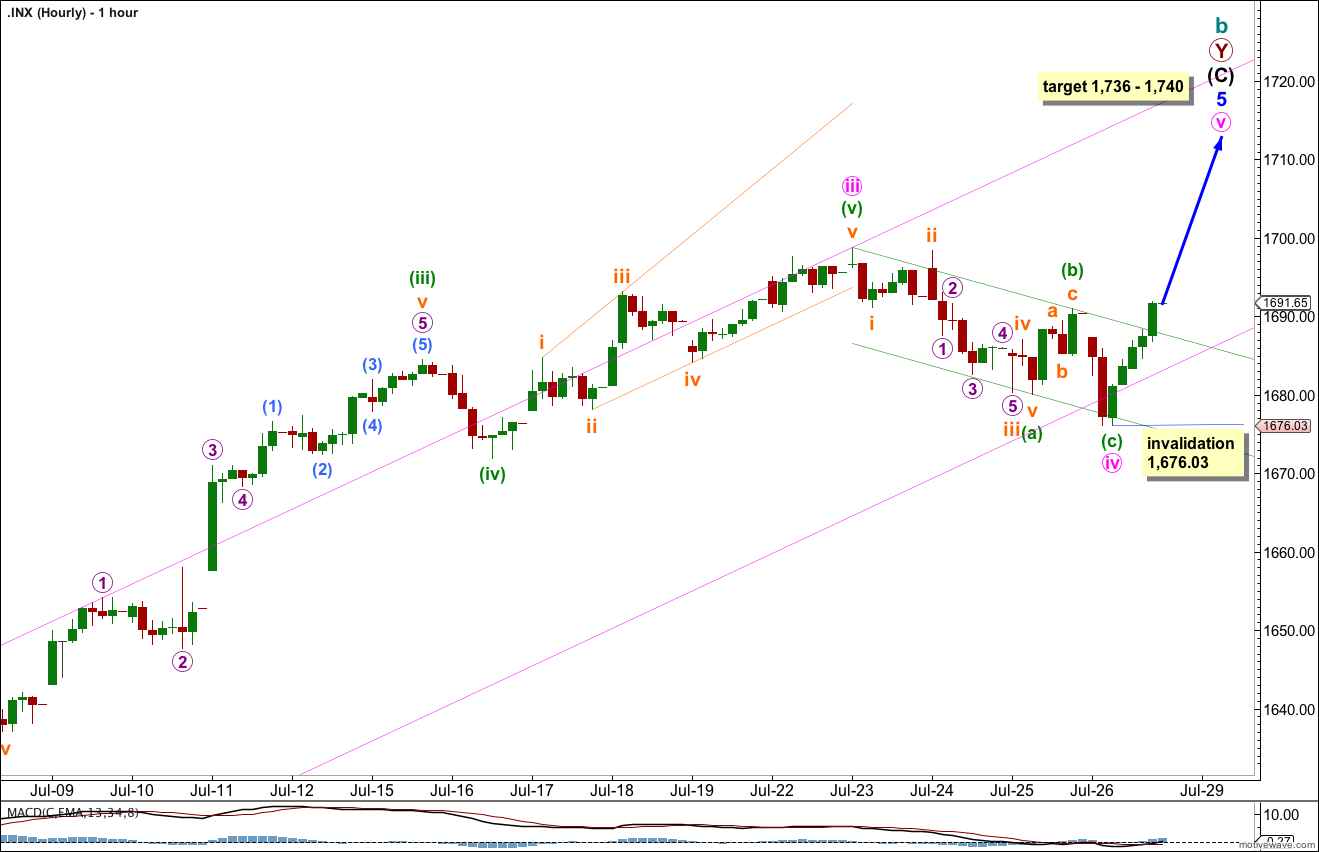

Price moved lower during Friday’s session confirming the main hourly wave count and invalidating the alternate. This fourth wave has now lasted a Fibonacci three days and is likely to be over here.

Click on the charts below to enlarge.

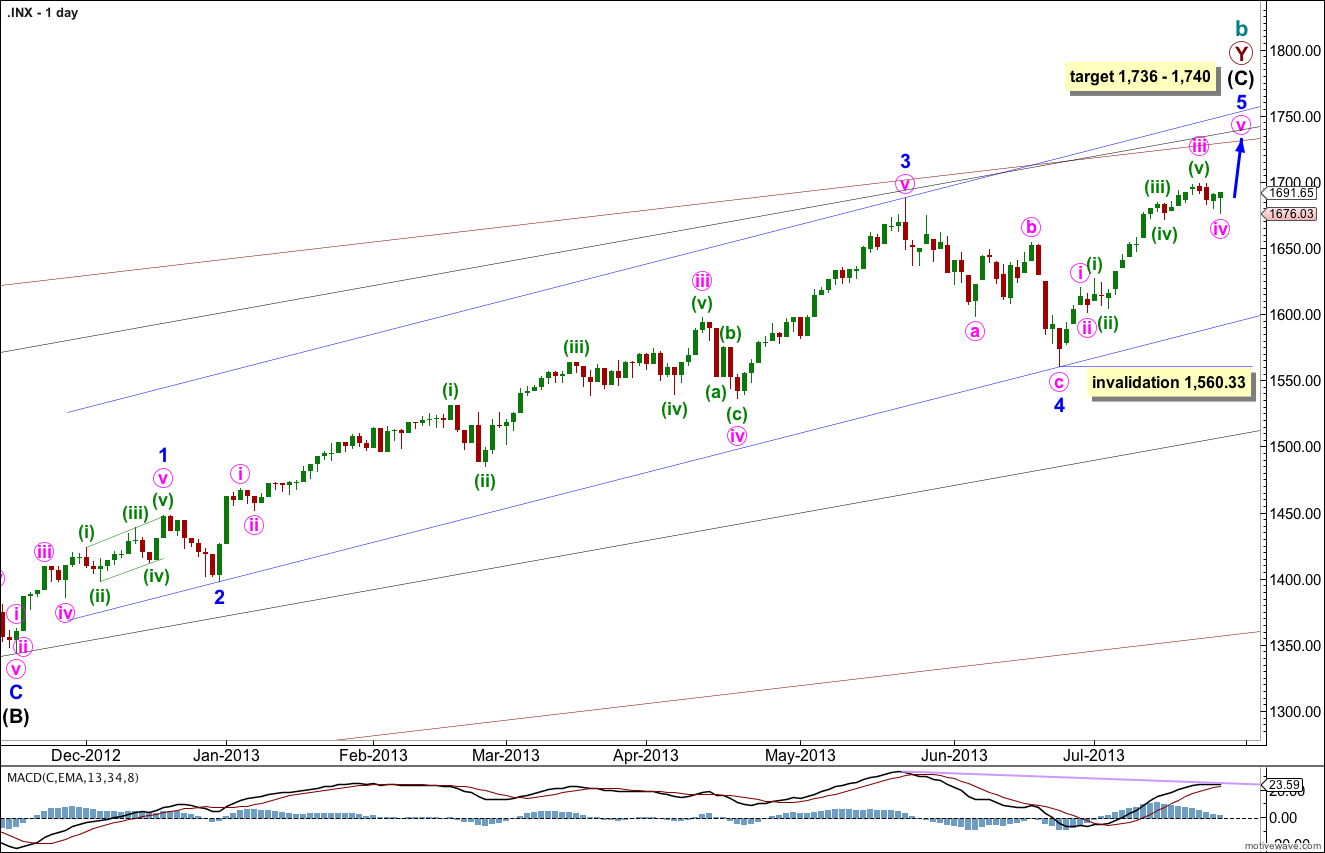

This wave count agrees with MACD and has some nice Fibonacci ratios in price and Fibonacci relationships in time.

Minor wave 3 is 15.1 points longer than 2.618 the length of minor wave 1.

Ratios within minor wave 3 are: there is no Fibonacci ratio between minute waves iii and i, and minute wave v is 5.44 points longer than equality with minute wave iii.

At 1,740 intermediate wave (C) would reach equality with intermediate wave (A). At 1,739 minor wave 5 would reach 0.618 the length of minor wave 3.

Within minor wave 5 no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,560.33.

Minor wave 1 lasted a Fibonacci 21 days, minor wave 2 lasted a Fibonacci 8 days, minor wave 3 has no Fibonacci duration at 98 days, and minor wave 4 lasted 22 days, just one day longer than a Fibonacci 21.

At this stage minor wave 5 has lasted 23 sessions. A further 11 sessions would see it ending in a Fibonacci 34. At that time I will look to see if the structure could be considered complete. If it can we shall have an alternate wave count to consider the possibility again of a trend change at cycle degree.

Keep drawing the wider parallel channels from the monthly chart and copy them over to the daily chart.

Minute wave iv is now a completed zigzag structure lasting a Fibonacci three days. There is no Fibonacci ratio between minuette waves (a) and (c).

Minute wave iv ended with a small overshoot of the parallel channel before price turned back upwards.

Minute wave ii was a brief shallow 32% zigzag structure. There is some alternation between minute waves ii and iv. Minute wave iv is a more shallow 23% longer lasting zigzag structure.

At 1,736 minute wave v would reach 0.618 the length of minute wave iii. Because there is already a good Fibonacci ratio between minute waves iii and i we may not see a Fibonacci ratio between minute wave v and either of iii or i. For this reason I favour the upper end of this four point target zone.

Price has now breached the upper edge of a small parallel channel containing minute wave iv. This is an indication that the fourth wave is now over (or at least this zigzag structure is over) and the fifth wave is now underway.

Within minute wave v no second wave correction may move beyond the start of the first wave. Movement below 1,676.03 would invalidate this wave count.

If this wave count is invalidated with downwards movement, then the low probability situation of a longer lasting minute wave iv would be the wave count I would use.

It is possible, but very unlikely that minute wave iv may yet continue further as a flat, double zigzag or double combination. If it did then it would be out of proportion to all the other corrections within minor wave 5 so far, and this wave count would have an odd look. However, that certainly does happen as we have recently seen with minor wave 4 compared to minor wave 2, and we could see another smaller fractal of this situation. It is a possibility I shall keep in mind. If we see a clear five wave structure upwards from here then this possibility shall be eliminated.