A small green candlestick or a doji were expected for Friday’s session. Friday completes a small green candlestick.

Summary: The probability that the upwards wave is over and the next wave down has begun is very high indeed. If the bear wave count is right (and it is supported by technical analysis), the target for primary wave 3 is at 1,423. Monday may see the session begin with a little upwards movement to a short term target at 2,063, and then a fifth wave down to new lows that may be about 33.53 points in length.

To see last published monthly charts click here.

To see how each of the bull and bear wave counts fit within a larger time frame see the Grand Supercycle Analysis.

To see detail of the bull market from 2009 to the all time high on weekly charts, click here.

New updates to this analysis are in bold.

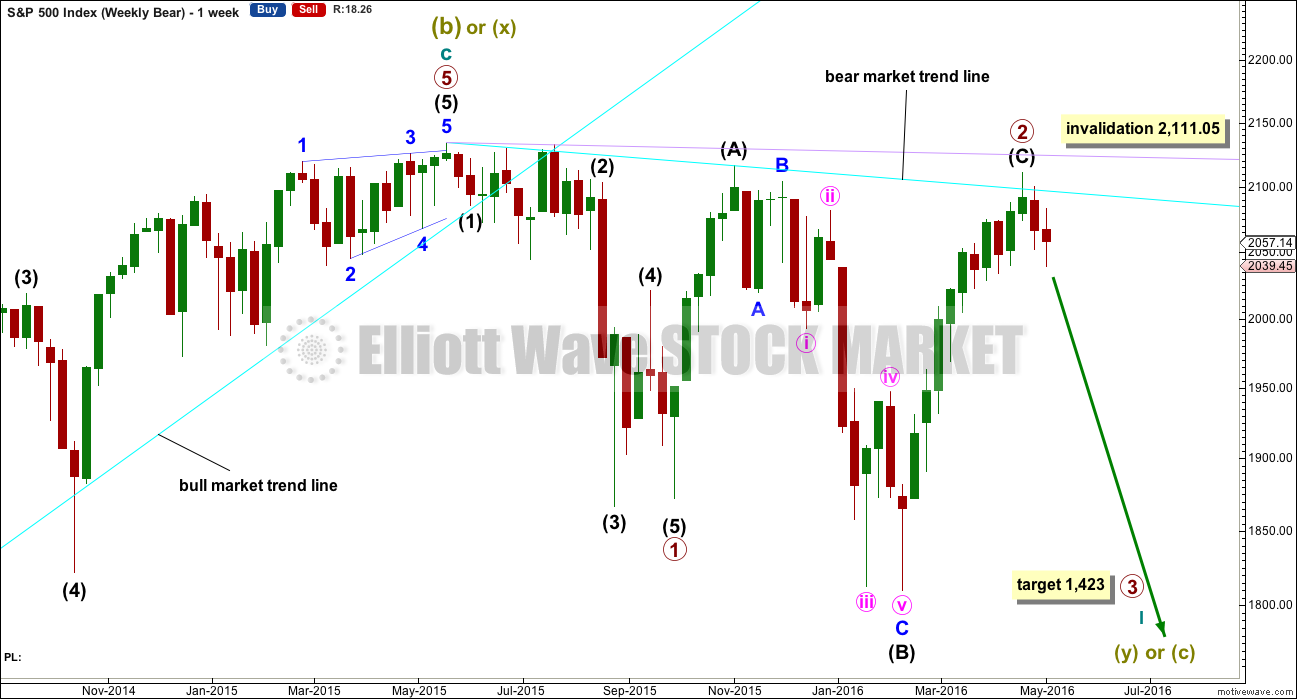

BEAR ELLIOTT WAVE COUNT

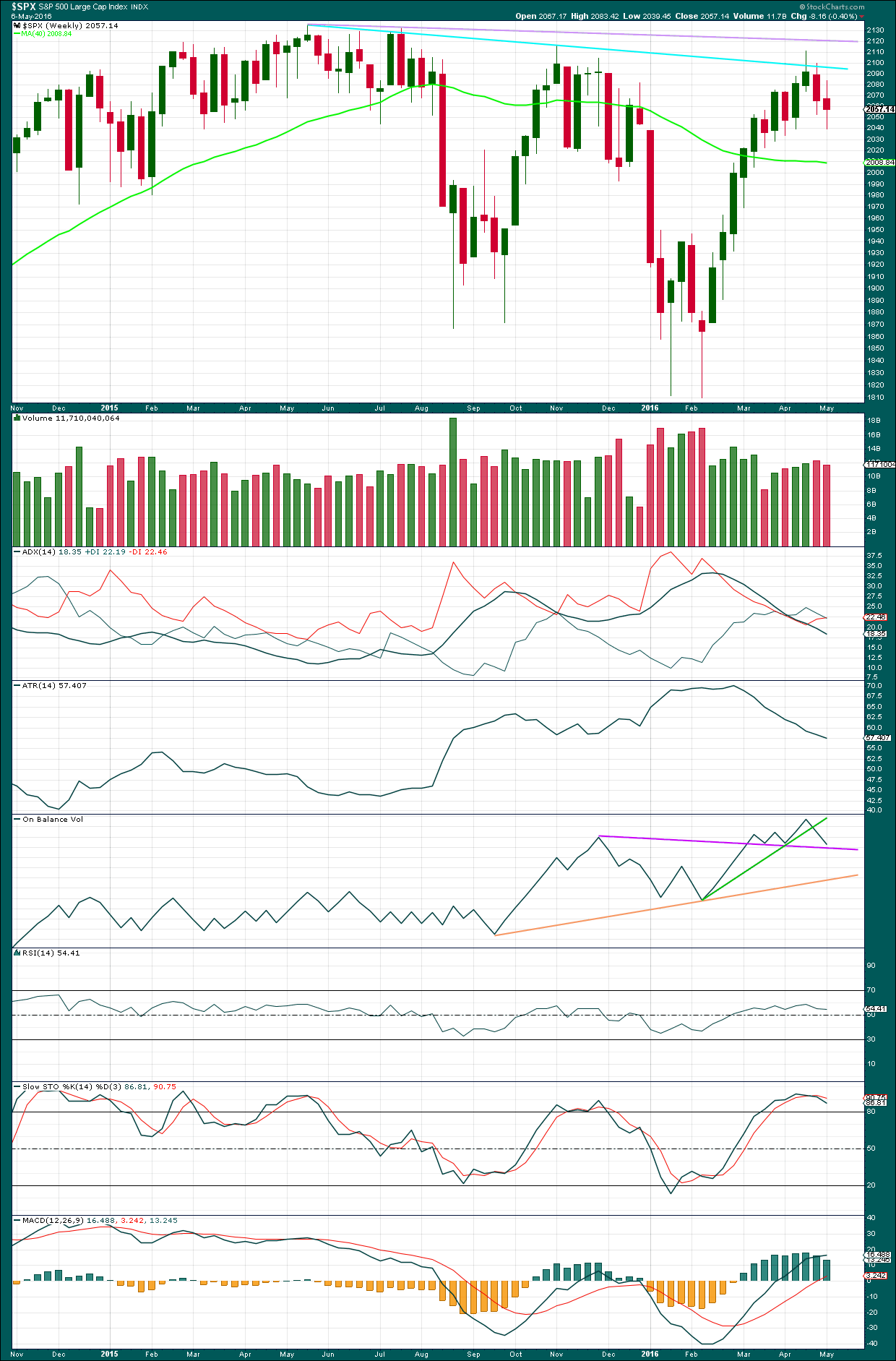

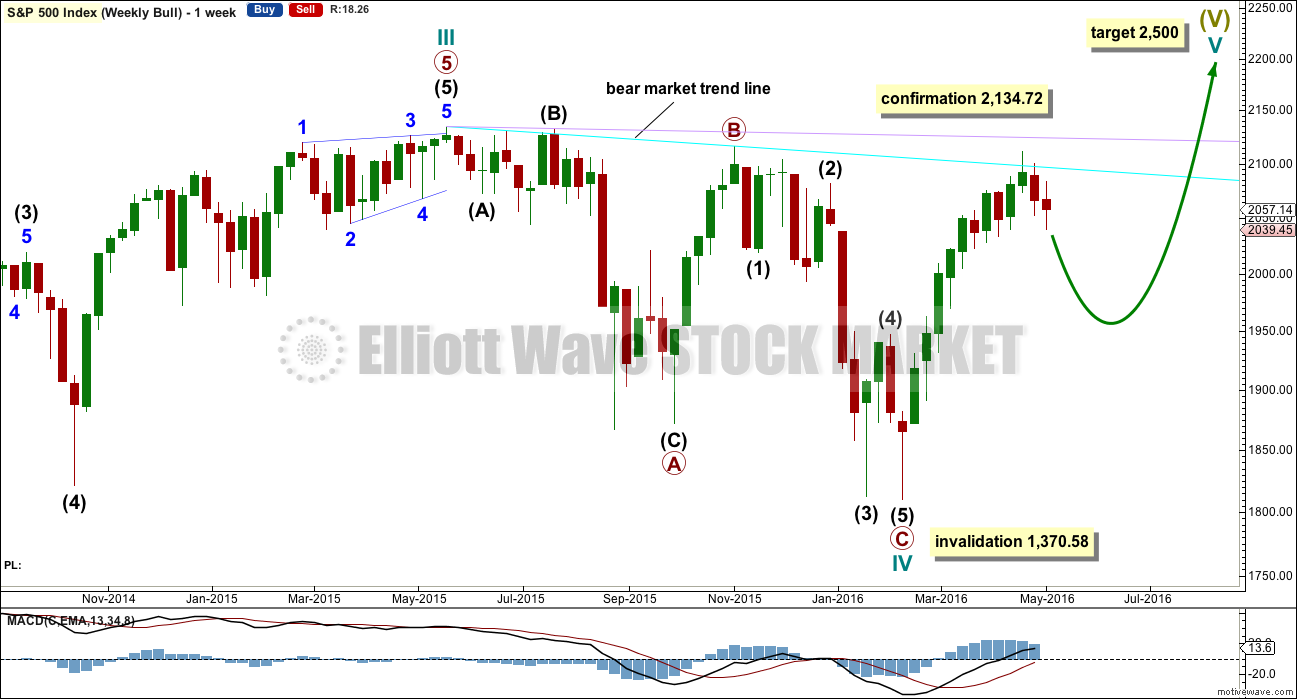

WEEKLY CHART

This bear wave count fits better than the bull with the even larger picture, super cycle analysis found here. It is also well supported by regular technical analysis at the monthly chart level.

Importantly, there is no lower invalidation point for this wave count. That means there is no lower limit to this bear market.

Primary wave 1 is complete and lasted 19 weeks. Primary wave 2 is either over lasting 28 weeks, or it may continue for another one or two weeks.

An expectation for duration of primary wave 3 would be for it to be longer in duration than primary wave 1. If it lasts about 31 weeks, it would be 1.618 the duration of primary wave 1. It may last about a Fibonacci 34 weeks in total, depending on how time consuming the corrections within it are.

At the last high in April, the weekly candlestick has a long upper shadow which is bearish. The next candlestick completes a bearish engulfing pattern. That pattern is now followed by another downwards week, so it is reinforced.

Primary wave 2 may be complete as a rare running flat. Just prior to a strong primary degree third wave is the kind of situation in which a running flat may appear. Within primary wave 2, intermediate wave (A) was a deep zigzag (which will also subdivide as a double zigzag). Intermediate wave (B) fits perfectly as a zigzag and is a 1.21 length of intermediate wave (A). This is within the normal range for a B wave of a flat of 1 to 1.38.

Within primary wave 3, no second wave correction may move beyond its start above 2,111.05.

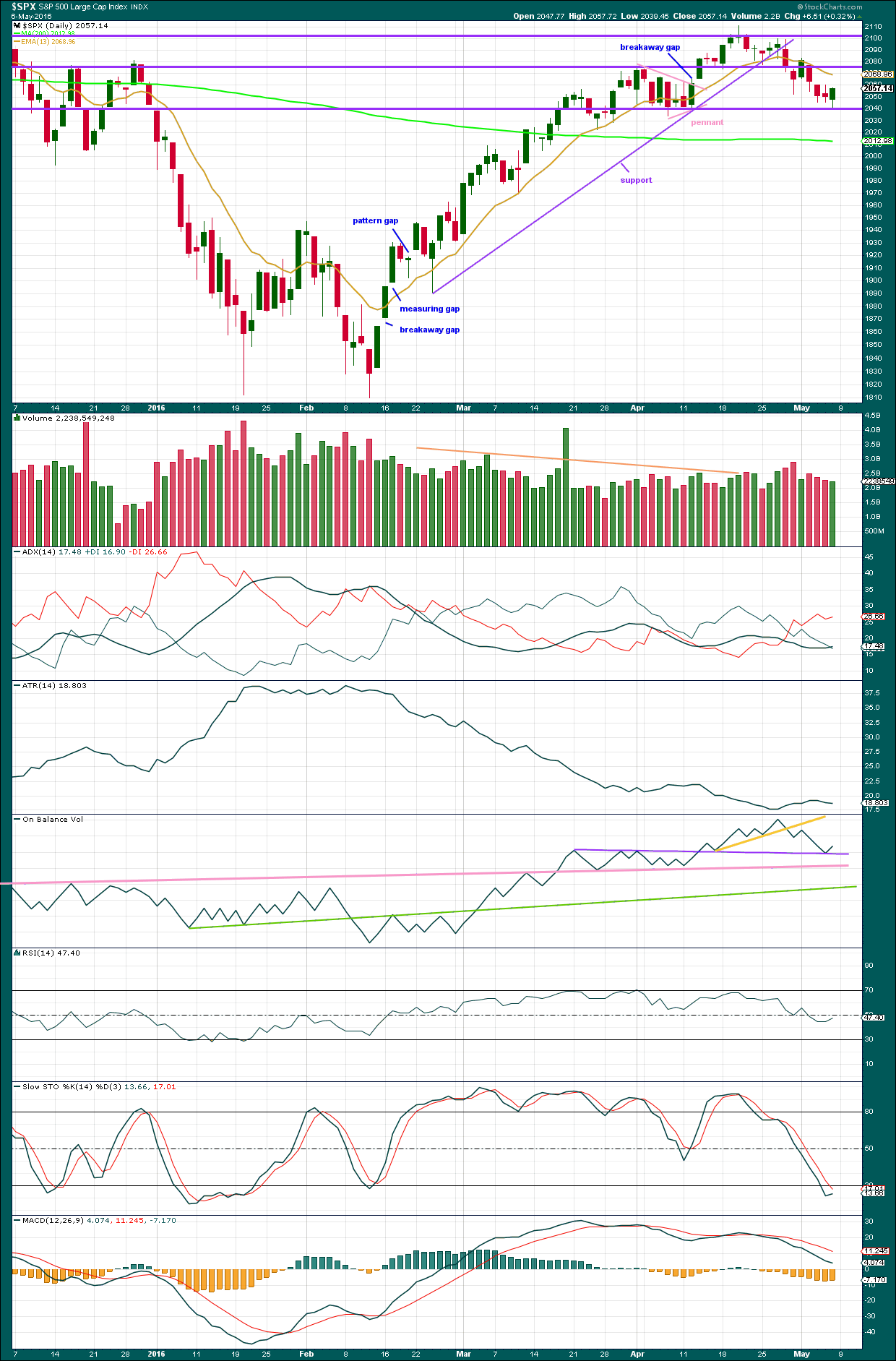

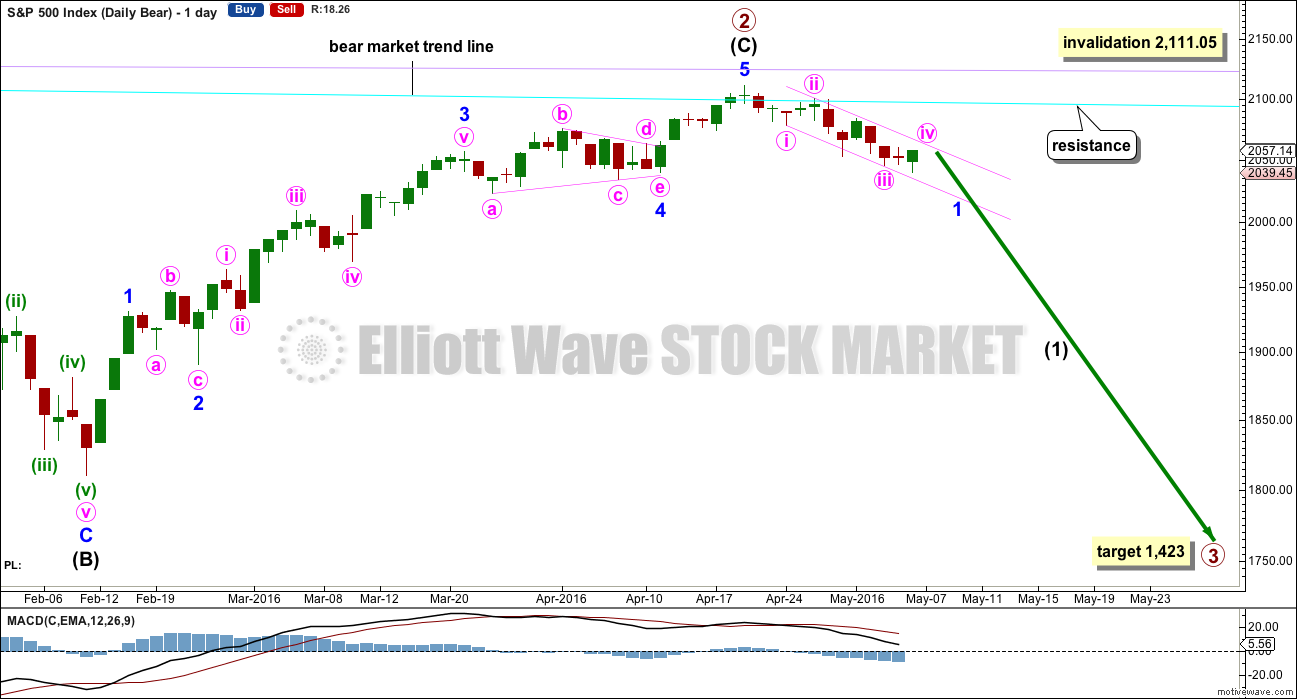

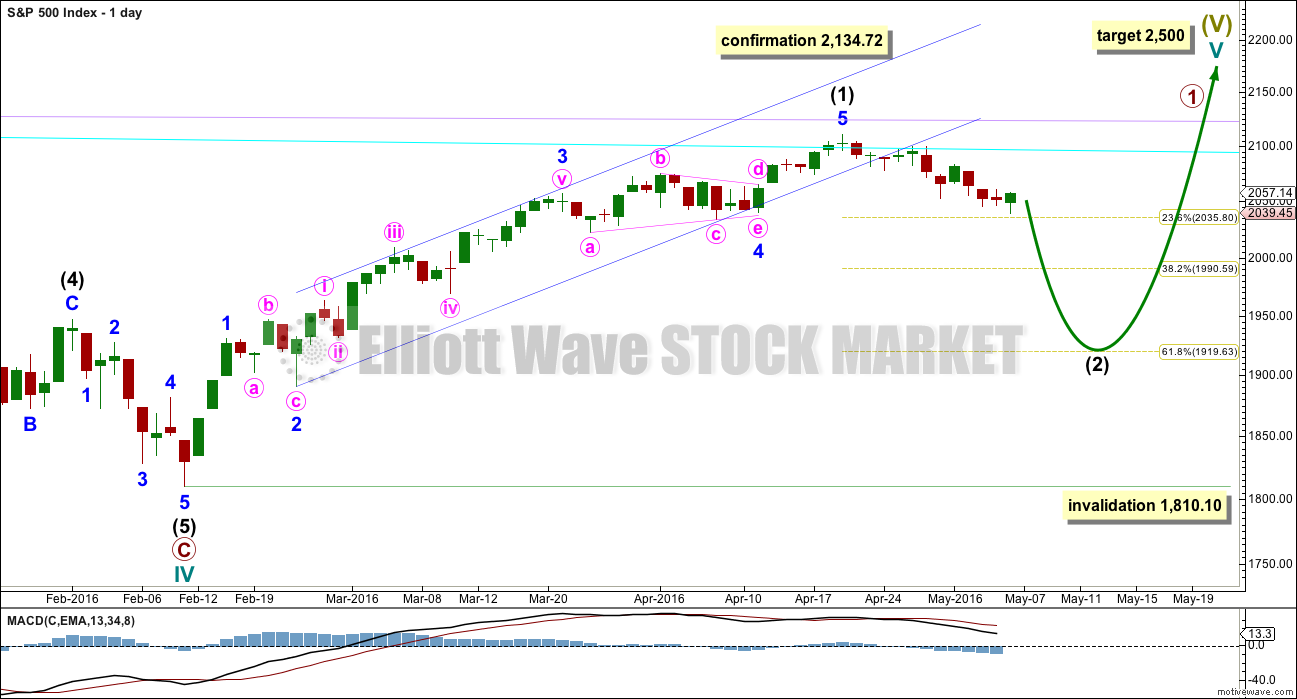

DAILY CHART

If intermediate wave (C) is over, then the truncation is small at only 5.43 points. This may occur right before a very strong third wave pulls the end of intermediate wave (C) downwards. At the end of this week, price has confirmed a trend change with a new low slightly below 2,039.74.

The next wave down for this wave count would be a strong third wave at primary wave degree. At 1,423 primary wave 3 would reach 2.618 the length of primary wave 1. This is the appropriate ratio for this target because primary wave 2 is very deep at 0.91 of primary wave 1. If this target is wrong, it may be too high. The next Fibonacci ratio in the sequence would be 4.236 which calculates to a target at 998. That looks too low, unless the degree of labelling is moved up one and this may be a third wave down at cycle degree just beginning. I know that possibility right now may seem absurd, but it is possible.

Alternatively, primary wave 3 may not exhibit a Fibonacci ratio to primary wave 1. When intermediate waves (1) through to (4) within the impulse of primary wave 3 are complete, then the target may be calculated at a second wave degree. At that stage, it may change or widen to a small zone.

Draw a small channel about the new downwards movement using Elliott’s first technique: draw the first trend line from the ends of minute waves i to iii, then place a parallel copy on the end of minute wave ii. The upper edge may show where minute wave iv finds resistance, and the downwards edge may show where minute wave v finds support.

Once there is some downwards movement for minute wave v, a subsequent breach of the upper edge of the channel would indicate that the impulse for minor wave 1 would be over and the following correction for minor wave 2 may have begun. Minor wave 2 may be deep. The equivalent minor wave 2 within the last big bear market was a 0.81 depth of minor wave 1 and it lasted one day longer than minor wave 1.

For this upcoming minor wave 2, the expectation should be for it to be deep and either even in duration or longer in duration than minor wave 1. Minor wave 2 may be deep enough to find resistance at the bear market trend line. This line should now offer very strong resistance; I would not expect price to break above it.

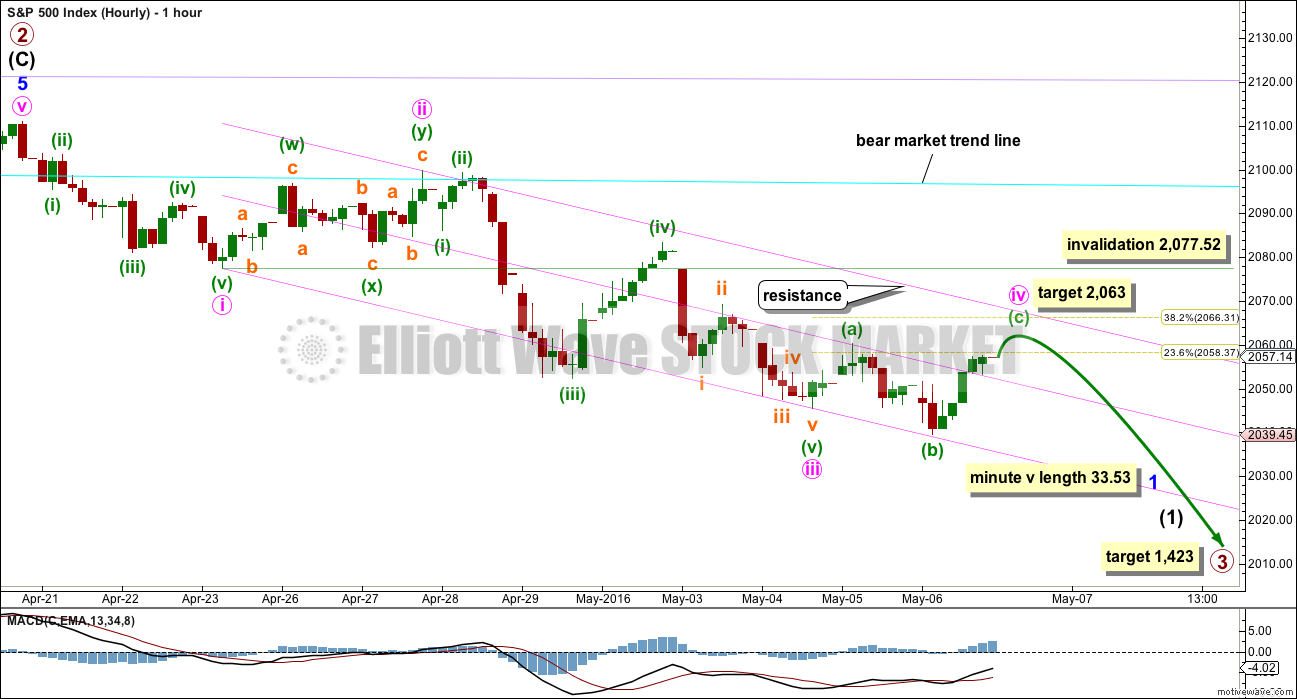

HOURLY CHART

Minute wave iii is just 0.09 points longer than 1.618 times the length of minute wave i. Minute wave iii shows an increase in momentum beyond minute wave i, and the strongest part is the middle of the third wave.

A channel drawn using Elliott’s first technique sees the middle of the third wave overshoot the lower edge. This looks typical. The upper edge of the channel may show where minute wave iv finds resistance.

Minute wave ii was a deep 0.67 double zigzag correction. Given the guideline of alternation, minute wave iv may be expected to be more shallow and a sideways type of correction such as a flat, combination or triangle. At this stage, all three options are still technically open.

So far within minute wave iv the first wave of minuette wave (a) fits as a three on the five minute chart. Minuette wave (b) also fits as a three (a double zigzag) on the five minute chart. This downwards wave will not fit well as a five. Minuette wave (b) is a 1.41 length of minuette wave (a). This is slightly longer than the common range of 1 to 1.38, but within the allowable convention of up to 2.

At 2,063 minuette wave (c) would reach 1.618 the length of minuette wave (a) and minute wave iv may complete as an expanded flat correction. An expanded flat correction may end on Monday, and it may be quick.

But minute wave iv does not have to complete as an expanded flat. This is most likely because they are very common structures, but it is not the only possibility.

Minute wave iv may continue sideways in an ever decreasing range as a running contracting triangle. If this structure unfolds, it may be time consuming, lasting another two or even three sessions.

Minute wave iv may continue sideways as a double combination. The structure would be relabelled minuette waves (w), (x) and (y). Minuette wave (y) would be underway and may complete as either a flat or triangle.

Minute wave iv may not move into minute wave i price territory above 2,077.52.

Stops may be set just above this invalidation point at this stage.

Minute wave ii lasted for two days producing two small green daily doji. Minute wave iv may be expected to last another one to three days to maybe produce another one to three doji or small green candlesticks.

At this stage, a target for minute wave v downwards to complete the impulse of minor wave 1 cannot be calculated because it is not known where it starts. Minute wave v is most likely to be equal in length with minute wave i at 33.53 points.

The S&P can behave like a commodity during its bear markets in that it can exhibit swift strong fifth waves. However, this behaviour is seen more often for third wave impulses (the fifth wave to end the third is swift and strong) and during the last bear market did not show up until the middle to end of the whole bear market. I would not necessarily expect this tendency to show up here for minute wave v, but it is a possibility to be aware of.

BULL ELLIOTT WAVE COUNT

WEEKLY CHART

Within primary wave C downwards, intermediate wave (2) is seen as an atypical double zigzag. It is atypical in that it moves sideways. Double zigzags should have a clear slope against the prior trend to have the right look. Within a double zigzag, the second zigzag exists to deepen the correction when the first zigzag does not move price deep enough. Not only does this second zigzag not deepen the correction, it fails to move at all beyond the end of the first zigzag. This structure technically meets rules, but it looks completely wrong. This gives the wave count a low probability.

This part of the structure is highly problematic for the bull wave count. It is not possible to see cycle wave IV as complete without a big problem in terms of Elliott wave structure.

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV may be a complete shallow 0.19 regular flat correction, exhibiting some alternation with cycle wave II.

At 2,500 cycle wave V would reach equality in length with cycle wave I.

Price remains below the final bear market trend line. This line is drawn from the all time high at 2,134.72 to the swing high labelled primary wave B at 2,116.48 on November 2015. This line is drawn using the approach outlined by Magee in the classic “Technical Analysis of Stock Trends”. To use it correctly we should assume that a bear market remains intact until this line is breached by a close of 3% or more of market value. In practice, that price point would be a new all time high which would invalidate any bear wave count.

This wave count requires price confirmation with a new all time high above 2,134.72.

While price has not made a new high, while it remains below the final bear market trend line and while technical indicators point to weakness in upwards movement, this very bullish wave count comes with a strong caveat. I still do not have confidence in it.

DAILY CHART

If the bull market has resumed, it must begin with a five wave structure upwards at the daily and weekly chart level. That may today be complete. The possible trend change at intermediate degree still requires confirmation in the same way as the alternate hourly bear wave count outlines before any confidence may be had in it.

If intermediate wave (2) begins here, then a reasonable target for it to end would be the 0.618 Fibonacci ratio of intermediate wave (1) about 1,920. Intermediate wave (2) must subdivide as a corrective structure. It may not move beyond the start of intermediate wave (1) below 1,810.10.

In the long term, this wave count absolutely requires a new high above 2,134.72 for confirmation. This would be the only wave count in the unlikely event of a new all time high. All bear wave counts would be fully and finally invalidated.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is a bearish engulfing candlestick pattern at the last high. This has occurred at the round number of 2,100 which increases the significance. Volume on the second candlestick is higher than volume on the first candlestick, which further increases the significance. That it is at the weekly chart level is further significance.

Engulfing patterns are the strongest reversal patterns.

Now this pattern is followed by another red weekly candlestick. The reversal implications of the pattern are confirmed.

This is a very strong bearish signal. It adds significant weight to the expectation of a trend change. It does not tell us how low the following movement must go, only that it is likely to be at least of a few weeks duration.

There is a weak bearish signal from On Balance Volume at the weekly chart level with a break below the green line. A stronger bearish signal would be a break below the purple line. At the end of this week, OBV has come down to almost touch the purple line. Some support may be expected about here, so this may prompt minor wave 2 to bounce higher.

There is hidden bearish divergence between Stochastics and price at the last high and the high of November 2015. Stochastics has moved further into overbought territory, but this has failed to translate into a corresponding new high in price. Price is weak. MACD exhibits the same hidden bearish divergence.

After a period of declining ATR, it should be expected to turn and begin to increase.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Volume data on StockCharts is different to that given from NYSE, the home of this index. Comments on volume will be based on NYSE volume data when it differs from StockCharts.

Price is finding support about the horizontal line at 2,040. A bounce up from here may be expected to find resistance at the next line about 2,070.

During this week, the two lightest volume days are both upwards days. Although volume declined while price fell for three days this week, volume for Friday’s upwards day is lighter still. The rise in price is not supported by volume, so the rise should be suspicious. It is more likely to be a counter trend movement. The volume profile continues to support the bearish wave count.

ADX is above 15 and increasing. The -DX line is above the +DX line. ADX indicates a downwards trend is in place.

ATR still disagrees at the end of the week. It is flat to declining. Some disagreement between ADX and ATR at the beginning of a new trend may be accepted.

On Balance Volume has found support and moved upwards from the strong purple line. If OBV turns back down and breaks below the purple line, then it should be expected to find support at the pink line. These support lines on OBV may serve to hold up price, albeit temporarily. Minute wave v may end when OBV finds support at the pink line. It may not be until the power of minor wave 3 arrives that OBV can break below these two strong support lines.

RSI is neutral. There is room for price to rise or fall.

Stochastics is just reaching into oversold. This oscillator may remain extreme for reasonable periods of time during a trending market.

Price may find resistance about the 13 day moving average while price is in a downwards trend, although often in the early stages of a new trend this line is overshot with the first correction.

MACD shows downwards movement is increasing in downwards momentum.

VOLATILITY – INVERTED VIX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Volatility declines as inverted VIX climbs. This is normal for an upwards trend.

What is not normal here is the divergence over a reasonable time period between price and inverted VIX (green lines). The decline in volatility is not translating to a corresponding increase in price. Price is weak. This divergence is bearish.

Price made a new short term high, but VIX has failed to make a corresponding high (pink lines). This is regular bearish divergence. It indicates further weakness in the trend.

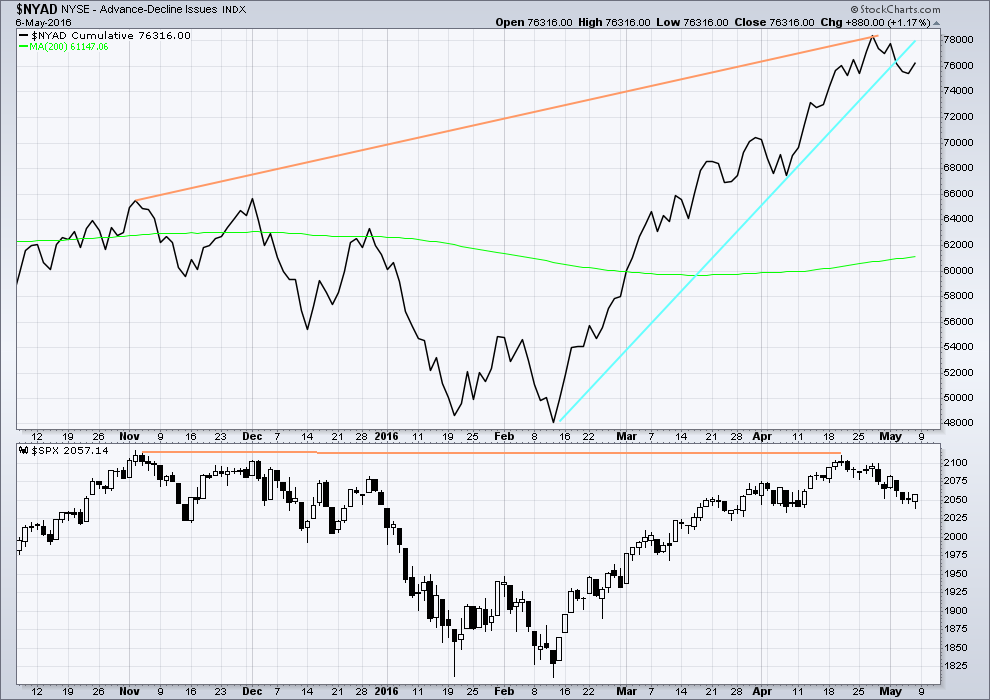

BREADTH – ADVANCE DECLINE LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

With the AD line increasing, this indicates the number of advancing stocks exceeds the number of declining stocks. This indicates that there is breadth to this upwards movement.

From November 2015 to now, the AD line is making new highs while price has so far failed to make a corresponding new high. This indicates weakness in price; the increase in market breadth is unable to be translated to increase in price (orange lines).

The 200 day moving average for the AD line is now increasing. This alone is not enough to indicate a new bull market. During November 2015 the 200 day MA for the AD line turned upwards and yet price still made subsequent new lows.

The AD line is now declining and has breached a support line (cyan). There is breadth to downwards movement; more stocks are declining than advancing which supports the fall in price.

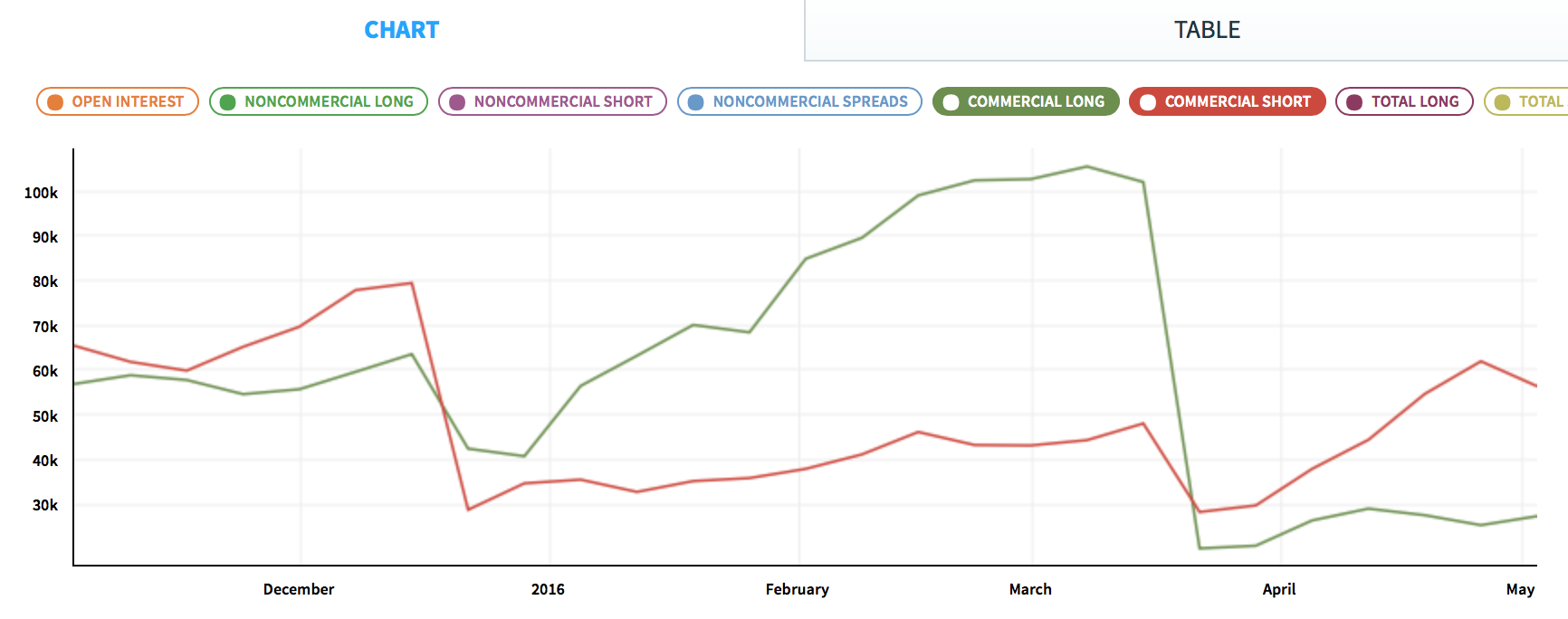

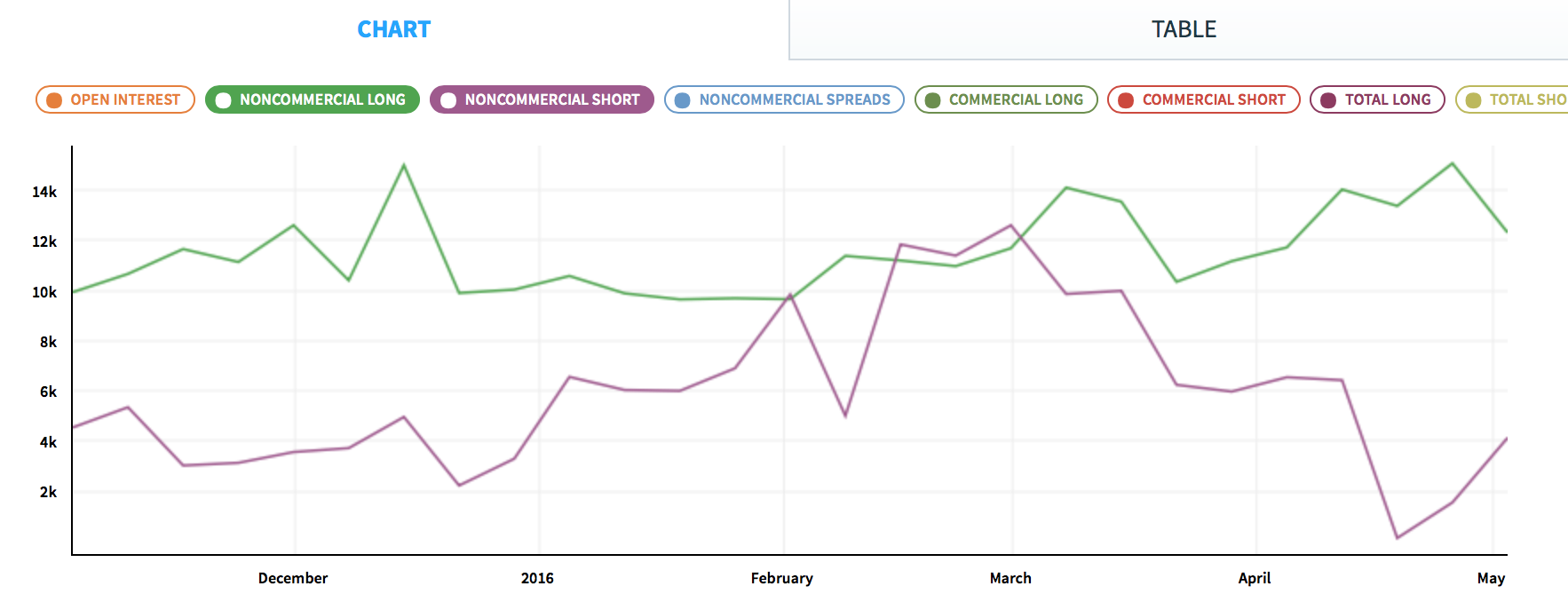

SENTIMENT – COMMITMENT OF TRADERS (COT)

Click chart to enlarge. Chart courtesy of Qandl.

This first COT chart shows commercials. Commercial traders are more often on the right side of the market. Currently, more commercials are short the S&P than long.

At the end of this week, commercials have decreased short positions and slightly increased long positions, but overall they remain more short than long. This still supports a bearish Elliott wave count. A bounce for minor wave 2 may be anticipated by the commercials.

*Note: these COT figures are for futures only markets. This is not the same as the cash market I am analysing, but it is closely related enough to be highly relevant.

Click chart to enlarge. Chart courtesy of Qandl.

Non commercials are more often on the wrong side of the market than the right side of the market. Currently, non commercials are predominantly long.

At the end of this week, non commercials have strongly increased short positions and less strongly decreased long positions. They remain overall long.

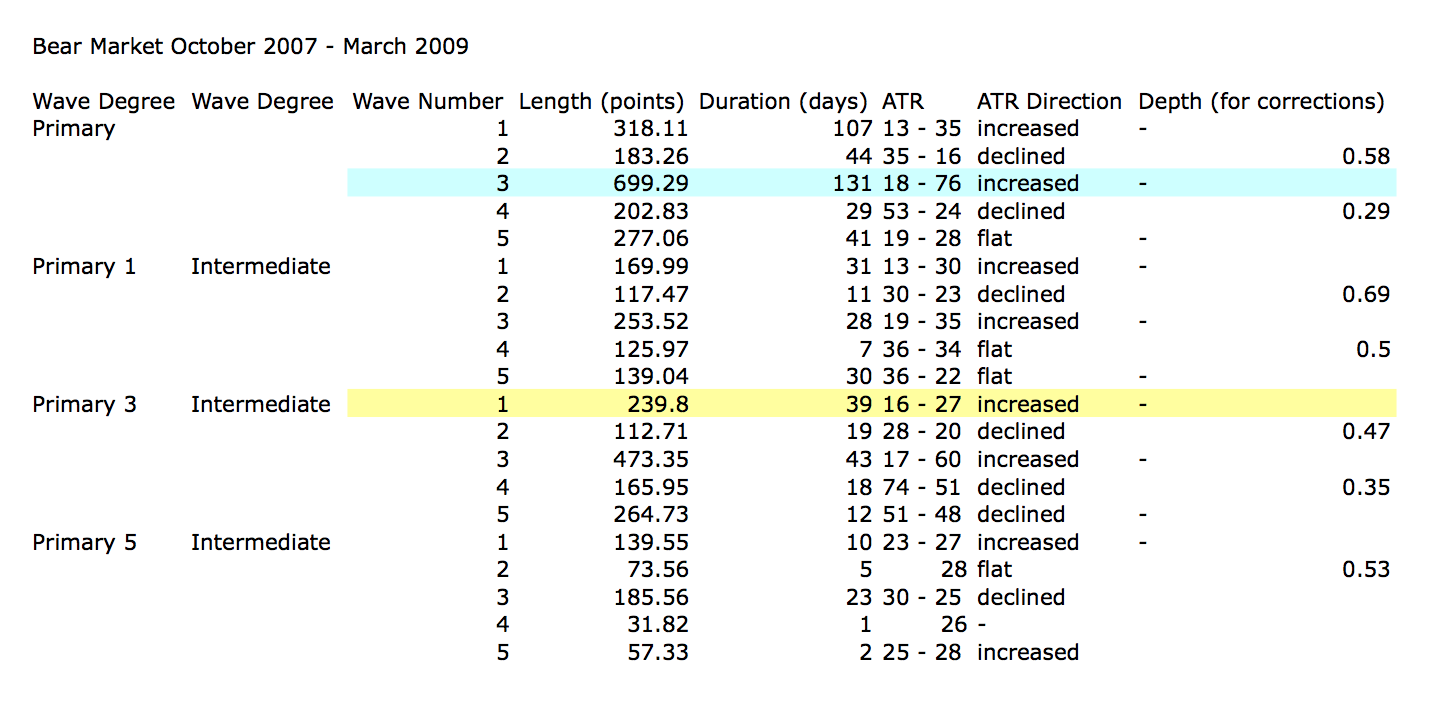

ANALYSIS OF LAST MAJOR BEAR MARKET OCTOBER 2007 – MARCH 2009

In looking back to see how a primary degree third wave should behave in a bear market, the last example may be useful.

Currently, the start of primary wave 3 now may be underway for this current bear market. Currently, ATR sits about 19. With the last primary degree third wave (blue highlighted) having an ATR range of about 18 to 76, so far this one looks about right.

The current wave count sees price in an intermediate degree first wave within a primary degree third wave. The equivalent in the last bear market (yellow highlighted) lasted 39 days and had a range of ATR from 16 – 27.

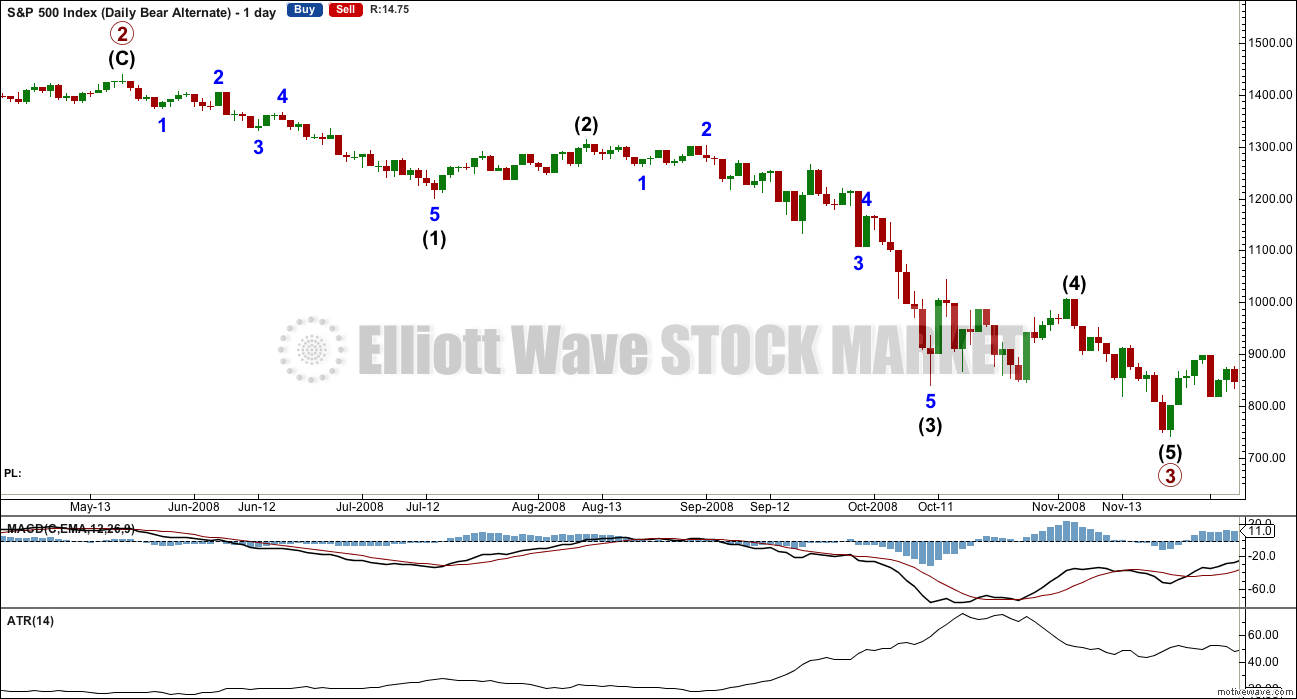

This chart is shown on an arithmetic scale, so that the differences in daily range travelled from the start of primary wave 3 to the end of primary wave 3 is clear.

Primary wave 3 within the last bear market from October 2007 to March 2009 is shown here. It started out somewhat slowly with relatively small range days. I am confident of the labelling at primary degree, reasonably confident of labelling at intermediate degree, and uncertain of labelling at minor degree. It is the larger degrees with which we are concerned at this stage.

During intermediate wave (1), there were a fair few small daily doji and ATR only increased slowly. The strongest movements within primary wave 3 came at its end.

It appears that the S&P behaves somewhat like a commodity during its bear markets. That tendency should be considered again here.

This chart will be republished daily for reference. The current primary degree third wave which this analysis expects does not have to unfold in the same way, but it is likely that there may be similarities.

DOW THEORY

I am choosing to use the S&P500, Dow Industrials, Dow Transportation, Nasdaq and the Russell 2000 index. Major swing lows are noted below. So far the Industrials, Transportation and Russell 2000 have made new major swing lows. None of these indices have made new highs.

I am aware that this approach is extremely conservative. Original Dow Theory has already confirmed a major trend change as both the industrials and transportation indexes have made new major lows.

At this stage, if the S&P500 and Nasdaq also make new major swing lows, then my modified Dow Theory would confirm a major new bear market. At that stage, my only wave count would be the bear wave count.

The lows below are from October 2014. These lows were the last secondary correction within the primary trend which was the bull market from 2009.

These lows must be breached by a daily close below each point.

S&P500: 1,821.61

Nasdaq: 4,117.84

DJIA: 15,855.12 – close below on 25th August 2015.

DJT: 7,700.49 – close below on 24th August 2015.

Russell 2000: 1,343.51 – close below on 25th August 2015.

To the upside, DJIA has made a new major swing high above its prior major high of 3rd November, 2015, at 17,977.85. But DJT has so far failed to confirm because it has not yet made a new major swing high above its prior swing high of 20th November, 2015, at 8,358.20. Dow Theory has therefore not yet confirmed a new bull market. Neither the S&P500, Russell 2000 nor Nasdaq have made new major swing highs.

This analysis is published @ 04:38 a.m. EST on 7th May, 2016.

While the high at 2,064.15 I have labelled minute iv holds this wave count will be possible.

The duration of minute ii and iv is perfectly equal at 20 hours each. There is perfect alternation: minute ii a deep double zigzag, minute iv a shallow expanded flat.

Minute iii is 1.618 X the length of minute i. At 2,031 minute v would = minute i in length.

It all looks absolutely textbook perfect. So perfect…. I’m sure Mr Market will stuff it up.

But so far this will be the wave count.

Risk is minute iv is not over and may continue sideways as a triangle or double flat or double combination.

From the high at 2,064.15 there could be a short first wave down and a deep expanded flat second wave correction, with C as an ending expanding diagonal.

That explains alot… Very nice!! 🙂

Eventually there will come a day when diagonals don’t fool me – just now quite yet.

The picture looks so much clearer now! Thanks Lara

You’re welcome all 🙂

So far its looking good. I’ll be expecting a red candlestick for Tuesdays session.

Minute v may last one to three sessions.

And so minor 1 may end in one to three sessions, and then minor 2 may begin upwards. I’ll be looking to exit my shorts at the end of minor 1 because I am expecting minor 2 to be very deep.

Exit my shorts…. LOL

I think I’ll keep my shorts on and close my trades.

ROFL – Thought was maybe part of your happy dance 🙂

(I totally read it as it was meant until you mentioned it!)

Awww Shucks!!! 🙂 🙂 🙂

woo hoo

perfectly ok to trade in your underwear,,, you can tell me,, Im a doctor,,, then again,, who wears underwear

It does look like we now have a low with a hammer on 5 min UVXY chart…

Now let’s take out shorts from basing area of 14.50- 14.75…thank you!

Oh and by the way, a close of that gap would be nice too; if not today, how’s about tomorrow?! 🙂

Considering where so many other indices are trading relative to their 200 DMA (RUT, DJT, NDX), I am deeply curious to see how SPX and DJI react to this pivot. They could be about to play catch up and take it out decisively, although one would be inclined to expect a bounce there. How they trade there may give some great insight about our anticipated P3 juggernaut….

Sharp break out of diagonal should be reversed if it is terminal…

Adding UVXY shares at 14.01

If todays high holds that may prove to be a great price.

I don’t think minute four is done. This last wave looking very much like another ending diagonal. UVXY not behaving as it should,. or would during an impulse down.

If we exceed 2064.16 then the best choice is Olga’s from below, minute iv continues. It looks like it is going to happen any moment.

Rodney, I’m starting to wonder if we might still be in (c) of Minute (iv)?? Is this a triangle W4 of (c) of Minute (iv) unfolding right now? If so then my scalp is about to go deep underwater in the short term.

New low below 2054.27 would invalidate it.

Hey guys, being a newbie here, can you please explain why most of you trade UVXY vs something like SPY puts. I understand that UVXY works well when there is clear downtrend in the market and the level of fear rises rapidly, but my concern is the decay during the sideways market like today.

Wouldn’t going long SPY puts be a better option for the more sideways market as the time decay is more predictable and then switch to UVXY once VIX rises closer to 20, as then month 1/2 contango would not cause UVXY to decay so much daily/weekly?

Appreciate all your comments.

Olga,

I am counting 5 down completed at today’s low of 2054+ with an extended third wave. We are now in the first correction, minuette 2, of minute wave 5 of minor 1.

BTW, the ending diagonal of minute 3 has been bothering me. I know it is technically possible, but I just don’t recall ending diagonals in third wave positions. I am sure they are much more common at a fifth wave position of the full impulse of the same degree. Just my thought.

Yeah I agree it could be counted as either a 5 or a zig zag. The W4 (if it’s a 5) looks a bit odd to me – looks more like a B wave between 2 impulses. But you can never be totally sure at such low degree.

I’m betting now on more downward movement so provided we don’t make a new high I’m happy. Unfolding wave structure will eventually confirm whether it was a 3 or a 5.

You were right about that 3 the other day so I’m not gonna argue 🙂 🙂

Of course I also am waiting for the conclusion of minor 1 with a new low. I guess I a may be turning into to much of an EW nerd if something like that keeps popping up in my mind. And you are correct, if we can confirm the movement at a higher degree, what happens at the lower degree can be left alone.

Sorry – by new high I meant I’m currently betting on there not being a new high above 2064.10 not a new ATH (I imagine we’re all now betting on there not being a new ATH!). Should really make myself clearer.

I also need to stop commenting so much – but the waves are getting alot more exciting 🙂 🙂 Been boring for months…..

Olga, with every comment I learn a bit more. Please keep ’em coming!

Me too – love to follow along your comments – adds a lot to my understanding, plus it’s interesting…

Thanks guys – I’ll try at least to keep them straight to the point 🙂

I understood what you wrote.

Lara mentioned we might get sideways movement, could be a long boring show.

Yep – I think that’s the case. We might get a few scalps out of it though.

We should be heading down just about now for the immediate bearish case…2060.34 possible wave four area…

That’s just gone up in smoke with the move above 2060.20 – Mr Market being the usual sly old dog.

EDIT – 2060.20 could be W4 (of the first 5 waves down), but I can count a quite nive 5 wave down before that so I’m currently thinking probably not. Also both waves down are about equal length which makes them probably A & C waves imho.

I expect we are about to move down again soon anyway so might be a good scalp here with a stop at todays highs??

Ok – Bought in again @ 14.49 – gonna try another scalp.

Think I might be pushing my luck 🙂 but this move up is also corrective I reckon, so should be retraced fairly soon. At best if Verne is right we should start to fly lower.

Bought 10% UVXY @14.55 with a stop at 2060.24.

Whilst there is no confirmation I intend these to be just scalp trades.

Mental stop moved down to 2059.37 – if goes above there then I think we’ll be range bound so will probably hold out for a break even then SOH with 20% dry powder.

Sold at 14.57 (break even inc commision) – gonna SOH until Mr Market shows his hand.

Should be a small third down on deck; if not Olga’s zig-zag in play….

I’m now more inclined to think we are in a larger W4 correction which is going to go sideways for a bit longer. It’s starting to look a bit odd for a W5 (of C) extension imho.

Whilst we remain below 2060.24 it could be a 3rd wave that’s just starting slow, but I suspect the reason UVXY is acting odd is because W4 is not yet over.

It might start picking up steam soon so I’m keeping an open mind.

Could be a very sluggish second wave still developing. Fractured markets weighing heavily against a bullish outlook…

Confirmed 5 down 3 up from todays high imho – moved my stop on todays purchase down to 2060.24. Until we get below 2053.21, this could be a zig zag correction (W2 of W5 of C), but we have now broken well below the lower trendline.

EDIT

Still not happy with UVXY – sold 10% @ 15 – will re-buy it when we go below 2053.21

1min Chart 🙂

The (possible) 5 up from 2039 I can also count as a double zig zag (which would make it a 3 wave move) so UVXY might be telling us we’re seeing a larger triangle / corrective structure developing.

If this current move down starts looking corrective without going above todays high then a triangle would be my first guess.

Your input is much appreciated Olga 🙂

You’re very welcome – chart of that idea

I certainly do not want to force anything but I can see a five down in DJI on the five minute chart. Let’s see if we get a three wave bounce…it all seems to be unfolding in slow motion…

UVXY headed lower; may be completing a five down…

We have the makings of another boring side-ways trading day I am afraid. Probably not much to see before we approach the close… *Yawn*

Just bought UVXY @ 14.62 – now @ 90%.

Didn’t await full confirmation so I might get burnt temporarily, but this small move up from 2056.45 looks corrective to me (atm!).

Whilst we remain above 2053.21, I’m in danger of us taking out today’s high in an extended 5th.

Now for a higher low in UVXY before hopefully a sprint into green territory…and of course a fill of that open gap from this morning…

The plethora of triangular formations the market has been making is really weird. We have yet another one today. It must be a symptom of market lethargy. I expect we will again see some sort of break up from this one before we get our initial impulse down.

A bit concerned atm with UVXYs lack of enthusiasm.

Might be signalling an extended W5 on the cards – below 2053.21 should put that idea to bed.

I think one more pop higher…

Below 2057.67 would confirm a reversal now – but UVXY still strange.

I might be looking a gift horse in the mouth, but I’m suspicious atm!

We might only be seeing wave A of an ABC from short term 2056.45 low atm – maybe UVXY is just signalling that Wave C of this ABC (if that’s what it is) will go a bit higher

Lower trendline currently providing support. If we get a small 5 down 3 up I’ll probably pounce 🙂

A small 5th down now would take us below the trendline.

EDIT – got that 5 down – now need a confirmed 3 up.

UVXY’s lack of conviction still bugging me though 🙁

This 5 wave move down from todays high might be a foxy C wave.

Adding to 15.00 strike calls. If this is a minuette four, closing gap at 15.27 from Friday will be filled today…open order to sell at 1.50…

Easily I think – it seems to already be signalling a turnaround.

Still hoping we get a bit of an extension but not holding my breath – might be on catch up to fill final 20% position.

Picked up a few speculative 15 strike UVXY calls expiring this week for 0.80 per contract; empahsis on speculative… 🙂

I think this wave is nearly done – nice 5 up.

Below 2060.50 (poss W4 of W5 of this wave C up) is probably the 1st sign.

Whilst above there W5 of C might extend, albeit we’re already at the target and W3 of C showed a nice extension.

3min RSI signalling a turnaround not far away atm. I’ve go a feeling I’ll have to buy above 15 awaiting that confirmation, but you never know – we might go a bit higher (so UVXY lower).

Check – lower trendline break – 2nd sign.

Below 2053.21 – 3rd Sign (i.e. W5 can’t be extending)

Below 2047.38 – 4th Sign (i.e. cannot be a W4)

It looks like we may have already had that double tap on the day’s low. I was able to lower my cost basis a bit on the revisit…

14.60 UVXY pre-market (at time of writing!) – perhaps the MM who filled my order at 15 after hours Friday wasn’t being so nice afterall.

Got a bit of dry powder to take advantage of any further discounts on offer 🙂

Doesn’t always work (you need to ensure you are within the larger EW context), but I’ve noticed UVXY will often go in the opposite direction as to what it was pre-market once the market opens. Perhaps we’ll see that again today.

If we can get down to 14 I’ll be very tempted 🙂

Olga,

Trading below $15 pre-market so I am getting ready to fire a shot or should I say stink bid (as Vern would say). I see a possibility of UVXY hitting $14.56 worst case $13.79 ( if the markets really ramp up).

Unless I see a turnaround I’m waiting for sub 14 (or close) to throw more powder at it. I risk ‘missing the boat’ but this market seems to be trading at extremes and has suprised me numerous times before.

Future are all in RED as oil prices retreated so we will see how much down UVXY gets today, I am in no rush as have a small position in play now

Unbridled short seller enthusiasm. We may see a commodity -like minute fifth down. UVXY acting like a second wave correcting going so low…

Top O’ the morning all!

Just a thought but given the correlation between stocks, is it at all possible that both the nasdaq and S&P have completed a minor 1, just curious as the nasdaq has broken above it’s decending channel line! is this reason enough for caution or is there confidence in another decline to finish minute wave v of minor 1.

Nasdaq has closed pretty close to that small channel I have, but that’s not enough to say it’s broken above yet.

For Nasdaq I’d have that also as minute iv.

But then, the count on Nasdaq is always harder than S&P. It’s gappy (no spell check, not happy) and it’s impulses aren’t always clean looking. So I’d let my count for S&P lead Nasdaq, never the other way around.

Thanks Lara, i must be placing my channel lines incorrectly, i see you add the first channel from minute i to minute iii but my top channel line just doesn’t look the same as yours also the price is different? Am i looking at something different? LOL

Our data may be slightly different.

This is how I’m drawing my channel and labelling Nasdaq ATM. So far I’d label the correction as minute iv.

Is this still a valid alternate wave count?

Happy Mother’s Day!! 🙂

Thanks Thomas for the chart and the Happy Mother’s Day wish.

As clearly stated numerous times, I am not a wave counter. When Lara published the current main / preferred bear hourly count and did not continue publishing the predecessor (your’s above), I assumed that this count was eliminated. As I am still fully loaded for the downside, I’d love to see this count revived. But I think that is wishful thinking. If it were still viable, I am guessing Lara would continue publishing it.

I don’t think the alternate wave count above violates elliott wave rules and the waves have better proportions therefore giving it a better look imho.

Lara’s primary hourly bear wave count certainly fits well with MACD. I didn’t spot this count on my own and appreciate Lara’s talent for recognizing these patterns.

Technically, yes. But it doesn’t fit with momentum.

The current count fits perfectly with MACD and it has a great Fibonacci ratio. The probability of the current count is very high compared to this alternate idea. Which is why I stopped publishing the alternate idea.

Thanks for the Happy Mothers Day wish. I did have a fabulous Mothers Day.

I instructed my teenager to get or make me a card and write something nice in it. I got a birthday card. With some nice words inside that made me very happy 🙂 And then I ate chocolate and everything was right with the world.

UVXY made a high of 59 at the end of minute three of minor C of intermediate B on Jan 20, and a slightly higher high of 61.92 on Feb 11 at the end of minute 5

And the point is?

How to spot the end of third and fifth waves within an impulse on S&P?

I see. When I first read it, I did not realize it was a continuation of the conversation below. Got it now. Thanks.

Sorry about the fragmentation. I have not figured out how to post two charts on the same comment…. 🙂

It’s annoying isn’t it that you can’t do that. But so far not possible. Use the reply and reply to yourself?

Lara’s observation in this update about the upcoming minor two correction is critical. I suspect, like the last one, it will be very deep, and possibly deeper considering the nature of the top. A lot of unsuspecting cubbies are going to be violently dislodged as the banksters mount a furious attack at the end of minute one down. I suspect it will complete intra-day with a swift reversal accompanied by the tell-tale hammer. Option traders will definitely want to book profits at the end of minute one down. I think it makes sense for position traders to do the same as the top of minute two will offer a better entry for the sweet spot of the trade of intermediate one down, namely, minute three. If UVXY behaves normally, we will see a spike at the end of minuette three of minute five down, and a slightly higher high at the end of minuette five down with a long upper wick in VIX and the same in UVXY or a spinning top with long upper and lower wicks.

In the past UVXY used to make its spike high at the end of the third wave down with a slightly lower high at the end of the fifth. At the last two interim lows on Jan 20 and Feb 11 (minute three and five of intermediate B) the higher spike ocurred on the actual day of the low as the fifth wave down completed.

In this UVXY showed some divergence from VIX as its high was actually made at 32.09 at the end of minute three down, and a slightly lower high at 30.9 on Feb 11 on completion of minute five of intermediate B.

My plan is to take profits at the end of minuette three, and with confirmation from VIX and/or UVXY enter long trades for minor two up.

Huge kudos to Lara for razor sharp EW analysis, that lets rightly piece together the volatility puzzle!

I will post a separate chart showing the spikes for UVXY.

I agree wholeheartedly. Thanks for the info regarding how UVXY may top out at the 3rd wave instead of the 5th. I am going to enter my sell price on Monday morning trying to anticipate the low of Minor 5. But I want it set in case I need to be away from my desk during market action.

I do not like trading 2nd waves. Minor 2nd waves are generally large enough to be able to take some profits. But they require daily and intraday diligence and observation. So I will let it go.

Around 2090 will be the point I begin loading the wagons again in anticipation of the downward move of Minor 3 of Intermediate 1 or Primary 3. My hope and guess is that Minor 3 will takes us below the 2000 level. I am guessing Intermediate 1 to take us down to the 1800 level before another bear trap 2nd wave at the Intermediate level. Then the long awaited Intermediate 3 of Primary 3 will strike taking us into the 1600’s or 1500’s.

Have a great weekend everyone.

Trading counter-trend moves is harrowing to say the least and I can understand taking a pass. I am learning that the key is ignoring the volatility during the correction and focusing on the duration and price targets. When it comes to price targets Lara is usually very accurate and that helps quite a bit. The bear market trend line is also proving to be a very reliable place to anticipate reversals.

The NY Fed chairman is already talking about further authority for the FED to bail out securities firms. I think it is going to be prudent to make timely withdrawals from brokerage accounts as the bear takes hold.

I already faced a brief lock-out of my account during one of the steep declines earlier this year. Fortunately I had entered my positions the day before. We will be sailing in uncharted waters in the months ahead.

Your words about problems we may anticipate with our brokerage accounts are wise ones. We could see some failed brokers and locked accounts, notwithstanding the SPIC insurance. If you are locked out of your account for weeks or months, the guarantee won’t do you you much good as you watch your holdings expire or fall in value during the lockout.

I would recommend to others what I have done–distribute your assets over more than one broker. Its a pain in the arse and it may slightly increase the risk of one broker going bust, but decreases your overall risk.

Just what we traders need is yet another area of risk, like we don’t face enough already, eh?

FWIW IB state that they don’t have more than 5% of client money (i.e. cash – albeit it’s not really is it! 😉 ) in any one bank.

I have got *significant* amounts of money in my brokerage account with them but mostly that is in PSLV (and PHYS to a much less extent one – can’t remember the symbol), so it’s not really with them – I’d just have the hassle of proving ownership to the liquidator (so I keep good records). I’d still much rather have it that way than it be sat in bank digits.

Problem with owing physical silver is the amount of space the stuff takes up for a decent position – hence why I’m using PSLV. Flogging the stuff would probably also be mega hassle.

Counterparty risk is a huge problem which will only become bigger imho – I take the threat incredibly seriously. It will be those who lose least that win the most.

That does help protect the broker’s clients when they spread their cash throughout more than one bank. However, it doesn’t cover all the bases. The problem is that its not just the banks in which cash is being parked that are at risk but the brokers themselves could be as well. When a client gets overextended and can’t cover his bets the broker is still liable to cover the other side of the transaction. With a number of large transactions, and/or his own assets poorly managed, the broker could get into trouble regardless of the health of associated banks.

Yep. That is going to be the source of the real problem. Leveraged clients and market makers on the wrong side of trades. Some of the instruments trading today with ridiculous built in leverage have the potential to do serious damage in a runaway market. I think the plan of the banksters is not so much to entirely stop the decline but to try and “manage” it so as to keep fear levels from becoming extreme. It could lead to a long slow grind lower if they are successful. Waves even at smaller degrees do seem to be getting longer…

IB auto liquidates your position and it is constantly monitored by their systems – they state that this will avoid the issues you rightly identify. Whether or not that is the case (bidless market) remains to be seen.

I’m not usually in alot of cash with them percentage wise other than when I’m SOH – just that which I use for trading. My PSLV & PHYS position is a much higher value buy and hold long term trade which shouldn’t have any significant counterparty risk.

When all said and done, the only way to be totally sure is to take physical delivery but that also carries some risk (theft etc). You can only do so much unfortunately.

Got a fill @ UVXY 15 – Happy Days – Now at 80%.

Must have been after hours as Google showing price only went down to 15.16.

Will probably lighten up during Minor 2 bounce albeit I’m expecting suprises to the downside so probably won’t go completely flat.

I don’t trust Mr Market will let the bears get on board so easily, especially after a nice 5 down then 3 up but I may well be completely wrong there.

I am also showing an intra-day low of 15.16 so some eager beaver MM must have decided to fill you. I think we will see an intra-day spike down on Monday so I have an open stink bid at 14.75 with a bit of dry powder just in case. I hope somebody bites!

Vern,

Picked some UVXY into the close and left a little ammo for Monday morning to catch any abnormal drop in UVXY. Let’s see how that works..

Same here…we could see a bit of a dip on Monday.

If enough folk start trading this beast smartly it’s going to give the MM fits. The spread will also improve… 🙂

Olga & Vern,

I am bit confused about some downside targets as minute v per Lara should end around 2030. Does that mean we expect another bounce to 2077 for minor wave 2 to happen next before P3. I was going to suggest to Lara that if it is possible perhaps include anticipated wave moves for future as currently we just have a green line down to 1400s.

Yeah – we expect another bounce in Minor 2 which (in theory) could retrace up to 100% of the whole move down from 2111, albeit 61.8% is the most common retrace point for W2. In general I am suspicious of any W2 that goes above 76.4% fib retrace, but this market trades at extremes atm and up to 100% retrace doesn’t break any EW rules.

Until Minor 1 has finished it is not possible to calc a target for Minor 2, albeit Lara is expecting it may be very deep.

I have found that generally the best way to play W2’s is using a trendline as they are often sharp zig zag structures (i.e. panic buying), though as we have seen countless times, S&P doesn’t always play along nice with trendlines.

In any case you can bet there will be plenty of commentary from myself and others when we think Minor 2 is done 🙂 In actual fact, the closer it goes to 2111 the better the risk / reward becomes (as your invalidation is closer to your entry point).

Personally I’m suspicious that Mr Market will pull a fast one somehow and make it a little more difficult, but that’s based on nothing other than feeling which I certainly don’t base any trades upon. If he’s feeling generous then I’m more than happy to take advantage 🙂

I’m not prepared to start to anticipate minor 2 until I know minor 1 is over and I know where minor 2 has begun.

For now all I’m prepared to say is it likely to be even in duration or longer in duration than minor 1, and if it is very deep it may end touching the bear market trend line.

Yes, the arrow is in a straight line. But we all know price won’t move like that. It’s a general idea only.

If you’re asking me to show wiggly arrows for exactly how I expect price to move on the way down I think you are asking too much of advance predictions. That’s not going to have very good accuracy so I’m not going to do it like that.

I agree – I’ve been tending to get out of the majority of my position before W4, and UVXY like you said tends to signal a reversal is coming near the end of W5 with a lower high.

It did exactly the same a few days ago (I got out at 17.50 I think, then the market dropped more, but I was only able to ditch the rest at 17.40). I sometime let a little of my position ride, just in case W3 goes a bit further than I thought.

Imo, this makes it easier to catch tops in UVXY, as you get another chance at it if W4 appears earlier than you thought (once at the end of W3 and the again at the end of W5).

The same is of course true in the other direction – we won’t necassarily see UVXY go below 15 on Monday as it anticipates W5, unless the current W4 goes quite alot higher.

The time lag can make UVXY a bit of a tricky beast.

Yep! Please remind me that next time I miss that. It sure is great to have a few others keeping a keen eye on some of these tells. Hopefully they will continue work well enough to give us the slight advantage every trader needs! 🙂

Hi Olga and Verne,

What are you folks expecting/targeting for a UVXY price range at the bottom of Minor 1? Based on Lara’s projections it looks like it may end in the area of SPX 2020-2030. If that’s the case, I’m not expecting much rise in UVXY since the SPX isn’t too far away from the price target. Maybe we are looking at something like 17-18 on UVXY? Appreciate your thoughts and insights as always.

Verne is the master in that regard, but to 2020-2030, I’m not expecting anything great, though we might get a spike at the end of Minuette (iii) of Minute 5 (maybe to 20 if we’re lucky??), as pointed out by Verne. That will be the point I look at unloading the majority.

I’ll use a trendline of the move down as well as structure, RSI and fib target to try get as close as possible to the top of the UVXY move – UVXY is often also a good indicator in that regard itself.

I don’t expect much of a spike for the end of minor one. SPX 2000 is a place where many are expecting a bounce but frankly I would not be surprised to see us slice through it. It also happens to be the area of the 200 day moving average and the gale force winds of a P3 down could start to manifest themselves early by taking it out decisively. The banksters have also burned an awful lot of capital last week. The bottom line is that the short sellers are unlikely to experience sufficient fear on this leg down to cover so a move to around 20-23 is about what I would expect. In fact, I would not rule another round of enthusiastic selling at the end of minute one down. The subsequent low at the top of minor two is going to be the second best Unicorn trade this year…

2nd! 🙂

1st! 🙂