Elliott wave analysis is useful in providing the most likely next direction, but often traders may be unsure exactly when to enter and exit based upon analysis.

If the market is predicted to move lower then obviously you would wait for prices to stop falling before buying, or for more aggressive traders they may sell short. If your wave count expects price to move upwards then obviously you would buy. Trying to trade against the main trend is extremely risky. The wave count should tell you what the main trend is.

Invalidation points are the most obvious place to put stops, and targets are the most obvious point at which to take profit. But this does not tell you where to enter a trade or how to add to your position.

In an effort to bridge this gap I offer the following. Please feel free to add your own comments and suggestions.

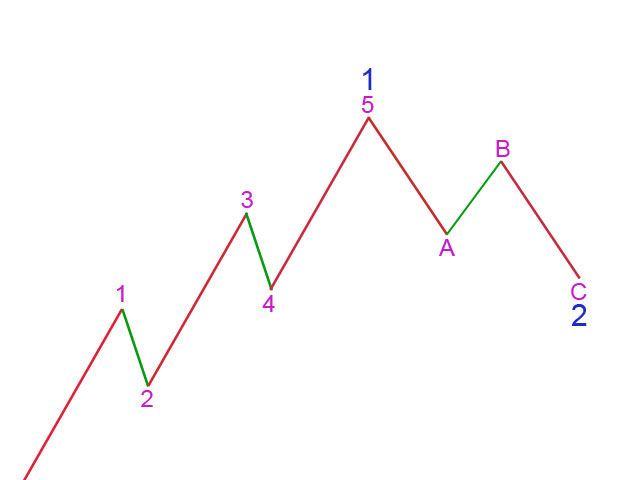

Using Elliott wave analysis we want to trade the actionary waves within the basic structure.

Actionary waves are waves which carry price in the direction of the main trend. Within an impulse (or a diagonal) actionary waves are 1, 3 and 5. Within a correction actionary waves are waves A and C.

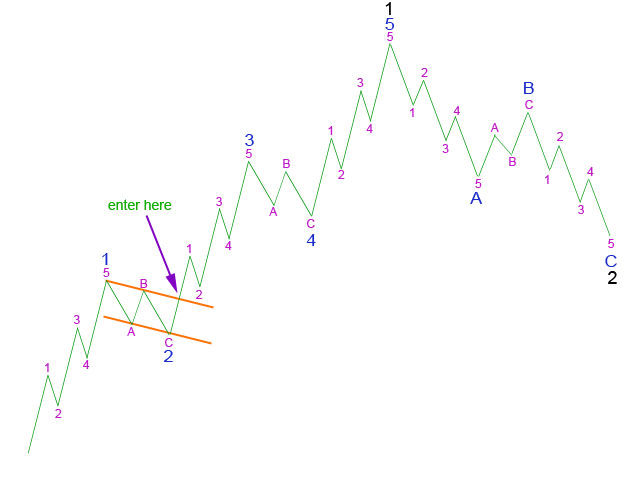

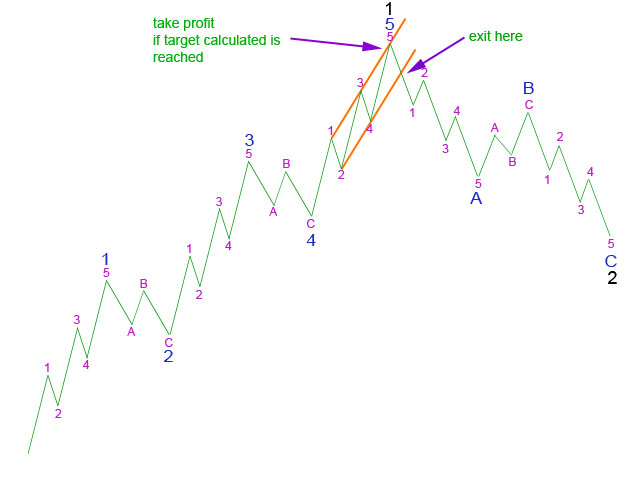

For each actionary wave the method is similar. Draw a trend channel around the prior reactionary wave. When the channel is breached then the next actionary wave should be underway, at that point enter a trade in the direction of the main trend. For the example above we enter a long position to trade the third wave upwards when price moves above the small orange channel containing the second wave zigzag.

When do you exit this trade?

You would calculate a target at which point you could close the trade and take profit. However, targets are not always met. If price falls short of the target how do you know when to get out?

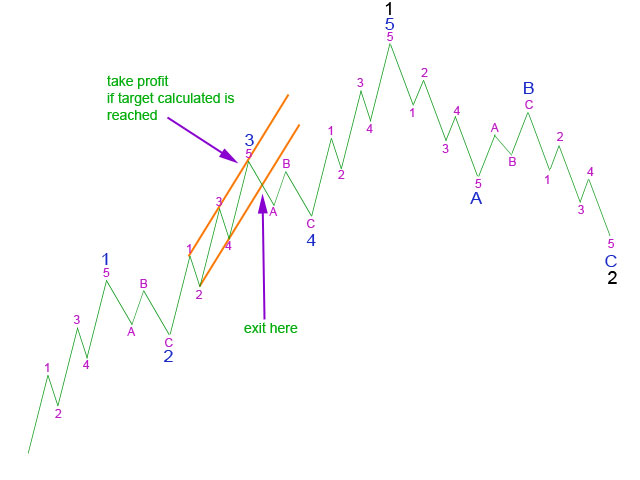

Using Elliott’s technique we draw a trend channel about the impulse which here is a third wave. Draw the channel from the highs of 1 to 3, and place a copy on the low of 2. If this does not contain wave 4 then redraw the channel as follows: draw a trend line from the lows of 2 to 4 and place a copy on the high of 1. If neither of these methods work then construct a “best fit” channel which contains as most of the movement as possible.

When the channel is breached in the direction opposite to the main trend in which you are trading then you should exit the trade.

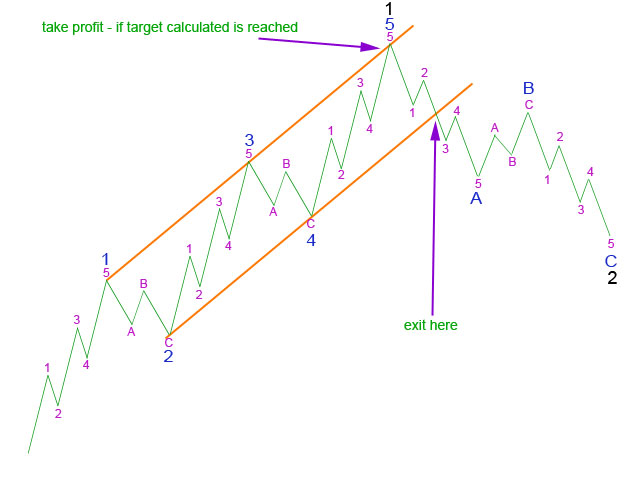

In exactly the same manner you would enter a trade for a fifth wave when you have confirmed that the fourth wave is complete:

And you would either take profit at your calculated target if price reaches the target, or you would exit the trade when it is clear that the trend has changed.

What wave degree you choose to trade will depend entirely upon what style of trading suits you best. If you don’t like to hold positions overnight or over a weekend then you would trade on hourly charts at wave degrees below minor. If you like to hold trades for weeks or months and don’t like to enter and exit so often you would trade on daily charts wave degrees at minor or intermediate.

Using this strategy you would trade this first wave at intermediate degree which may last several weeks to a few months. If your calculated target was reached you may exit about the high. If price fell short of your calculated target you would exit the trade when the channel is breached in the direction opposite to your trade.

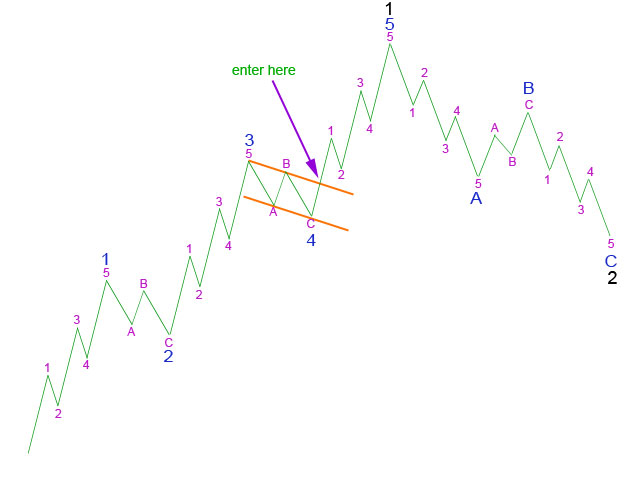

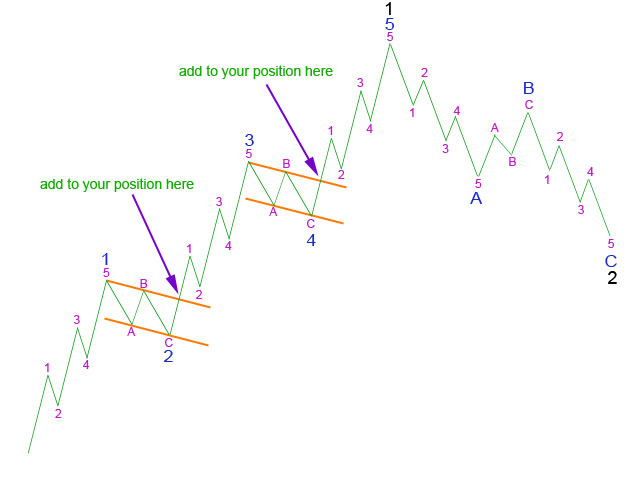

How would you add to a longer term position?

Corrections may be used as opportunities to join the trend.

In the above diagram you may add to your position in the early stage of the third wave, and again in the early stage of the fifth wave. You can take this idea and move it down one degree; you may also add to your position when each of the lower degree corrections are confirmed complete with their own channel breaches. There would then be several opportunities to add to a position.

Within stock markets the easiest wave degrees to trade would be at least minor, or intermediate. With wave degrees much below this the movements are mostly smaller and brief. However, this concept can work at all wave degrees and for all types of traders. Scalping would work on lower wave degrees, on hourly charts and down to 5 minute. Longer term trading would work best on daily charts at minor degree and intermediate degree, or even above. It depends upon your particular style and risk appetite.

In the diagrams above the structures shown are the simplest possible; impulses and zigzags. However, in reality there is a lot more variation than this, particularly for corrections. Zigzags lend themselves very well indeed to parallel channels, but flat corrections do not. Combinations and double and triple threes also do not lend themselves to trend channels at all. For these structures you draw a channel about the final C wave of the final structure and use this channel to indicate an end to the correction. Some real life examples from the S&P 500 Index are provided below.

Real life examples of third waves.

The holy grail of Elliott wave analysis for traders is a third wave. Third waves are strong and carry price in a clear direction. They’re usually the longest movement within a larger movement so offer the biggest profit opportunity. The best thing about third waves I think is their structure. They can only subdivide into a five wave impulse. This is the easiest structure to analyse and also to trade. Because there is only one structure variation is limited, and so there should be less error in analysis.

Unfortunately within the stock market the best third waves have been downwards for the last few years. At the time of writing this article we have one just ended (mid August 2011). There will be more to come.

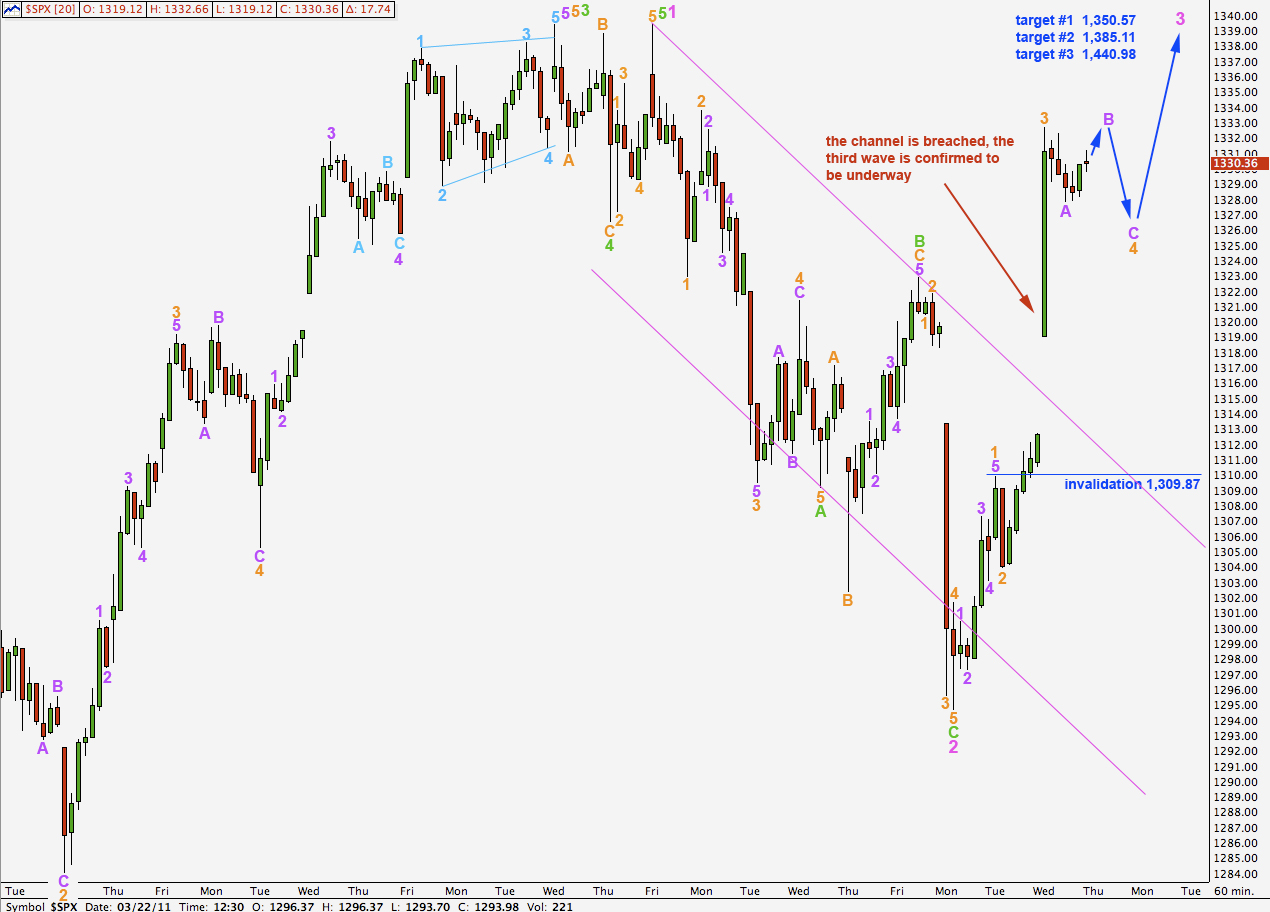

In the example above we were looking for the end to a second wave. This second wave is a simple zigzag and so we can draw a trend channel about it. When the channel is breached we have our indication that upwards movement may be the third wave we are expecting. Once we have trend channel confirmation that a third wave is underway we may enter long.

If the wave count is correct and this is a third wave we would want to take profit at the target. In this instance there are three targets, and when price reaches each target we may use our Elliott wave analysis to see if the wave is likely to be over, or not.

In that particular instance price reached a little above the first target. We had recalculated the target, but a trend channel breach and invalidation point told us when the third wave was over two weeks later.

Sometimes the market is unclear and we have more than one wave count. When all the possibilities except one remain, when all the wave counts but one are invalidated, then we can have more confidence in our analysis.

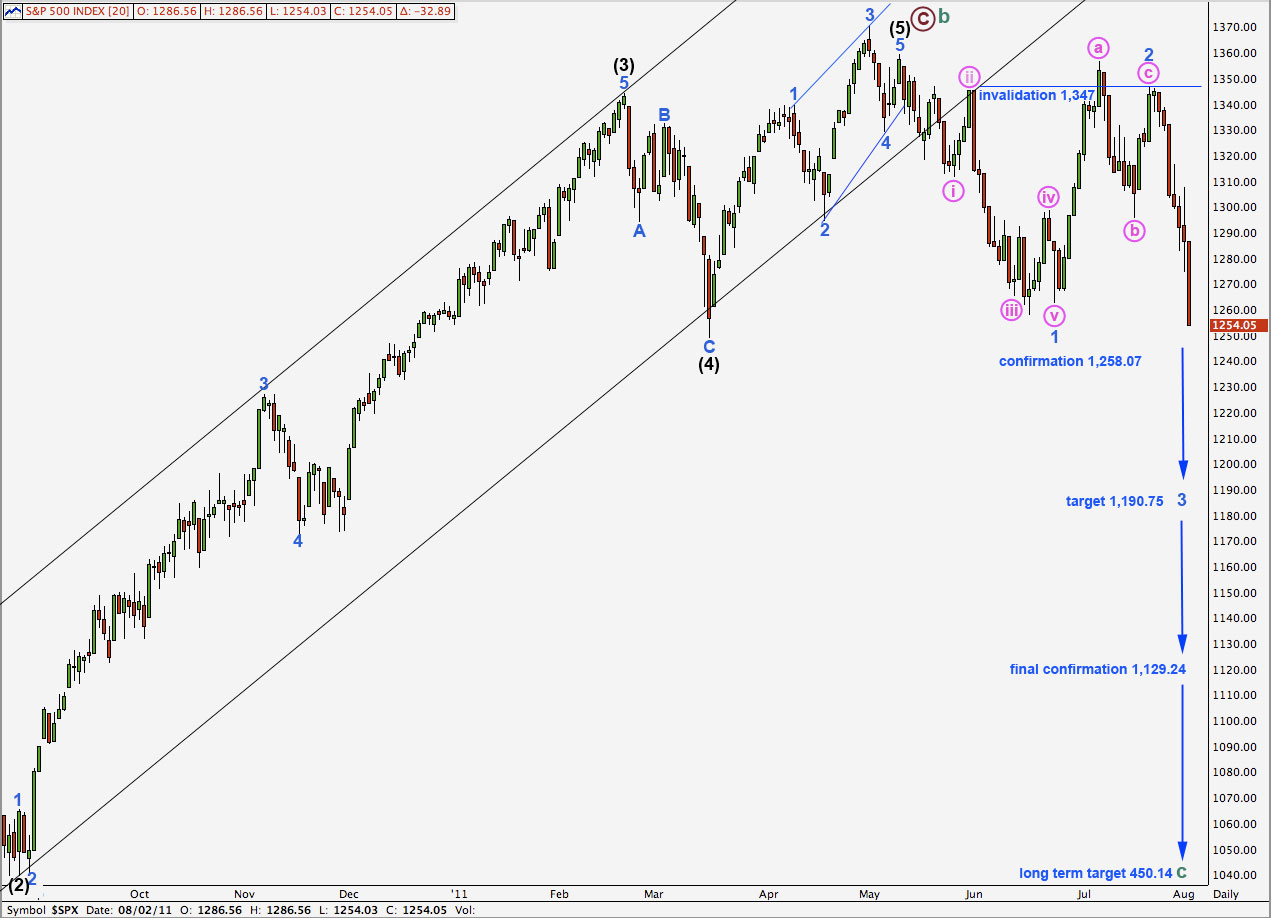

In the following example the third wave is downwards. Up to the point where price moved below 1,258.07 we had an alternate bullish wave count. When price moved below 1,258.07 we had only one wave count and a target at 1,190.75 for the third wave to end.

Once the third wave develops further we can use ratios within it to refine the target for it to end. At each point along the way there will be small bounces and for particularly aggressive traders these may be used as opportunities to join the trend, if the wave structure and technical indicators tell us that the trend is unfinished.

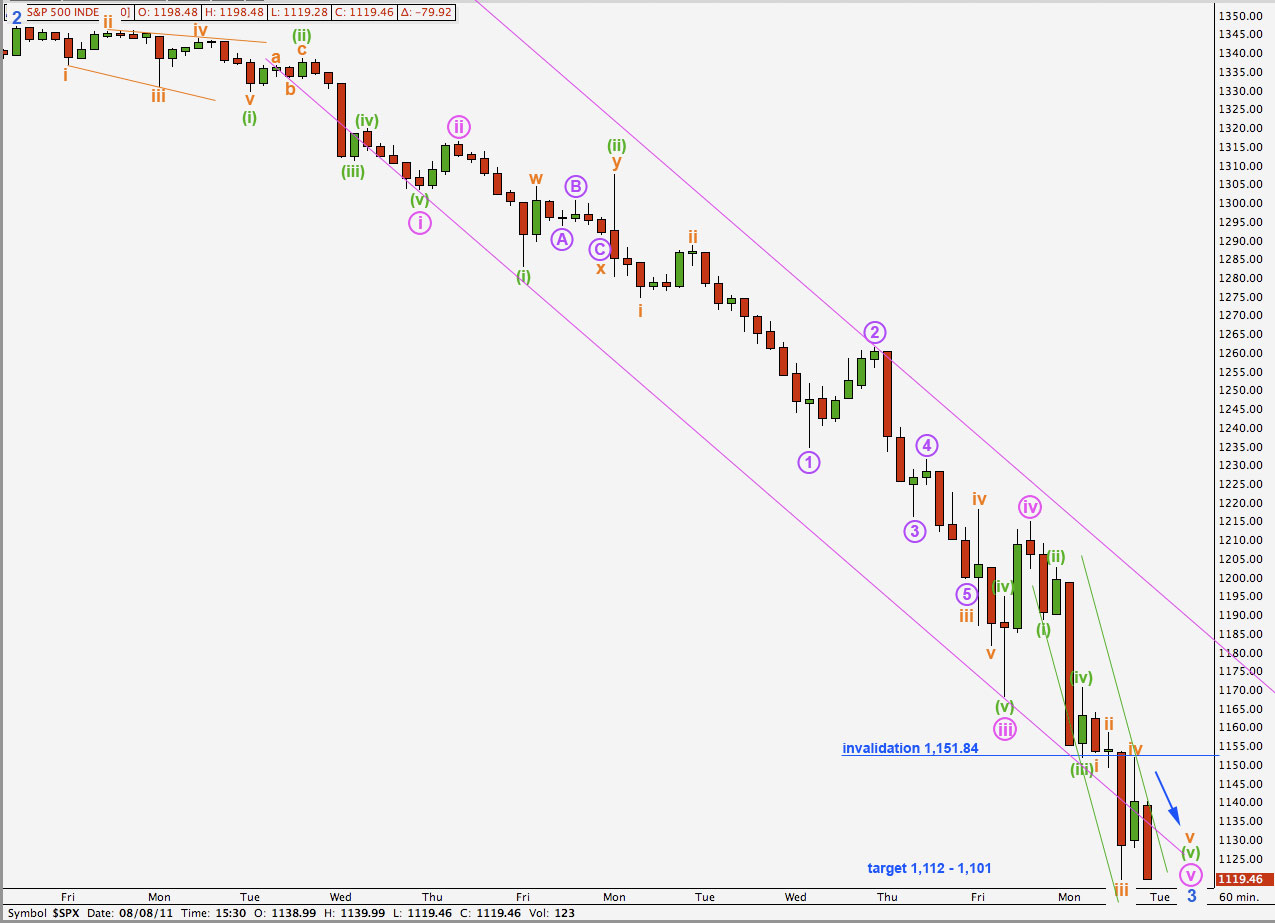

In this instance after markets closed for the 8th of August we had our final target calculated and expected it to be reached within the following day or two. We could also draw a trend channel, here not quite Elliott’s technique but a best fit, to tell us when the third wave was over. But in this instance we did not need the trend channel as price ended just above the lower end of our target zone, the perfect place to exit and take profit.

This method does not always work as well as the two examples above show. If the wave count is wrong then price will probably not move in the direction you expect. That is why it is essential to always use stops. If the analysis you are using is more often right than wrong then you should be able to make a profit more often than a loss.

The approach to using Elliott wave analysis to trade markets as outlined here is not by any means the only valid approach. You may find it too cautious, you may find it too risky. Every trader will have their own preferred methods.

In conclusion, the best most profitable and longest lasting traders are the ones who manage the money in their trading accounts most wisely. Even if your wave count correctly predicts direction for the next 2 weeks you can still manage to lose money, if you over leverage and let fear be your guide. Keeping leverage low will allow you to have losses and still survive.

Hi Lara, just the sort of guidance we all need. Thanks. Gary

Lara–

Great information here. Thanks