Downwards or sideways movement was expected but price has again moved higher. I still expect it is most likely minuette wave (iv) is incomplete.

The wave counts remain the same.

Summary: It is still most likely that minuette wave (iv) is incomplete. Tomorrow may begin with a little more upwards movement to 1,981. Thereafter, movement below 1,964.04, and below the aqua blue trend line on the hourly chart, would confirm subminuette wave b is over and subminuette wave c has begun, which should make a slight new low below 1,904.78.

Click on charts to enlarge.

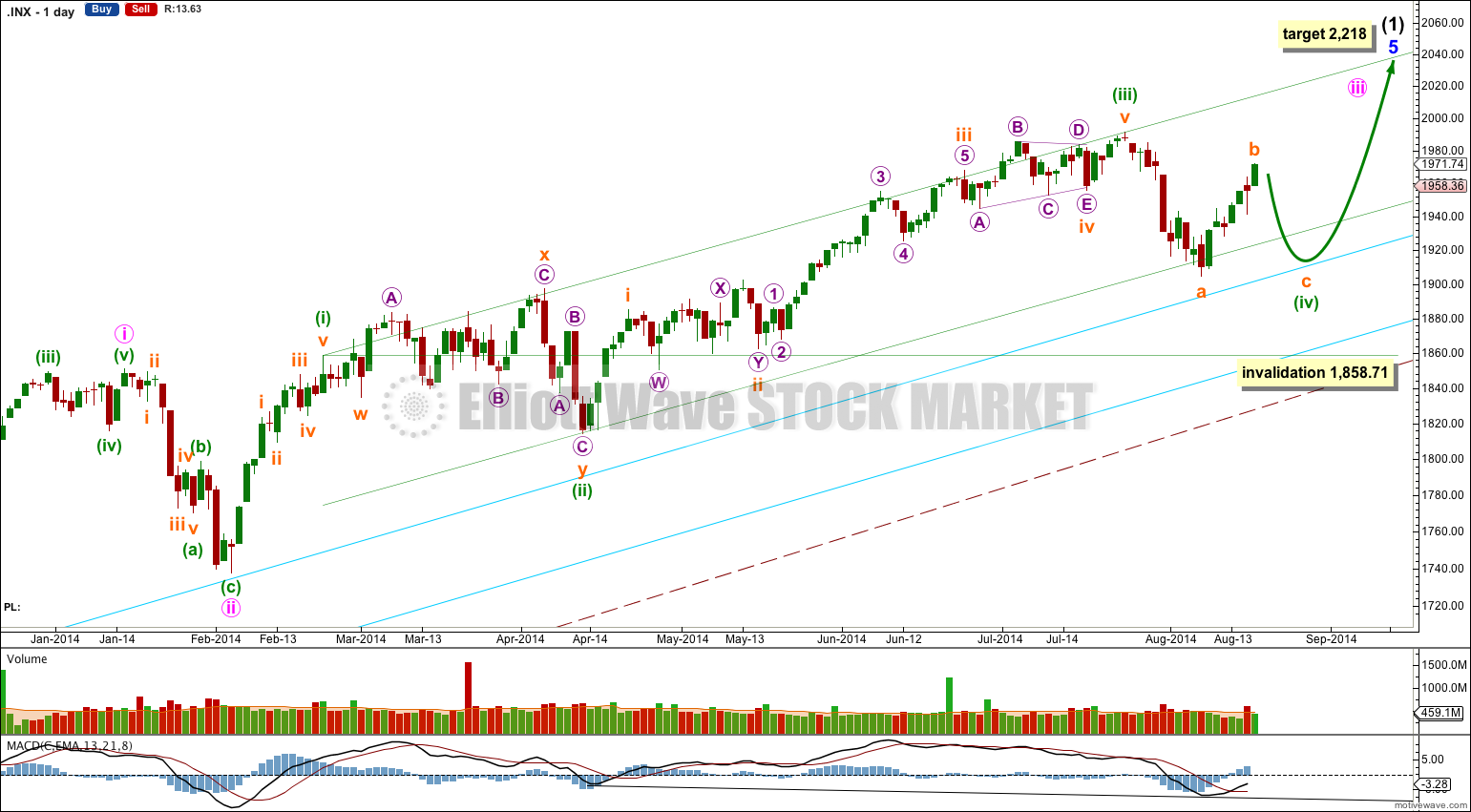

The aqua blue trend lines are critical. Draw the first trend line from the low of 1,158.66 on 25th November, 2011, to the next swing low at 1,266.74 on 4th June, 2012. Create a parallel copy and place it on the low at 1,560.33 on 24th June, 2013. While price remains above the lower of these two aqua blue trend lines we must assume the trend remains upwards. This is the main reason for the bullish wave count being my main wave count.

Bullish Wave Count.

There are a couple of things about this wave count of which I am confident. I see minor wave 3 within intermediate wave (1) as over at 1,729.86 (19th September, 2013). It has the strongest upwards momentum and is just 0.76 longer than 2.618 the length of minor wave 1. At 455 days duration this is a remarkably close Fibonacci ratio. The subdivisions within it are perfect. If this is correct then minor wave 4 ends at 1,646.47 and this is where minor wave 5 begins.

Minor wave 5 is unfolding as an impulse. If minor wave 5 has passed its middle then I would expect to see more divergence between price and MACD develop over coming weeks.

Along the way up towards the final target I would expect to see two more corrections complete: the current correction for minuette wave (iv) and one more for minute wave iv.

Minuette wave (iv) may not move into minuette wave (i) price territory below 1,858.71.

At 2,218 minor wave 5 would reach equality in length with minor wave 3. This target may be met in October.

I have drawn a parallel channel about minute wave iii using Elliott’s first technique: draw the first trend line from the highs of minuette waves (i) to (iii), then place a parallel copy on the low of minuette wave (ii). Minuette wave (iv) so far slightly breaches the lower edge of this channel, and at its end I expect another small breach. This may indicate an overthrow of the channel on the opposite side for the upcoming fifth wave.

Minuette wave (iv) may reach as low as the 0.618 Fibonacci ratio of minuette wave (iii) at 1,881.28, which would provide alternation in depth of correction between minuette waves (ii) and (iv), (minuette wave (ii) was a shallow 37% correction). Downwards movement may find final support about the upper aqua blue trend line, continuing a pattern which has lasted about a year now. If the upper aqua blue trend line is overshot by downwards movement then I would expect price to find support at the lower aqua blue trend line, although it may not get that low.

Minuette wave (ii) lasted exactly a Fibonacci 34 sessions. So far minuette wave (iv) has lasted 17 sessions, and if it continues for another four it will last a Fibonacci 21 sessions and have a 0.618 Fibonacci ratio to the duration of minuette wave (ii).

The large maroon – – – channel is copied over from the weekly chart. It is drawn in exactly the same way on bull and bear wave counts. For the bull wave count this channel is termed a base channel about primary waves 1 and 2. A lower degree second wave should not breach the lower edge of a base channel drawn about a first and second wave one or more degrees higher. The lower maroon – – – trend line differentiates the bull and bear wave counts at cycle degree and monthly chart level.

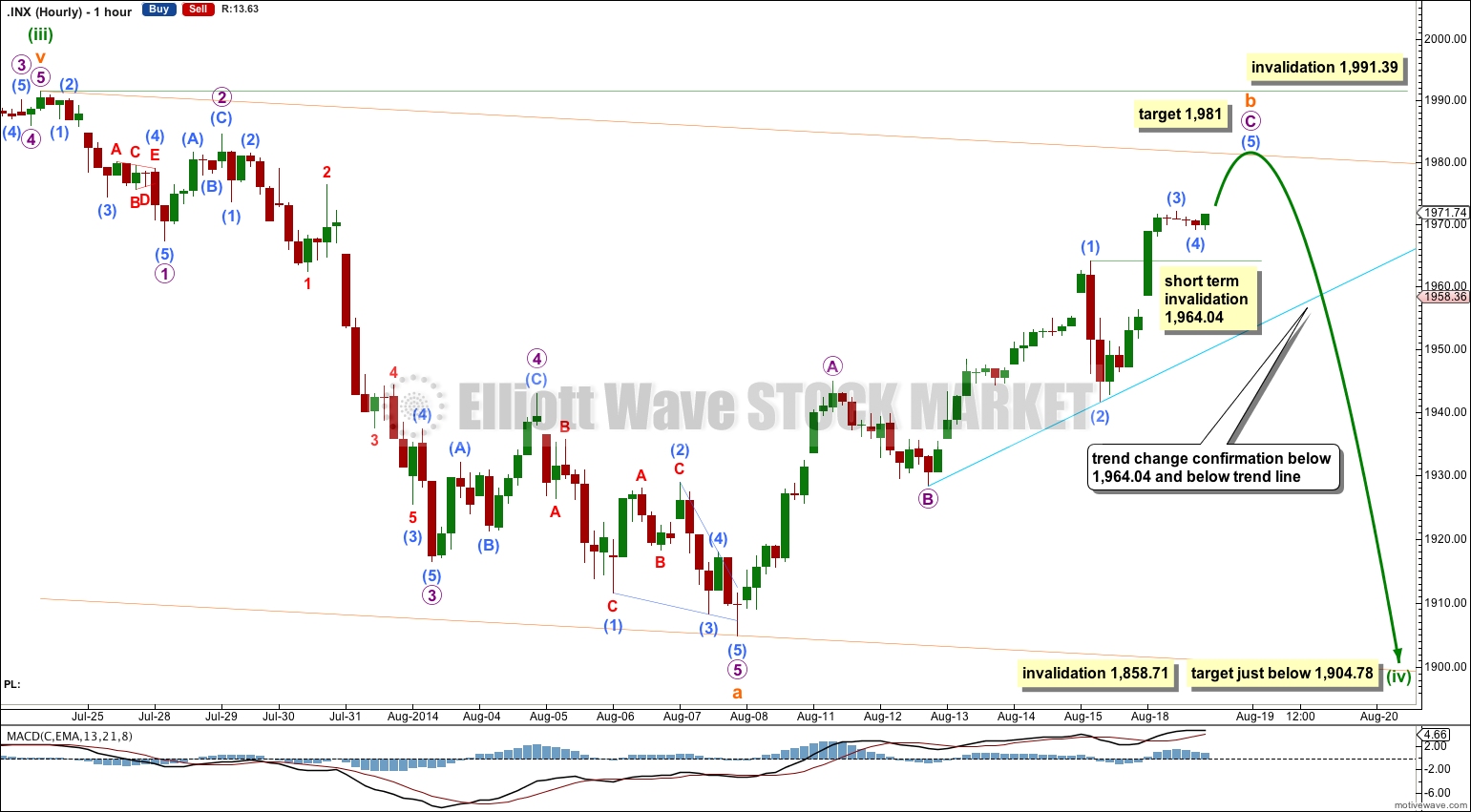

Main Hourly Wave Count.

Further upwards movement made the last wave count look ridiculous. I have reanalysed the end of subminuette wave a, which may have ended with an ending contracting diagonal for micro wave 5 at the low of 1,904.78.

Ratios within subminuette wave a are: micro wave 3 is 5.44 points longer than 2.618 the length of micro wave 1, and micro wave 5 is just 0.82 short of 1.618 the length of micro wave 1.

If subminuette wave a ends there then subminuette wave b subdivides nicely as an almost complete zigzag. Because subminuette wave a subdivides as a five subminuette wave b may not move beyond the start of subminuette wave a above 1,991.39.

Within subminuette wave b micro wave C is almost complete. At 1,981 submicro wave (5) would reach 0.382 the length of submicro wave (3).

Submicro wave (4) may not move into submicro wave (1) price territory below 1,964.04. Once submicro wave (5) could be considered complete then subsequent movement below 1,964.04 would indicate that micro wave C is over.

Subminuette wave b does not fit into an Elliott channel. The aqua blue trend line is drawn using a classic technical analysis method, from the first two swing lows in the uptrend. When this aqua blue trend line is clearly breached that shall be a strong indicator that subminuette wave b is over and subminuette wave c downwards is underway.

Subminuette wave c is most likely to make at least a slight new low below the end of subminuette wave a at 1,904.78 to avoid a truncation.

Subminuette wave c may end when price comes to touch (or almost touch) the upper aqua blue trend line on the daily chart.

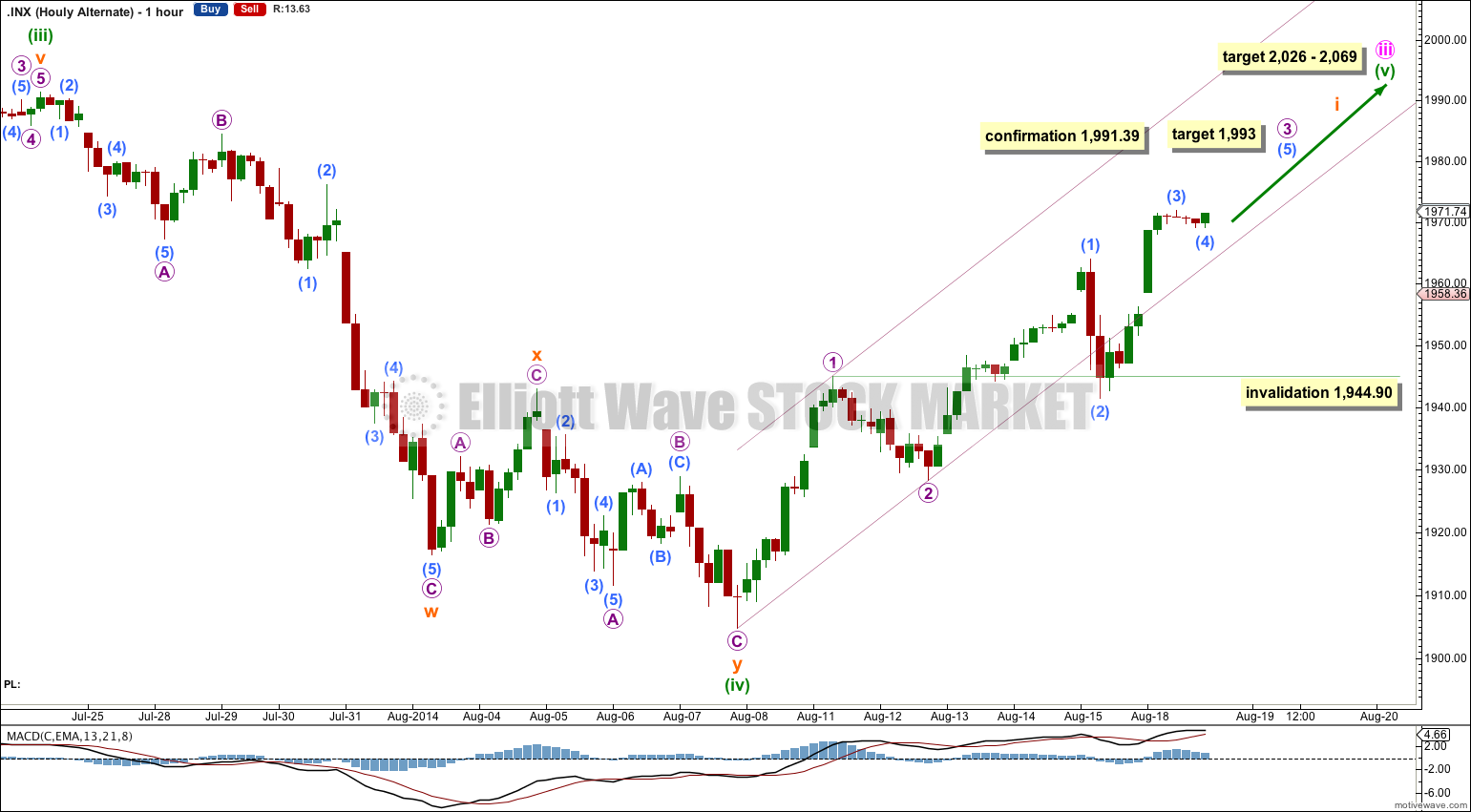

Alternate Hourly Wave Count.

Could minuette wave (iv) be over? If it is then it would fit best as a double zigzag. The problem with this wave count, and it is highly significant, is the structure of the final wave of micro wave C within subminuette wave y. This downwards movement does not fit at all as a five wave structure (either impulse or ending diagonal) on the five minute chart and the hourly chart. It fits very well indeed as a three.

Any wave count which sees minuette wave (iv) as over has to see that last wave down as a five. This has a very low probability, maybe as low as 5%. I attach the 5 minute chart for this piece of movement so you may judge for yourselves.

A further problem with this alternate today is the breach of submicro wave (2) of the base channel drawn about micro waves 1 and 2, one degree higher. This breach does not invalidate this alternate, but it does further reduce the probability.

At 1,993 micro wave 3 would reach 1.618 the length of micro wave 1. Micro wave 4 to follow it may not move into micro wave 1 price territory below 1,944.90.

I will certainly allow for the possibility that I could be wrong, that this minuette wave (iv) is actually over and my analysis of it is incorrect. This alternate would be confirmed with movement above 1,991.39.

At 2,026 minuette wave (v) would reach equality in length with minuette wave (i). At 2,069 minute wave iii would reach 1.618 the length of minute wave i. This gives a rather wide target zone though and may be narrowed towards the end when the target can be calculated at subminuette wave degree as well.

Within micro wave 3 no second wave correction may move beyond the start of its first wave below 1,928.29.

Bearish Alternate Wave Count

This bearish alternate wave count expects that the correction is not over. The flat correction which ended at 666.79 was only cycle wave a (or w) of a larger super cycle second wave correction.

The structure and subdivisions within primary wave C for the bear wave count are the same as for intermediate wave (1) for the bull wave count. Thus the short to mid term outlook is identical.

The differentiation between the bull and bear wave count is the maroon – – – channel. The bull wave count should see price remain above the lower maroon – – – trend line. The bear wave count requires a clear breach of this trend line. If this trend line is breached by a full weekly candlestick below it and not touching it then this bear wave count would be my main wave count and I would then calculate downwards targets.

We should always assume the trend remains the same until proven otherwise; the trend is your friend. While price remains above the lower maroon – – – trend line I will assume that the S&P 500 remains within a bull market.

This analysis is published about 07:09 p.m. EST.