Upwards movement was again expected from the main Elliott wave count.

Summary: The AD line today makes a new all time high. This is extremely bullish. Today’s candlestick has a long lower wick and closes very close to highs. Expect upwards movement as most likely tomorrow.

A new high above 2,757.12 would provide confidence that a low is in place. The target would then be about 2,849; a consolidation lasting about two weeks may be expected at about this target.

A new low below 2,691.99 would indicate the pullback is continuing and should then end at least slightly below 2,676.81. The target is about 2,664.

The invalidation point must remain at 2,594.62.

The mid to longer term target is at 2,922 (Elliott wave) or 3,045 (classic analysis). Another multi week to multi month correction is expected at one of these targets.

The final target for this bull market to end remains at 3,616.

Pullbacks are an opportunity to join the trend.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

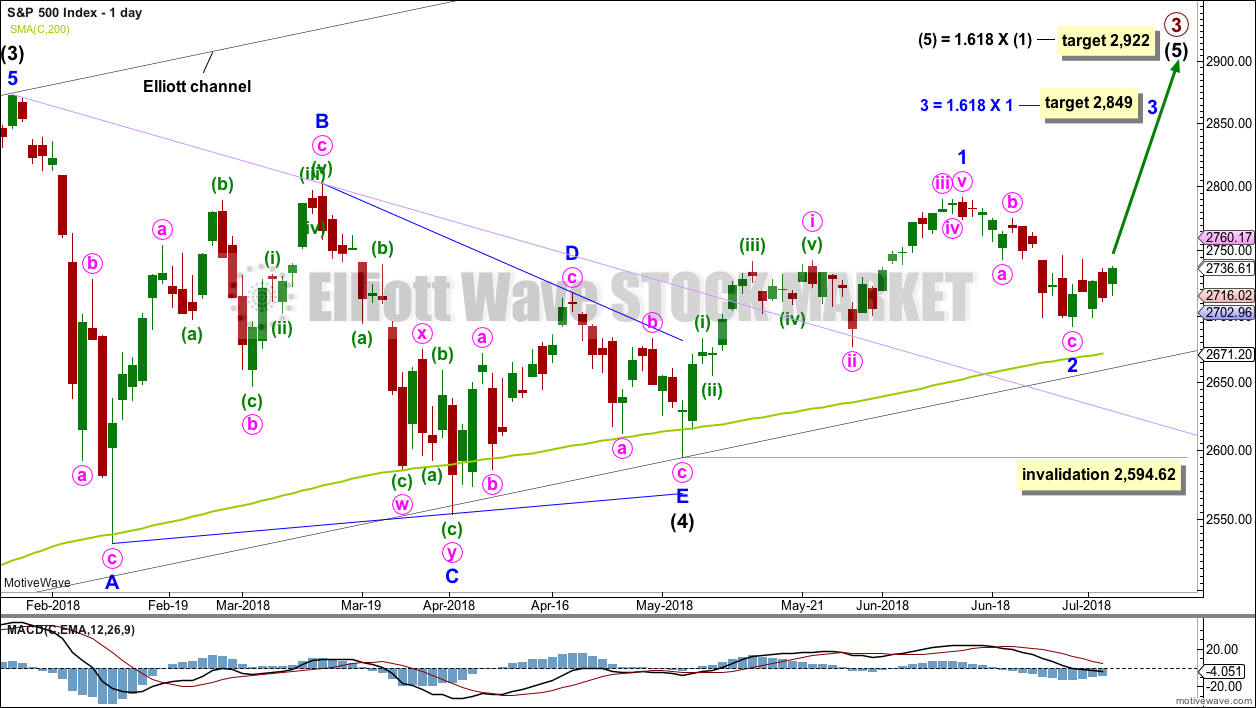

ELLIOTT WAVE COUNT

WEEKLY CHART

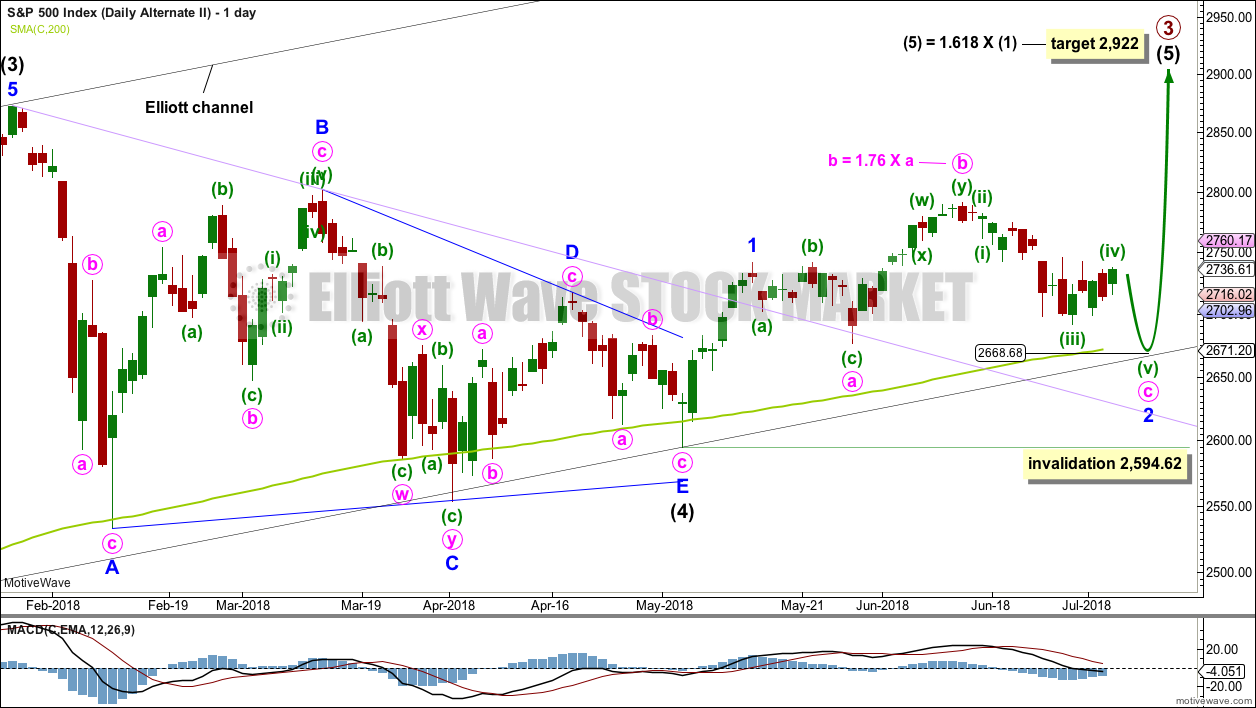

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

Intermediate wave (4) may now be a complete regular contracting triangle lasting fourteen weeks, one longer than a Fibonacci thirteen. There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

Within intermediate wave (5), no second wave correction may move beyond the start of its first wave below 2,594.62.

At this stage, the expectation is for the final target to me met in October 2019.

A multi week to multi month consolidation for primary wave 4 is expected on the way up to the final target.

DAILY CHART

It is possible that intermediate wave (4) is a complete regular contracting triangle, the most common type of triangle. Minor wave E may have found support just below the 200 day moving average and ending reasonably short of the A-C trend line. This is the most common look for E waves of triangles.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). The most common Fibonacci ratio would be equality in length with intermediate wave (1), but in this instance that would expect a truncation. The next common Fibonacci ratio is used to calculate a target for intermediate wave (5) to end.

Price has clearly broken out above the upper triangle B-D trend line. This indicates that it should now be over if the triangle is correctly labelled.

A trend line in lilac is added to this chart. It is the same line as the upper edge of the symmetrical triangle on the daily technical analysis chart. Price found support about this line.

Minor wave 1 may have been over at the last high. Minor wave 1 will subdivide as a five wave impulse on the hourly chart; the disproportion between minute waves ii and iv gives it a three wave look at the daily chart time frame. The S&P does not always exhibit good proportions; this is an acceptable wave count for this market.

It looks like minor wave 2 for this first daily wave count should be over here. The structure at lower time frames looks complete. If it does continue lower, then it may complete as a double zigzag. This idea is considered in a second hourly chart below.

A target is calculated for minor wave 3 to end.

Minor wave 2 may not move beyond the start of minor wave 1 below 2,594.62.

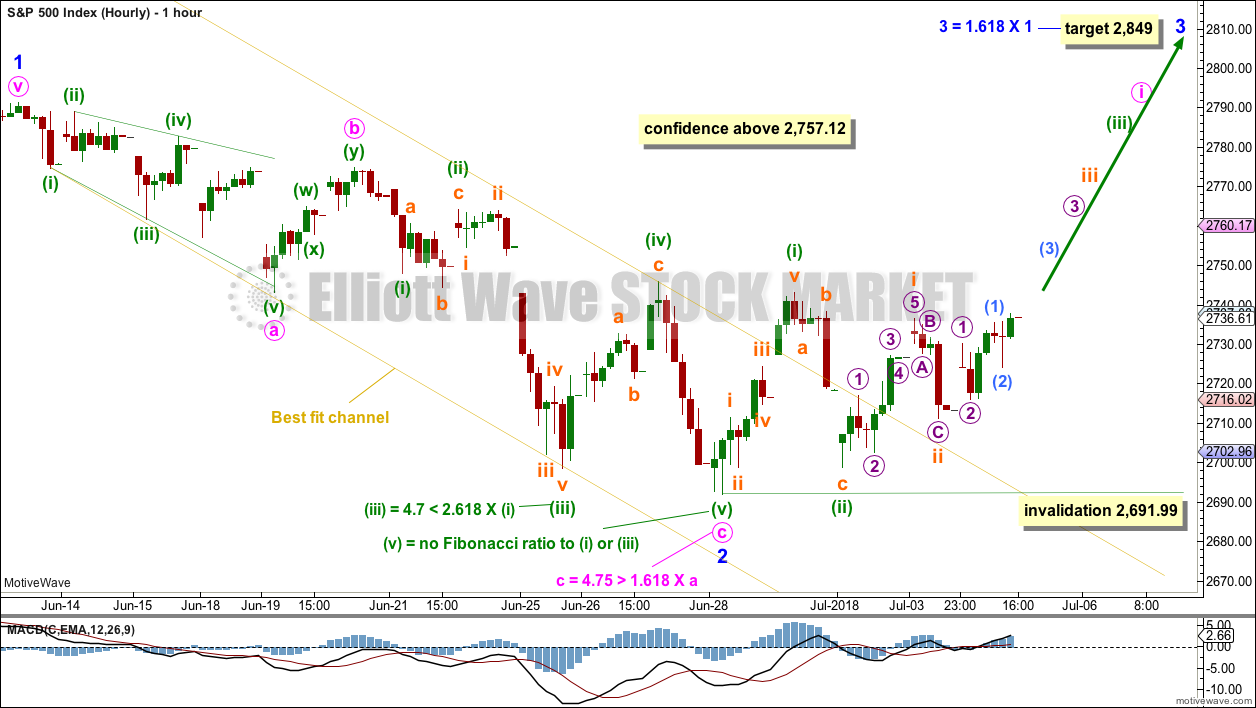

HOURLY CHART

Minor wave 2 may now be a complete zigzag; all subdivisions fit for a 5-3-5 downwards. A best fit channel is drawn about this downwards movement. The channel is breached, giving a first indication that a low may be in place. A new high now above 2,757.12 would add confidence that a low is in place.

Upwards movement labelled minuette wave (i) looks best as a five, and downwards movement labelled minuette wave (ii) looks best as a three.

While minuette wave (ii) is labelled here as complete, it is also possible to move the degree of labelling within it down one and see it continue sideways as a flat or combination. The invalidation point must remain as it is for this reason.

If minuette wave (ii) is over, then there may now be a series of four overlapping first and second waves complete. If this labelling is correct, then a strong increase in upwards momentum may occur this week as the middle of a third wave unfolds higher.

The hourly wave counts differ in where the leading diagonal at the start of the downwards movement is seen to end. This labelling has the better fit; the leading diagonal for minute wave a fits all Elliott wave rules.

Minuette wave (ii) may not move beyond the start of minuette wave (i) below 2,691.99.

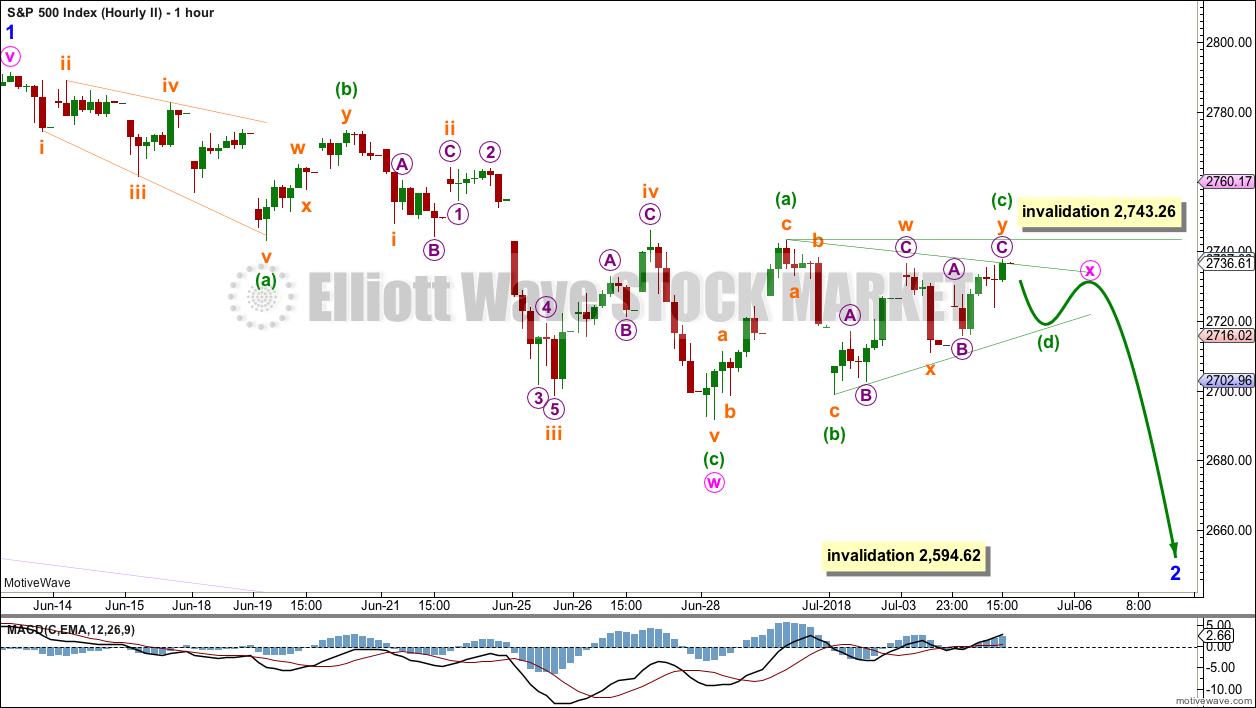

SECOND HOURLY CHART

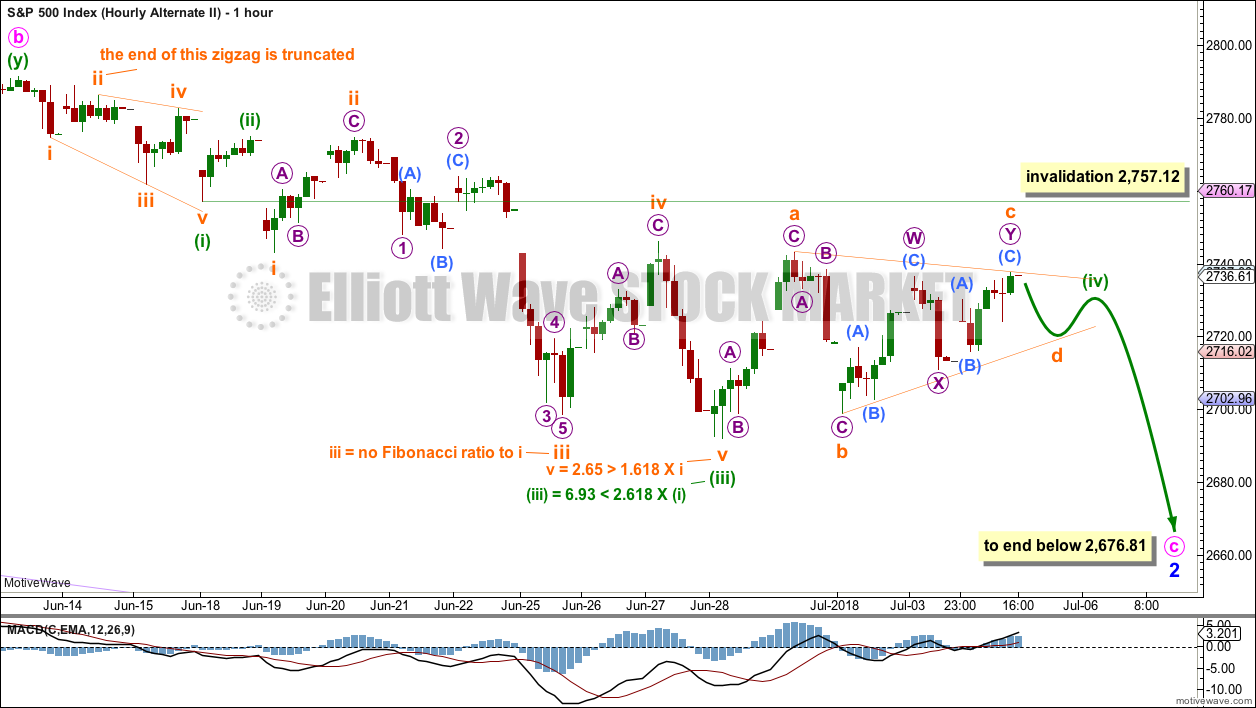

If the degree of labelling within the zigzag is moved down one degree, it is possible to see that minor wave 2 could continue lower as a double zigzag.

The first zigzag in the double is complete, labelled minute wave w. The double is joined by a corrective structure in the opposite direction, labelled minute wave x.

Minute wave x may be an incomplete regular contracting triangle. The triangle is adjusted slightly today to see minuette wave (c) as a double zigzag that’s complete at today’s high. Minuette wave (c) of the triangle may not move beyond the end of minuette wave (a) above 2,743.26. If a triangle is unfolding, then this invalidation point cannot be moved any higher.

When the triangle may be complete, then another zigzag to last a few days may move price lower. Minor wave 2 may not move beyond the start of minor wave 1 below 2,594.62.

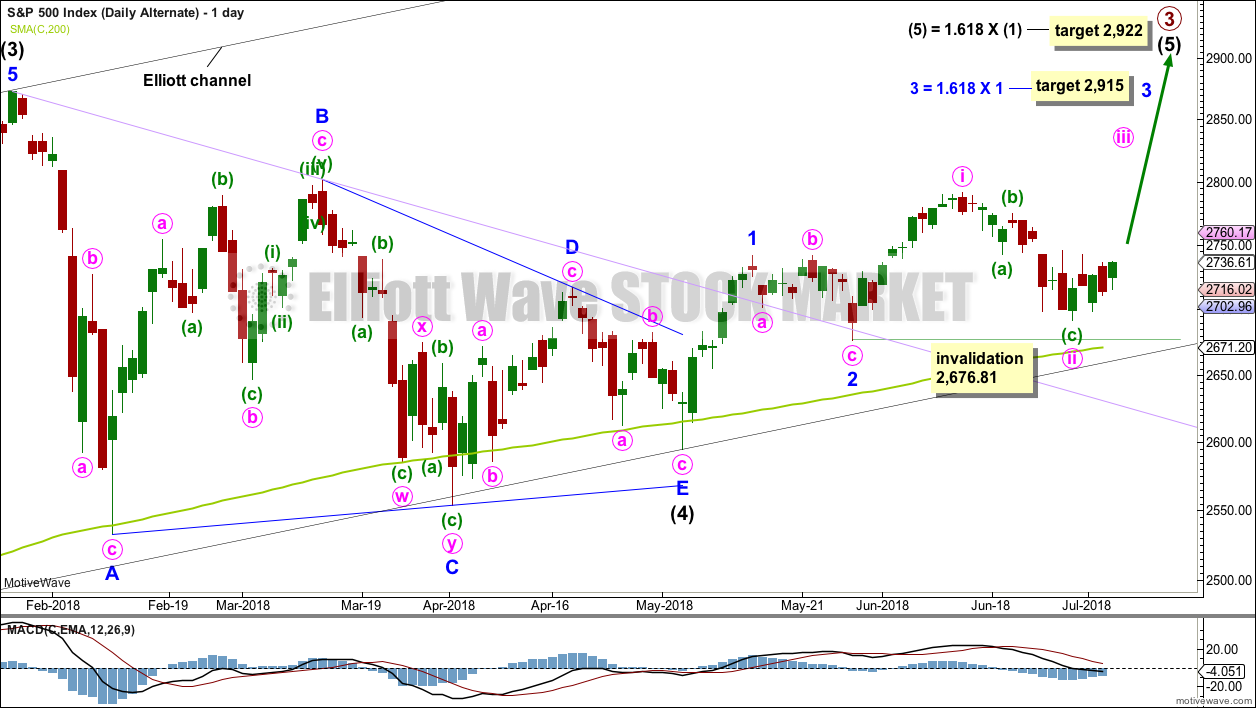

ALTERNATE DAILY CHART

It is possible that minor waves 1 and 2 are already over. The last high may have been minute wave i. Minute wave ii may need one more low to be complete.

Minute wave ii may not move beyond the start of minute wave i below 2,676.81.

This alternate wave count resolves the problem of an odd looking minor wave 1 for the main wave count. The only problem with this alternate wave count is minute wave ii is not contained within a base channel which would be drawn about minor waves 1 and 2.

This wave count is very bullish. It expects to see a very strong upwards movement as the middle of a third wave begins here.

SECOND ALTERNATE DAILY CHART

It is also possible that minor wave 1 ended earlier and downwards movement is the end of an expanded flat correction for minor wave 2.

The 0.618 Fibonacci ratio of minor wave 1 here would be about 2,651. This would be very slightly below the lower edge of the black Elliott channel and slightly below the 200 day moving average.

This second alternate wave count expects a somewhat deeper pullback about here to make a new low below the end of minute wave a at 2,676.81, so that minute wave c avoids a truncation and minor wave 2 avoids a running flat correction. If the pullback ends about the lower edge of the black Elliott channel, then that would be now about 2,664.

Minor wave 2 may not move beyond the start of minor wave 1 below 2,594.62.

SECOND ALTERNATE HOURLY CHART

Minuette wave (i) may have ended earlier. This leading expanding diagonal still meets all Elliott wave rules, but the end of subminuette wave ii is truncated. This reduces the probability of this wave count.

The channel on last analysis for this wave count is removed, because it was not showing where price was finding resistance.

Minute wave c would be very likely to make at least a slight new low below 2,676.81 to avoid a truncation and a very rare running flat.

Minuette wave (iv) may not move into minuette wave (i) price territory above 2,757.12.Minuette wave (iv) may be unfolding sideways as a regular contracting triangle.

TECHNICAL ANALYSIS

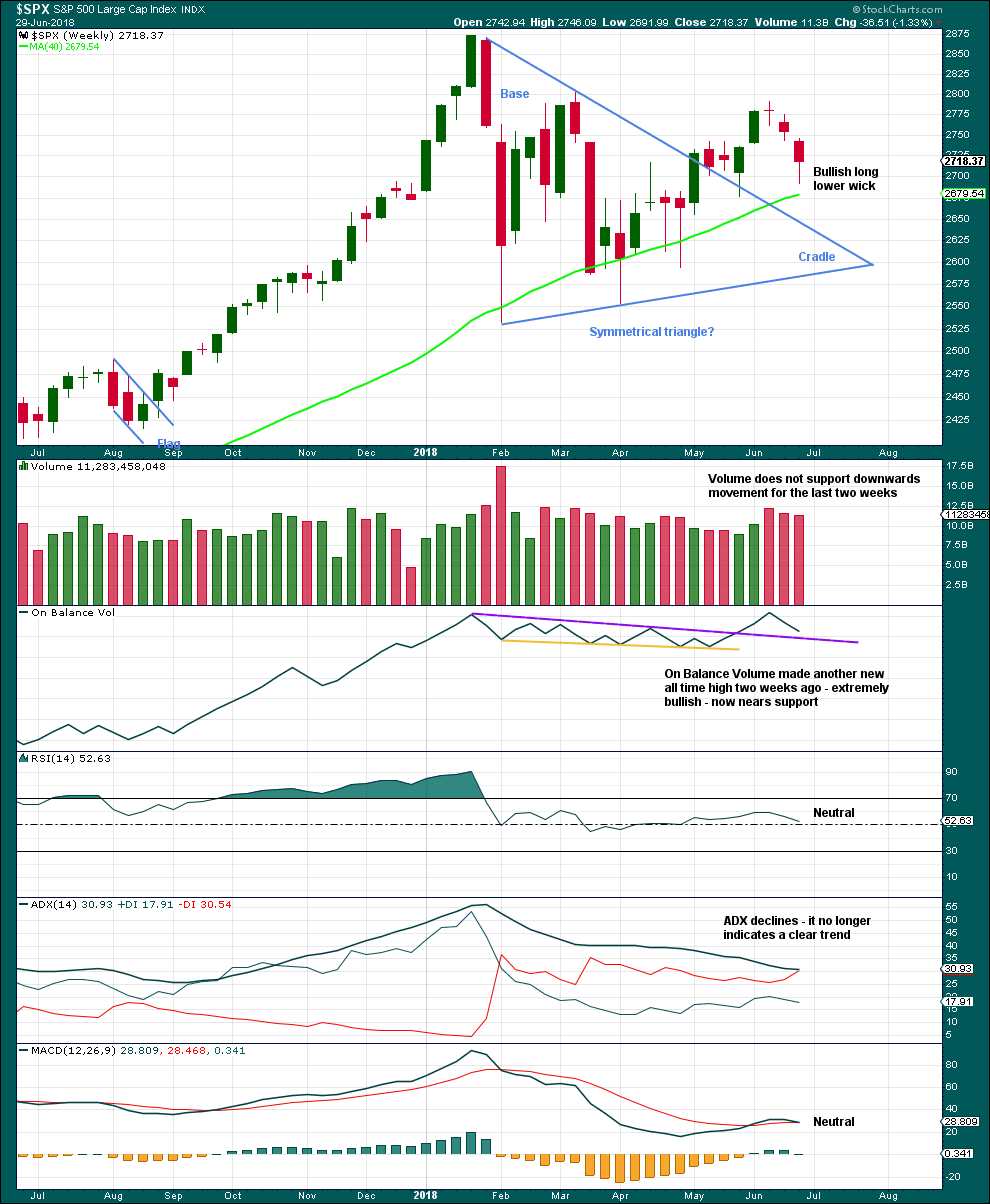

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Downwards movement of the last two weeks still looks most likely as a pullback within a developing upwards trend. Long lower candlestick wicks, a lack of support from volume, and nearby support from On Balance Volume all look bullish.

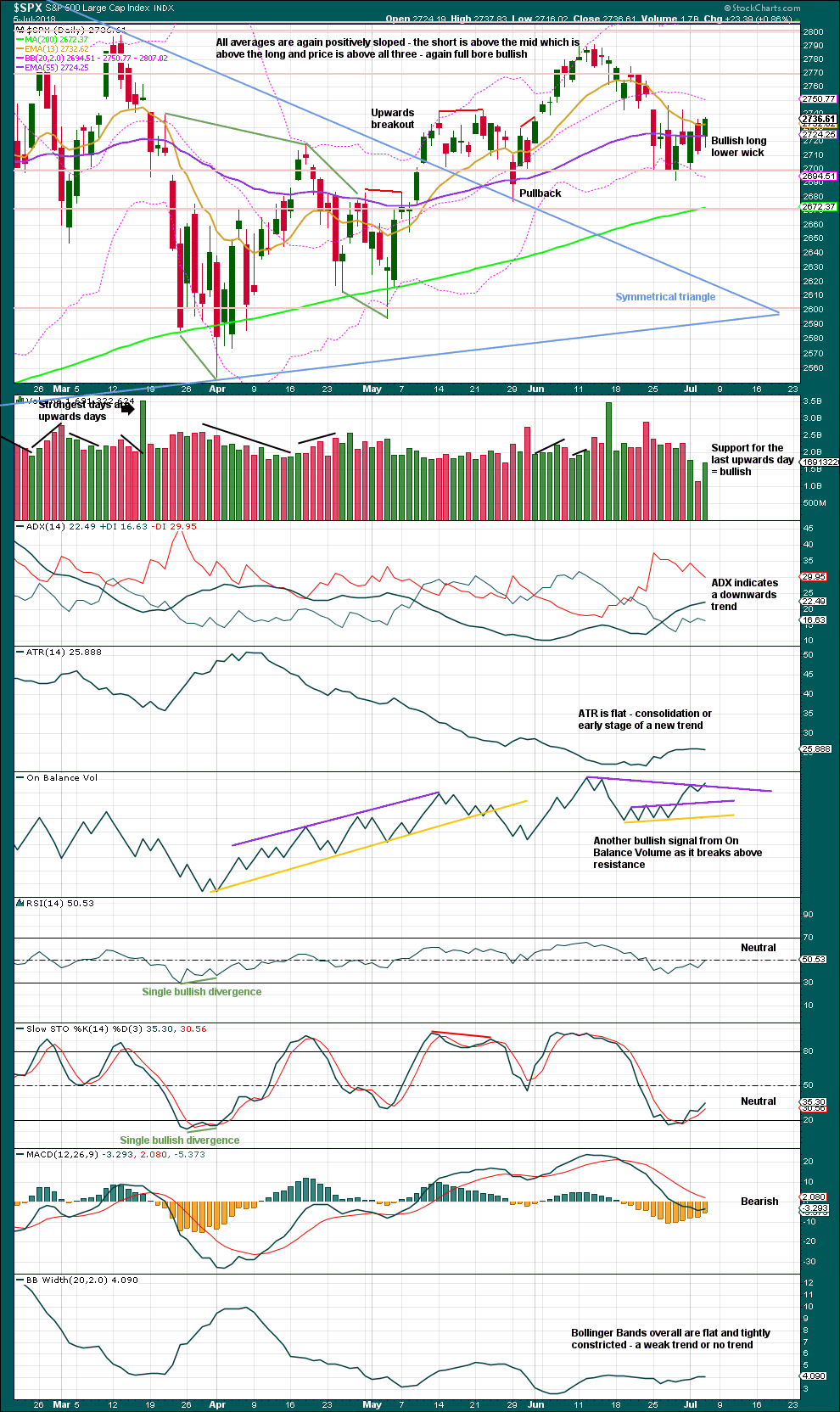

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle may now be complete. The base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is above the Elliott wave target at 2,922, so the Elliott wave target may be inadequate.

Since the low on the 2nd of April, 2018, price has made a series of higher highs and higher lows. This is the definition of an upwards trend. But trends do not move in perfectly straight lines; there are pullbacks and bounces along the way. While price has not made a lower low below the prior swing low of the 29th of May, the view of a possible upwards trend in place should remain. Note though that the second alternate Elliott wave count allows for a new swing low yet expects a third wave upwards to begin from there. This is entirely possible.

A new resistance line is drawn on On Balance Volume today. It has three tests, is not very long held, and has a shallow slope; it has weak technical significance. The bullish signal is weak.

Today’s candlestick is reasonably bullish.

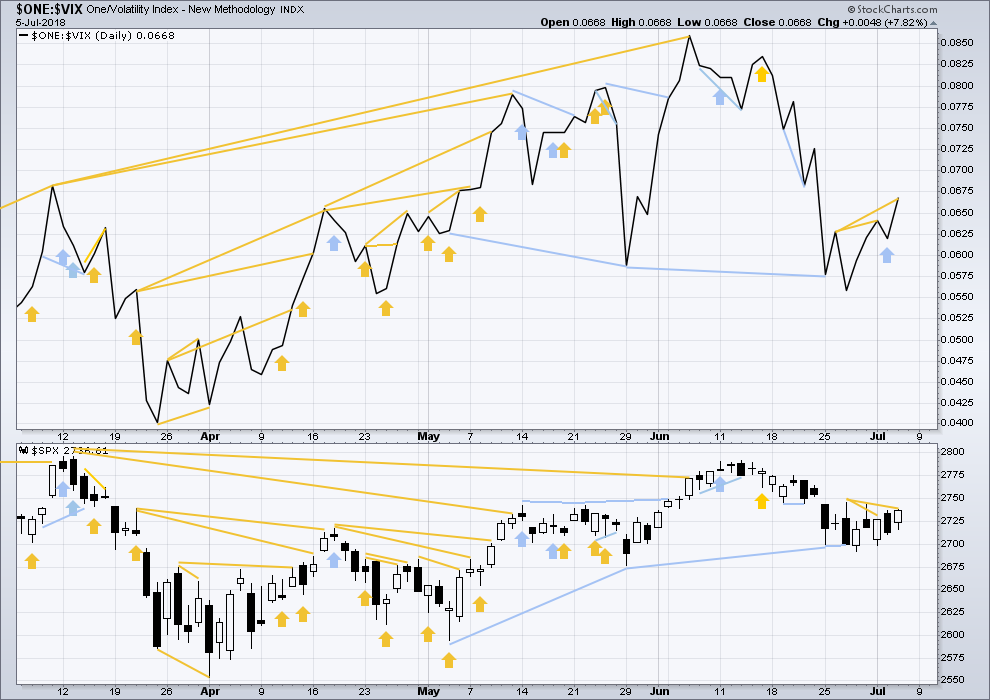

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is mid term bearish divergence between price and inverted VIX: inverted VIX has made a new swing low below the prior swing low of the 29th of May, but price has not. Downwards movement has strong support from increasing market volatility; this divergence is bearish. However, it must be noted that the last swing low of the 29th of May also came with bearish divergence between price and inverted VIX, yet price went on to make new highs.

This divergence may not be reliable. As it contradicts messages given by On Balance Volume and the AD line, it shall not be given much weight in this analysis.

There is new short term bullish divergence between price and inverted VIX. Inverted VIX has made two new small highs above the last small swing high, but price has not yet done so.

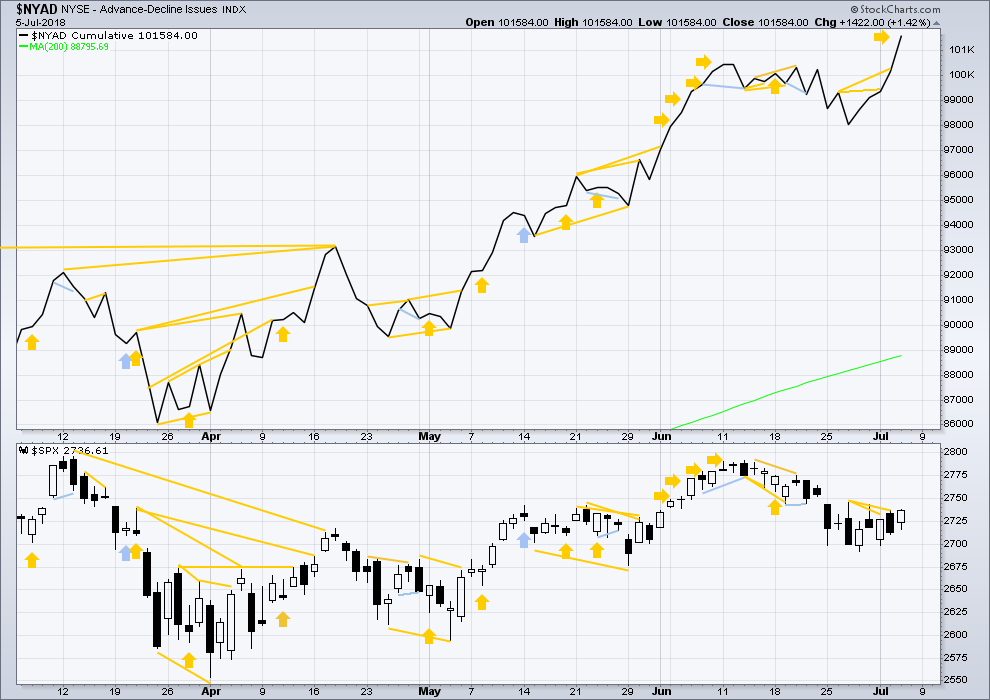

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line means that any bear market may now be an absolute minimum of 4 months away. It may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Small caps and mid caps have both recently made new all time highs. It is large caps that usually lag in the latter stages of a bull market, so this perfectly fits the Elliott wave count. Expect large caps to follow to new all time highs.

Breadth should be read as a leading indicator.

The AD line today makes another new all time high. This is extremely bullish and strongly supports the main Elliott wave count at the daily and weekly chart levels. The short term bullish divergence also offers support to the first main hourly Elliott wave count.

Price may reasonably be expected to follow through in coming weeks.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

Only Nasdaq at this stage is making new all time highs. DJIA and DJT need to make new all time highs for the ongoing bull market to be confirmed.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

Published @ 07:21 p.m. EST.

CELG daily showing it exiting about an 18 day squeeze with a strong upward push.

AND it’s now in the volume hold (blue profile, and the hole is highlighted with the gray box). Price doesn’t stay in these zones. Ergo…CELG is “most likely” headed to the next volume node up, which is about 89. From it’s current 82.35.

Just sayin’…not advice, YMMV!!!

Nasdaq 100 showing 100-2 advance-decline. SP500 showing 454-47.

Ka-boom!!!

A day that strongly indicates the market has it own’s rhythm, INDEPENDENT of the outside world. THE DAY trades war volleys are first shot, we finally get the rip upward we’ve been waiting weeks for. Or maybe it’s that adage that the market hates uncertainty (“will it actually start?”) and loves conclusions (“yes!”).

AMTD monthly is a river going up hill. This hourly chart shows the bulk of the recent “back eddy” against the current. It is looking just about set up to go back the other way, maybe not “all the way” to the news highs, but at least a 38-62% retrace, and given the general market mode seeming to move to “bullish”.

A near touch on the 38% fibo, broke the sharpest down trend line, and looking other indications, particularly polarity inversion to “up”. Though I might take it on the break of that current upper Darvas box.

The steadily ramping trend lines under the weekly SPX action clearly shows the building momentum since the April 2 low. Strongly supportive of the main bullish count.

I really appreciate your charts and commentary Kevin, been here for a few years

Thank you kindly Debbie! Just trying to make some money, you know. And if I can help a few others in the same goal, cool.

Killer short squeeze!!!!!!! And killer launch (or continuation) of the minor 3. New ATH’s, coming within a few weeks I would expect. I’ve heard comments elsewhere of “this is unhealthy for the market”. LMAO. Not many people have the advantage of Lara’s wave map!!! We here know exactly what’s happening (even if one or two of us were starting to lose faith, okay I admit it but darn the market pushed that minor ii to the limit!!!).

My small butterfly anticipating that price would stay in the old range through the end of today is toast (as I put it on I thought “yea, this’ll make the market move!”). Oh well, my far far larger set of long positions are doing happy dances! Let ‘er rip!!!

today’s SPX top likely to be in the range of 2764-2770.5, for the reasons show on the chart.

2757.12 passed….

As it stands at the moment, a VERY bullish week when viewed at the weekly level. And again note that THIS WEEK COMES OFF A 3 WEEK SQUEEZE in SPX. With sharp upside price movement. Usually…that is followed by MORE sharp movement in the same direction, for several weeks. Not always. But often. Weekly trend is still “down” and even daily TF is still “down”, but obviously lower tf’s are strongly up.

Where is everyone?

Anyone here ever do a deep dive into what happened in after hours trading last year on July 3rd?

What do you think of the “glitch” explanation? Interesting times ahead! 🙂

Watching for acceleration through 2747…or, a turn back down and selling.

Price action choppy, overlapping, spastic. Perhaps something other than a third up at multiple degrees…a close above 2750 and I will be adding to hedges…

My 5 minute chart shows a strong upward movement in a relatively narrow channel. A strong up trend day. So far. I suspect DJX is choppier.

2754 is a 62% retrace and the next test. Then 2770.5 (78%).

Price in in a volume air pocket now. It won’t stay here!

The next high trade volume area, where price is likely to settle for the day, is 2757-64.