A slight new low changes the structure on the main hourly Elliott wave count. The new labelling has a better fit.

Summary: It is increasingly likely today that the next wave up has just begun. Confidence would be had above 2,294.08. The target is 2,338 for the short term and 2,382 for a longer term trade. If price breaks below 2,257.02, then a deeper pullback would be expected to be underway to end at the purple trend line.

New updates to this analysis are in bold.

Last monthly and weekly charts are here. Last historic analysis video is here.

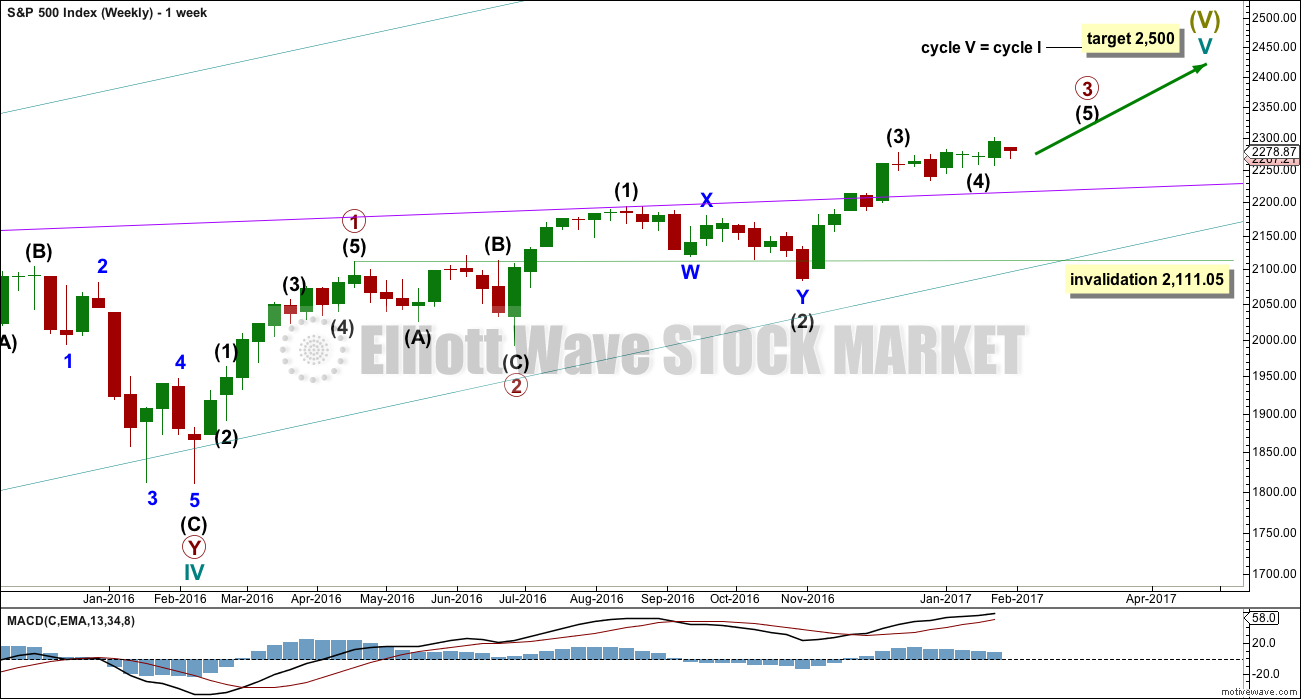

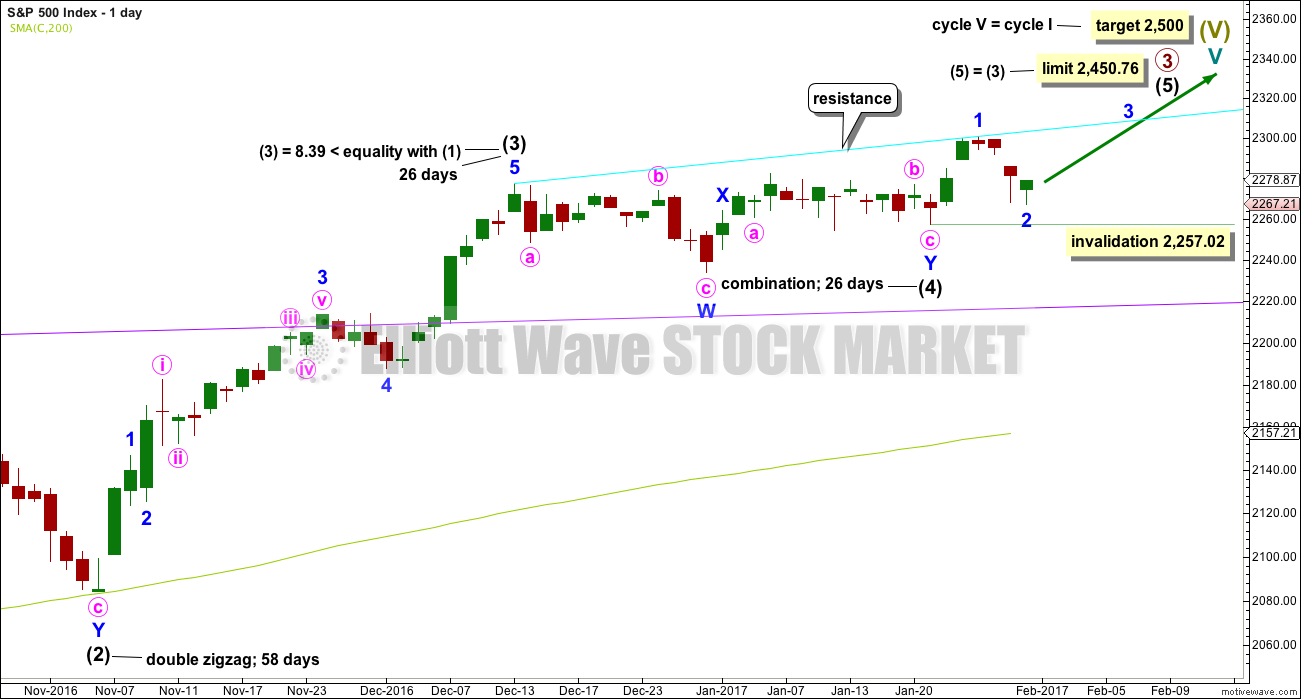

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave V is an incomplete structure. Within cycle wave V, primary wave 3 may be relatively close to completion.

When primary wave 3 is complete, then the following correction for primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

Primary wave 2 was a flat correction lasting 47 days (not a Fibonacci number). Primary wave 4 may be expected to most likely be a zigzag, but it may also be a triangle if its structure exhibits alternation. If it is a zigzag, it may be more brief than primary wave 2, so a Fibonacci 21 sessions may be the initial expectation. If it is a triangle, then it may be a Fibonacci 34 or 55 sessions.

Primary wave 3 at this stage though is incomplete and may continue to move price higher.

DAILY CHART

It is possible that intermediate wave (4) is a complete combination: zigzag – X – flat. It would have been even in duration with intermediate wave (3), both lasting 26 days.

Intermediate wave (3) is shorter than intermediate wave (1). One of the core Elliott wave rules states a third wave may never be the shortest wave, so this limits intermediate wave (5) to no longer than equality in length with intermediate wave (3) at 2,450.76.

Within intermediate wave (5), no second wave correction may move beyond its start below 2,257.02.

Intermediate wave (5) has so far lasted just six days. It may be expected to be shorter both in length and duration compared to intermediate wave (3). At this stage, an expectation of a Fibonacci 13 days total for intermediate wave (5) looks reasonable, so it may now continue for another seven days or sessions.

The proportion here between intermediate waves (2) and (4) is acceptable. There is alternation. Both are labelled W-X-Y, but double zigzags are quite different structures to double combinations.

It is my judgement today that the probability of this main wave count has now increased to about 60%.

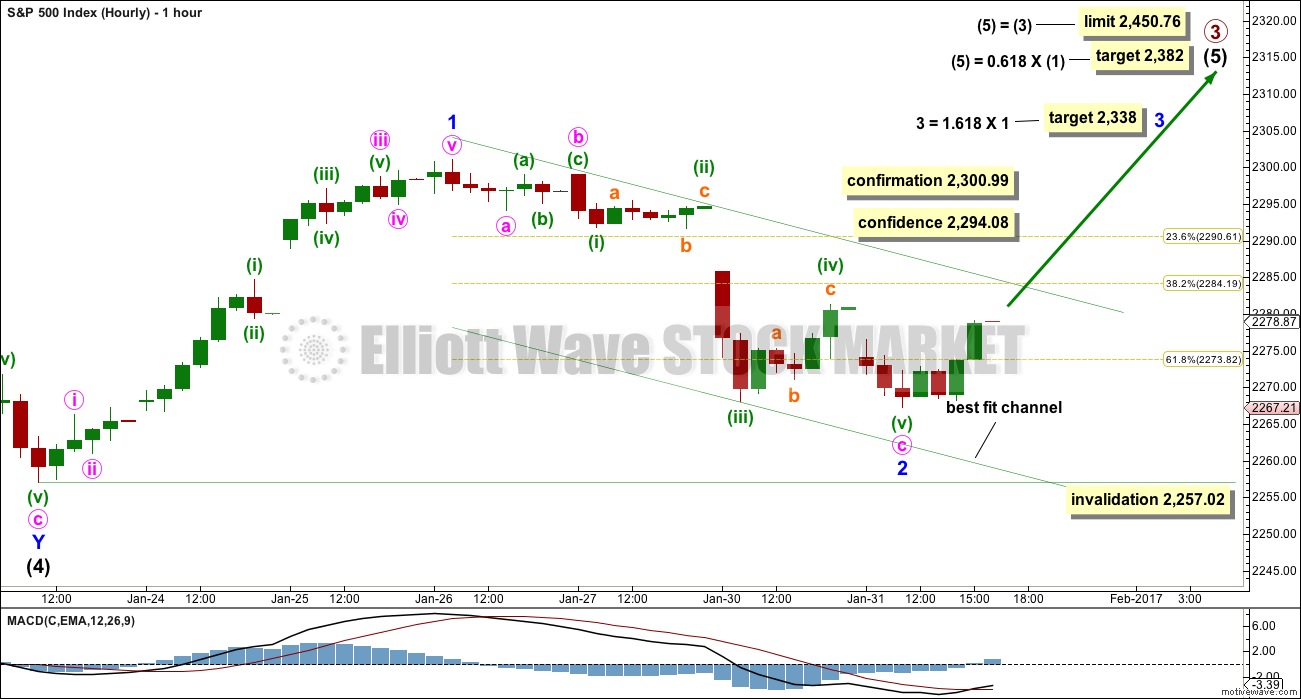

HOURLY CHART

Intermediate wave (5) must subdivide as a five wave structure, either an impulse or an ending diagonal. At this stage, it is not possible to eliminate either option.

Within intermediate wave (5), minor wave 1 and now minor 2 may be complete.

Minor wave 2 will not fit as a complete single zigzag on the five minute chart. The correction of minuette wave (ii) fits as an expanded flat. This provides alternation with the zigzag of minuette wave (iv).

Minute wave c is 2.53 longer than 4.236 the length of minute wave a.

Within minute wave c there are no Fibonacci ratios between minuette waves (i), (iii) and (v).

Minor waves 1 and 2 have now both lasted a Fibonacci three sessions. The proportions are still very good.

A new high above 2,294.08 would add some confidence to this wave count. A new high above 2,300.99 would confirm it and invalidate any alternate. At that stage, reasonable confidence in targets may be had.

The target for minor wave 3 assumes the most likely Fibonacci ratio for it to minor wave 1. Minor wave 3 may last about a Fibonacci five days.

If price moves below 2,257.02, this main wave count would be invalidated and the alternate below would be confirmed.

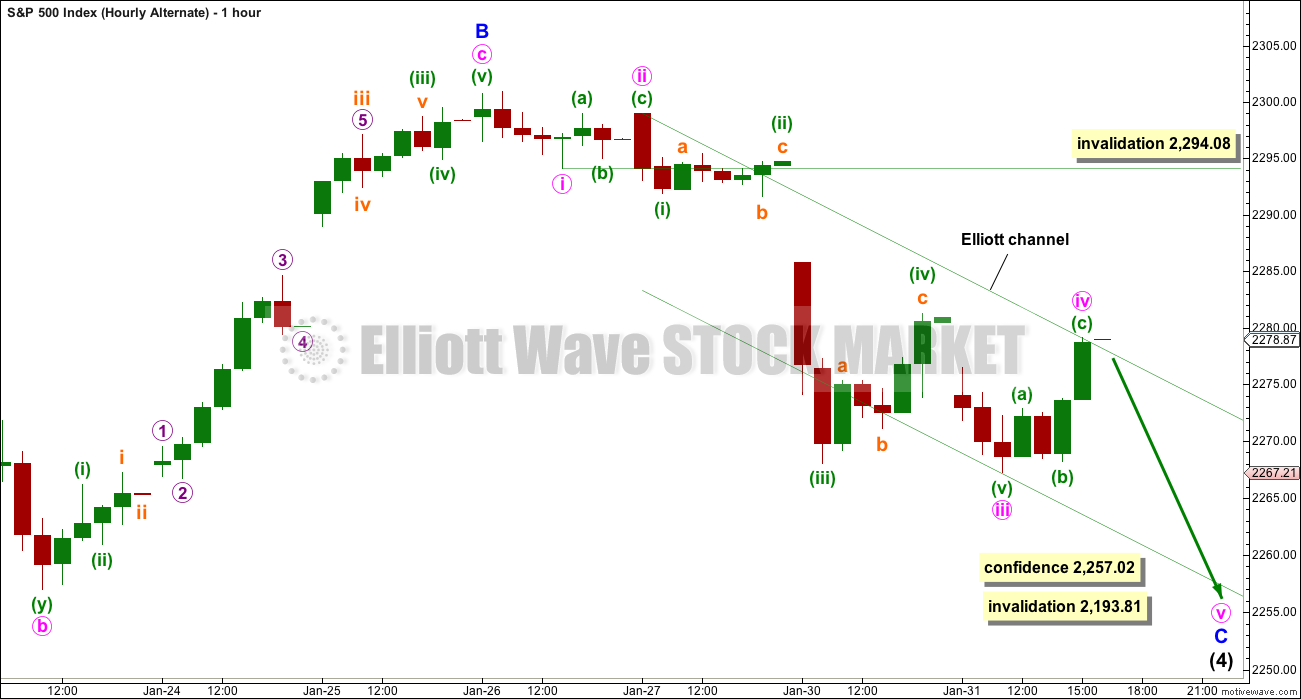

ALTERNATE ELLIOTT WAVE COUNT

DAILY CHART

It remains possible that intermediate wave (4) is an incomplete expanded flat correction.

So far intermediate wave (4) may have lasted 32 sessions. It may continue for another two to total a Fibonacci 34 days or sessions.

No target is given for minor wave C downwards because a target calculated using the Fibonacci ratio of 1.618 to minor wave A results in price falling short of the purple trend line. Minor wave C may end only when price comes down to touch the trend line again.

Minor wave B is now a 1.53 length to minor wave A. This is longer than the normal length of up to 1.38 but within the allowable convention of 2. The length of minor wave B has reduced the probability of this wave count.

Intermediate wave (4) may not move into intermediate wave (1) price territory below 2,193.81. It should find very strong support at the purple trend line and stop there.

HOURLY CHART

Minor wave C must subdivide as a five wave structure. At this stage, it may be an impulse.

Within the impulse, it may have begun with two overlapping first and second waves. The structure of downwards movement is seen on the hourly chart in the same way for both wave counts, because A-B-C of a zigzag and 1-2-3 of an impulse both subdivide 5-3-5.

There is alternation between the expanded flat of minuette wave (ii) and the zigzag of minuette wave (iv).

It is possible that minute wave iv may continue higher, but it may not move into minute wave i price territory above 2,294.08.

A new low below 2,257.02 would add substantial confidence to this wave count. At that stage, look for downwards movement to continue and end only when price comes to touch the purple trend line on the daily and weekly charts.

TECHNICAL ANALYSIS

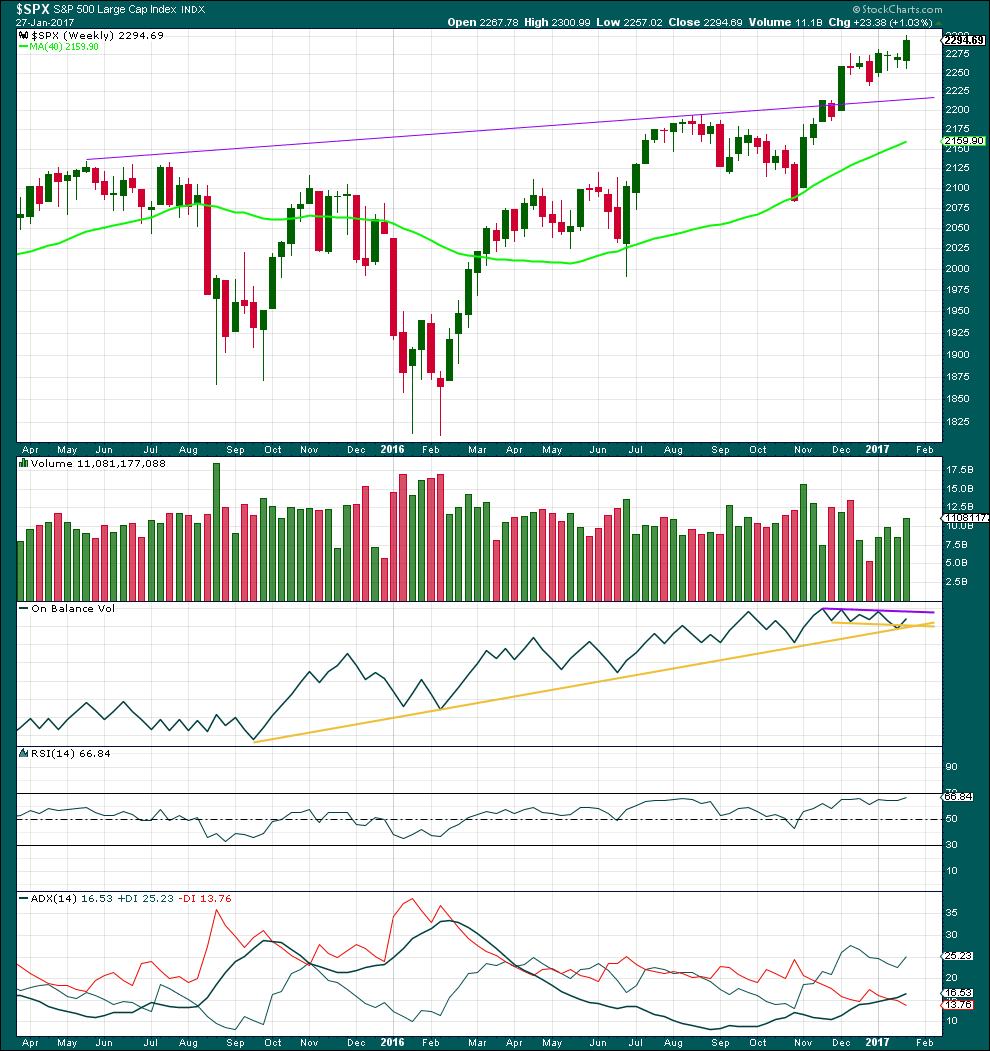

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A strong upwards week comes with an increase in volume. The rise in price is supported by volume.

On Balance Volume has found support and moved up and away from the long yellow support line. This is a bullish signal. OBV has not yet reached resistance. It may find some resistance at the purple line.

RSI is not yet overbought and exhibits no divergence with price. There is room still for price to rise further.

ADX indicates the beginning of an upwards trend. This is not extreme. There is plenty of room for the trend to continue.

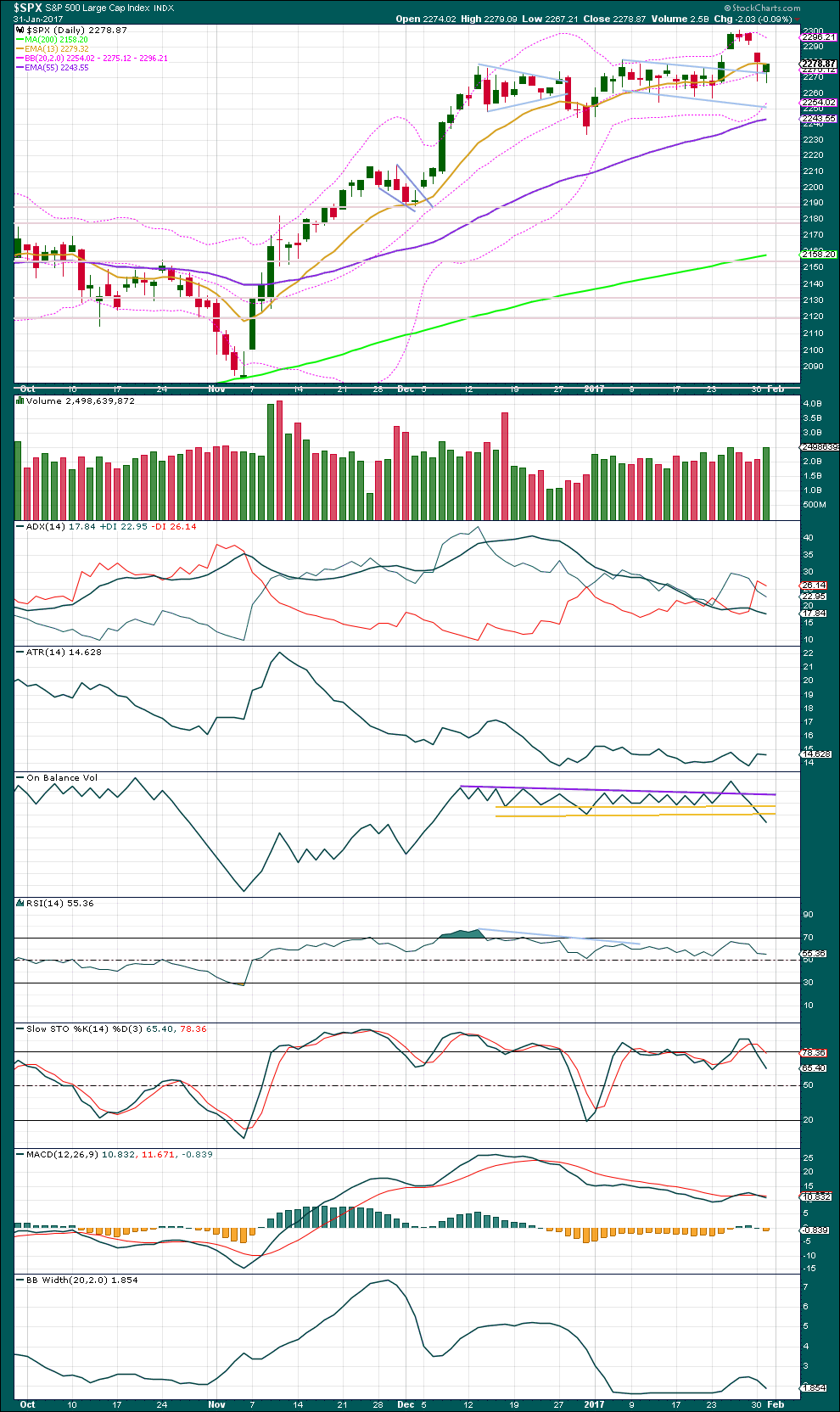

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The gap down yesterday completes an island reversal pattern. However, not much weight at all will be given to this pattern today.

From one of my favourite technical analysis texts, the classic “Technical Analysis of Stock Trends” by Magee et al:

“The island pattern is not common, and it is not, in itself, of major significance, in the sense of denoting a long term Top or Bottom, but it does, as a rule, send prices back for a complete retracement of the Minor Move which preceded it.”

In this instance, the preceding minor move would be the small upwards movement from 2,257.02 on the 23rd of January to the last high of 2,300.99 on the 26th of January.

Further from Magee: “An Island Pattern is not easy to trade on, unless it be for a short term “scalp”, as, obviously, a good share of the retracement may already have been accomplished by the time the Island is charted and an order to buy or sell on its indications can be executed.”

The preceding move has been mostly retraced. This pattern fits neatly with the expectations for the main Elliott wave count.

The long lower wicks on the last two daily candlesticks are both bullish. With two in a row now, this is more bullish than yesterday.

Volume was stronger today for a downwards day, the balance of which was down. This is bearish. On its own though this would not necessarily indicate more downwards movement.

The candlestick closed green; although bears dominated at the start of the session, the bulls were able to push price up above the open at the end of the session.

It looks like the island top was a high following an upwards breakout from a bull flag pattern. Now price looks to have curved down to find support about the upper edge of the pattern. It would be typical behaviour of price to now move up and away.

ADX still indicates the market is not yet trending, but it has indicated a potential change from up to down. No new trend though is indicated today, only a consolidation.

ATR remains overall flat. This agrees with ADX that currently this market may not yet be trending.

On Balance Volume gave a bearish signal with a break below the upper yellow line. However, this line has been breached before and OBV immediately returned above it, so the line is weakened. A parallel copy is drawn and pulled lower, but it has no technical significance. The lower line is now breached. This may be read as a weak bearish signal. Overall, On Balance Volume looks bearish.

RSI is not extreme. There is plenty of room for price to move higher or lower here.

Stochastics has only just returned from overbought. It exhibits longer term divergence with price (back to the 9th of December, 2016) which may favour the alternate Elliott wave count. Not too much weight will be given to the overbought condition as this oscillator may remain extreme for weeks during a trend for the S&P.

The bullish signal given by MACD may be negated today.

Bollinger Bands began to widen slightly as price moved higher. Now they have contracted as price moved lower. This suggests the trend here if it develops may be more likely upwards.

Overall, this classic technical analysis is more bullish than bearish.

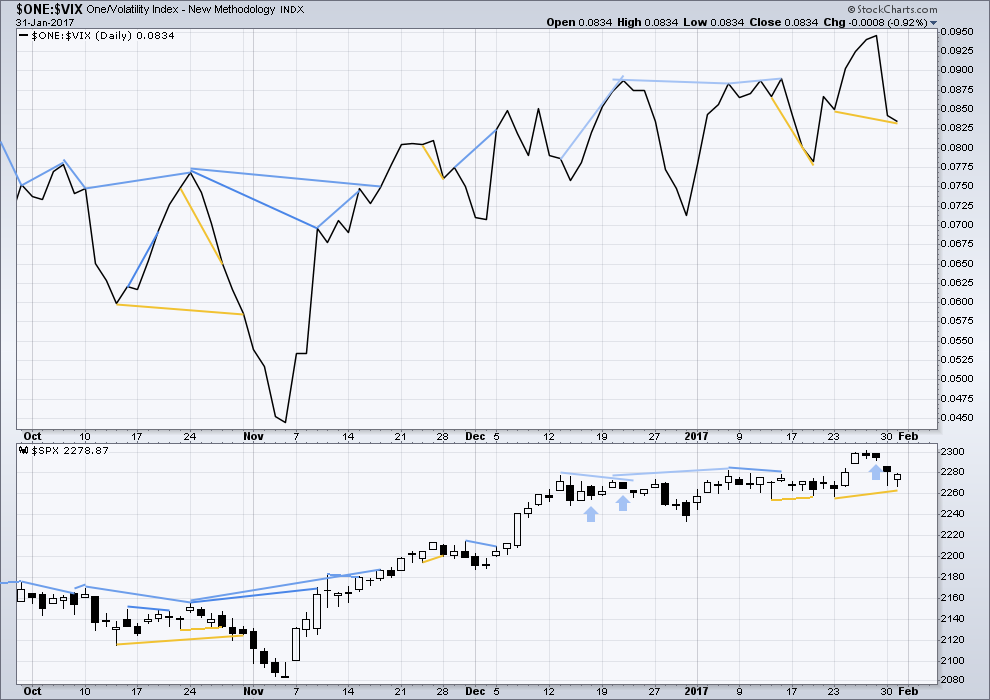

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There are a few instances of multi day divergence between price and inverted VIX noted here. Bearish divergence is blue. Bullish divergence is yellow. It appears so far that divergence between inverted VIX and price is mostly working to indicate short term movements spanning one or two days. While this seems to be working more often than not, it is not always working. As with everything in technical analysis, there is nothing that is certain. This is an exercise in probability.

Short term divergence is noted with yellow lines (this continues to develop further from yesterday): price has made a higher low from the low of the 23rd of January, but inverted VIX has made a lower low. This is hidden bullish divergence and indicates underlying strength.

Four prior instances of hidden bullish divergence are noted on this chart. Only one of those four resulted almost immediately in upwards movement, and two of the four were followed by several days of downwards movement. Only a very little weight is given to this divergence today. This offers small support for the main Elliott wave count.

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

No new divergence at today’s new high is noted between price and the AD line.

Price moved overall lower today with the balance of volume during the session downwards. But the AD line has moved higher; market breadth improved while price moved lower. This single day divergence indicates something is wrong with this session; it is not normal. This is interpreted as bullish and favours the main Elliott wave count.

DOW THEORY

The DJIA, DJT, S&P500 and Nasdaq have made new all time highs in December of 2016. This confirms a bull market continues.

This analysis is published @ 11:43 p.m. EST.

This movement is very choppy and gappy so far. (no spellcheck, not happy!) Typical of a consolidation.

I’m expecting the breakout is most likely up. But it hasn’t happened yet.

We closed above the 13 day exponential moving average. We have a long lower wick on the daily candle again. Both support the main count for a move higher to ATH.

“Choppy and gappy” certainly describe the last month plus. Really difficult to label and analyze. I might have to take a new name / handle — SOH Rodney.

On another note, today is the first day I’ve seen the sun in over three weeks. We are having a very powerful winter; record snowfall and record cold temps. This winter cannot support the global warming theory in my area. I am also getting cabin fever. I cannot wait for it to be over and our spring time begin.

It’s all about averages Rodney (climate change that is). We’ve had a not so warm but very dry summer so far. The kids are back in school this week so the waves have less grommets in them for me to navigate 🙂 Getting heaps of surf lately, so happy. My arms are noodles.

New record, almost 30 waves in a 3 hour session. Woo hoo!

Wow Lara, I’m jealous. Been flat for two weeks here. Glad someone’s surfin

Your turn next. The waves here are dying, I’m milking this swell for all it’s worth 🙂

I know next to nothing about surfing. But I can imagine catching a wave every 10 minutes for 3 hours is a very rigorous workout. Good for you.

Very interesting that the move up has filled the gap creating the island reversal. Since then price has moved down sharply. I am thinking this favors the alternate count.

Thanks Lara. We are at a difficult point with opposing hourly and daily counts especially when the odds are near equal. Your analysis while quite clear reflects the market, the overall trend is up but we are in a consolidation / correction looking for the next move up. The market presents an indecisive picture. Invalidation and confirmation points are a fair distance away from our current price. The TA indicators you present are mixed as well.

Bottom line, I am still hesitant to go long at this point.

Hoping everyone has a good day.

I’m long with a small position. I’ve set my stop just below the invalidation point on the main hourly chart.

I expect Gold to go down and the S&P overall to go up.

That’s not working so well this morning, but I’ll hold on.

I am looking for that island reversal reversal gap to be negated.

I know I sound like a broken record but the final stages of this bull should be manic and the current level of remarkable bullish presumption makes me cautious. I would be more confident with a return to the 2200 area before a sustained run higher. In all the years I have been watching volatility and its various extremes, what we are currently seeing is unprecedented imo. I do not believe the current put/call ratio is truly capturing the actual level of complacency in this market as portrayed by VIX futures. Traders are virtually 100% certain the market will be higher fifteen to thirty days out. If the market moves higher from here with this level of optimism, I would be inclined to think we are closer to a top than most of us suspect. We are either going to see a big move up as a third gets going tomorrow, or we at the least test the bottom, and possibly break, this rectangular trading range that has contained price action for so many weeks now. This is a tough market!