diverge in the future, and I will continue to consider this as an alternate until one or the other is invalidated.