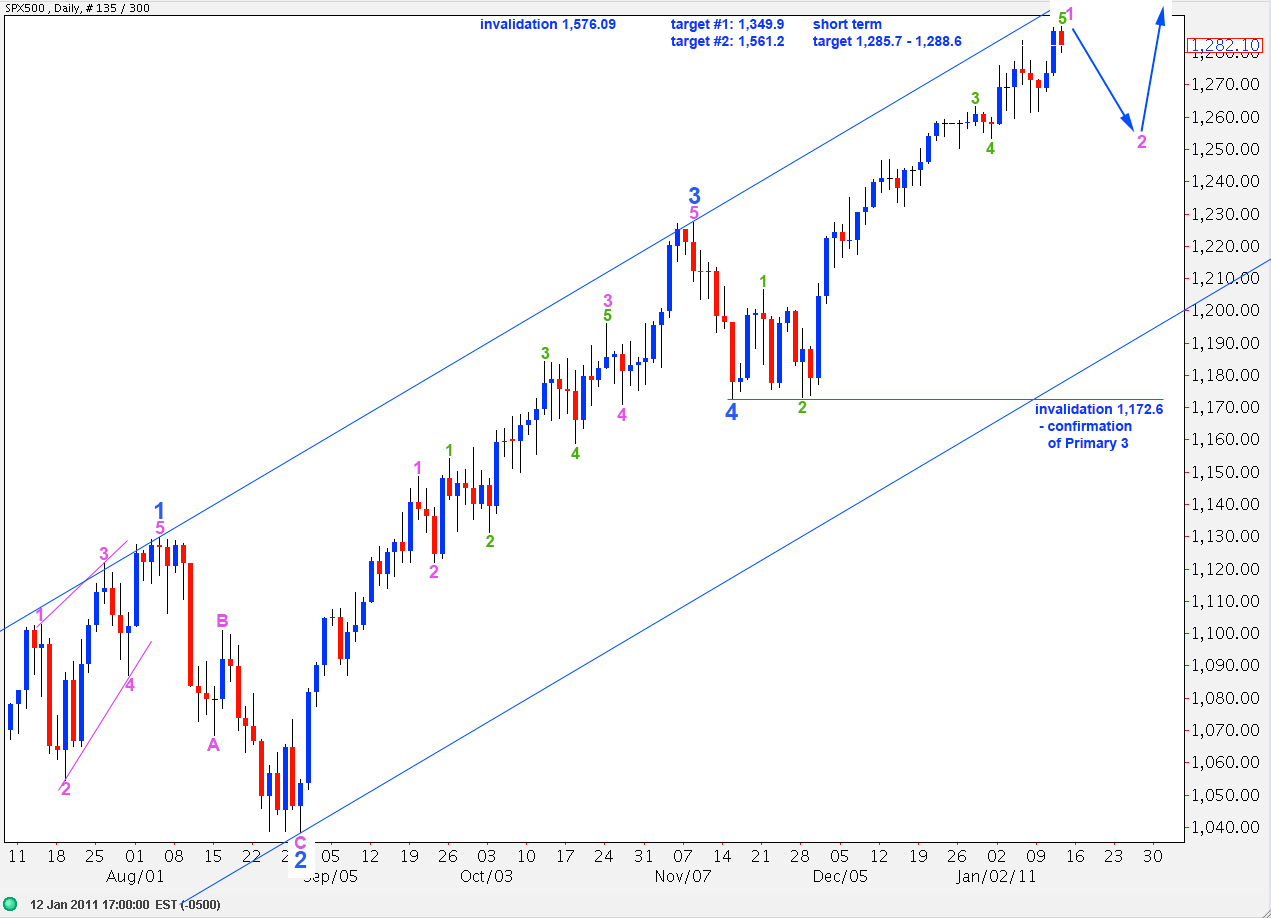

Elliott Wave chart analysis for the SPX500 for 13th January, 2011. Please click on the charts below to enlarge.

As expected yesterday we saw one more small push upward. Although it made a new high it was smaller than anticipated.

I can see two immediate possibilities on the hourly chart and I present both below. I favour neither at this stage; they are both equally valid.

When we see the trend change we are expecting it will be confirmed when price moves below 1,253.4. At that stage downward movement may not be a second wave correction within wave 5 green and, therefore, 5 green must be over.

This degree of labeling expects the trend change will be at minute degree. A second wave at minute degree may last only a few days, up to about a week or so. It should not take price outside the lower edge of the wide blue parallel channel drawn here on the daily chart.

Wave 2 pink may not move below the start of wave 1 pink. Therefore, this degree of labeling for wave 5 blue is invalidated below 1,172.6.

If we move the degree of labeling for wave 5 blue up one degree then we may be on the verge of a trend change at primary degree.

If the trend change that we are expecting is at primary degree then downward movement may be very strong, even volatile.

If this wave count is correct and upward movement is over then ratios are:

At intermediate degree there is no relationship between waves A and C.

At minor degree (blue) ratios within wave C black are: blue wave 3 is 8.2 points short of 1.618 the length of wave 1 blue and blue wave 5 is just 1.3 points short of 0.618 the length of blue wave 3. Blue wave 5 is also just 6.4 points short of equality with blue wave 1.

Ratios within blue wave 5 are: pink wave 3 is 2.7 points short of 2.618 the length of pink wave 3 and pink wave 5 is just 0.7 points short of equality with pink wave 1.

If upward movement is over here then the ratios are very good indeed. This indicates a possible turning point here but it is not confirmation of a trend change. We could see still further upward movement and there could still be other (different) but equally as good ratios and relationships achieved. Especially at intermediate degree.

Primary wave 3 may take over a year to complete and it must take price below 666.80.

If price moves below 1,172.6 we may consider primary wave 3 is underway.

We will have final confirmation with elimination of a slim outlying alternate possibility when price moves below 1,129.9.

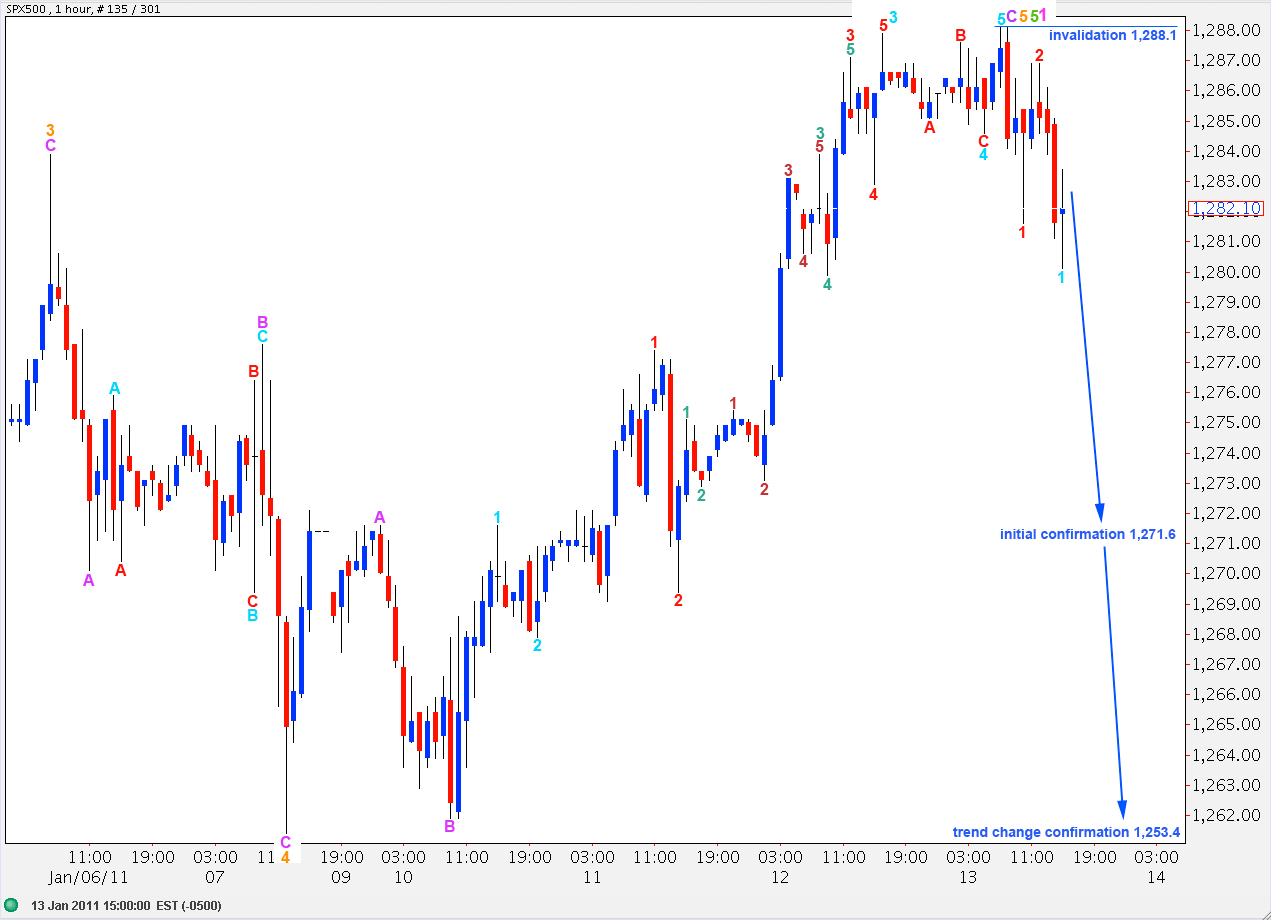

Main Hourly Wave Count.

We expected one final upward push to end this structure and we did get that. Wave 5 aqua is just 0.2 short of 0.382 the length of wave 1 aqua.

We can now see a satisfactory and complete ending diagonal structure for wave 5 green.

We will have an initial indication that we have seen a trend change when price moves below 1,271.6 because at that stage downward movement may not be a second wave correction within wave C purple.

We will only have confirmation of a trend change, at least at minute degree, however, when we see price move below 1,253.4.

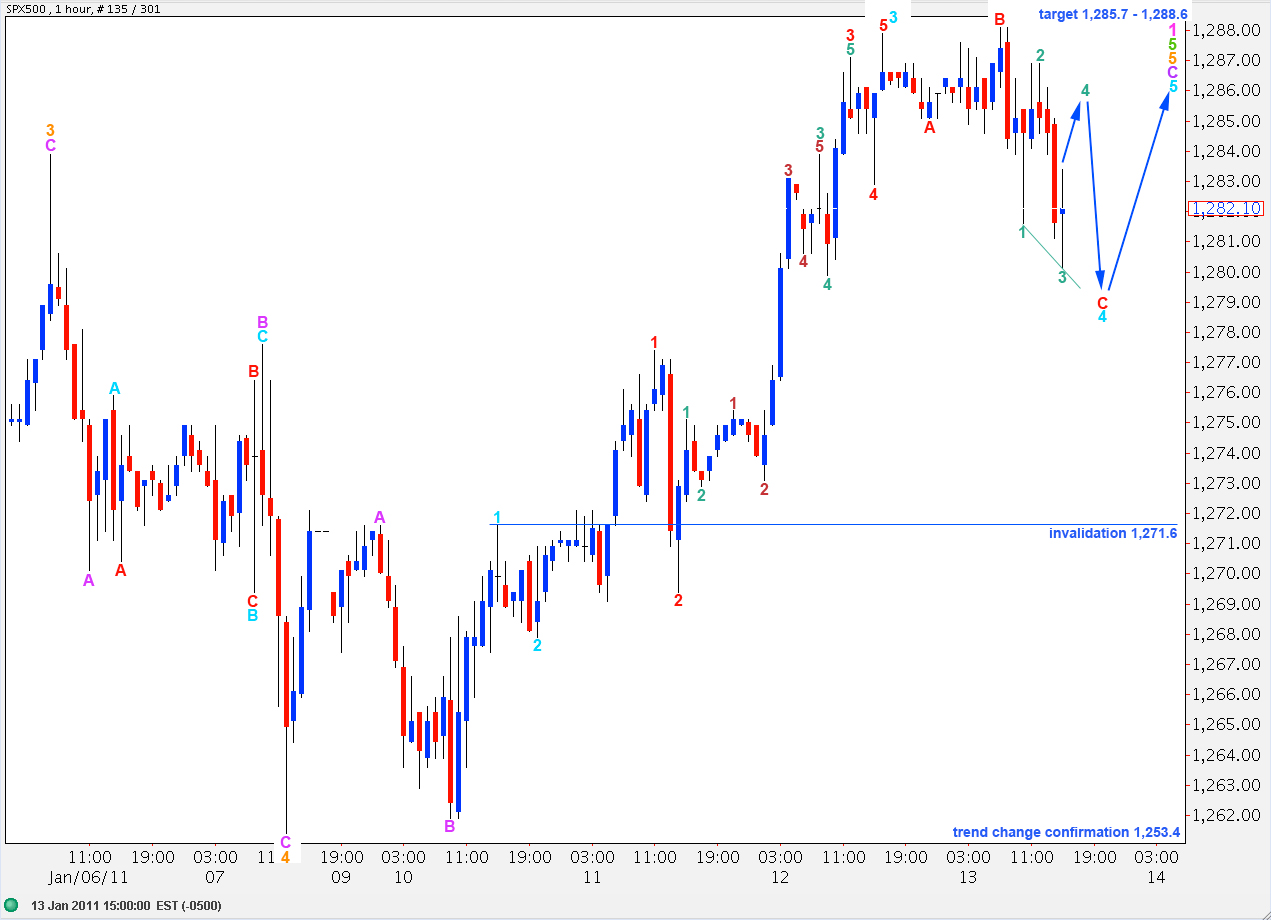

Alternate Hourly Wave Count.

The small upward push we were expecting could also be a B wave of an expanded flat correction for the fourth wave we were expecting to complete yesterday.

Within wave 4 aqua wave B red was a 107% correction of wave A red, meeting the requirements for an expanded flat. This expects a C wave which ends substantially beyond the end of wave A.

Wave C red has already passed 2.618 the length of wave A red at 1,280.8. However, it does not have a complete five wave structure. Wave C could end lower with no fibonacci ratio to wave A red. But this would then not have a typical expanded flat look.

Wave 4 aqua may not move into wave 1 aqua price territory. Therefore, this interpretation of most recent movement is invalidated with movement below 1,271.6.

If this wave count is correct then the last fifth wave upwards we have been expecting has not yet occurred. Upward movement should move back into the target zone and likely just above the end of it.