Elliott Wave chart analysis for the SPX500 for 25th March, 2011. Please click on the charts below to enlarge.

Although upwards movement for Friday’s session has not invalidated the alternate wave count, the Dow did have its alternate wave count invalidated and so it now seems more likely that primary wave 2 is not over for either of these markets. I have swapped around the main and alternate wave counts for the S&P today.

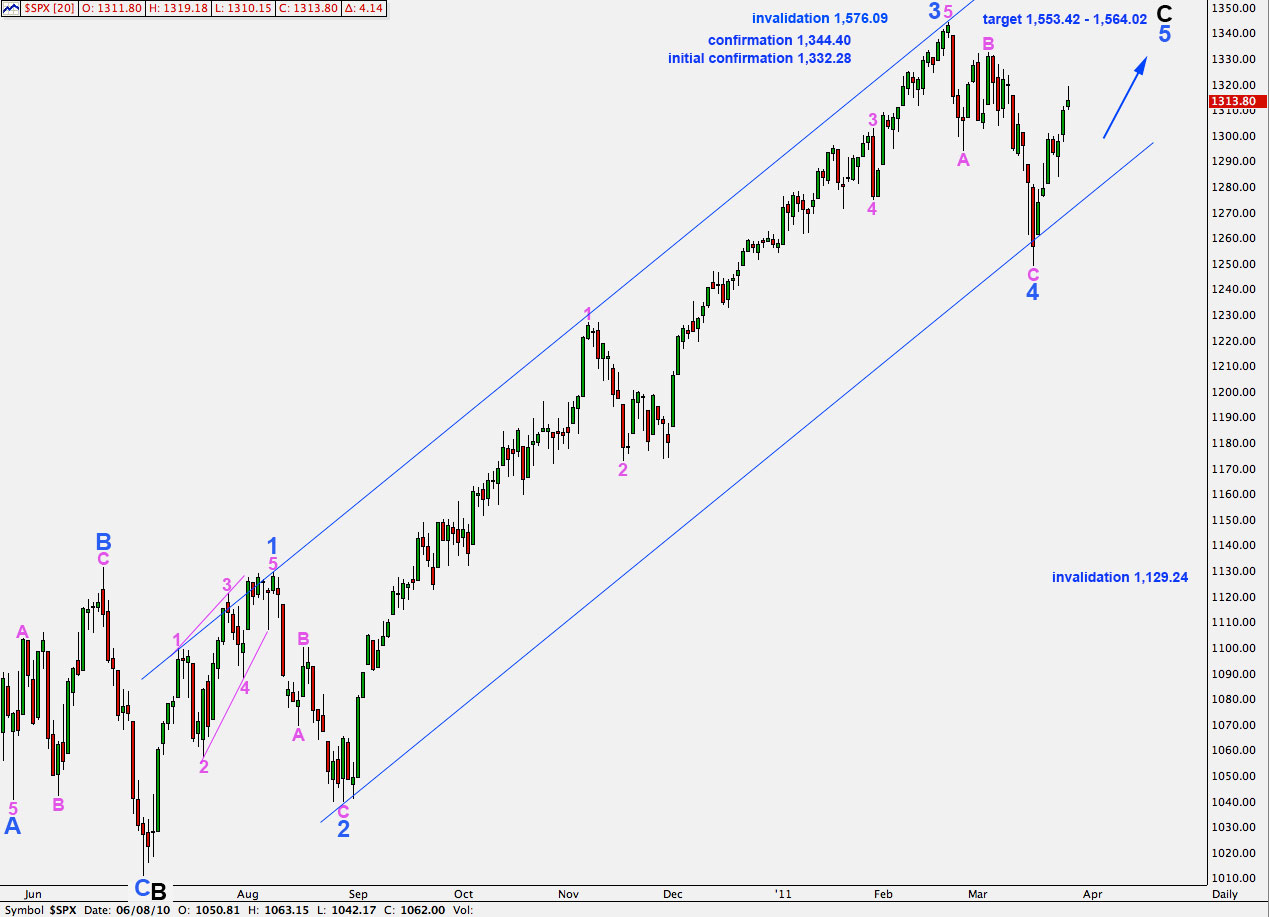

Main Wave Count.

As much as I do not like the three wave look of wave 3 blue for this wave count, recent upwards movement has a better fit here.

Movement above 1,332.28 would confirm this wave count.

At 1,553.42 wave 5 blue will reach equality with wave 3 blue.

At 1,564.02 wave C black will reach equality with wave A black.

This wave count is invalidated with movement above 1,576.09.

This wave count expects a little downwards movement to end wave 4 orange correction before price turns upwards again to end wave 3 green. A short term target for wave 3 green is at 1,339.49 where it will equal 1.618 the length of wave 1 green.

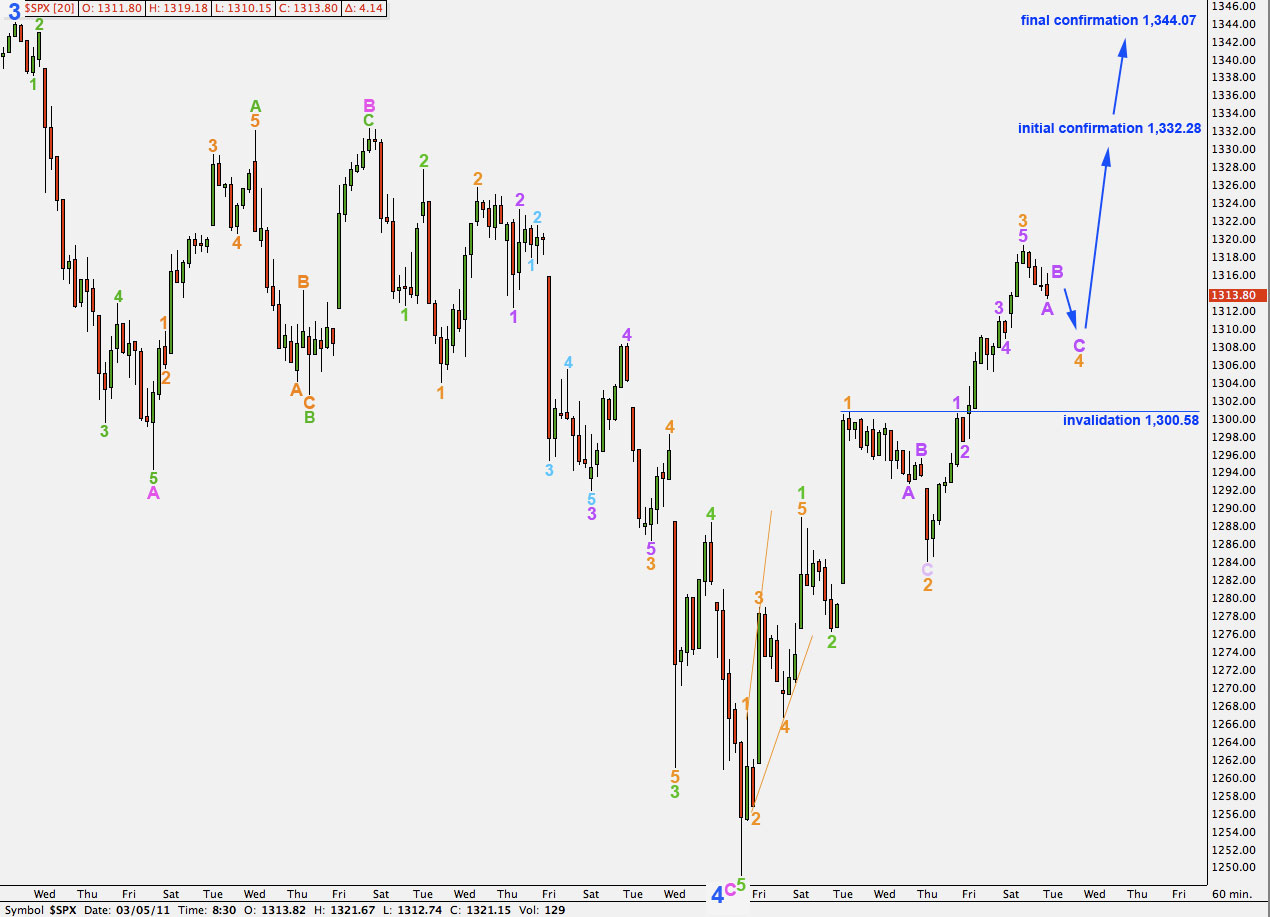

Movement above 1,332.28 would invalidate the alternate wave count and so confirm this main wave count.

There is no fibonacci ratio between waves 3 and 1 orange.

Ratios within wave 3 orange are: wave 3 purple has no fibonacci ratio to wave 1 purple and wave 5 purple is 0.15 points longer than 0.618 the length of wave 1 purple.

Wave 4 orange may not move into wave 1 orange price territory. This wave count is invalidated by movement below 1,300.58.

Wave 4 orange may end about the fourth wave of one lesser degree about 1,308.86.

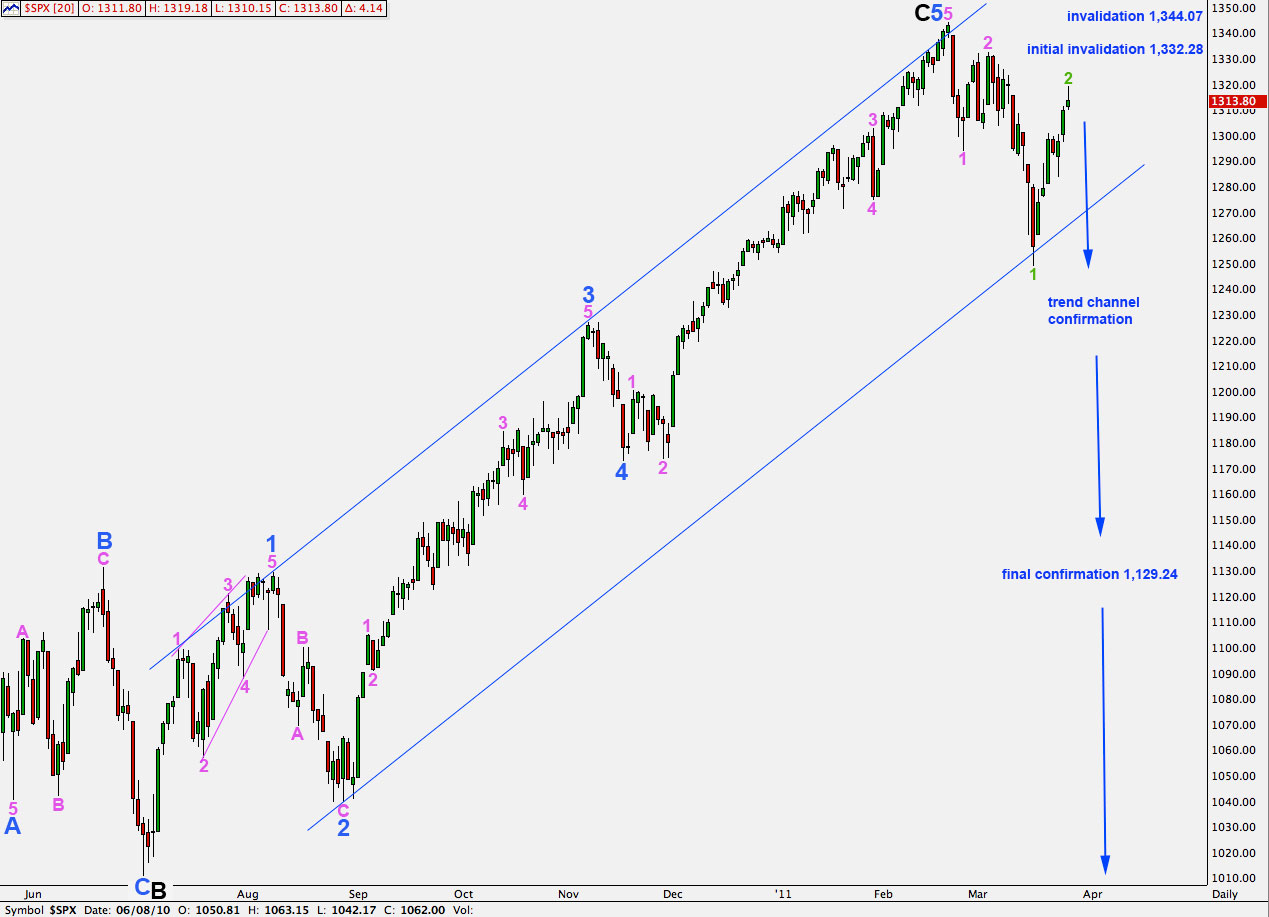

Alternate Wave Count.

This alternate wave count expects that we have had a trend change at primary degree and that primary wave 3 down has begun which must move beyond the end of primary wave 1 at 666.79.

This trend change is unconfirmed. We need to see a candlestick on the daily chart below the wide blue parallel channel to confirm it.

Movement above 1,332.28 would invalidate this wave count because wave 2 green may not move beyond the start of wave 1 green. It is difficult to see the end of wave 2 pink any higher and so this price point is an important point of differentiation between the two wave counts.

Movement below 1,129.24 would give full confidence that downwards movement is primary wave 3.

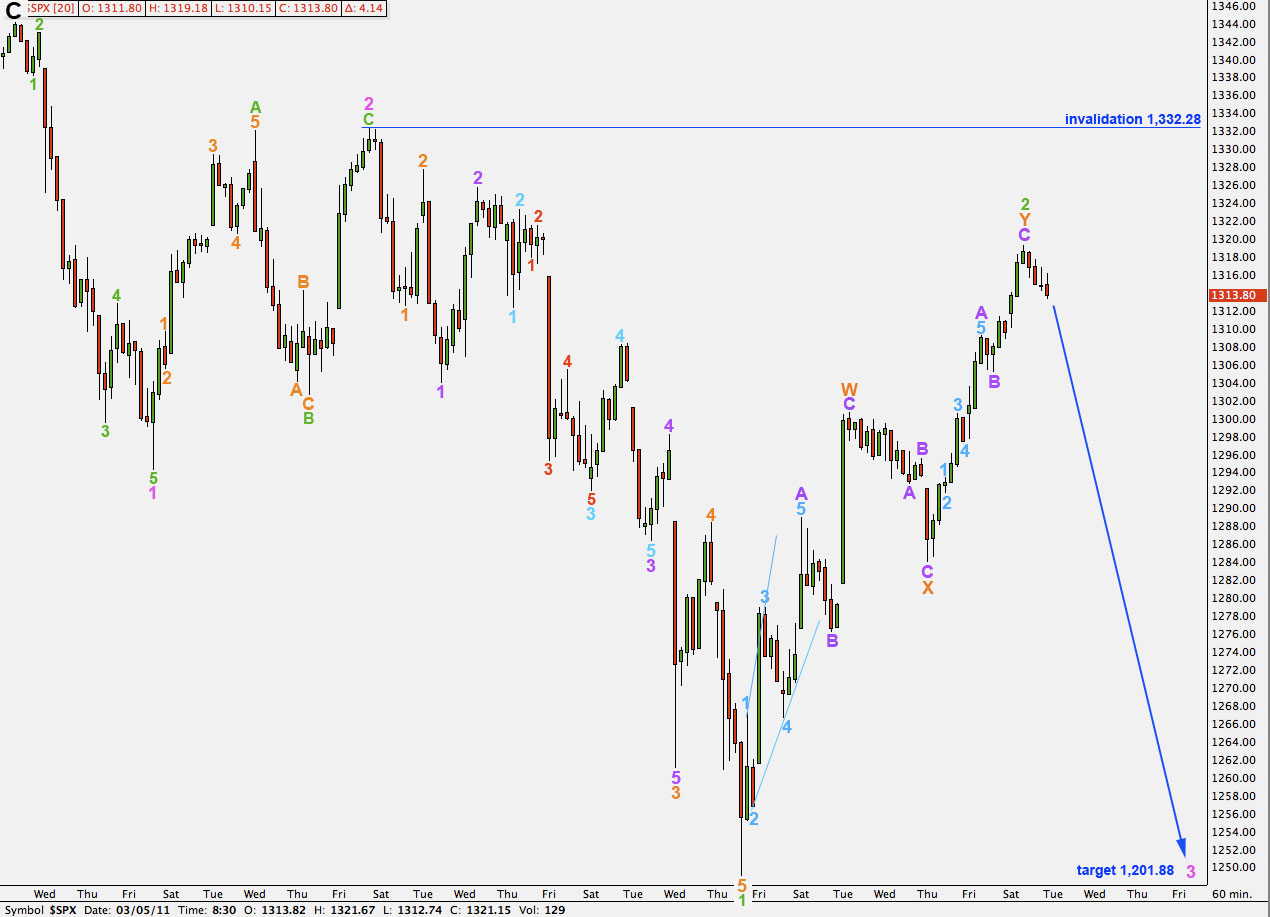

The structure for wave 2 green may be complete.

Within wave Y orange zigzag wave C purple is 1.6 points short of 0.618 the length of wave A purple.

Within wave W orange zigzag wave C purple is just 0.2 points short of 0.618 the length of wave A purple.

Any further extension of wave 2 green may not move beyond the start of wave 1 green. Movement above 1,332.28 would invalidate this wave count.