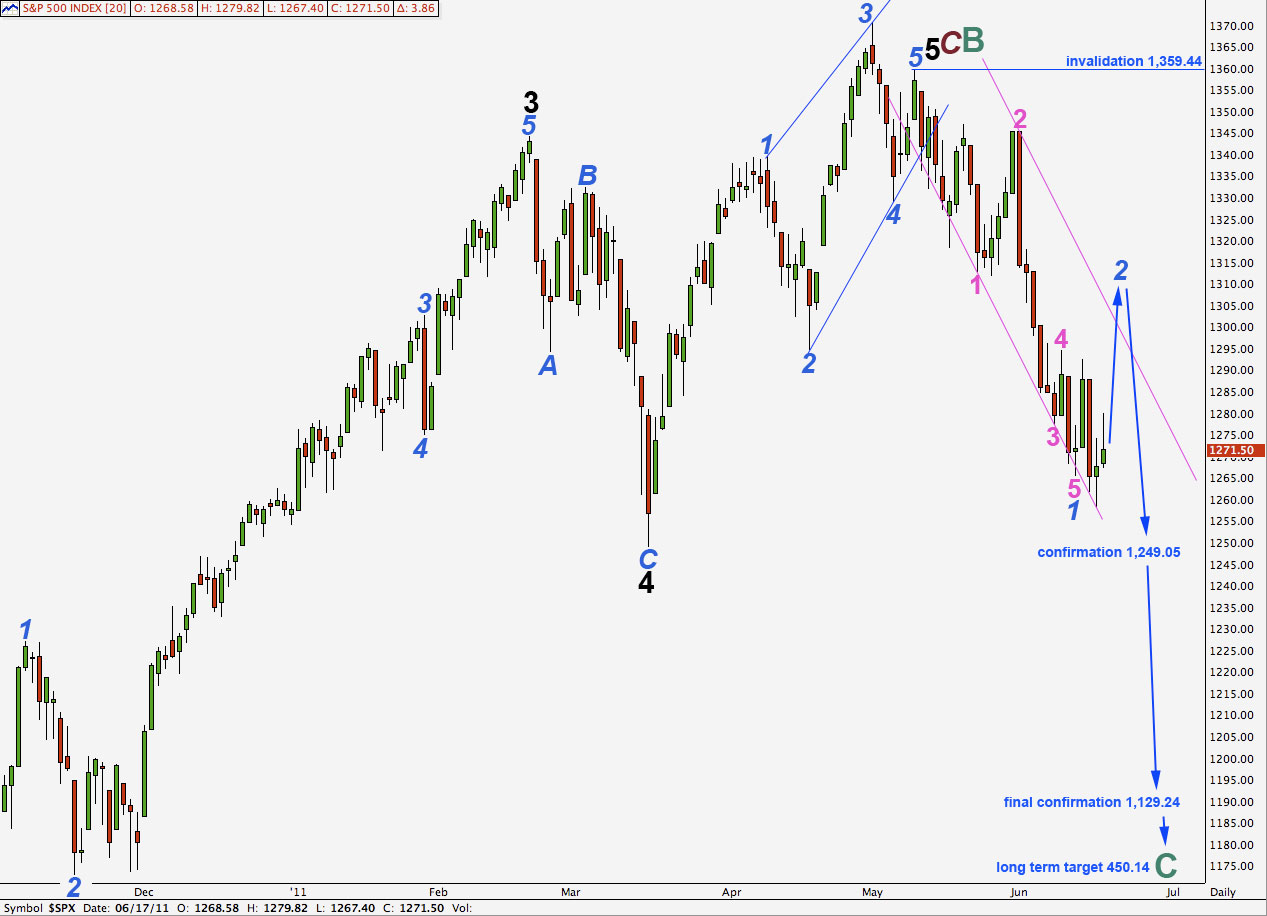

Elliott Wave chart analysis for the S&P 500 for 17th June, 2011. Please click on the charts below to enlarge.

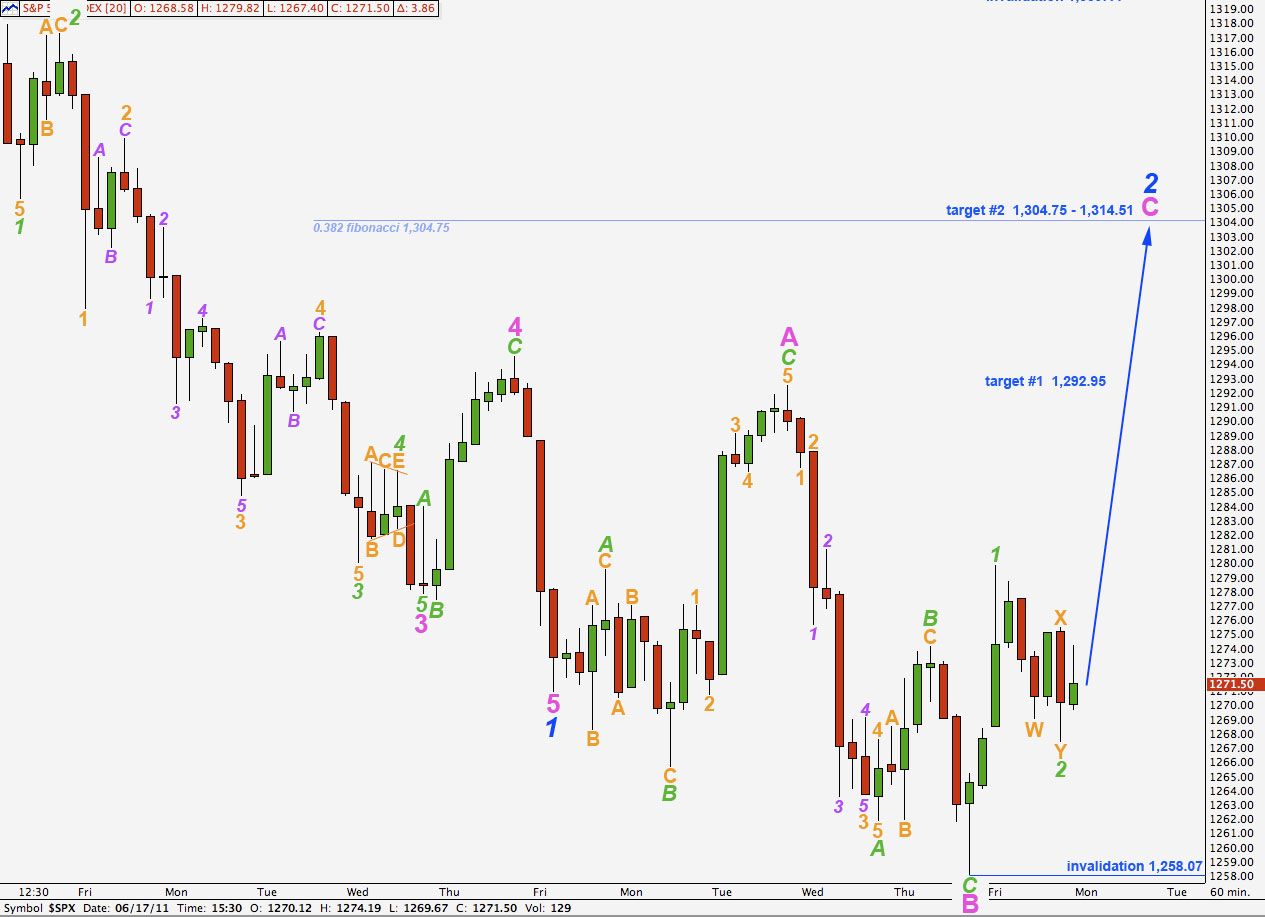

As expected from last analysis for the first hourly wave count we have seen upwards movement during Friday’s session. This has been enough to invalidate the other two hourly wave counts and so to end the week we have only one.

Wave 2 blue may be unfolding as an expanded flat correction. Wave 2 may not move beyond the start of wave 1 blue. This wave count is invalidated with movement above 1,359.44.

In the mid term, when this second wave correction is over, we would expect the next wave down to be a strong third wave. At that stage we will be looking closely at wave behaviour. If it matches with our expectations for this wave count then its probability will increase. If it does not match for this wave count then we must more seriously consider our alternates.

Movement below 1,249.05 will confirm that wave 5 black for this wave count must be over.

Movement below 1,129.24 will eliminate any alternate which saw this downwards movement as still a fourth wave at black degree within the impulse for primary wave C. At that stage we would be very confident that the S&P 500 is in a longer term bear market.

While price remains above these levels we must understand that the possibility that price could turn back upwards and make new highs does remain.

In the long term this wave count expects cycle wave C to last at least a year, if not several, and it may end at equality with cycle wave A about 450.14.

Wave B pink was a deep 160% correction of wave A pink. For an expanded flat, the most common type of flat correction, wave C should end substantially beyond the end of wave A. At 1,314.51 wave C pink will reach 2.618 the length of wave A pink. This second target is more likely than the first. It is also reasonably close to the 0.382 fibonacci ratio of wave 1 blue at 1,304.75.

Upwards movement for wave 1 green within wave C pink has a good impulsive count on a 5 minute chart.

Wave 2 green looks like a double zigzag, within wave W its B wave is a perfect contracting triangle on a 5 minute chart. Triple zigzags are rare and so it would be highly unlikely for wave 2 green to extend any lower. If it did it may not move beyond the start of wave 1 green below 1,258.07.

Wave 3 green may end about 1,302.59 where it would reach 1.618 the length of wave 1 orange. This would fit nicely with the second higher target for wave C pink to end.

Wave C pink may take another few days to complete. It is extremely likely to move at least to the end of wave A pink at 1,292.95 to avoid a truncated C wave and so a running flat. However, it does not have to. If downwards pressure is strong enough we may even see another running flat. It is possible but very unlikely.