Elliott Wave chart analysis for the S&P 500 for 7th June, 2011. Please click on the charts below to enlarge.

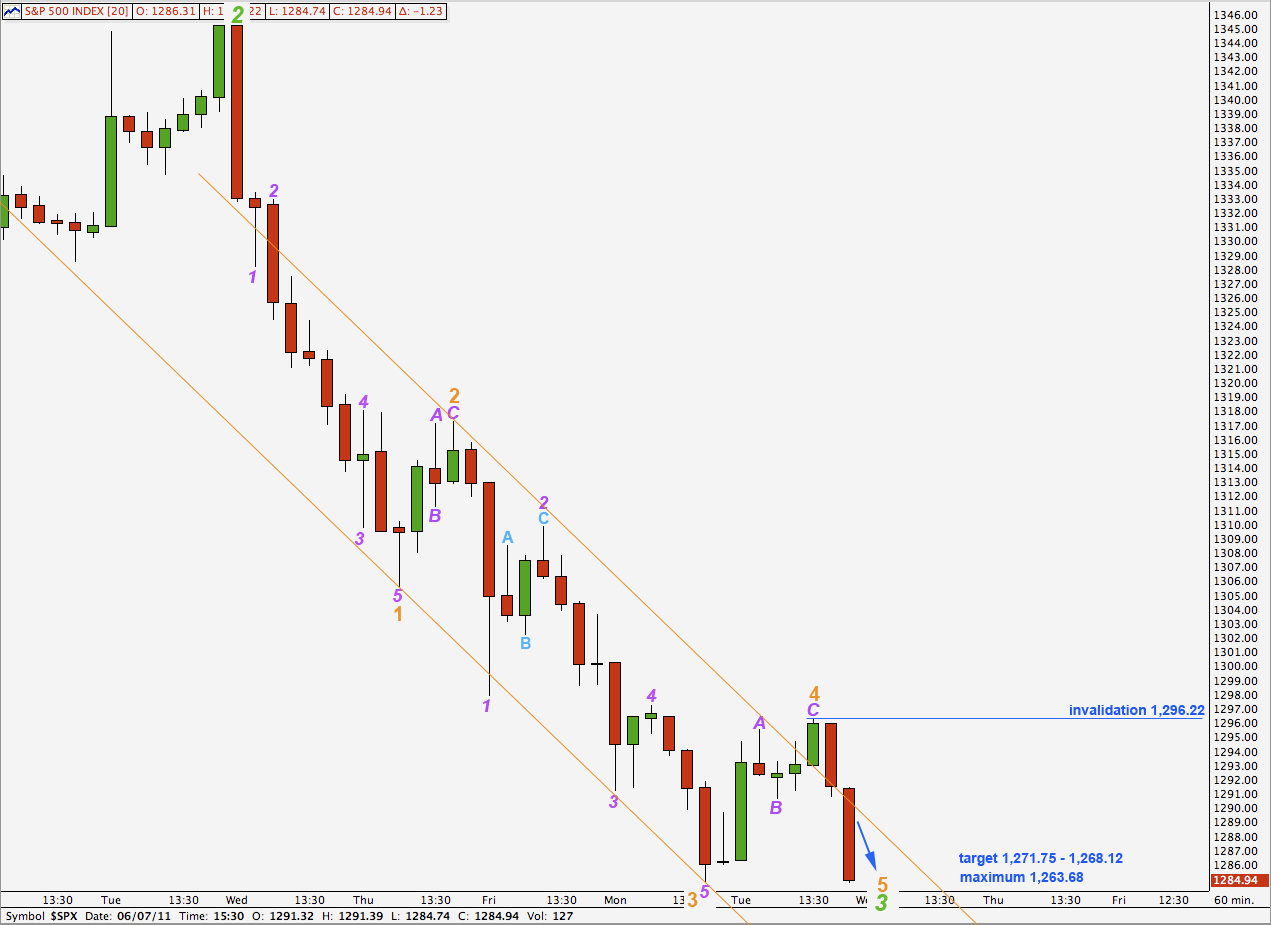

The S&P moved upwards a little during Tuesday’s session for a small correction which was what we were expecting. Thereafter, price has turned back downwards but has not quite made a new low.

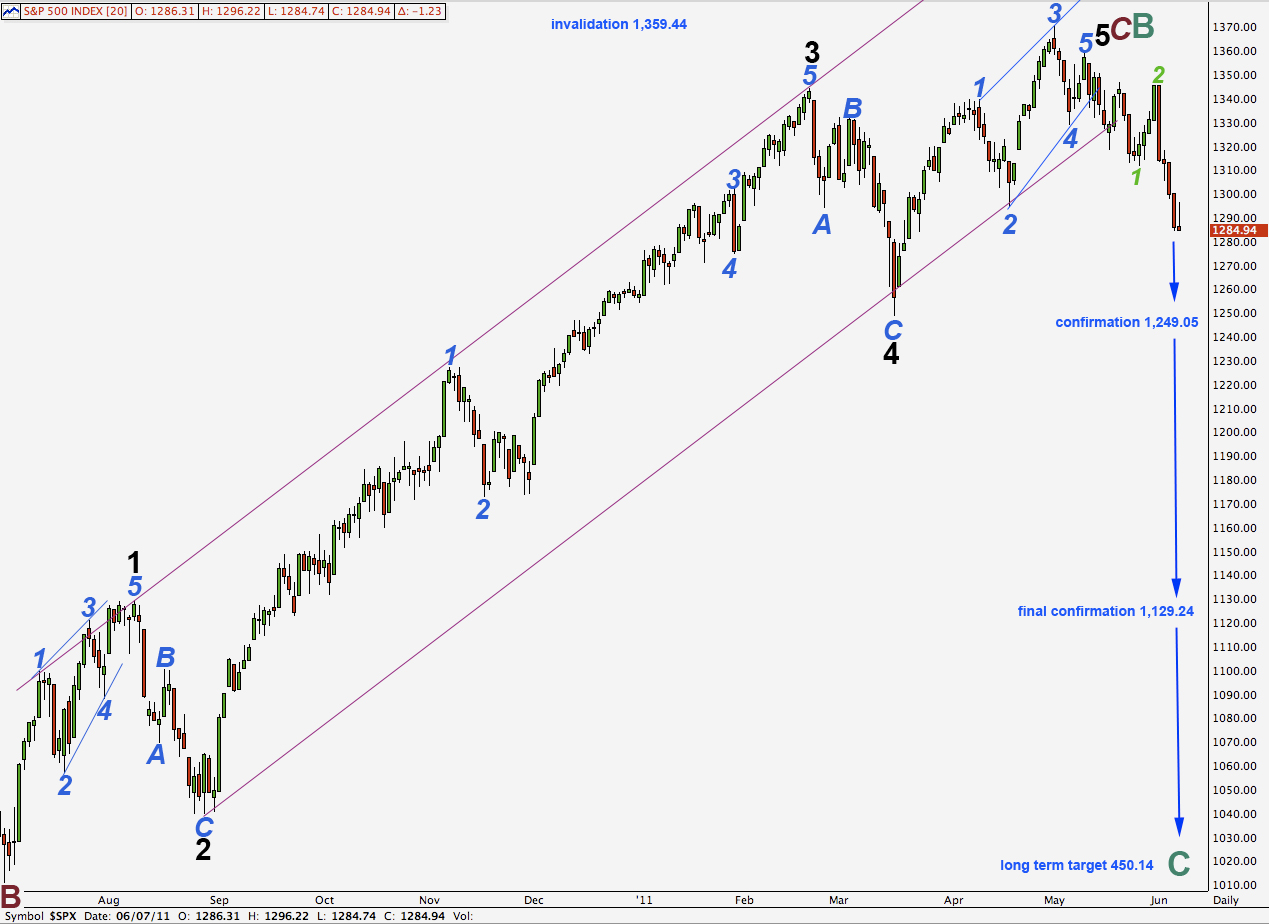

In the long term it is likely that cycle wave C will reach equality with cycle wave A at 450.14. Cycle wave C should take at least a year, if not longer, to complete.

Further movement below 1,249.05 would increase the probability of this bear market. At that stage a very unlikely alternate which saw downwards movement as a second wave correction within wave 5 black would be invalidated.

Finally, movement below 1,129.24 would invalidate the one remaining alternate bullish wave count and so give us a lot of confidence that the S&P is in a bear market.

Any second wave correction may not move beyond the start of its first wave. This wave count is invalidated with movement above 1,359.44.

We had expected wave 4 orange to begin Tuesday’s session and for price to remain below the end of wave 1 orange which is at 1,305.61.

Wave 4 orange has overshot the small parallel channel containing wave 3 green. We may expect that a fifth wave overshoot of the channel on the opposite is likely.

Wave 3 orange has no fibonacci ratio to wave 1 orange and is 7.05 points shorter than wave 1. This gives a maximum length for wave 5 orange to 1,263.68. If this price point is passed by this downwards movement which is wave 3 green then the middle of this third wave would be extending and we would need to move the degree of labeling from the high labeled 2 orange all down one degree.

Because wave 3 orange has no fibonacci ratio to wave 1 orange it is more likely that wave 5 orange will exhibit a ratio to either of 3 or 1. At 1,271.75 wave 5 orange will reach 0.618 the length of wave 1 orange.

At 1,268.12 wave 3 green will reach 1.618 the length of wave 1 green.

Within wave 5 orange any second wave correction may not move beyond the start of the first wave. This wave count is invalidated with movement above 1,296.22.

Alternately, wave 5 orange may be over at (or very close to) 1,284.74 where it would be just 0.95 points short of 0.382 the length of wave 3 orange. If upwards movement takes price above the invalidation point at 1,296.22 then this would be a likely wave count. At that stage we would expect that upwards movement would be a fourth wave correction at green degree which may not move into wave 1 green price territory above 1,311.80.