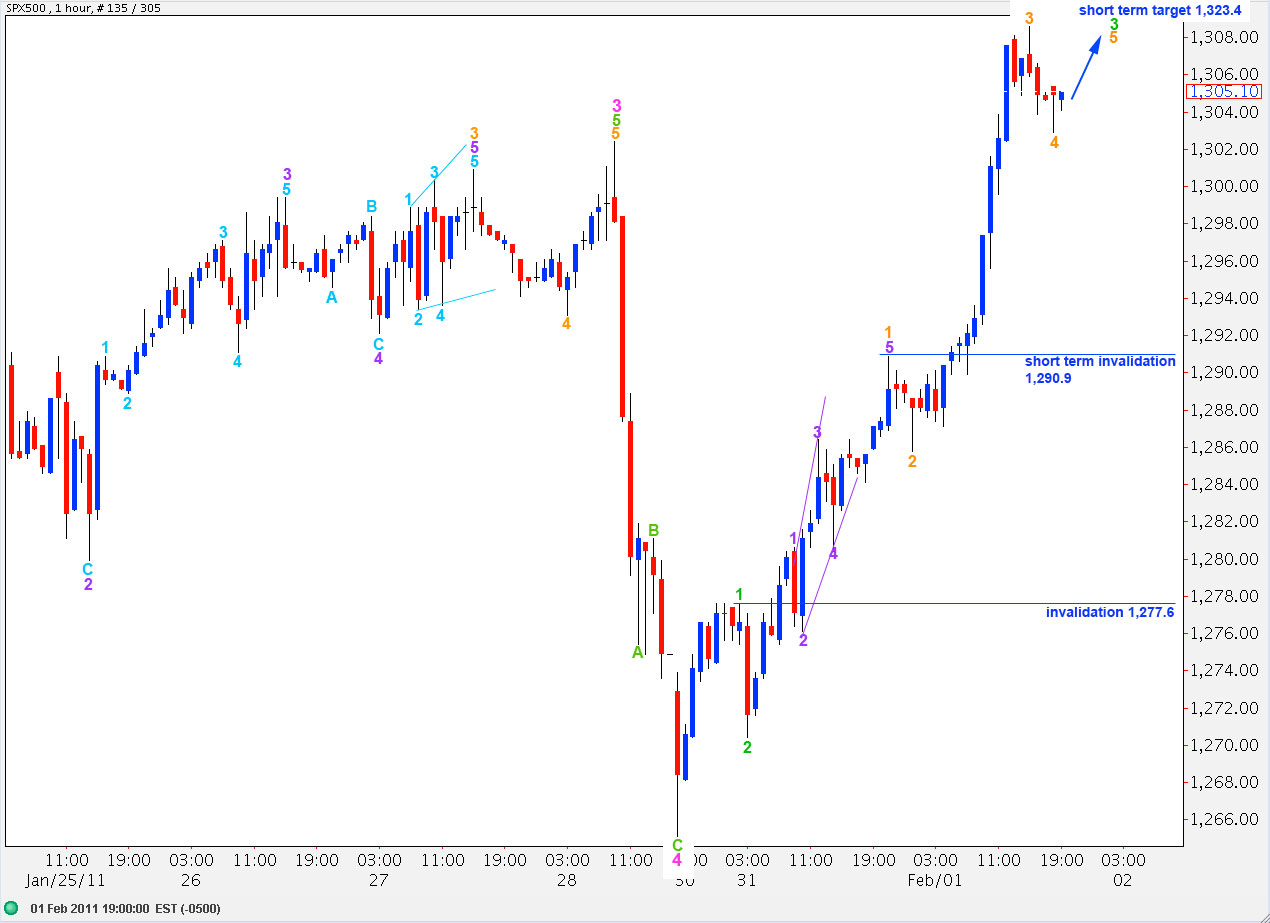

Elliott Wave chart analysis for the SPX500 for 1st February, 2011. Please click on the charts below to enlarge.

Upward movement invalidated our main hourly wave count, confirming the alternate. We have further up to go for the S&P before this impulse is over.

We have only one wave count on the daily chart now. Waves 4 and 2 pink are proportional to each other in length, giving this wave 5 blue a nice impulsive five wave structure. Wave 3 pink is just 15 points short of 4.236 the length of wave 1 pink. At 1,345 wave 5 pink will reach 0.618 the length of wave 3 pink.

At 1,349.9 wave C black will reach 0.618 the length of wave A black.

Ratios within pink wave 3 are: wave 3 green is 6.3 points short of equality with wave 1 green and wave 5 green is just 2.8 points longer than 0.382 the length of green wave 1.

The upward wave structure is incomplete. Therefore, we should see further upward movement.

The downward wave which is labeled here 4 pink and which looked suspiciously like a three, was indeed a three. Wave behaviour during this short correction may be indicative of what is to come when this whole upward movement is complete.

The degree of labeling here may have to be moved up one degree. I will be keeping this in mind as this structure unfolds.

Within green wave 3 orange wave 3 is just 2.3 points longer than equality with orange wave 1.

At 1,323.35 wave 3 green will reach 4.236 the length of green wave 1. At 1,323.4 wave 5 orange to end green wave 3 will reach equality with wave 1 orange. Therefore, 1,323.4 is a short term target for the next upward wave for 5 orange to end. If wave 4 orange moves any lower this target will be less likely. Any further downward movement at this stage for wave 4 orange may not move into wave 1 orange price territory. Therefore, the short term invalidation point is at 1,290.9.

About that point we should see another fourth wave correction, this time at green degree. This downward correction may not move into wave 1 green price territory; at that stage the invalidation point must move down to 1,277.6.

The final fifth wave at green degree may take price into the target zone on the daily chart.