Price moved upwards for Friday’s session with slow momentum, which is what our wave count now expects.

Not much has changed from last analysis.

Click on the charts below to enlarge.

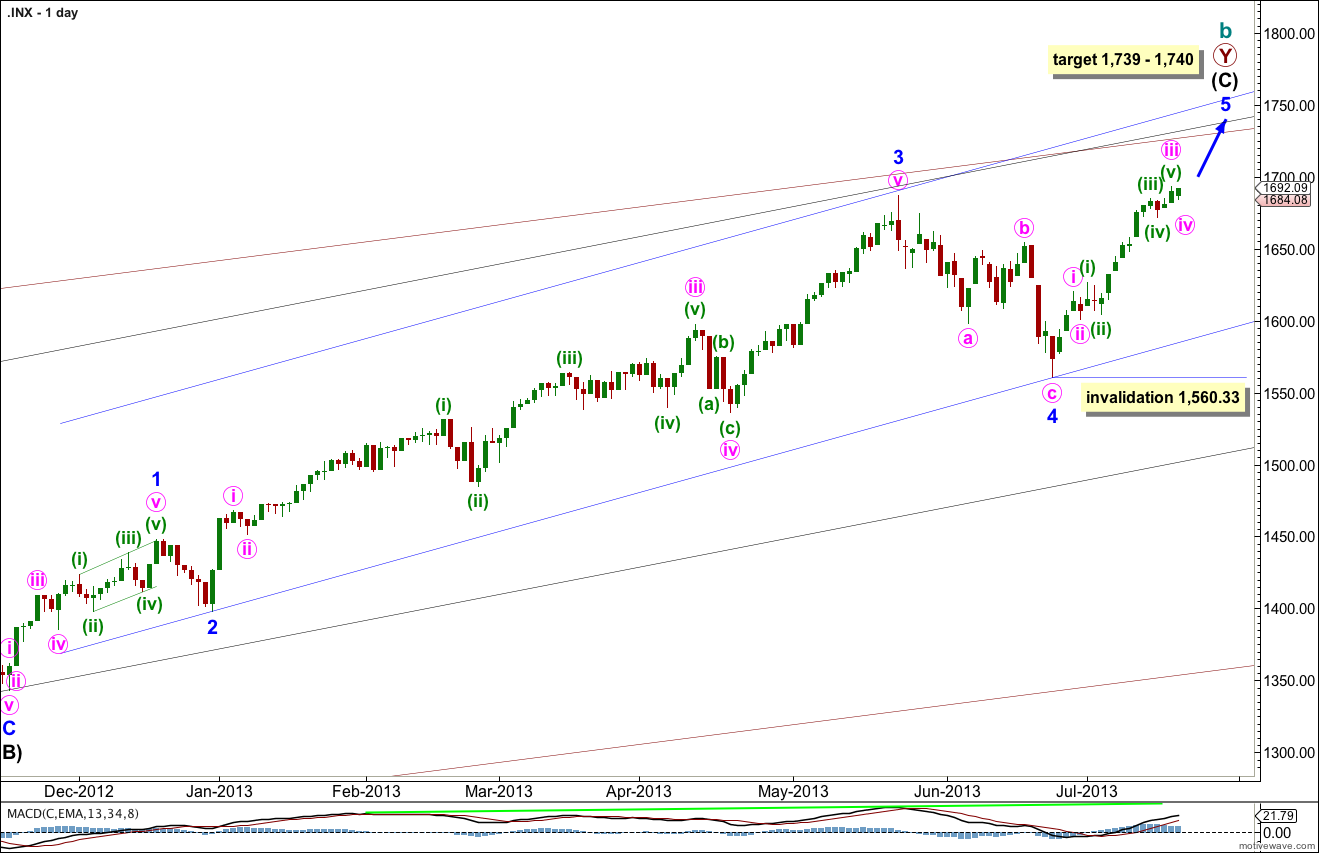

This wave count agrees with MACD and has some nice Fibonacci ratios in price and Fibonacci relationships in time.

Minor wave 3 is 15.1 points longer than 2.618 the length of minor wave 1.

Ratios within minor wave 3 are: there is no Fibonacci ratio between minute waves iii and i, and minute wave v is 5.44 points longer than equality with minute wave iii.

At 1,740 intermediate wave (C) would reach equality with intermediate wave (A). At 1,739 minor wave 5 would reach 0.618 the length of minor wave 3.

Within minor wave 5 no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,560.33.

Minor wave 1 lasted a Fibonacci 21 days, minor wave 2 lasted a Fibonacci 8 days, minor wave 3 has no Fibonacci duration at 98 days, and minor wave 4 lasted 22 days, just one day longer than a Fibonacci 21.

At this stage minor wave 5 has lasted 18 days. In another three days it would have lasted a Fibonacci 21. A further 13 days beyond that would see it ending in a Fibonacci 34. At each of these dates I will look to see if the structure could be considered complete. If it can we shall have an alternate wave count to consider the possibility again of a trend change at cycle degree.

Keep drawing the wider parallel channels from the monthly chart and copy them over to the daily chart.

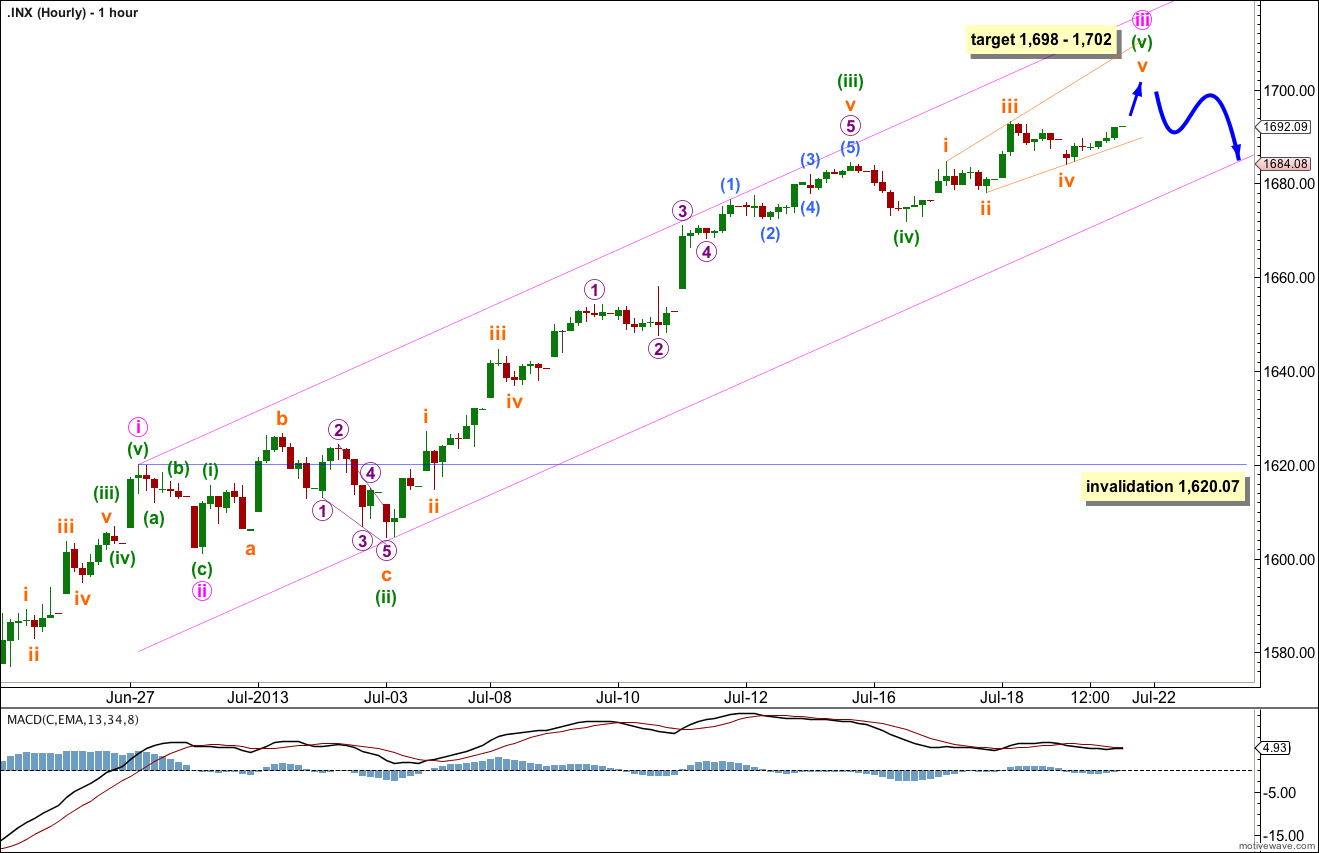

An ending expanding diagonal may be unfolding in this fifth wave position for minuette wave (v). However, on the five minute chart subminuette waves i and iii do not subdivide easily as three wave zigzags, and they may be impulses. If this is the case then the diagonal may be a leading diagonal and the target for minute wave iii to end may be too low.

Either way, the diagonal structure is incomplete. The final fifth wave upwards is extremely likely to make a new high above the end of subminuette wave iii at 1,693.12 to avoid a truncation. Subminuette wave v should fall short of the upper edge of the diagonal trend line.

When the diagonal structure is completed, if it is an ending diagonal, then we should expect choppy, overlapping movement probably for a couple of days or so for minute wave iv. Minute wave iv may not move into minute wave i price territory. Movement below 1,620.07 would invalidate this wave count.

If the diagonal is leading then when it is over we should expect choppy, overlapping movement probably for up to one session for a deep second wave correction.

Downwards movement for a correction, whether it be minute wave iv or a second wave, should find support about the lower edge of the best fit parallel channel drawn here.

At 1,698 minute wave iii would reach 1.618 the length of minute wave i. At 1,702 minute wave (v) would reach 0.382 the length of minute wave (iii).