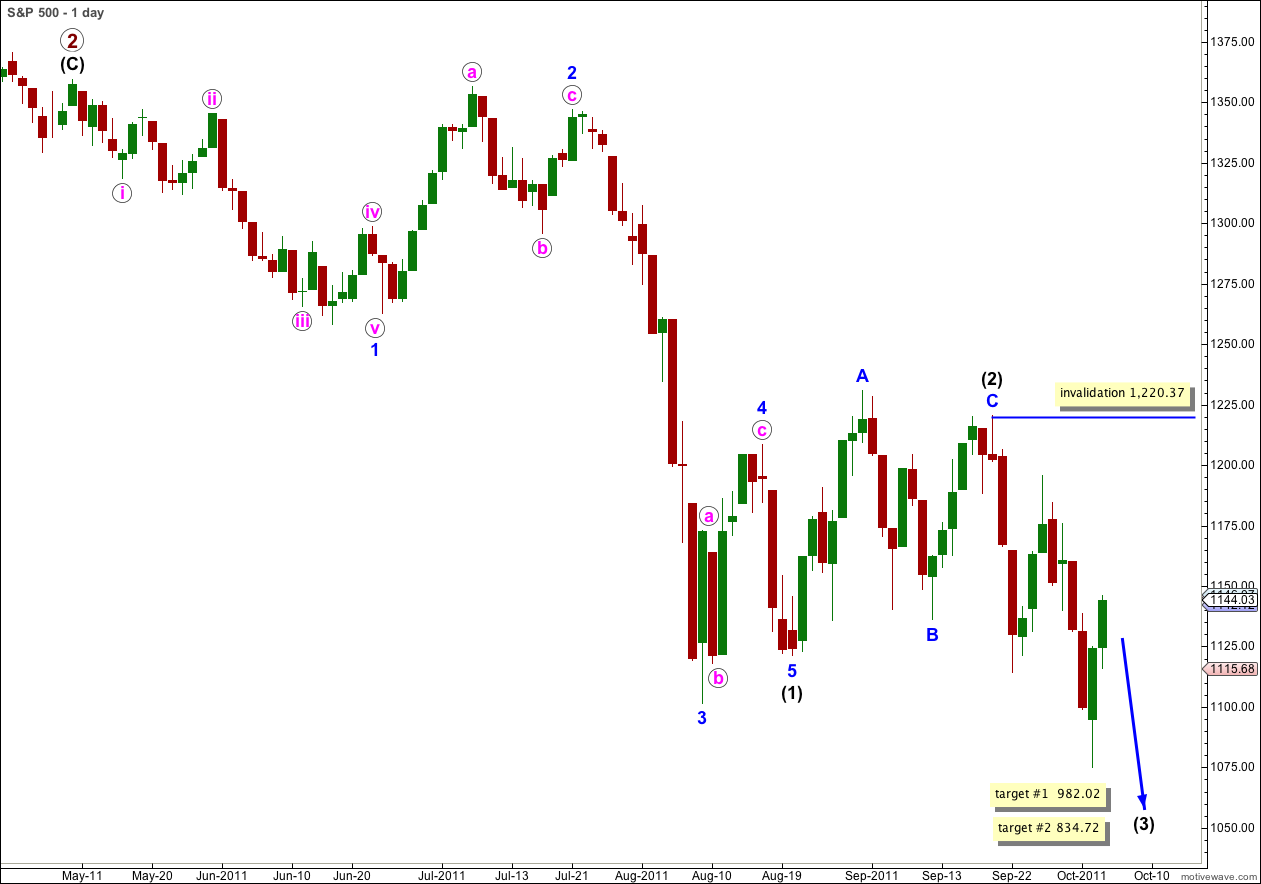

Elliott Wave chart analysis for the S&P 500 for 5th October, 2011. Please click on the charts below to enlarge.

We had expected the S&P 500 to move lower during Wednesday’s session, but it moved higher. Again, recent corrections are ending up much deeper than we are anticipating. I have a nice alternate wave count for us today which explains the choppy movement downwards.

The alternate wave count today sees wave 1 blue within wave 3 black as incomplete, and I have moved the invalidation point on the daily chart up to the end of (2) black at 1,220.37. Within wave (3) black wave 2 blue may not move beyond the start of wave 1 blue.

Targets for wave (3) black remain the same as previously calculated, and I will again consider the first higher target.

At 982.02 wave (3) black would reach equality in length with wave (1) black.

At 834.72 wave (3) black would reach 1.618 the length of wave (1) black.

Main Hourly Wave Count.

Wave 1 blue may be unfolding as a leading diagonal.

The diagonal may be expanding, although it is also possible that it is contracting with a third wave still the longest. We will have a clearer idea of which type it is when wave iv pink is over. So far wave iv pink is shorter than wave ii pink but its structure is incomplete.

Within a leading diagonal subwaves 2 and 4 must be zigzags, subwaves 1, 3 and 5 are commonly zigzags also but they may be impulses.

Ratios within wave i pink impulse are: wave (iii) green is 1.6 points longer than 2.618 the length of wave (i) green, and wave (v) green is just 0.19 points longer than equality with wave (i) green.

Within wave ii pink wave (c) green is 5.98 points short of 2.618 the length of wave (a) green.

Within wave iii pink zigzag wave (c) green is 4.86 points short of 1.618 the length of wave (a) green.

Within wave iv pink zigzag wave (c) green would reach 0.618 the length of wave (a) green at 1,160.41. This is the lower end of our target zone.

2nd and 4th waves of diagonals typically retrace between 0.66 and 0.81 of the prior wave. Wave iv pink would reach 0.81 the length of wave iii pink at 1,172.85. This is the upper end of our target zone.

Within diagonals wave 4 should overlap wave 1 price territory. Wave iv pink may not move beyond the end of wave ii pink. This wave count is invalidated with movement above 1,195.86.

The subdivisions all fit perfectly for this wave count, and there are some excellent Fibonacci ratios. If wave iv pink moves higher to move above 1,156.41 where it would reach equality with wave ii pink then the diagonal would be expanding and have a typical look.

This wave count explains all the choppy overlapping movement, the deep corrections, very nicely.

Following a leading diagonal we should expect a deep second wave correction (this is a tendency not a certainty) and following that an extended third wave. If the diagonal continues to be viable then we shall have some good guidelines as to what to expect when it is over.

Alternate Hourly Wave Count.

This was yesterday’s alternate wave count and today it remains valid, although the probability is lower with this series of deep second wave corrections.

This wave count sees downwards movement as a series of overlapping first and second waves. This indicates a build up of potential energy to the downside which should be released in explosive downwards movement when the third wave down at green degree begins.

This alternate expects very strong downwards movement which should begin tomorrow. If downwards momentum does not increase significantly tomorrow this wave count will have a reduced probability.

At 1,146.40 wave c orange within wave (ii) green would reach 0.382 the length of wave a orange.

Wave (ii) green may not move beyond the start of wave (i) green. This wave count is invalidated with movement above 1,159.61.

We may use Elliott’s channeling technique to draw a channel about the upwards zigzag. When this channel is fully breached by downwards movement then the upwards zigzag should be over and the next wave down to a new low should be underway.

I don’t have a target for wave (iii) green yet because wave (ii) green is incomplete.