Upwards movement was again expected, and that is what happened today. The target remains the same.

A signal today from On Balance Volume offers a clue as to a likely direction tomorrow for price.

Summary: If resistance about 2,670 – 2,675 can be overcome, then the upwards swing should continue. The first target is at 2,705. If price keeps rising through the first target, then the next target is a zone from 2,752 to 2,766. Some support from volume and a bullish signal from On Balance Volume offer a little support to a bullish outlook, at least for the short term.

If price makes a new low tomorrow below 2,610.79, then expect a pullback may end below 2,586.27.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here. Video is here.

An alternate idea at the monthly chart level is given here at the end of this analysis.

An historic example of a cycle degree fifth wave is given at the end of the analysis here.

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique as if intermediate wave (4) was over at the first swing low within it. If intermediate wave (4) continues sideways, then the channel may be redrawn when it is over. The upper edge may provide resistance for intermediate wave (5).

Intermediate wave (4) may not move into intermediate wave (1) price territory below 2,193.81. However, it would be extremely likely to remain within the wider teal channel (copied over from the monthly chart) if it were to be reasonably deep. This channel contains the entire bull market since the low in March 2009, with only two small overshoots at the end of cycle wave IV. If this channel is breached, then the idea of cycle wave V continuing higher would be discarded well before the invalidation point is breached.

At this stage, it now looks like intermediate wave (4) may be continuing further sideways as a combination, triangle or flat. These three ideas are separated into separate daily charts. All three ideas would see intermediate wave (4) exhibit alternation in structure with the double zigzag of intermediate wave (2).

A double zigzag would also be possible for intermediate wave (4), but because intermediate wave (2) was a double zigzag this is the least likely structure for intermediate wave (4) to be. Alternation should be expected until price proves otherwise.

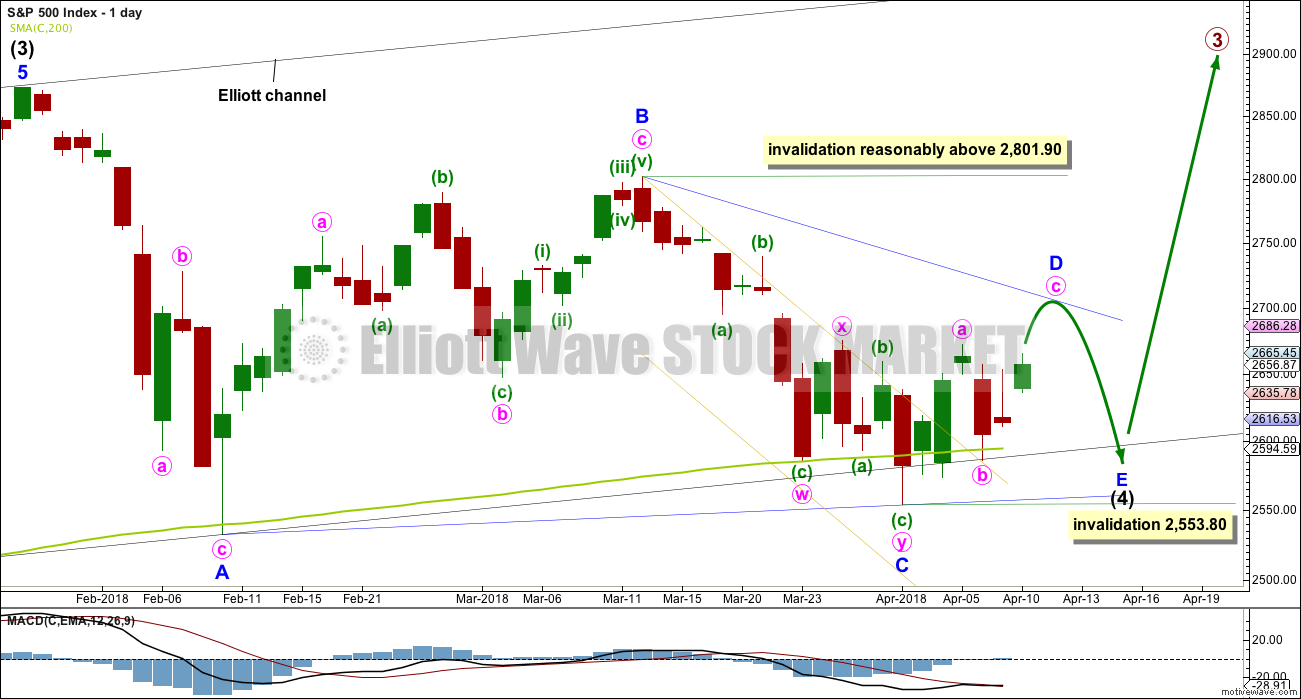

DAILY CHART – TRIANGLE

This first daily chart looks at a triangle structure for intermediate wave (4). The triangle may be either a regular contracting or regular barrier triangle. Within the triangle, minor waves A, B and C may be complete.

If intermediate wave (4) is a regular contracting triangle, the most common type, then minor wave D may not move beyond the end of minor wave B above 2,801.90.

If intermediate wave (4) is a regular barrier triangle, then minor wave D may end about the same level as minor wave B at 2,801.90. As long as the B-D trend line remains essentially flat a triangle will remain valid. In practice, this means the minor wave D can end slightly above 2,801.90 as this rule is subjective.

When a zigzag upwards for minor wave D is complete, then this wave count would expect a final smaller zigzag downwards for minor wave E, which would most likely fall reasonably short of the A-C trend line.

If this all takes a further three weeks to complete, then intermediate wave (4) may total a Fibonacci 13 weeks and would be just two weeks longer in duration than intermediate wave (2). There would be very good proportion between intermediate waves (2) and (4), which would give the wave count the right look.

There are now a few overshoots of the 200 day moving average. This is entirely acceptable for this wave count; the overshoots do not mean price must now continue lower. The A-C trend line for this wave count should have a slope, so minor wave C should now be over.

Within the zigzag of minor wave D, minute wave b may not move beyond the start of minute wave a below 2,553.80.

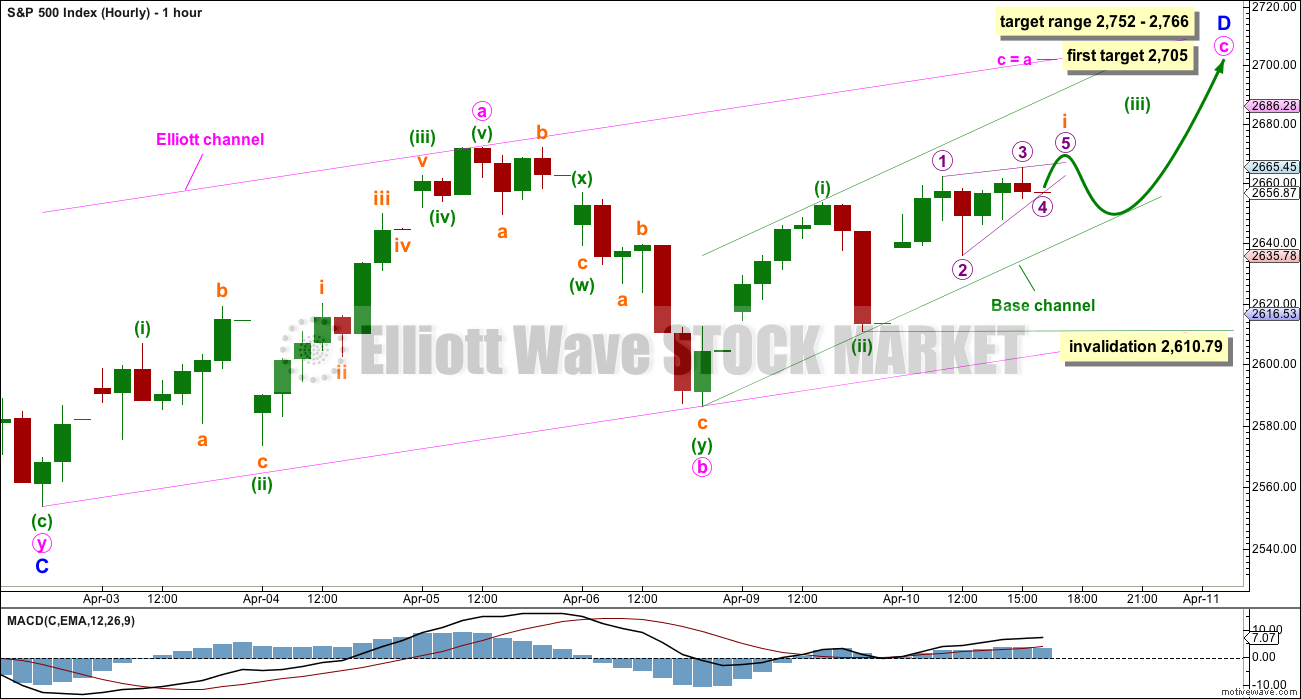

HOURLY CHART

Minor wave D upwards should subdivide as a zigzag. Within the zigzag, minute wave b now shows up on the daily chart as a large red daily candlestick. This would give minor wave D an obvious three wave look on the daily chart, which should be expected.

Minute wave b subdivides as a completed double zigzag. The most common Fibonacci ratio is used to calculate a target for minute wave c. This would see minor wave D shorter than the common length of 0.80 to 0.85 the length of minor wave C.

Minute wave c must subdivide as a five wave structure. So far minuette waves (i) and (ii) may be complete. Minuette wave (iii) may have begun; it may only subdivide as an impulse, and within it subminuette wave i may be an almost compete leading contracting diagonal.

Second wave corrections following leading diagonals in first wave positions are normally very deep. However, in this instance, subminuette wave ii may find support about the lower edge of a base channel drawn about minuette waves (i) and (ii), one degree higher. Support there may prevent subminuette wave ii from being very deep.

Subminuette wave ii may not move beyond the start of subminuette wave i below 2,610.79.

Minute wave c may end about the upper edge of the pink upwards sloping Elliott channel, which is drawn about the zigzag of minor wave D.

If price makes a new low below 2,610.79 tomorrow, then use the alternate hourly chart below.

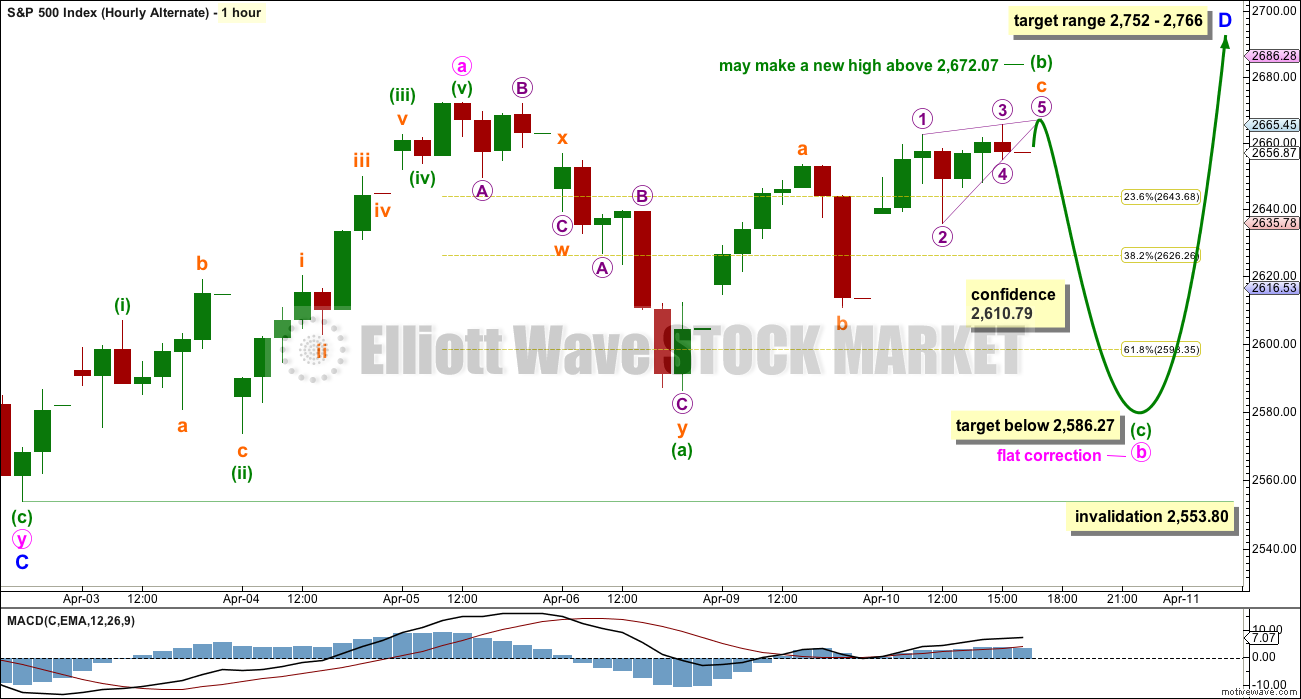

ALTERNATE HOURLY CHART

By simply moving the degree of labelling down within the last downwards wave, it is possible that minuette wave (b) may be incomplete.

If minute wave b has begun with a double zigzag downwards for minuette wave (a), then it may be either a flat or a triangle. A flat is more common, so that shall be how this chart is labelled. If price continues sideways in an ever decreasing range for another day or so, then a triangle will also be charted.

For now let us consider the possibility of minute wave b continuing sideways in a larger range for a flat correction. Within the flat correction, minuette wave (b) has passed the minimum requirement of 0.9 the length of minuette wave (a). The common range for minuette wave (b) would be from 1 to 1.38 times the length of minuette wave (a), giving a range from 2,672.07 to 2,704.67.

Minuette wave (b) may be a single zigzag, and within it subminuette wave c may be an almost complete ending contracting diagonal. If the diagonal ends with a small overshoot of the 1-3 trend line, and then price quickly reverses, look out for a possible strong and sharp fall. Minuette wave (c) would be highly likely to end below the end of minuette wave (a) at 2,586.27 to avoid a truncation.

Minute wave b may not move beyond the start of minute wave a below 2,553.80.

DAILY CHART – COMBINATION

Double combinations are very common structures. The first structure in a possible double combination for intermediate wave (4) would be a complete zigzag labelled minor wave W. The double should be joined by a three in the opposite direction labelled minor wave X, which may be a complete zigzag. X waves within combinations are typically very deep; if minor wave X is over at the last high, then it would be a 0.79 length of minor wave W, which is fairly deep giving it a normal look. There is no minimum nor maximum requirement for X waves within combinations.

The second structure in the double would most likely be a flat correction labelled minor wave Y. It may also be a triangle, but in my experience this is very rare, so it will not be expected. The much more common flat for minor wave Y will be charted and expected.

A flat correction would subdivide 3-3-5. Minute wave a must be a three wave structure, most likely a zigzag. It may also be a double zigzag. On the hourly chart, this is now how this downwards movement fits best, and this will now be how it is labelled.

Minute wave b must now reach a minimum 0.90 length of minute wave a. Minute wave b must be a corrective structure. It may be any corrective structure. It may be unfolding as an expanded flat correction. A target is calculated for it to end. Within minuette wave (c), the correction for subminuette wave ii may not move beyond the start of subminuette wave i below 2,553.80.

The purpose of combinations is to take up time and move price sideways. To achieve this purpose the second structure in the double usually ends close to the same level as the first. Minor wave Y would be expected to end about the same level as minor wave W at 2,532.69. This would require a strong overshoot or breach of the 200 day moving average, which looks unlikely.

DAILY CHART – COMBINATION II

This is another way to label the combination.

Minor wave W is still a zigzag labelled in the same way, over at the first low within intermediate wave (4).

The double is joined by a quick three in the opposite direction labelled minor wave X, subdividing as a zigzag.

Minor wave Y may have begun earlier and may now be a complete expanded flat correction. However, in order to see minor wave Y complete there is a truncated fifth wave as noted on the chart. This reduces the probability of this wave count.

If intermediate wave (4) is a complete double combination, then minor wave Y has ended somewhat close to the end of minor wave W; the whole structure would have an overall sideways look to it.

A target is calculated for intermediate wave (5). Within intermediate wave (5), minor wave 2 may not move beyond the start of minor wave 1 below 2,553.80.

At the hourly chart level, this wave count would expect a five up continuing. The labelling for the short term would be the same as the hourly chart published above for the first wave count.

DAILY CHART – FLAT

Flat corrections are very common. The most common type of flat is an expanded flat. This would see minor wave B move above the start of minor wave A at 2,872.87.

Within a flat correction, minor wave B must retrace a minimum 0.9 length of minor wave A at 2,838.85. The most common length for minor wave B within a flat correction would be 1 to 1.38 times the length of minor wave A at 2,872.87 to 3,002.15. An expanded flat would see minor wave B 1.05 times the length of minor wave A or longer, at 2,889.89 or above.

Minor wave B may be a regular flat correction, and within it minute wave a may have been a single zigzag and minute wave b may have been a double zigzag. This has a very good fit. The subdivisions at the hourly chart level at this stage would be the same for the last wave down as the main wave count.

This wave count would require a very substantial breach of the 200 day moving average for the end of intermediate wave (4). This is possible but may be less likely than a smaller breach.

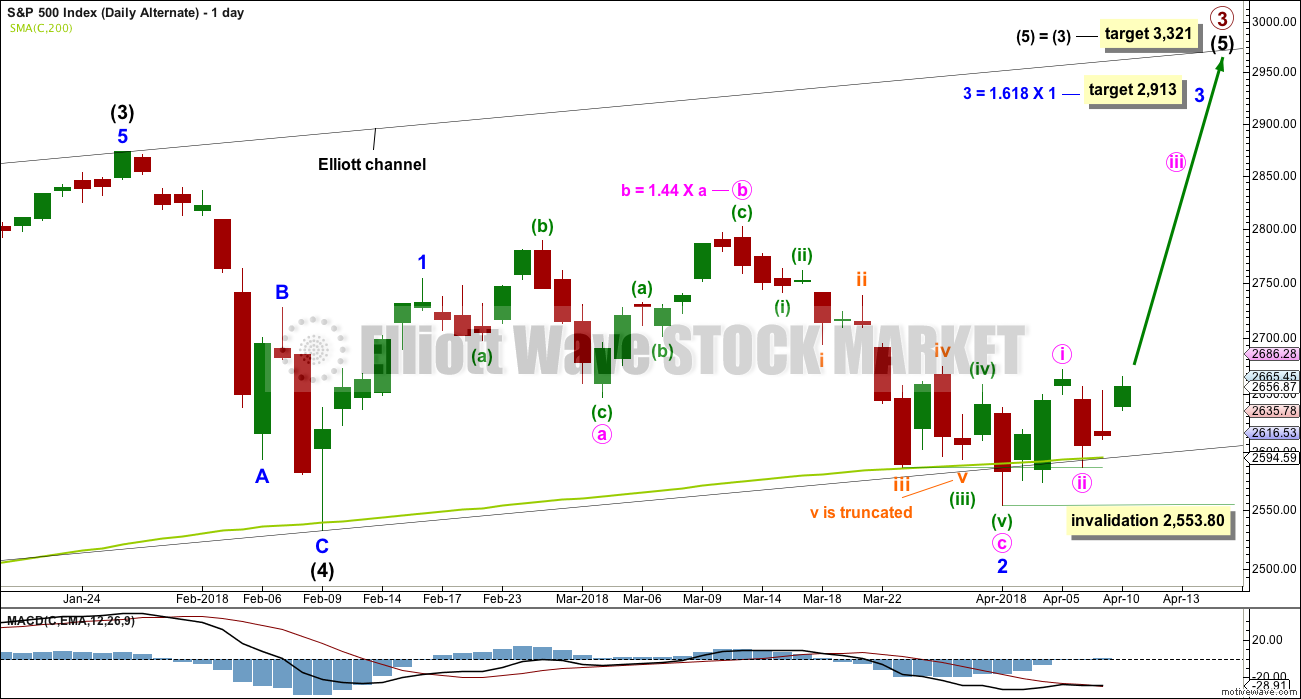

DAILY CHART – ALTERNATE

It is possible still that intermediate wave (4) was complete as a relatively brief and shallow single zigzag.

A new all time high with support from volume and any one of a bullish signal from On Balance Volume or the AD line would see this alternate wave count become the main wave count.

The target for minor wave 3 expects the most common Fibonacci ratio to minor wave 1.

Within minor wave 2, there is a truncation as noted on the chart. This must necessarily reduce the probability of this wave count.

Within minor wave 3, minute wave ii may not move beyond the start minute wave i below 2,553.80.

TECHNICAL ANALYSIS

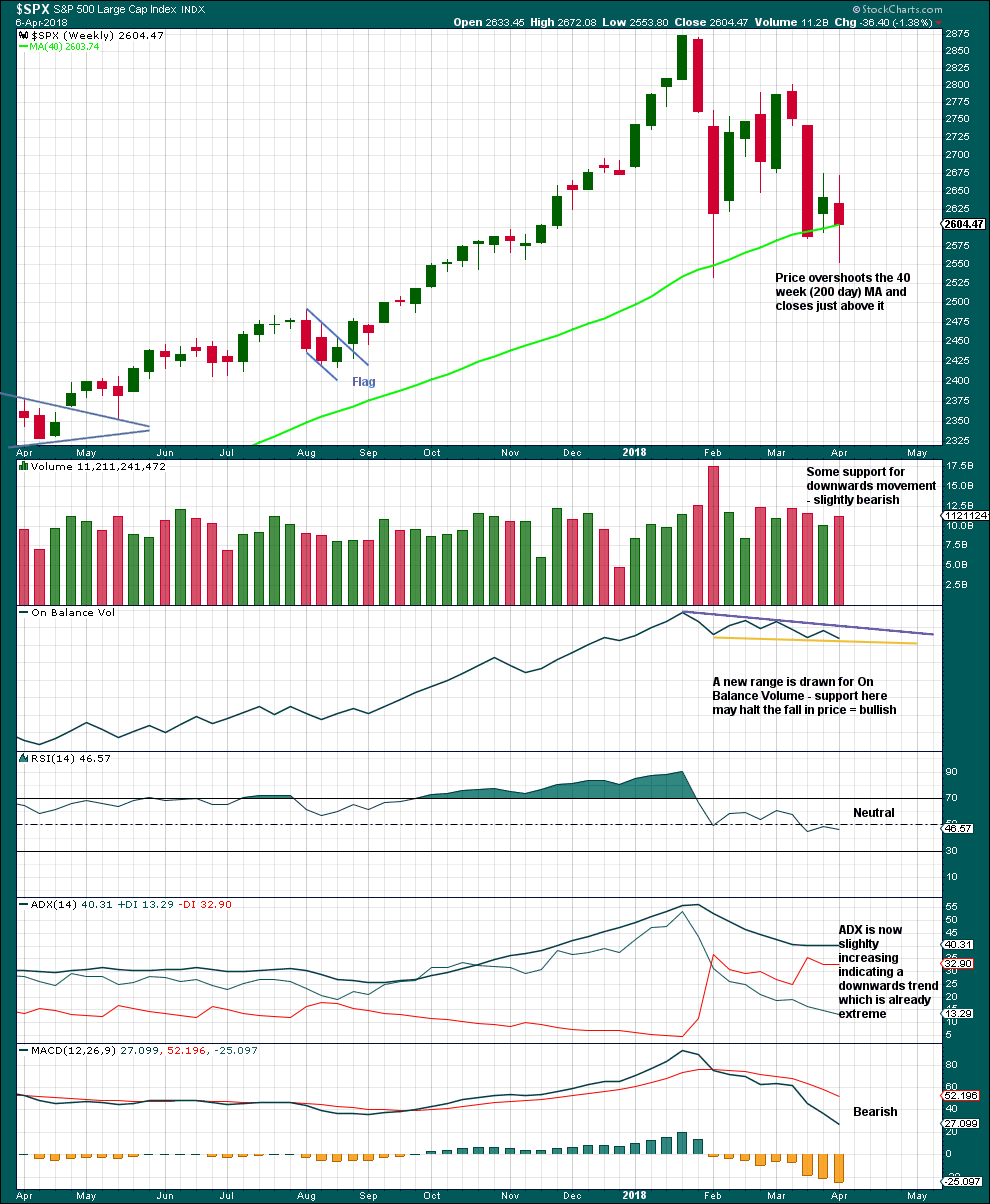

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The last completed weekly candlestick has longer upper and lower wicks; it is almost a spinning top. This represents a balance of bulls and bears with the bears slightly winning. A slight increase in volume for downwards movement is only slightly bearish; volume remains lighter than the last two prior downwards movement, so overall volume is declining.

Another downwards week would provide a bearish signal from On Balance Volume. An upwards week would provide a bullish signal. Expect support here until it gives way.

The trend on ADX is extreme because the ADX line is above both directional lines.

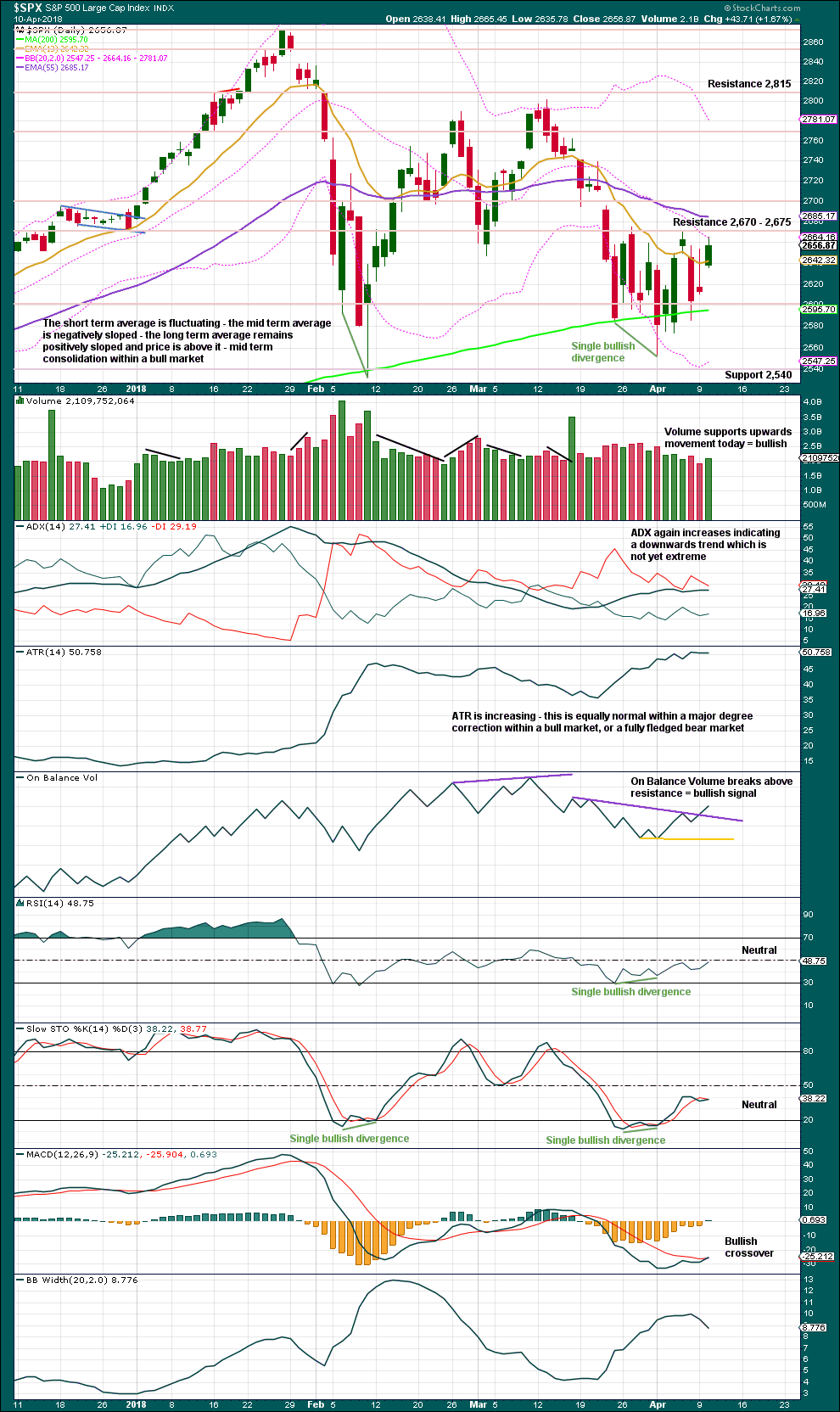

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Some weight today will be given to the bullish short term volume profile. It supports the main hourly wave count.

The signal from On Balance Volume today is weak, but not too weak. The trend line was tested three times, had a shallow slope, and was not too short held. It offers slightly weak technical significance.

While MACD giving a bullish signal also supports the main hourly wave count, this is not strong support. MACD can fluctuate during a consolidation giving many false signals.

A slight contraction in Bollinger Bands today is concerning for the main hourly wave count and may offer some support to the alternate.

Overall, this chart is mixed today. The balance of weight will be given to the bullish short term outlook, but there is strong resistance to overcome at 2,670 to 2,675 though before any reasonable confidence may be had in it.

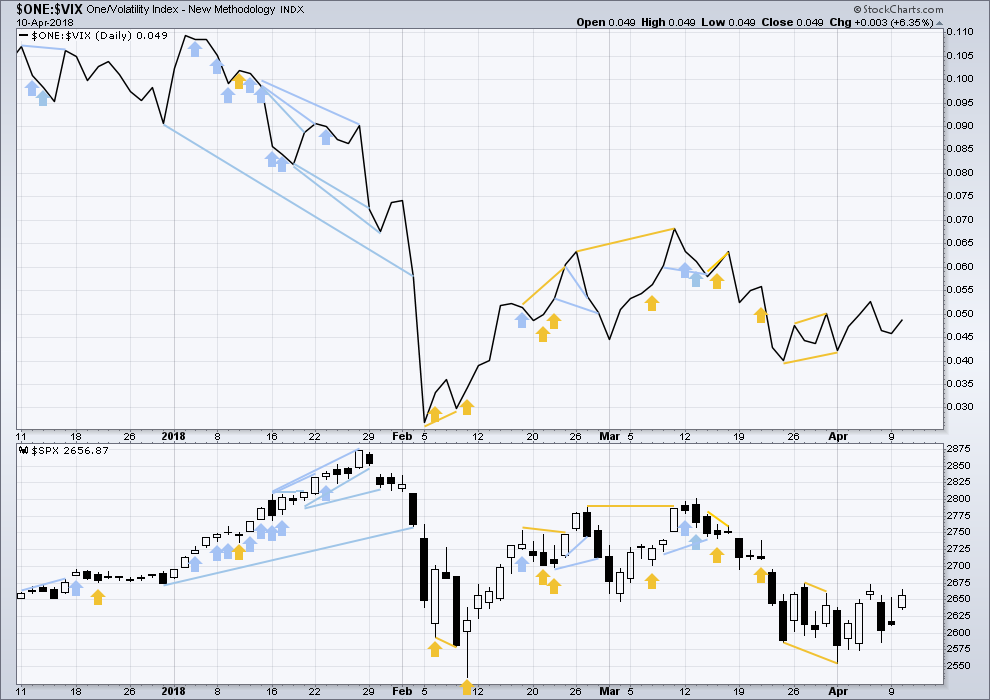

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Both price and inverted VIX today moved higher. Neither made a new small swing high. There is no divergence to note for any signal either way.

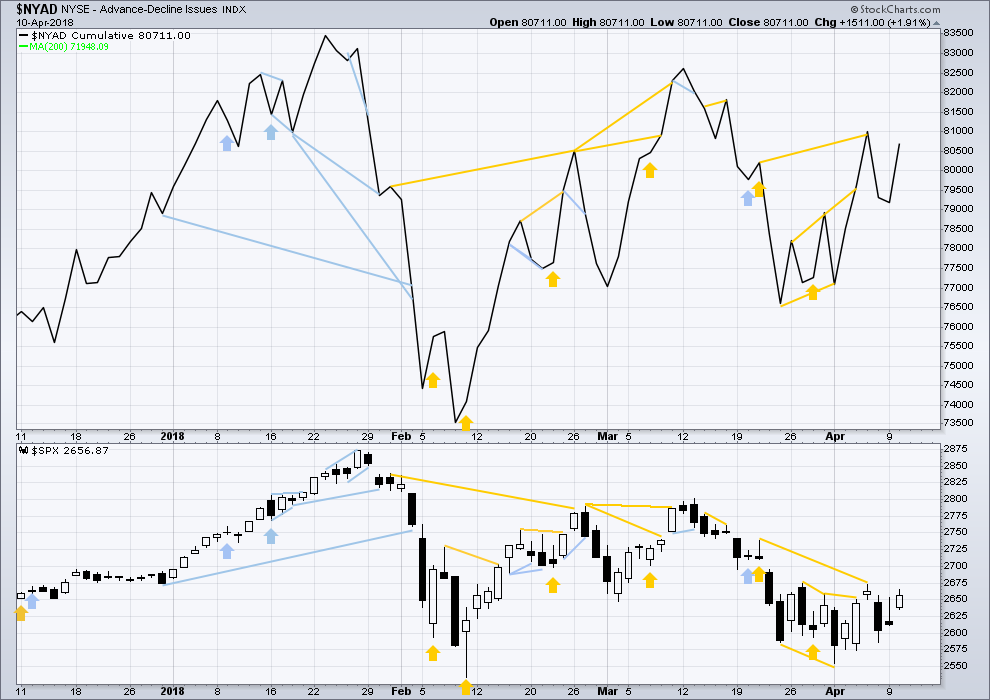

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

All of small, mid and large caps last week moved lower. None have made new small swing lows, and for all the fall has been even. There is no divergence to indicate underlying weakness.

Breadth should be read as a leading indicator.

Both price and the AD line today moved higher, but neither have made a new small swing high. There is no divergence. The rise in price today has support from rising market breadth. This is bullish.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

At this stage, only DJIA has made a new major swing low. DJT also needs to make a new major swing low for Dow Theory to indicate a switch from a bull market to a bear market. For an extended Dow Theory, which includes the S&P500 and Nasdaq, these two markets also need to make new major swing lows.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

Published @ 09:29 p.m. EST.

This sideways movement looks like minute wave b isn’t done yet. I’m going to consider other possible structures for it.

A triangle may be unfolding. That could explain the confusion, a battle between bulls and bears. This is one possibility of several.

You mean the battle between global central banks holding up the illusion and large hedge funds and pensions and sovereign wealth funds liquidating. Foreign buyers have completely disappeared and as usual, retail we get the rug pulled on them. See FED minutes sighting higher GDP growth and labor market improvement, then simultaneously lowering annual GDP forecast down to 2%. They have retail sales getting cut in half by 4th Quarter. As I’ve said before, anyone who is not an expert should sit out.

I forgot to mention Type 4 – 7 i didn’t even mention these because these levels might only be in a certain number of galaxy’s through our universe.

for all intensive purposes these levels would be considered Gods to us cave man.

Lol

DJIA is down 250 points and VIX is also red… Interesting

Sold to close second batch of SPY 265 strike puts on break from rising bearish wedge.

This is definitely a calm day

The Federal Reserve just announced in its minutes they need to slow the US economy down.

At the same time the Federal Reserve is unwinding its 4.5 trillion dollar bond portfolio at a tune of 60 billion dollars a month.

Thoughts anyone

That’s good they are unwinding. But it will take 75 months or 6.25 years to get rid of it all. But I have no fear that they will ever accomplish clearing their books.

If I have it right…putting a lot of bonds on the sales block drives the price of bonds down…which drives interest rates up…which slows the economy. So it’s all internally consistent, isn’t it? It’s interesting to note as well that after every single period of extremely low interest rates in the US, soon after the rate rise begins…a major war is initiated. I’m suspicious (and quite concerned) that history will be repeating itself in this way soon. Now back to my nap….

Kevin I completely agree

Civil war broke out in the US after the 1850’s stock market crash

World war 1 broke out after a stock market crash 6-7 years before that.

And of course the great depression were we entered the war 9 year after the bottom.

The next war could be World war 3 where we have much more to worry about.

We have had 5 – 6 Human bottle necks in the history of man kind as we know it.

They are saying that we are due for another one if that means nature makes it happen or if we make it happen on our own Greed and Domination.

No wonder why we will never make it to a type 1 civilization.

We will not be one the lucky ones in the Blue Planet Lottery.

We are currently a type 0

Maybe 2 – 5 planets might make it to a type 3 civilization in our whole entire Galaxy.

Any how it felt good to get that out there.

Cheers!

looking precarious here…

One of the most bearish formations…….

Yes, the dreaded rising wedge…

What is one of Russia’s biggest exports….oil…..what happens during skirmishes in the Middle East……prices go up…..who benefits…..Russia…..hmmmm….

Undoubtably. Explains the chemical attack perfectly. Someone is being played. (Or engaging in the farce as a accommodating participant…)

In the meantime at least 40 innocent men, women and children have been murdered with chemicals and 100’s more seriously injured. This is a sad but fitting commentary on human nature.

Very sad. As are so many military operations around the world that take out innocent civilian bystanders. Perhaps someday humans will advance beyond war, as as species and via the necessary social development. Meanwhile…I’m trading oil related stocks long. Everything will get worse before it gets better. I wonder how in general the market will react once the US gov’t hits the “launch” button on whatever “response” they are cooking up. We’ll see…

Questions that have been bothering me all day.

I do not think humans will ever advance beyond war. Cain killed his brother Able and it has been war ever since. This human nature will not change and cannot change. No one ever had to teach their children how to be bad or naughty. Well, at least I did not . Have a good day, Kevin and all.

Check out HomoDeus by Harari….

My view Rodney is the only hope is that human consciousness and morality will develop to the point where most people view the interests of (a) the other and (b) the long term as more important than the short term interests of the self. Such change will only happen as a process of evolution; there has to be a “survival benefit” that makes that mentality win (survive), and the old school mentality lose (die off). What that would be is the question I guess. The most likely scenario is that human kind, as a kind of cancerous growth on the host planet, eventually self-terminates or is otherwise largely terminated by Gaia. Self-termination is just a few nukes away, sadly, and that in turn is only a madman’s decision away. We literally survive on the brink. So…better enjoy every moment, we aren’t guaranteed any tomorrows! (I learned that one early in life, myself, came close, very close…).

Meanwhile, I’m fascinated to see which way this market eventually breaks…and how many head fakes it makes before it actually proceeds significantly.

There’s some interesting evidence from archaeology that war did not come until human population grew to the point where we formed nations.

War may be a result of population density, among other factors.

I have a view that may be very unpopular here, and it’s only my opinion. If women were a full 50% of all decision making, wealth and power in our society I suspect war may be much much less. Particularly mothers with babies and young children. The changes in hormones from pregnancy, birth and breastfeeding completely changes ones outlook. Not all for sure, but every other mother I’ve spoken to about this. And it’s a lot.

Less testosterone and more bonding hormones in charge may change things.

Again, only my opinion. Feel free to disagree. And I know that this membership is over 90% male so this may be wildly unpopular.

Daily 5 wave down on bitcoin (GBTC) completed, and a 1-2 up potentially just completed. All kinds of buy triggers firing, or about to. I like the set up; low risk, high potential…extreme volatility and leverage too of course.

Hourly. Note buy signals on macd, stochRSI, and parabolic SAR….

Foist. And this…something to keep in mind.

Another something to consider…