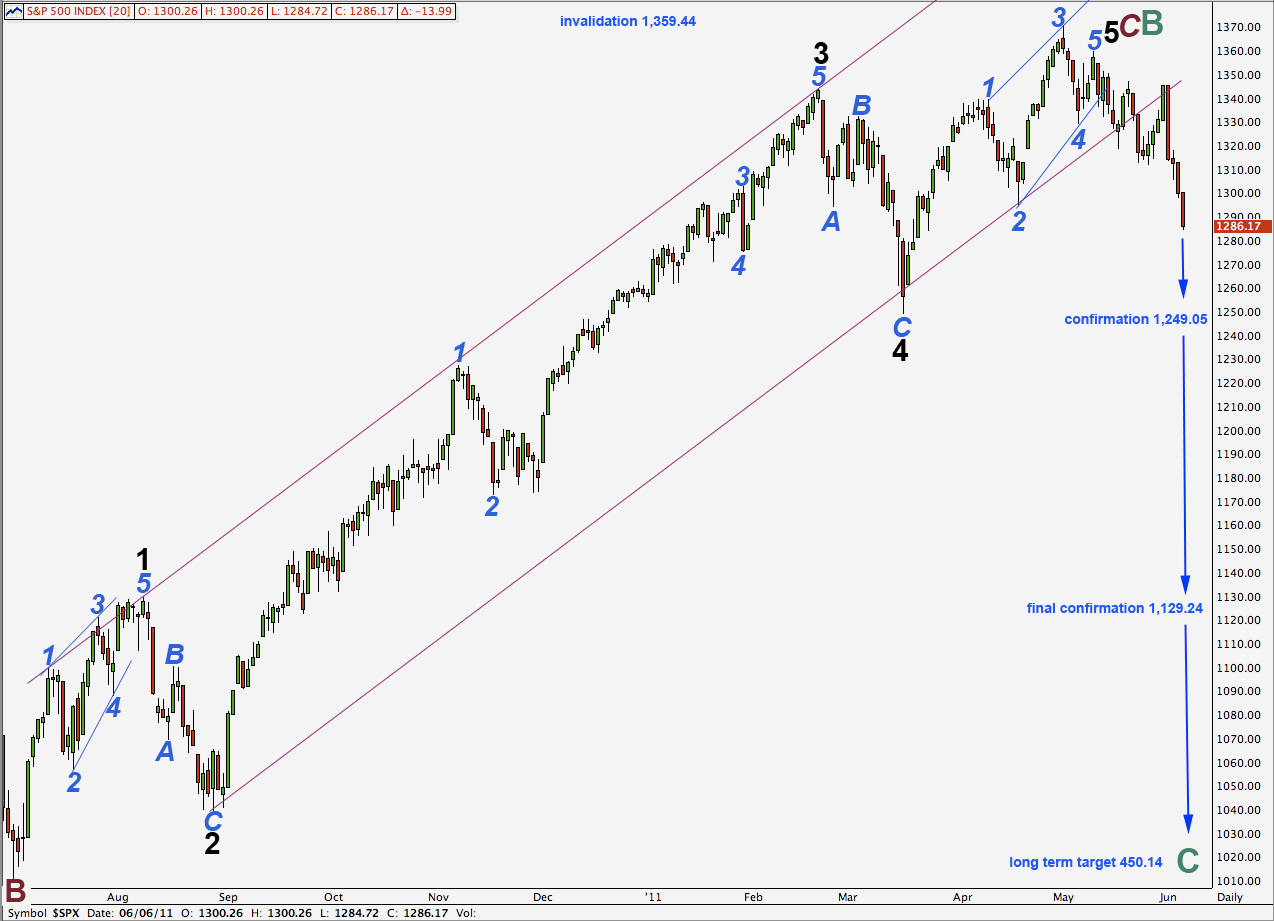

Elliott Wave chart analysis for the S&P 500 for 6th June, 2011. Please click on the charts below to enlarge.

With further downwards movement expected from last analysis main wave count, we can again narrow down the number of alternate possibilities that we are working with. I have only the one main daily wave count for you today. The only bullish alternate that I can see as still possible is a very large expanded flat correction for wave 4 black within primary wave C, and as explained previously this looks highly unlikely.

In the long term it is likely that cycle wave C will reach equality with cycle wave A at 450.14. Cycle wave C should take at least a year, if not longer, to complete.

Further movement below 1,249.05 would increase the probability of this bear market. At that stage a very unlikely alternate which saw downwards movement as a second wave correction within wave 5 black would be invalidated.

Finally, movement below 1,129.24 would invalidate the one remaining alternate bullish wave count and so give us a lot of confidence that the S&P is in a bear market.

Any second wave correction may not move beyond the start of its first wave. This wave count is invalidated with movement above 1,359.44.

Monday’s downwards movement is a complete five wave impulse on a 5 minute chart. Wave 3 orange is 7.05 points shorter than wave 1 orange and so wave 5 orange to come may not be longer than 32.54 points.

Ratios within wave 3 orange are: wave 3 purple is 0.74 points short of equality with wave 1 purple and wave 5 purple is 0.98 points longer than 0.618 the length of wave 3 purple.

Wave 4 orange may begin tomorrow’s session and may not move into wave 1 orange price territory. This wave count is invalidated with movement above 1,305.61.

At 1,268.12 wave 3 green will reach 1.618 the length of wave 1 green. If this wave count is correct this target may be reached tomorrow or the day after.

We may use Elliott’s technique to draw a channel around wave 3 green. Wave 4 orange within it may end about the upper end of the channel and the final fifth wave downwards may end either midway in the channel or about the lower edge.