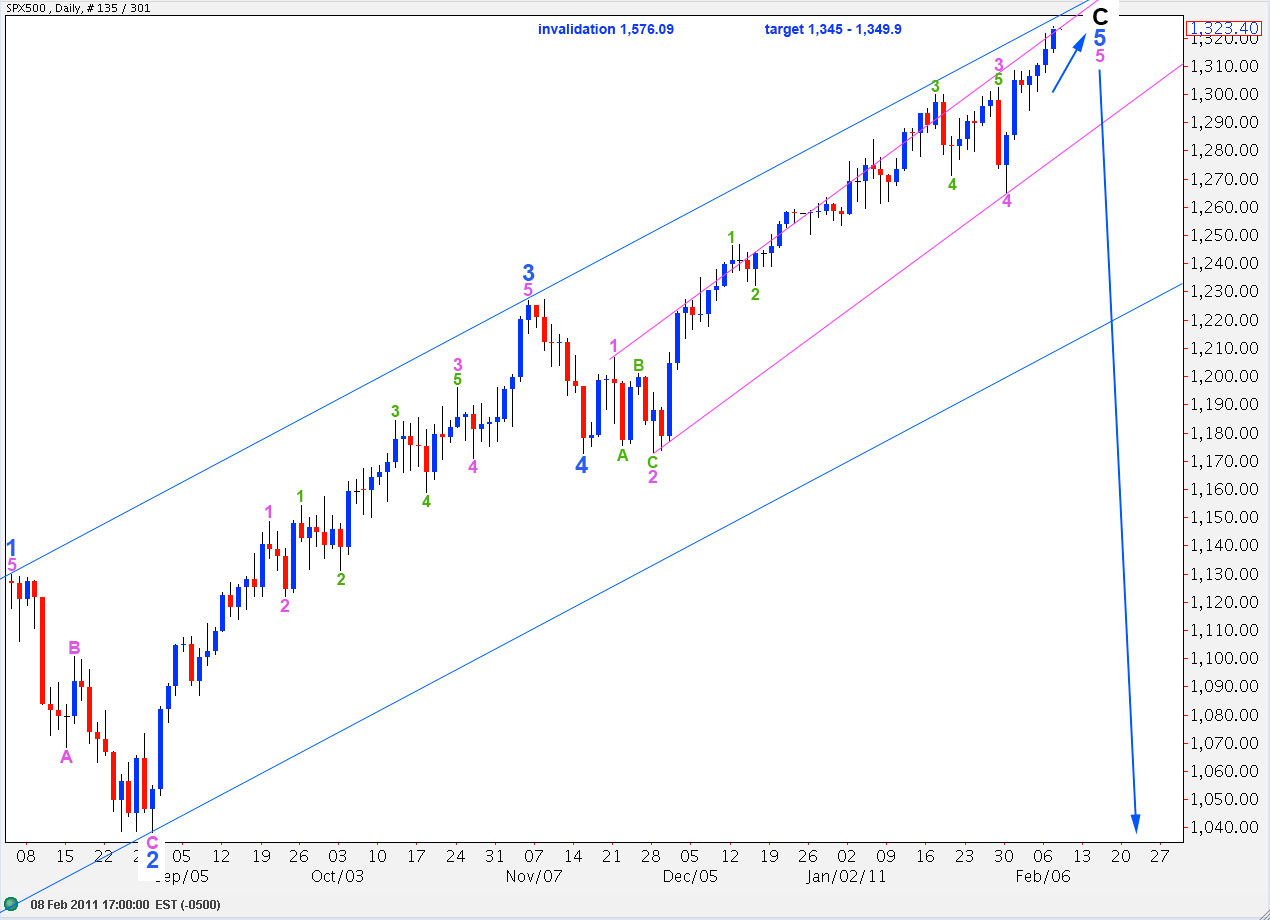

Elliott Wave chart analysis for the SPX500 for 8th February, 2011. Please click on the charts below to enlarge.

As expected the S&P continues with slow upward movement toward the target zone. It is almost at the short term target zone on the hourly chart and the gap to the upper edge of the blue parallel channel here on the daily chart is narrowing. We may see the end of this upward movement overshoot the blue channel, and that may be an indication that the trend is very close to changing.

The pink parallel channel will provide our first indication of a trend change when it is breached to the downside. The blue channel will provide final indication of a trend change at intermediate and, therefore, primary degree when it too is breached to the downside.

At 1,345 wave 5 pink within wave 5 blue will reach 0.618 the length of wave 3 pink. At 1,349.9 wave C black will reach 0.618 the length of wave A black.

For this main wave count primary wave 2 may not move beyond the end of primary wave 1. Therefore, movement above 1,576.09 would invalidate this wave count.

Our alternate historical weekly wave count expects price to rise above 1,485.16 minimum. If this price point is reached the historical count will become our main wave count, which allows for new highs for the S&P before a strong downward wave to new lows.

The long term outlook for the main wave count and the alternate historical wave count is the same: a strong C wave should carry price to historic lows and will be a long and devastating ride down. However, the alternate allows for new highs before this occurs.

Price is edging slowly closer to the short term target for wave 3 orange to end. Wave 4 purple has most likely extended further sideways and waves A and C aqua within it are perfectly equal in length.

The wave structure is still incomplete. It requires more upward movement before we again may be at a turning point.

Wave 5 purple is most likely unfolding as an ending diagonal with each subwave dividing into a zigzag. At 1,324.6 wave 5 purple will reach equality with wave 1 purple.

Within wave 5 purple wave 3 aqua of this diagonal may not be over. It may reach a little higher yet. The subsequent fourth wave zigzag downward for 4 aqua may not move beyond the end of wave 2 aqua below 1,318.9. Thereafter, a final zigzag upwards for wave 5 aqua into the short term target zone would end wave 3 orange.

Wave 4 orange may not move into wave 1 orange price territory. Therefore, movement below 1,310.9 would invalidate this wave count.