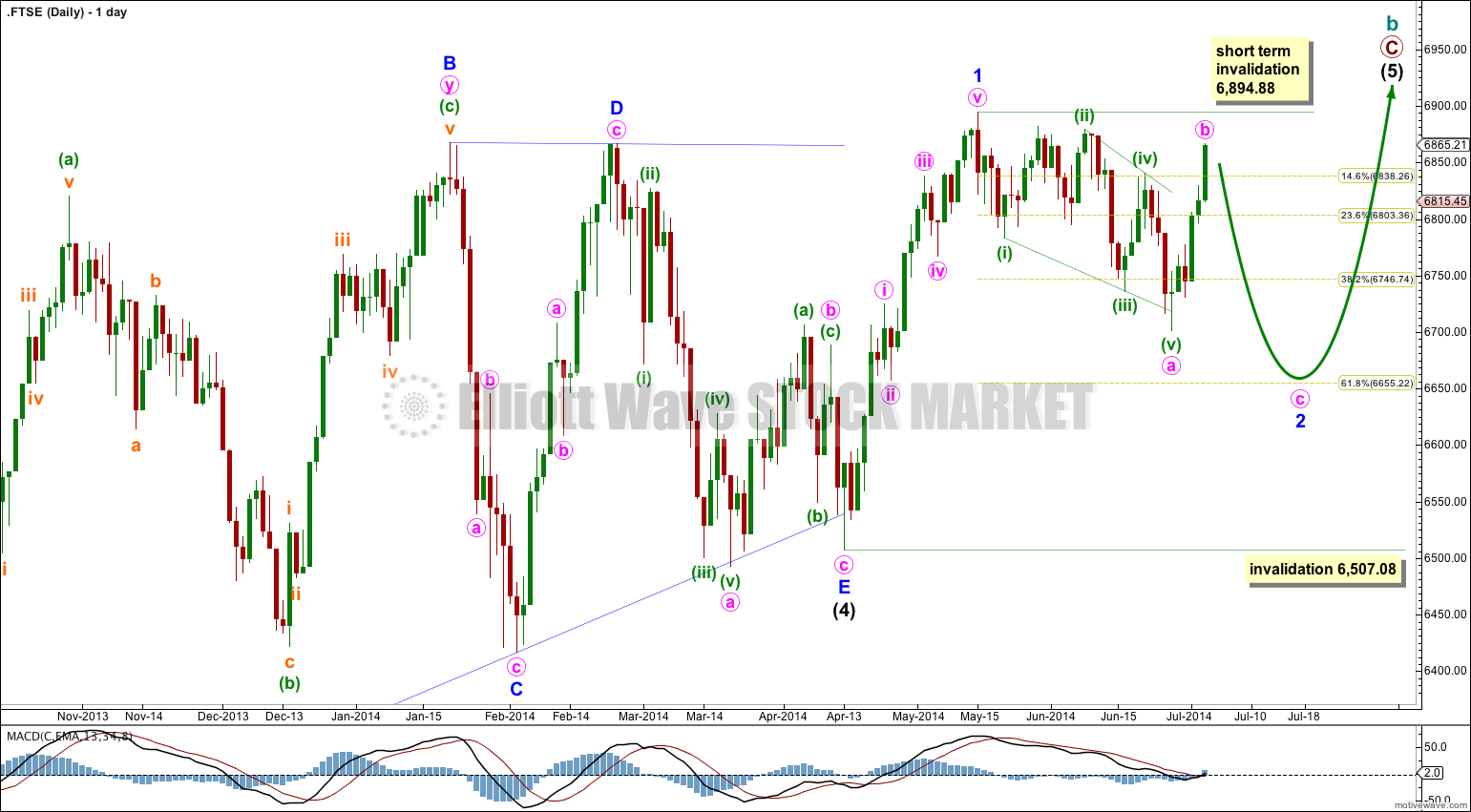

Last analysis of FTSE was invalidated by downwards movement. I had expected to see a long extended fifth wave following a fourth wave barrier triangle, but the fifth wave was very brief and was over already.

Click on charts to enlarge.

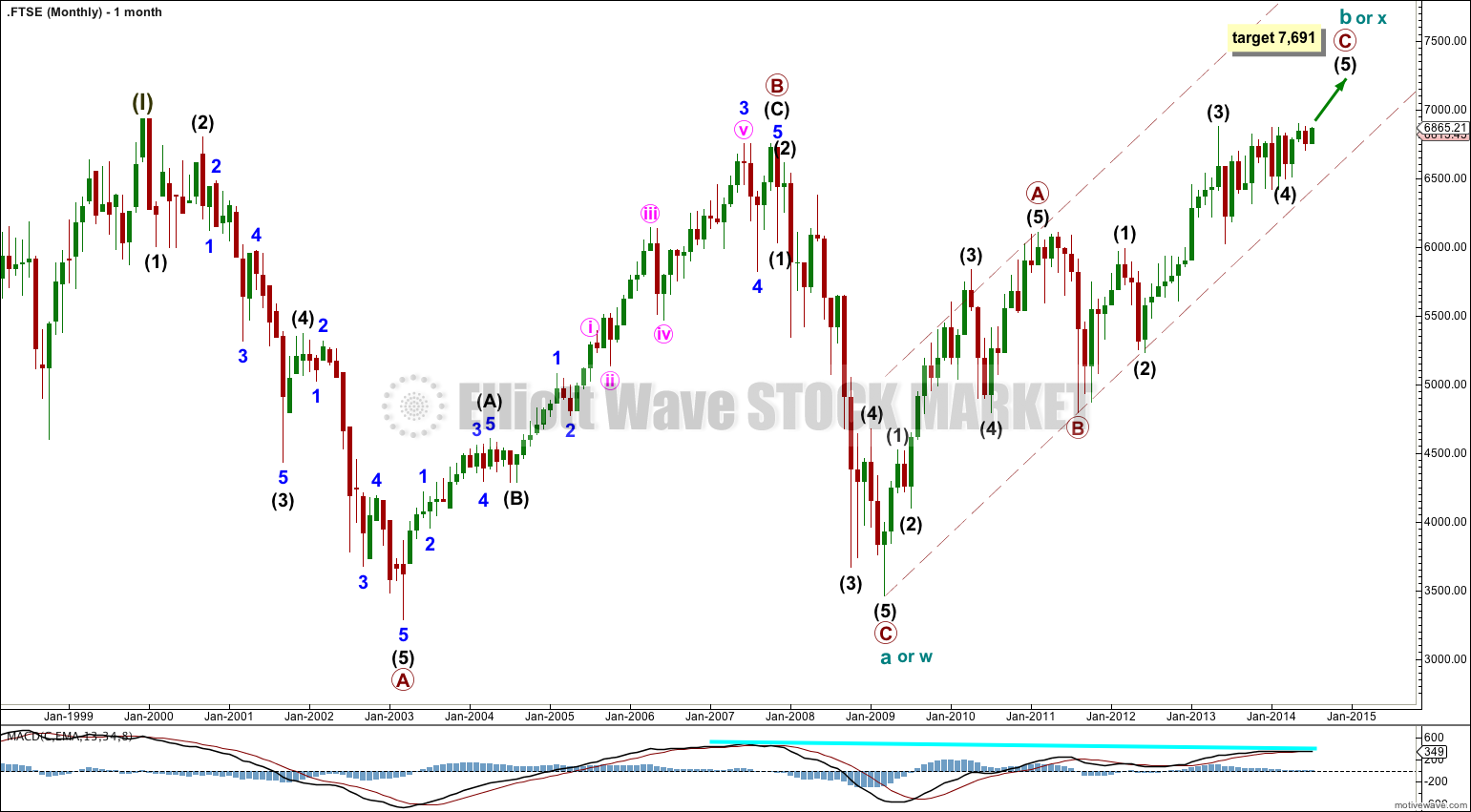

The bigger picture sees FTSE in a huge correction for a super cycle wave (II).

Super cycle wave (II) may be either a regular flat correction (labeled cycle a, b, c) or it may be a double flat or combination (labeled cycle w, x and y).

There is no Fibonacci ratio between primary waves A and C.

A regular flat correction would expect a five wave structure downwards for cycle wave c to move at least a little below the end of cycle wave a at 3,460.71 to avoid a truncation. Cycle wave c would be expected to last from one to several years, with a shorter time frame more likely.

A double flat or combination would expect a three wave structure downwards for cycle wave y to end about the same level as cycle wave a at 3,460.71. Cycle wave y would be expected to last from one to several years, with a longer time frame more likely. It could look like a repeat of cycle wave a.

There is divergence at the monthly chart level with MACD which supports this wave count.

Cycle wave b (or x) subdivides as a zigzag and is most likely incomplete. At 7,691 intermediate wave (5) would reach equality with intermediate wave (1).

Intermediate wave (5) is unlikely to be over as the S&P 500 continues higher. This is the main reason for adjusting my FTSE wave count.

There is no Fibonacci ratio between intermediate waves (3) and (1). This makes it likely we shall see a Fibonacci ratio between intermediate wave (5) and either (3) or (1). Equality with (1) is the most likely ratio.

Within minor wave 2 the structure is unlikely to be complete. Minute wave a subdivides as a leading contracting diagonal. Minute wave b may not move beyond the start of minute wave a above 6,894.88. If this invalidation point is breached prior to more downwards movement then it must be that minor wave 2 would be over. Movement above 6,894.88 prior to a new low below 6,701.59 would indicate that a third wave upwards is underway.