Another small day moves price essentially sideways.

Summary: The target is at 2,440 (Elliott wave target) to 2,448 (classic analysis target). Expect upwards movement to continue. Corrections are an opportunity to add to long positions.

In the short term, a new low now below 2,398.16 would indicate a deeper pullback may be underway.

New updates to this analysis are in bold.

Last monthly and weekly charts are here. Last historic analysis video is here.

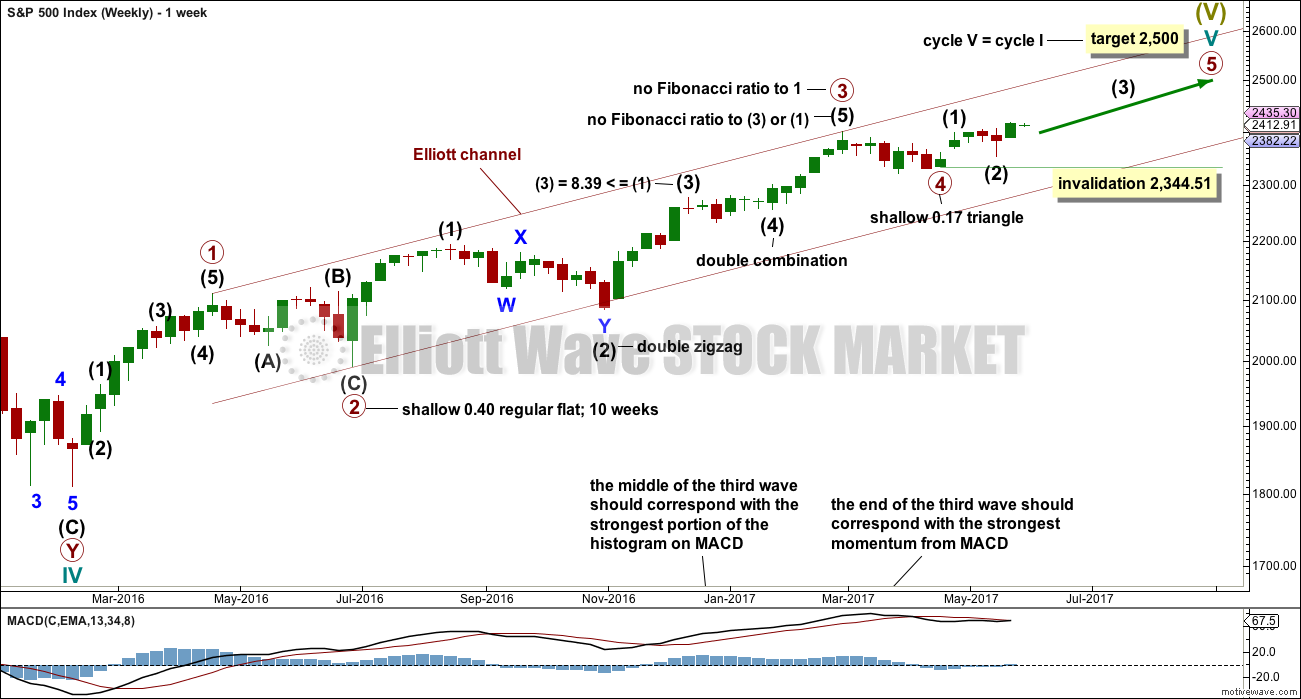

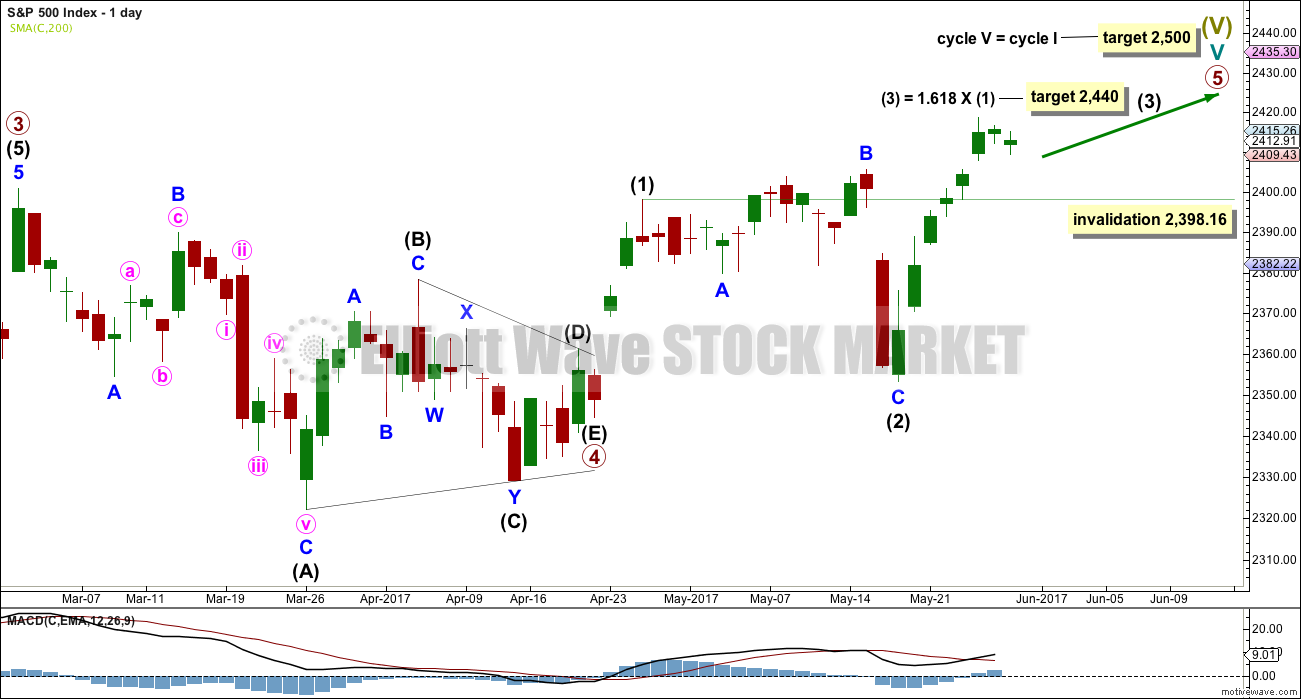

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

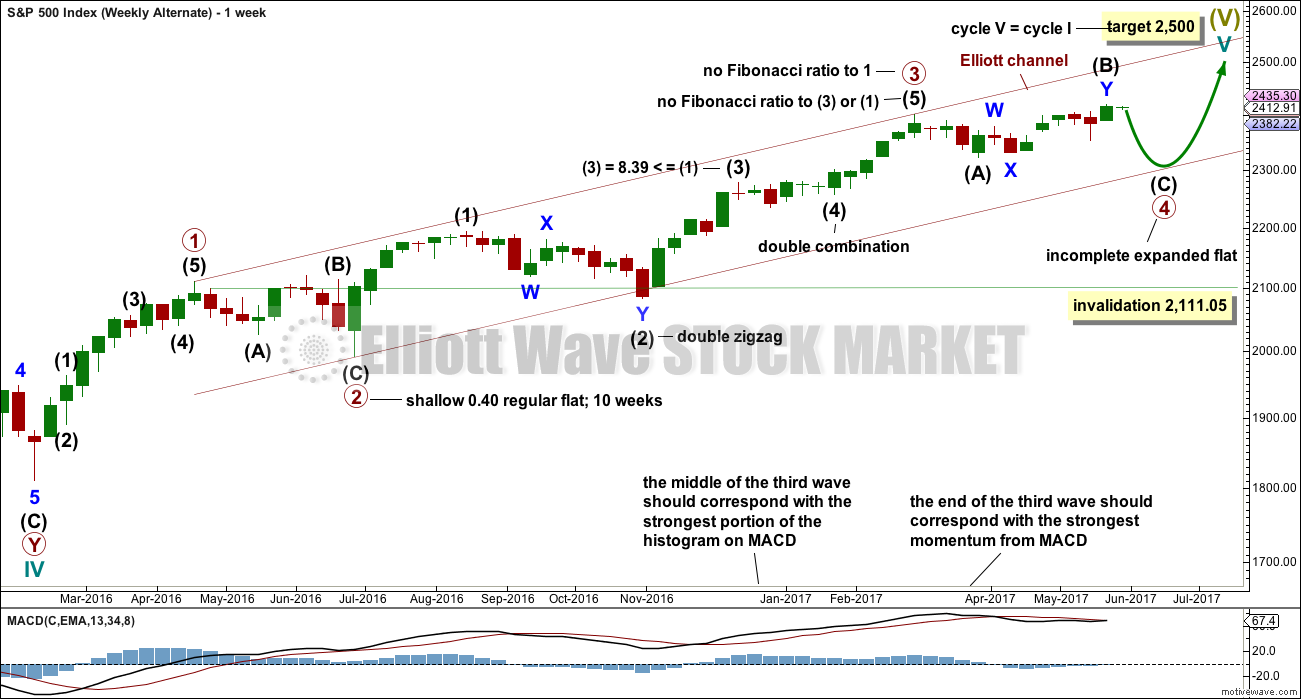

This wave count has a better fit with MACD and so may have a higher probability.

Primary wave 3 may be complete, falling short of 1.618 the length of primary wave 1 and not exhibiting a Fibonacci ratio to primary wave 1. There is a good Fibonacci ratio within primary wave 3.

The target for cycle wave V will remain the same, which has a reasonable probability. At 2,518 primary wave 5 would reach 0.618 the length of primary wave 1. If the target at 2,500 is exceeded, it may not be by much.

There is alternation between the regular flat correction of primary wave 2 and the triangle of primary wave 4.

Within primary wave 3, there is alternation between the double zigzag of intermediate wave (2) and the double combination of intermediate wave (4).

If primary wave 4 is over and primary wave 5 is underway, then within primary wave 5 intermediate wave (2), if it moves lower, may not move beyond the start of intermediate wave (1) below 2,344.51 (this point is taken from the triangle end on the daily chart).

DAILY CHART

Primary wave 5 must complete as a five wave motive structure, either an impulse (more common) or an ending diagonal (less common). So far, if this wave count is correct, it looks like an impulse.

Intermediate wave (3) is now far enough developed to move the invalidation point up. If intermediate wave (4) begins shortly, it may not move into intermediate wave (1) price territory below 2,398.16.

Intermediate wave (3) may only subdivide as an impulse structure.

HOURLY CHART

Intermediate wave (3) may only subdivide as an impulse. For the S&P 500, it is most common for third wave impulses to exhibit extended third waves within them. Here, minor wave 3 is just 4.44 points short of 4.236 the length of minor wave 1.

Minor wave 4 may have completed as double combination.

Any movement below 2,398.16 would see this main wave count discarded in favour of the alternate below.

Price points are given for the anchor points of the best fit channel. The channel is breached by some sideways movement; this is typical of the S&P 500. It often forms slow rounded tops and while doing so it breaches channels only to turn and continue higher. This may be happening for the end of intermediate wave (3). A final fifth wave for minor wave 5 looks like it is still required.

ALTERNATE WEEKLY CHART

This alternate is new in response to a member’s suggestion. At this stage, there are several alternate wave counts possible. It is time to consider one more.

This wave count is identical up to the end of primary wave 3, Thereafter, it looks at the possibility that primary wave 4 may be an incomplete expanded flat correction.

If the expanded flat is primary wave 4, then there is very little alternation with the regular flat of primary wave 2.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

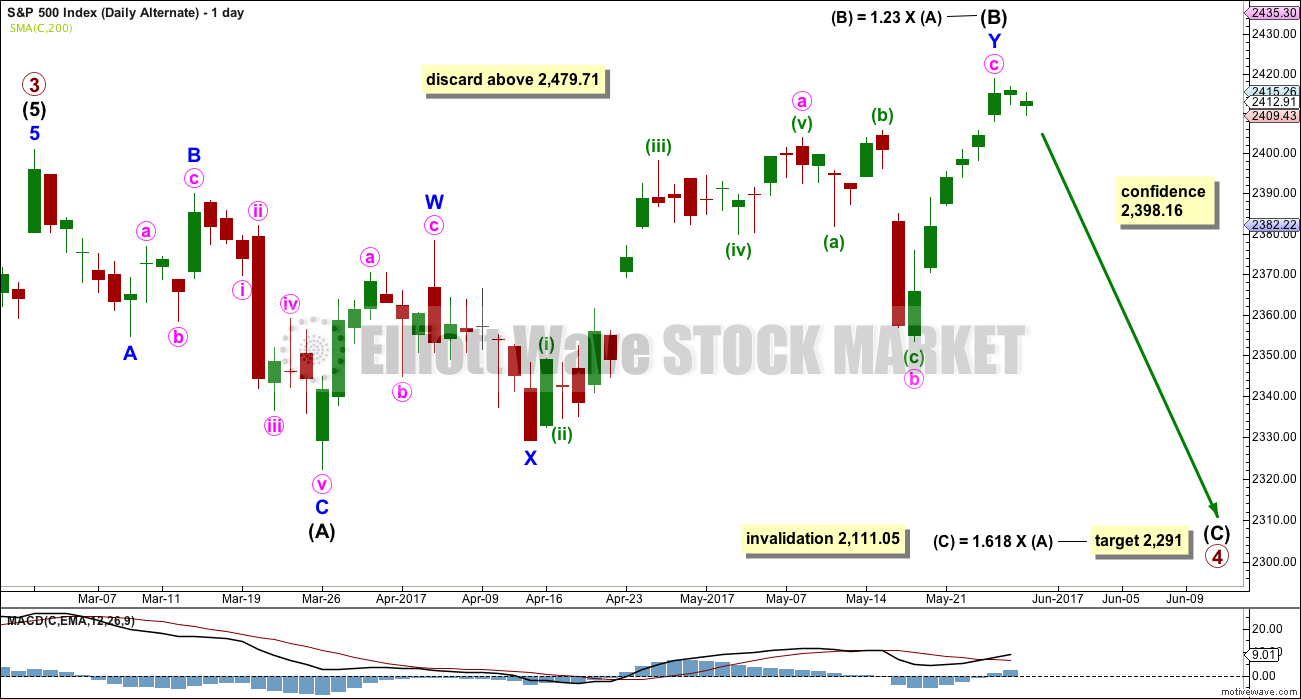

ALTERNATE DAILY CHART

Within the possible expanded flat correction, intermediate wave (A) fits as a single zigzag and intermediate wave (B) fits as a double zigzag and is within the normal range for B waves of flats.

If price keeps rising, then when intermediate wave (B) reaches twice the length of intermediate wave (A) at 2,479.71, then the idea of a flat correction continuing should be discarded based upon a very low probability. Unfortunately, this price point is far enough away to be of little use. This alternate may be discarded sooner if structure shows it is unlikely.

It is also possible that the expanded flat correction is intermediate wave (4) within primary wave 3. This alternate idea will be published if it shows itself to be true. For now, because it does not diverge from the alternate published above, this second idea will not be published on a daily basis.

TECHNICAL ANALYSIS

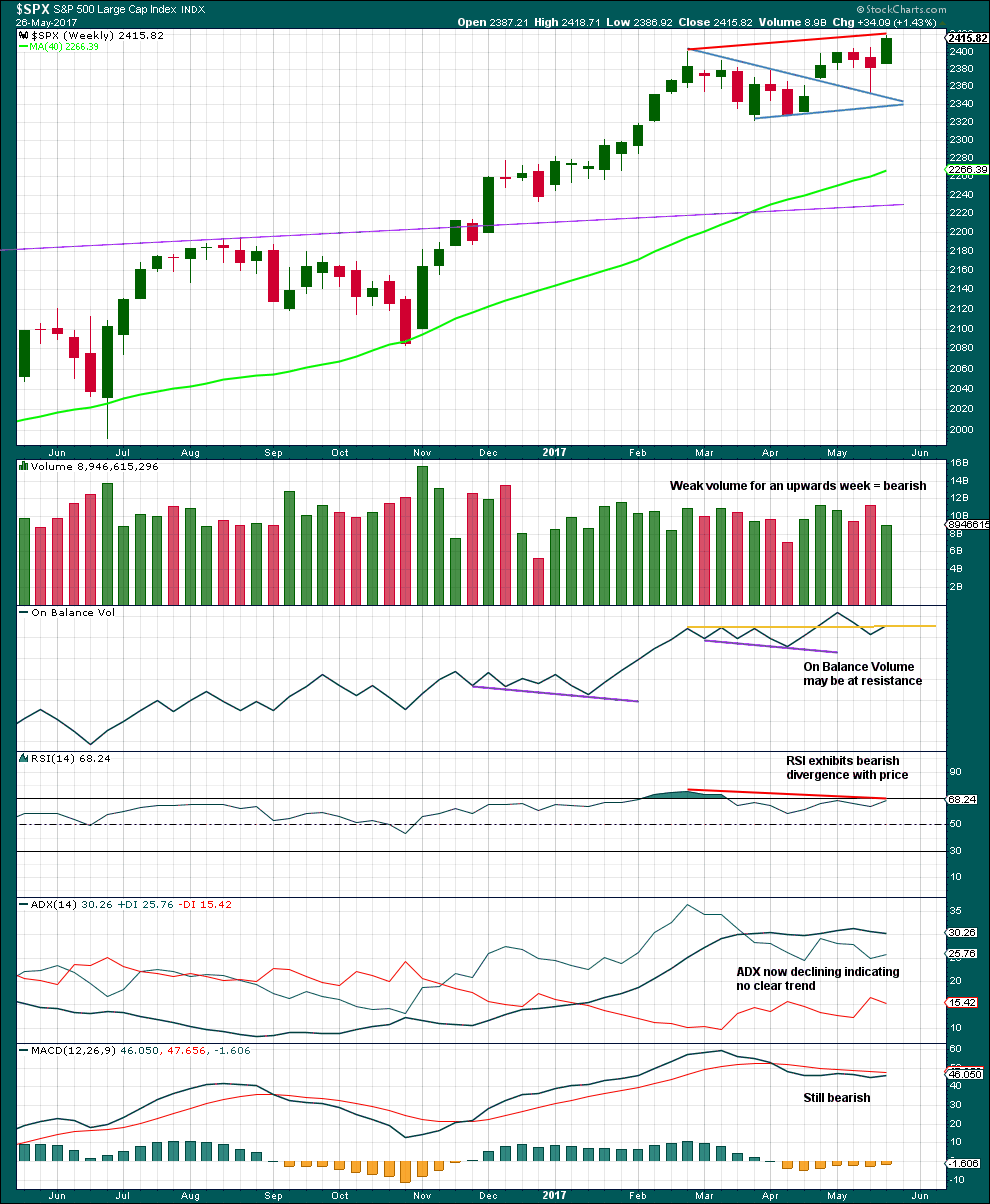

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This weekly chart supports the alternate wave counts over the main wave count.

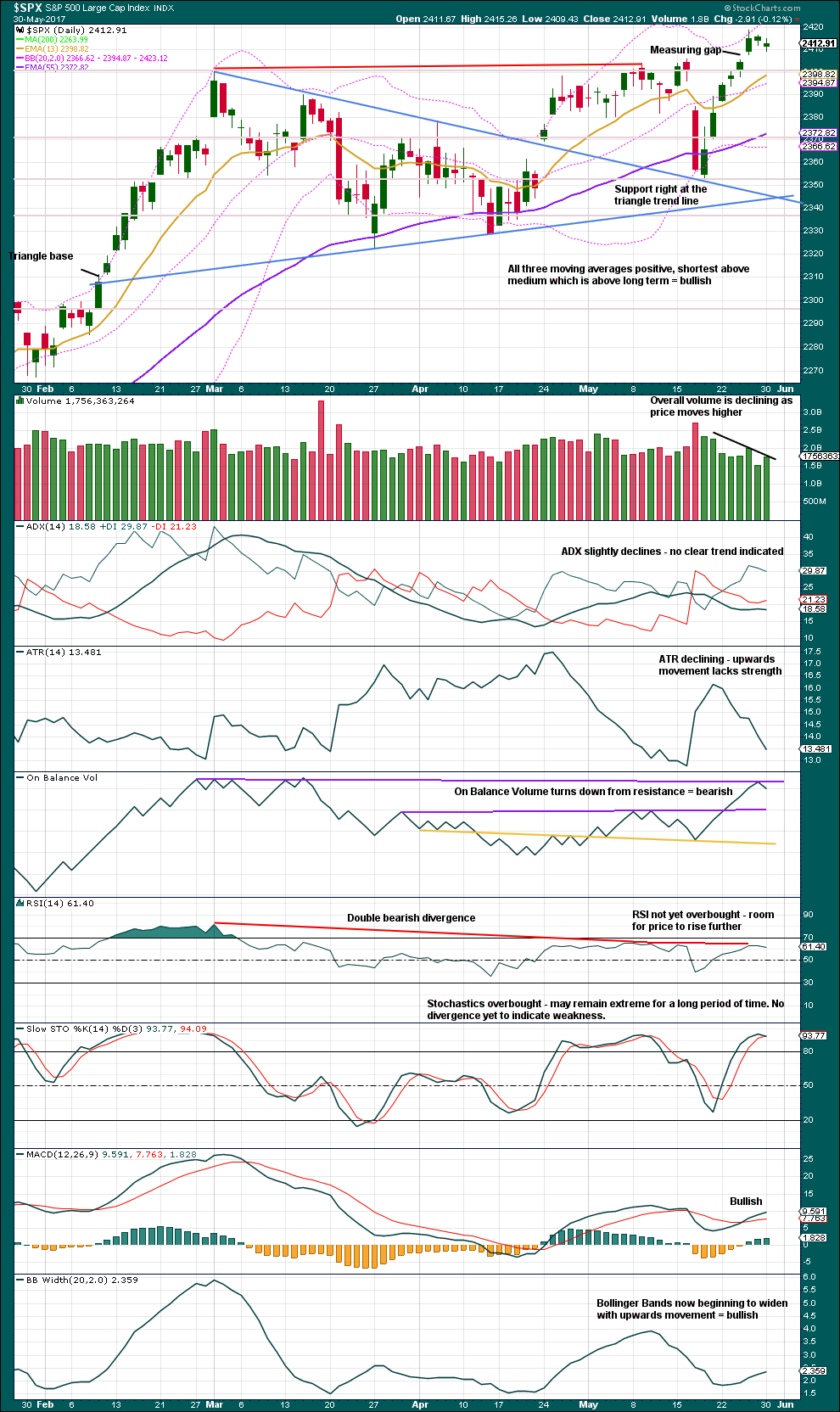

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

If the widest part of the symmetrical triangle is taken from the high of the 1st of March to the low of the 27th of March, then a measured rule target would be at 2,448. This is just 8 points above the Elliott wave target.

If the last gap is a measuring gap, then a target would be about 2,460.

Overall, declining volume is bearish. Some increase in volume for a downwards day today with the balance of volume down is also bearish. Volume and On Balance Volume support the alternate wave counts.

MACD is bullish. Bollinger Bands may be beginning to widen, so this is now slightly bullish.

Overall, this picture is still more bearish than bullish.

If there is something wrong with a trend, then it is often a B wave. Classic technical analysis at the end of the week offers more support to the new alternate wave count than the main wave count.

However, we have been here before. Price keeps rising although the trend looks weak. Assume the trend remains the same until proven otherwise.

The breakout from the triangle followed by a curve down and test of support at the prior resistance line looks like very typical price behaviour. It is moving up and away. The target is not yet reached. It seems most sensible to assume it will be, until the alternate Elliott wave count is confirmed by price.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Hidden mid term bearish divergence has now been followed by one downwards day. It may be followed by one more before it may be considered to be resolved.

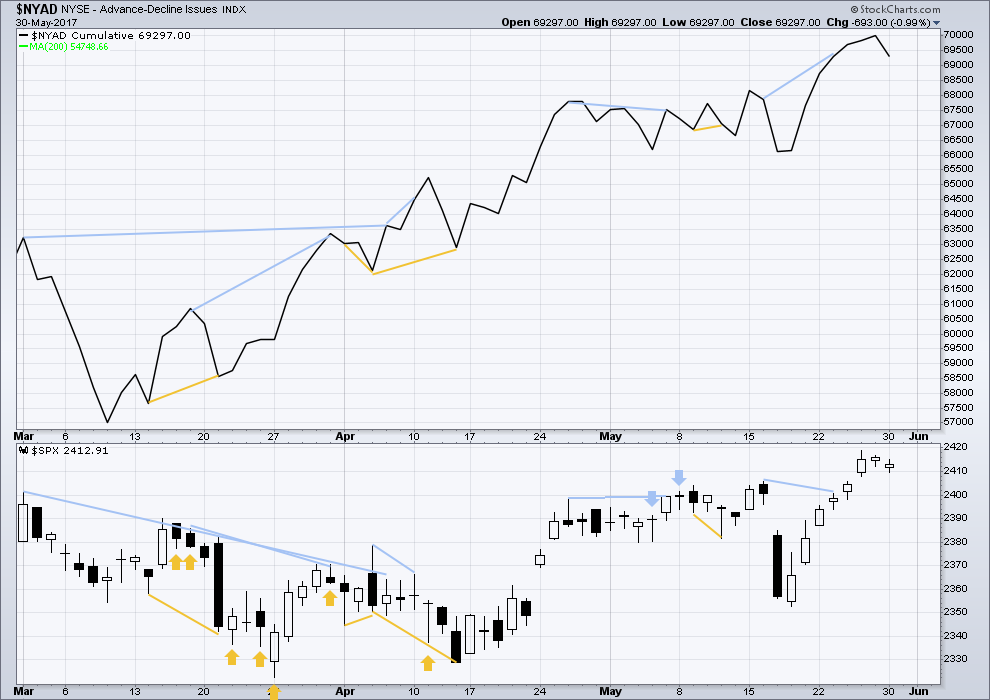

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

With the last all time high for price, the AD line also made a new all time high. Up to the last high for price there was support from rising market breadth.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. With no divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

There is no divergence between price and breadth today; both are making new all time highs. Upwards movement in price has support from rising market breadth.

DOW THEORY

The DJIA, DJT, S&P500 and Nasdaq continue to make new all time highs. This confirms a bull market continues.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,029.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

This analysis is published @ 09:28 p.m. EST.

So far this still looks like a continuation of the fourth wave.

There’s not enough room for intermediate (4) to move into and remain above intermediate wave (1) price territory at this stage. So I’ll still expect it to move higher.

Thank you Lara. Question for you…

Would you mind refreshing us on when it is that a correction needs to be labeled “w-x-y” and how early into the structure this becomes clear? TIA!

For double zigzags: if the first zigzag does not move price deep enough, consider a double. Their X waves are usually relatively brief and shallow, they have a slope against the main trend.

For double combinations: if the first structure does not take up enough time consider further sideways movement for a combination. Their X waves are usually deep and may may new price extremes. They are sideways movements.

That helps a lot. Thank you!

Glad I’m sitting out in my PA; that Bankster Manipulation at 10am low is just disgusting. Anyone with half a brain can spot this. I’m sensing we are much close to this exploding than we may think.

Lara, I see that you have a target ranging from 2440 to 2460. Is that for wave 3 up with a final wave 5 up to 2500 as in your top chart?

Yes. It assumes shallow fourth waves, and short fifth waves.

Which is fairly common for the S&P

You guys are too slow. I’m jumping in 🙂

I surfed with dolphins again yesterday, and this time I had my GoPro.

Video here.

Eh, I’ll be impressed when you get some killer whales on tape. 😉

Dude, I’ll be paddling away so fast, ain’t no way I’ll have time to stop and carefully film Orca if they show up 🙂 🙂 🙂

Those guys have really BIG sharp teeth!

Really awesome. Thanks for sharing this with us.