Yesterday’s analysis expected downwards movement for Tuesday as a second wave correction began. Price did move lower in typically choppy overlapping corrective movement.

Click on the charts below to enlarge.

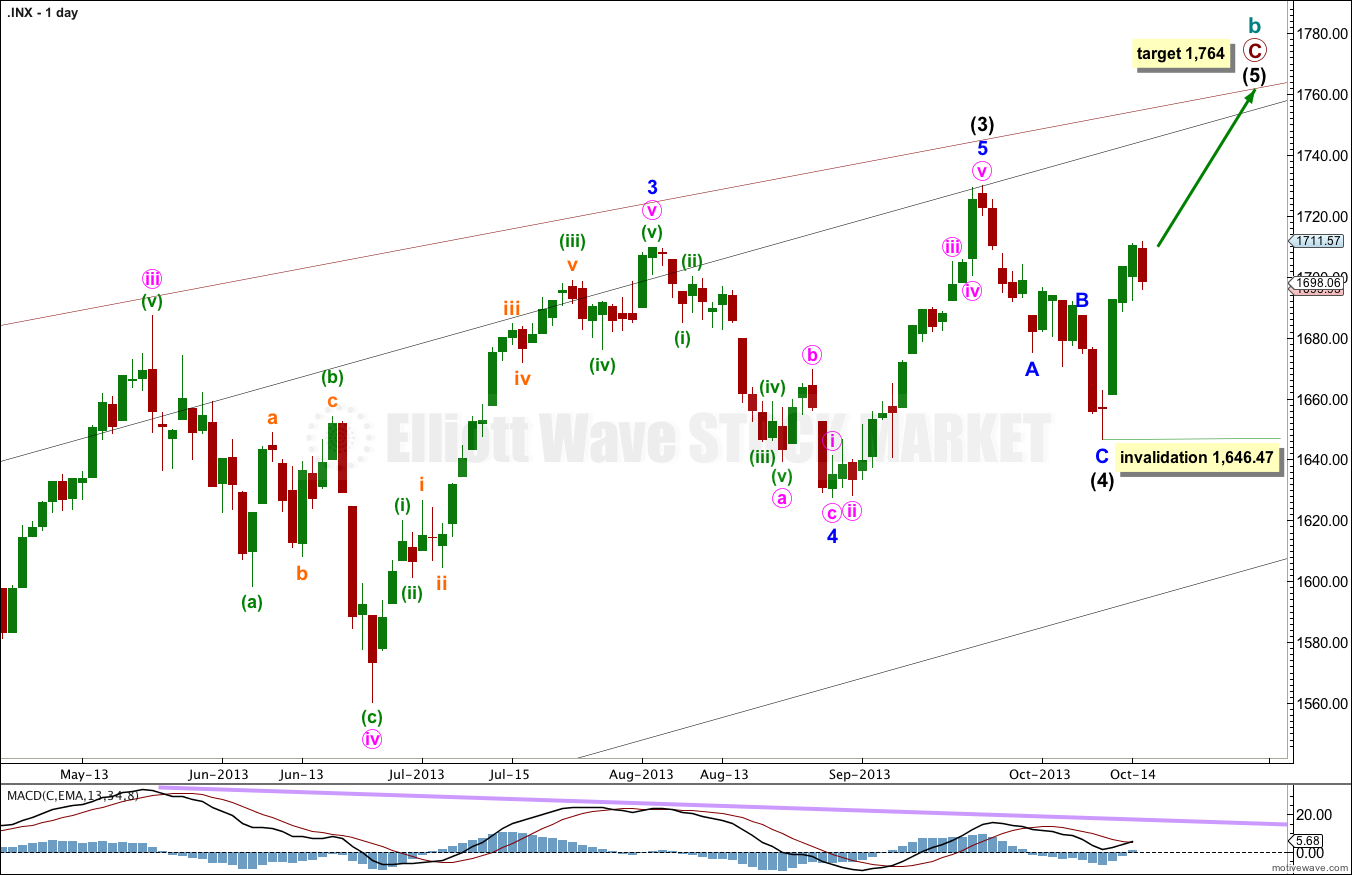

Intermediate wave (4) is now over and lasted 14 days, just one more than a Fibonacci 13.

If intermediate wave (5) exhibits a Fibonacci time relationship it may end in a Fibonacci 13 days (or sessions) on 28th October. Please note: this is a rough guideline only. Within this wave count there are no Fibonacci time relationships at primary or intermediate degree. Sometimes this happens, but not often enough to be reliable.

October is a common month for big trend changes with the S&P 500. This wave count could very well complete the structure for intermediate wave (5) this month.

At 1,764 primary wave C would reach equality with primary wave A.

Within intermediate wave (5) no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,646.47.

Main Hourly Wave Count.

Tuesday’s movement unfolded as a near perfect expanded flat correction. Minute wave b is 105% the length of minute wave a, and minute wave c is just 0.54 points short of 1.618 the length of minute wave a.

It is possible that minor wave 2 is already over in one session.

This wave count would be confirmed if the next upwards movement is a five wave structure. Minor wave 3 can only subdivide as an impulse, and within it minute wave i can only subdivide into a five wave structure, either a leading diagonal (unlikely) or an impulse (most likely).

Within minor wave 3 no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,695.63.

At 1,760 minor wave 3 would reach equality in length with minute wave i.

Alternate Hourly Wave Count.

By simply moving the degree of labeling within minor wave 2 all down one degree this expanded flat may be only the first structure within a double flat or double combination.

The purpose of double flats and double combinations is to take up time and move price sideways. They occur when the first structure does not take up enough time. That certainly may be the case here, as if it is over minor wave 2 would have only lasted one day, and it may continue sideways for longer to be better in proportion.

Within double flats and double combinations there is no limit to the length of the X wave, and it may make a new price extreme. Minute wave X must unfold as a corrective structure, and would most likely be a zigzag. If the next wave upwards is a three, then this wave count would be correct.

The second structure in a double may be either a flat, zigzag or triangle. It would most likely end a little below 1,695.93, with mostly sideways movement.

Minor wave 2 may not move beyond the start of minor wave 1. This wave count is invalidated with movement below 1,646.47.

add to me analyse please…

If you want to sign up you can do so by clicking the big green button.