Last analysis expected an upwards breakout with reasonable confidence. This is exactly what has happened for Friday.

Summary: The profit target is at 2,478. The upwards trend has internal strength and health. Use corrections as an opportunity to join the trend. Any members not currently long this market may have another opportunity next week when a small fourth wave unfolds, which should remain above 2,430.98.

Always use stops. They should be set at this time just below 2,430.98, or for profitable positions use a trailing stop. Invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly and weekly charts are here. Last historic analysis video is here.

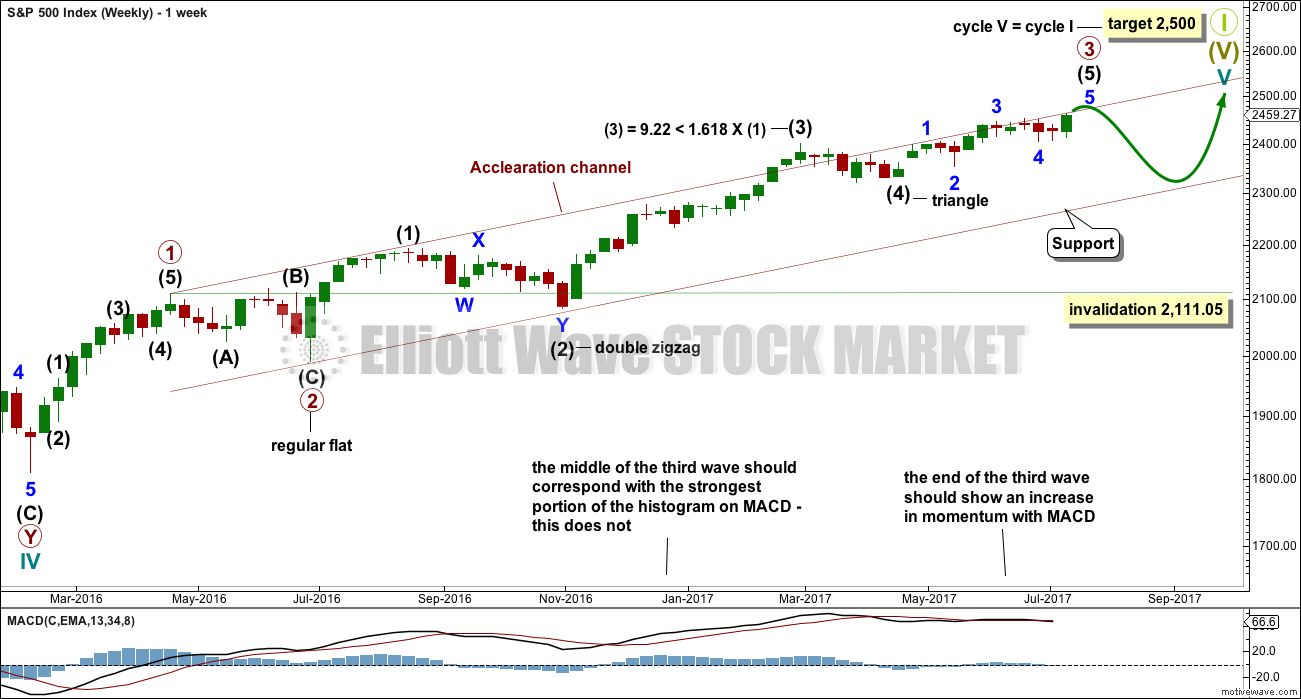

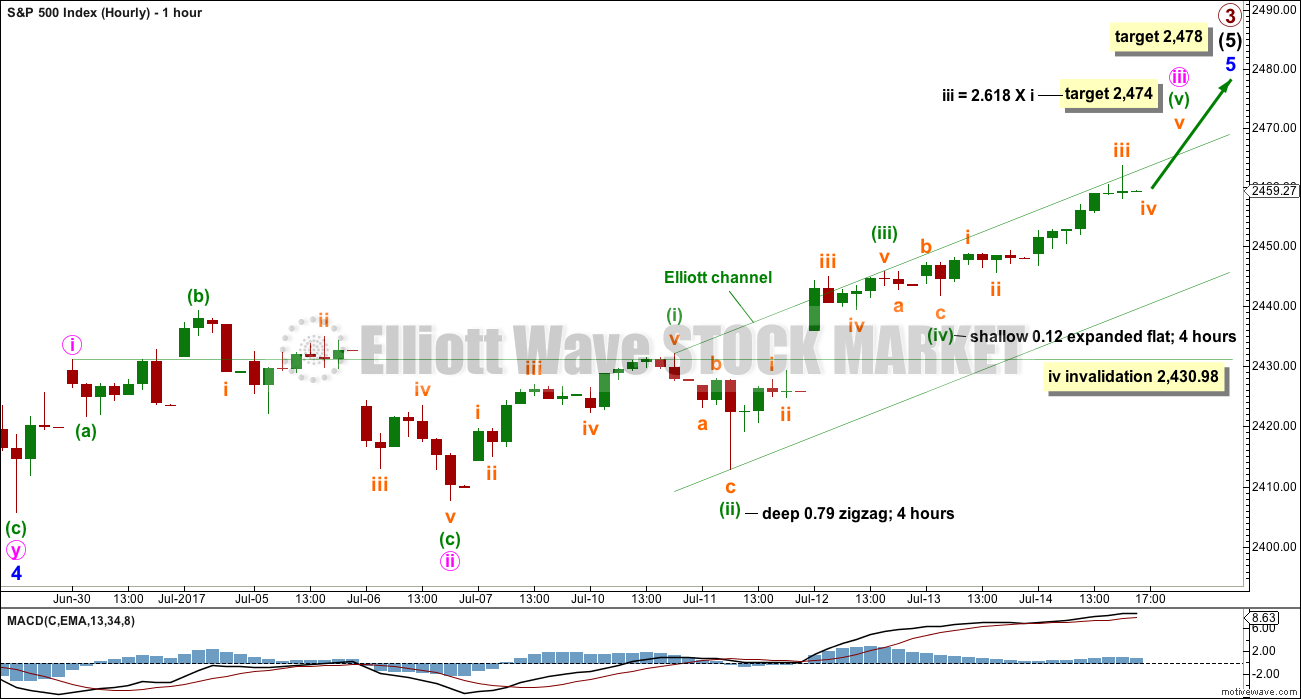

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count is identical to the alternate wave count up to the high labelled minor wave 3 within intermediate wave (5) within primary wave 3.

This alternate wave count sees primary wave 3 as incomplete, but close to completion.

Within primary wave 3 impulse, the final wave of intermediate wave (5) is seen as incomplete. Intermediate wave (5) is subdividing as an impulse.

When intermediate wave (5) is complete, then primary wave 3 would be complete. Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

If price reaches the target at 2,500 and either the structure is incomplete or price keeps rising, then the next target would be the next Fibonacci ratio in the sequence between cycle waves I and V. At 2,926 cycle wave V would reach 1.618 the length of cycle wave I.

DAILY CHART

The daily chart shows only the structure of intermediate wave (5); this structure is an impulse.

Within intermediate wave (5), minor waves 1 through to 4 are now complete. The final fifth wave of minor wave 5 should now be underway. Within minor wave 5, the upcoming correction for minute wave iv may not move into minute wave i price territory below 2,430.98.

There is perfect alternation between the deep expanded flat of minor wave 2 and the shallow double zigzag of minor wave 4.

HOURLY CHART

Minor wave 5 may be subdividing as an impulse so far. The middle of the third wave is showing an increase in upwards momentum.

If my labelling within minor wave 5 is wrong, it may be to label minuette wave (iii) as over already. It may be extending further. If my targets are wrong at this stage, they may now be too low.

When minute wave iii is complete, then minute wave iv may not move into minute wave i price territory below 2,430.98.

Use the Elliott channel to indicate when minute wave iii is over. When this channel is clearly breached by downwards movement, not sideways, it shall be an early indicator that minute wave iv may possibly be underway. However, the S&P500 has a tendency to form slow rounded tops, breaching channels then continuing on higher before finally turning. This is an early indication of a potential trend change, and should be approached with caution.

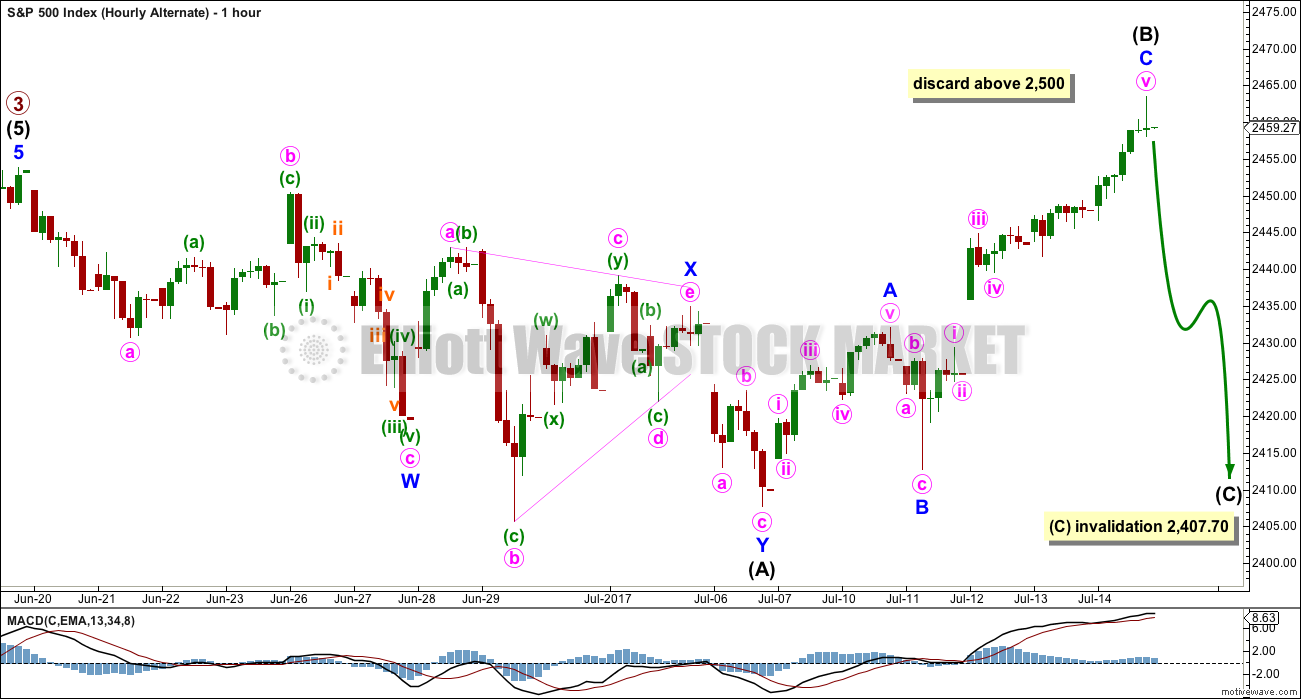

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

Primary wave 4 may now be underway.

Primary wave 2 was a regular flat correction that lasted 10 weeks. Given the guideline of alternation, primary wave 4 may most likely be a single or multiple zigzag or a triangle and may last about a Fibonacci eight or thirteen weeks, so that the wave count has good proportion and the right look. So far it has lasted three weeks. This is far too brief to be considered complete or even close to complete.

Primary wave 4 may end within the price territory of the fourth wave of one lesser degree. Intermediate wave (4) has its range from 2,400.98 to 2,322.35.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

DAILY CHART

A new all time high means a double zigzag for primary wave 4 is still possible but much less likely. A double combination would be more likely but would not offer very good alternation with the flat correction of primary wave 2.

What would still offer good alternation would be a running contracting triangle.

Within the triangle, intermediate wave (A) can be easily seen as a double zigzag. All remaining sub-waves of the triangle should then be simple A-B-C corrections.

There is no rule stating a limit for B waves within running triangles. There is a convention within Elliott wave for flat corrections that states when a possible B wave is more than twice the length of the A wave, the idea of a flat should be discarded based upon a very low probability. That convention will be applied here to the triangle. At 2,500 intermediate wave (B) would reach twice the length of intermediate wave (A). A triangle should be discarded above that point.

HOURLY CHART

The double zigzag for intermediate wave (A) is a perfect fit.

So far intermediate wave (B) is 1.21 times the length of intermediate wave (A).

Intermediate wave (C) of a contracting triangle may not move beyond the end of intermediate wave (A) below 2,407.70. Although an expanding triangle would be valid, they are the rarest of Elliott wave structures. In my nine years of daily Elliott wave analysis I have only ever seen one structure which in hindsight was an expanding triangle. If price makes a new low here below 2,407.70, then another scenario would be considered.

TECHNICAL ANALYSIS

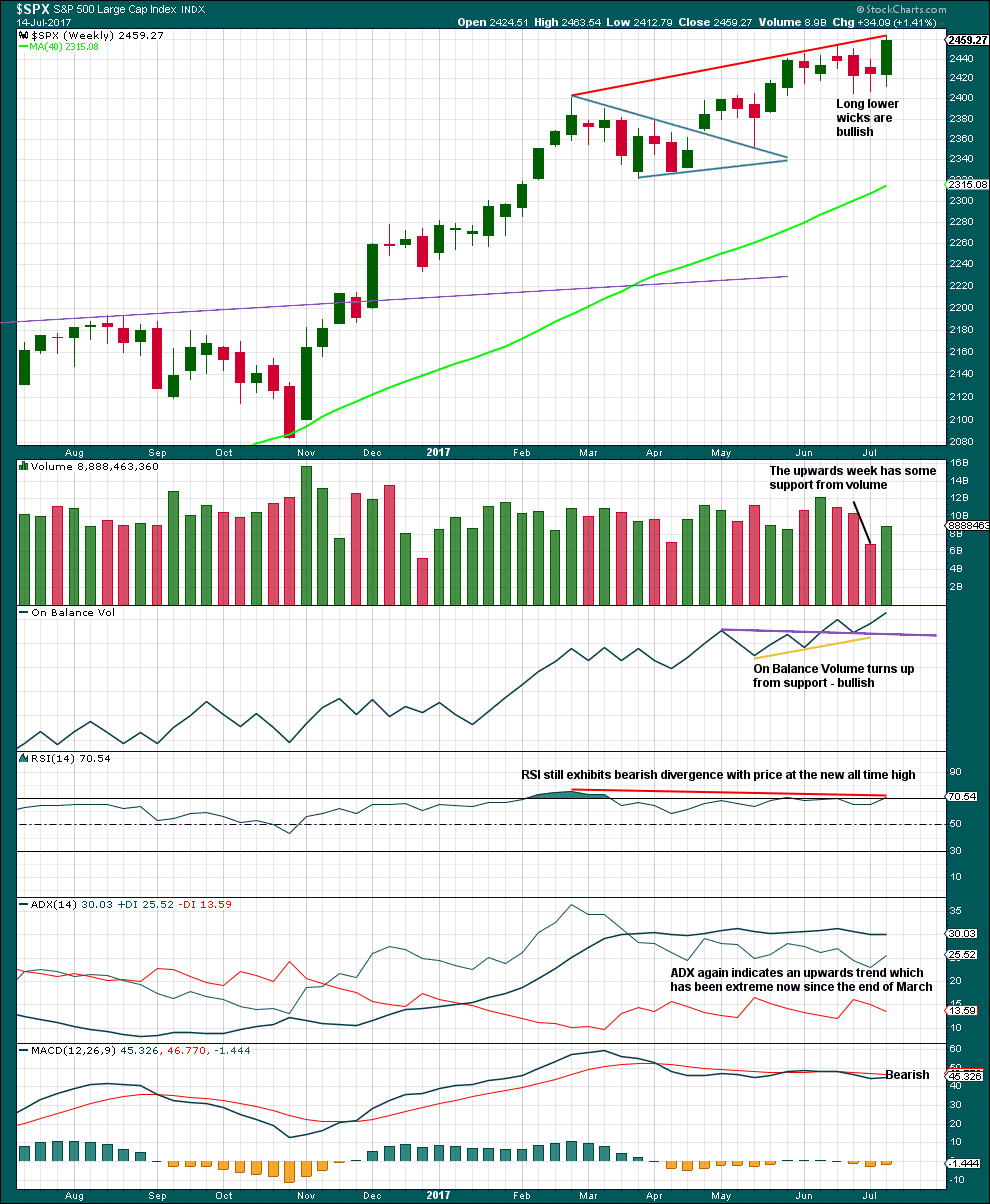

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Candlesticks, volume, and On Balance Volume are bullish.

ADX, RSI and MACD are bearish.

Overall, give more weight to volume and On Balance Volume.

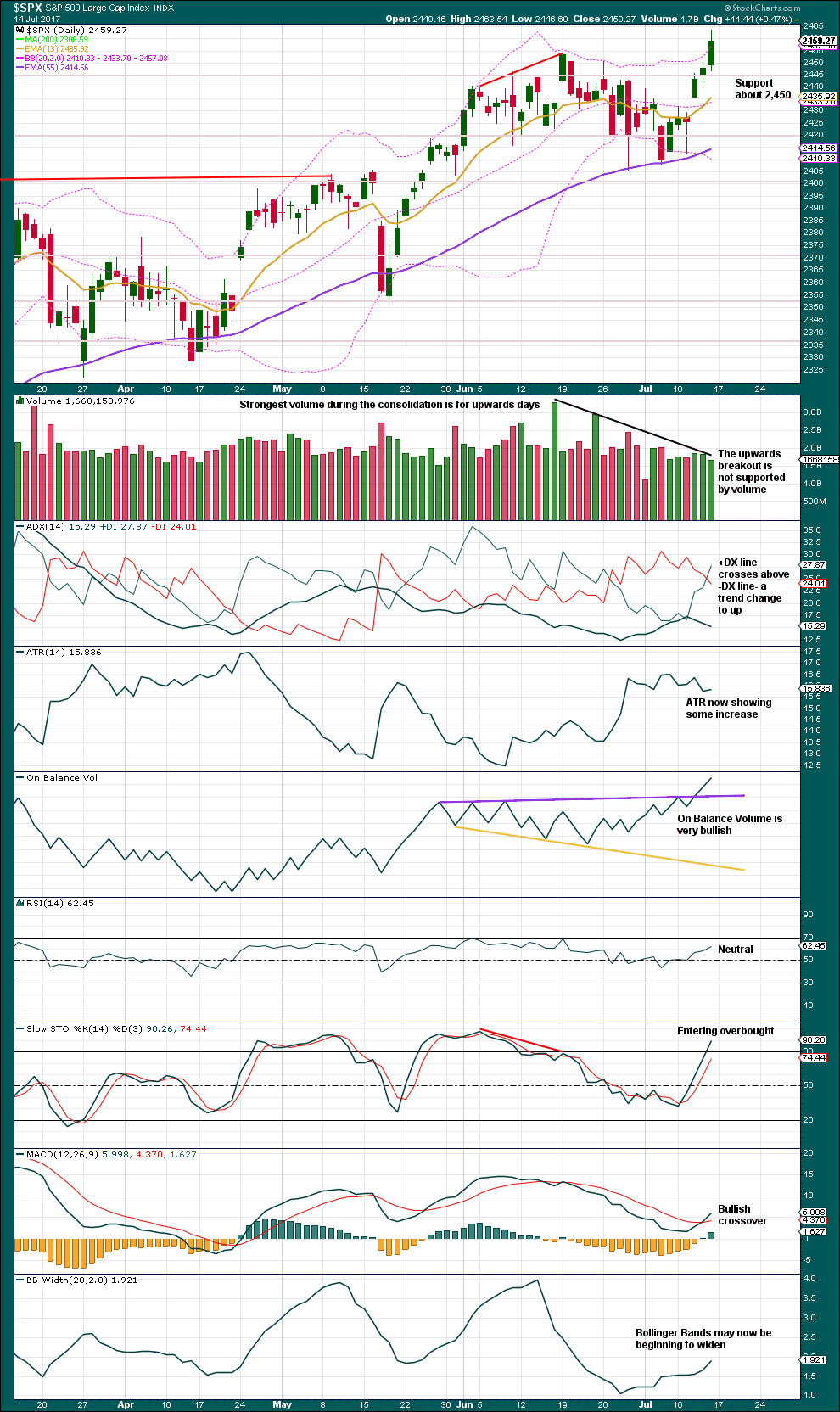

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Look now for support about 2,450 for any pullbacks within this upwards trend.

On Balance Volume is very bullish. Give this more weight than other indicators. It correctly predicted the upwards breakout before it happened, as it so often does.

However, the breakout does not have support from volume, so it is suspicious. This signals that another pullback may come sooner rather than later.

On Balance Volume, ATR, ADX, MACD and Bollinger Bands are all bullish.

The slightly longer upper wick on Friday’s candlestick is slightly bearish, and volume is for the very short term bearish.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is no new divergence between price and inverted VIX. Both made new all time highs on Friday. Upwards movement is coming with a normal corresponding decline in volatility.

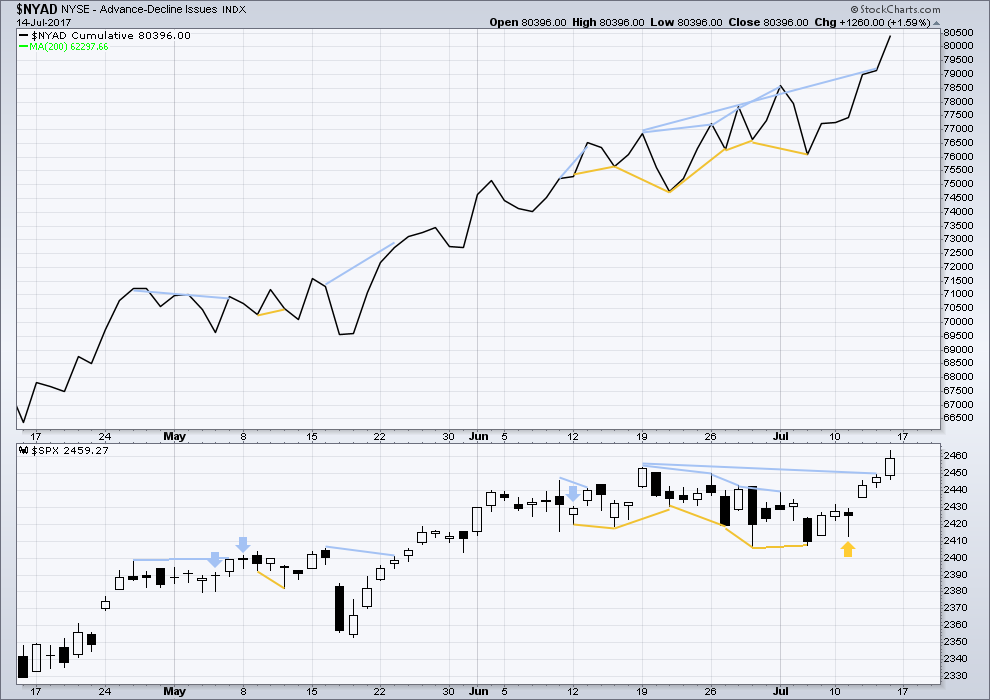

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

With the last all time high for price, the AD line also made a new all time high. Up to the last high for price there was support from rising market breadth.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

Bearish divergence noted in last analysis has failed. There is no divergence now between price and market breadth. The new all time high on Friday has support from rising market breadth.

Lowry’s measures of internal market strength and health continue to show a healthy bull market. The rise in price comes with expanding buying power and contracting selling pressure, normal and healthy for a bull market, even an old one.

Historically, almost every bear market is preceded by at least 4-6 months of divergence with price and market breadth. There is no divergence at all at this time. This strongly suggests this old bull market has at least 4-6 months to continue, and very possibly longer.

DOW THEORY

The S&P500, DJIA and DJT have all made new all time highs.

Nasdaq still has not made a new all time high. Modified Dow Theory (adding in technology as a barometer of our modern economy) indicates some weakness at this time within the bull market, but there is zero indication that it is over. What is much more likely is that Nasdaq may too make a new all time high next week. If it does, the ongoing bull market will again be confirmed.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,029.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

This analysis is published @ 10:57 p.m. EST on 15th July, 2017.

End of day comment and chart posted under the video.

ok,, I will take it

It was just a sitting duck wasn’t it Doc 🙂

Aflack!! 🙂

Aflack, I’m back, for this week alone. Then I am off for two weeks visiting family in the safest city in the world, Chicago (I hope you realize the sarcasm).

Hi Rod! Great to hear from you! Looks like you were right about that 2470 target. We nred another 15 points in NDX Comp.

Be sure and wear your Kevlar in Chi town my friend. Another gruesome weekend… 🙁