Yesterday’s analysis expected downwards movement for Thursday’s session which is not what happened. Price has moved higher but remains well within the same small range it has been trading in over the last week, and the wave count still has a very typical look.

The wave count remains the same with just the one daily and one hourly chart.

Click on the charts below to enlarge.

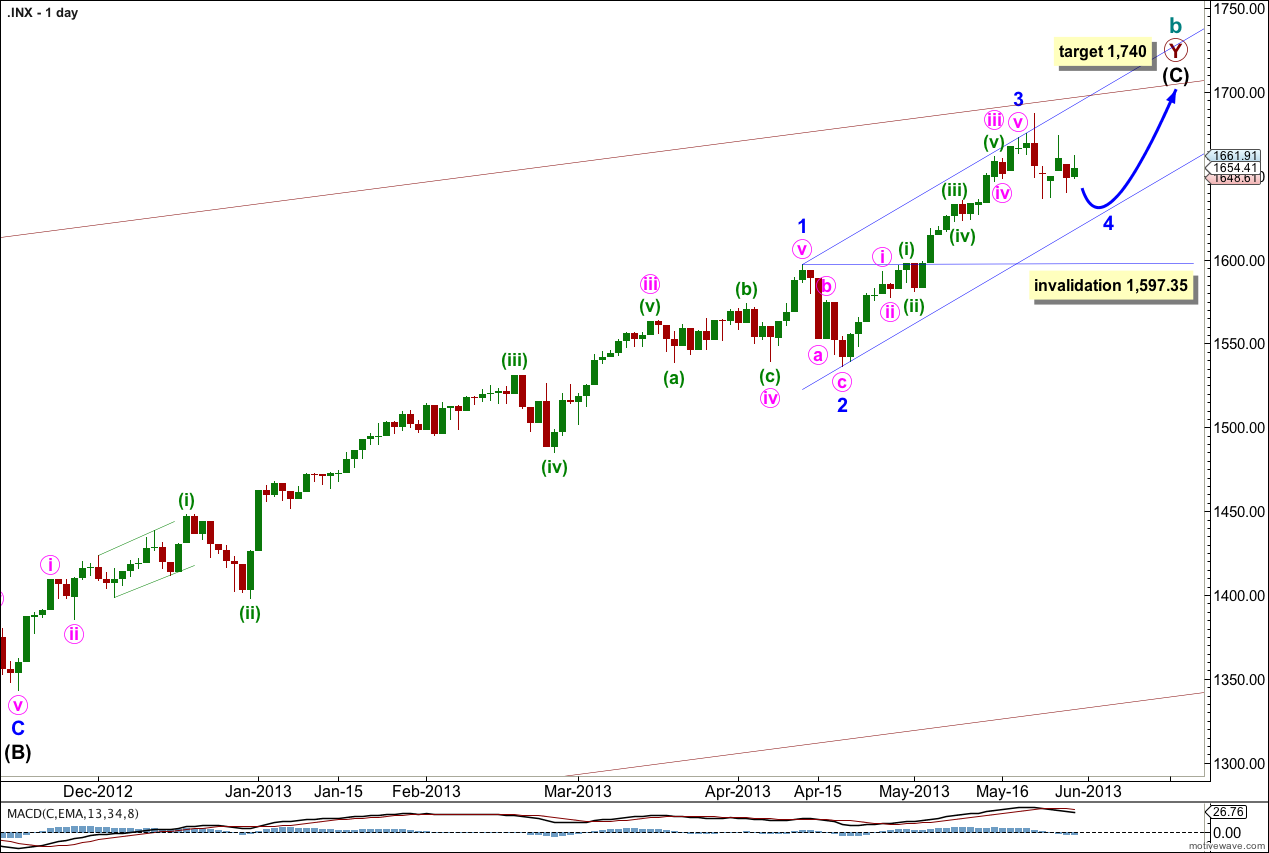

Within intermediate wave (C) minor wave 1 was extended.

Minor wave 3 is now complete. There is no Fibonacci ratio between minor waves 3 and 1. This means it is highly likely we should see a Fibonacci ratio between minor wave 5 and either of 3 or 1.

Minor wave 3 is shorter than minor wave 1. Minor wave 5 would be limited to no longer than equality with minor wave 3 because a third wave may never be the shortest.

At 1,740 intermediate wave (C) would reach equality with the orthodox length of intermediate wave (A). When minor waves 3 and 4 within intermediate wave (C) are complete I will use calculations at minor degree to add to this target so it may change or widen to a zone.

Minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement below 1,597.35.

Draw the parallel channel about intermediate wave (C) using Elliott’s first technique. Draw the first trend line from the highs of minor waves 1 to 3, then place a parallel copy upon the low of minor wave 2. Expect minor wave 4 to find support at the lower edge of this channel. The following fifth wave may end midway in the channel where it intersects with the upper maroon trend line.

The very wide maroon trend channel shown here is copied over from the monthly chart. We may find this movement ends as it finds resistance at the upper trend line.

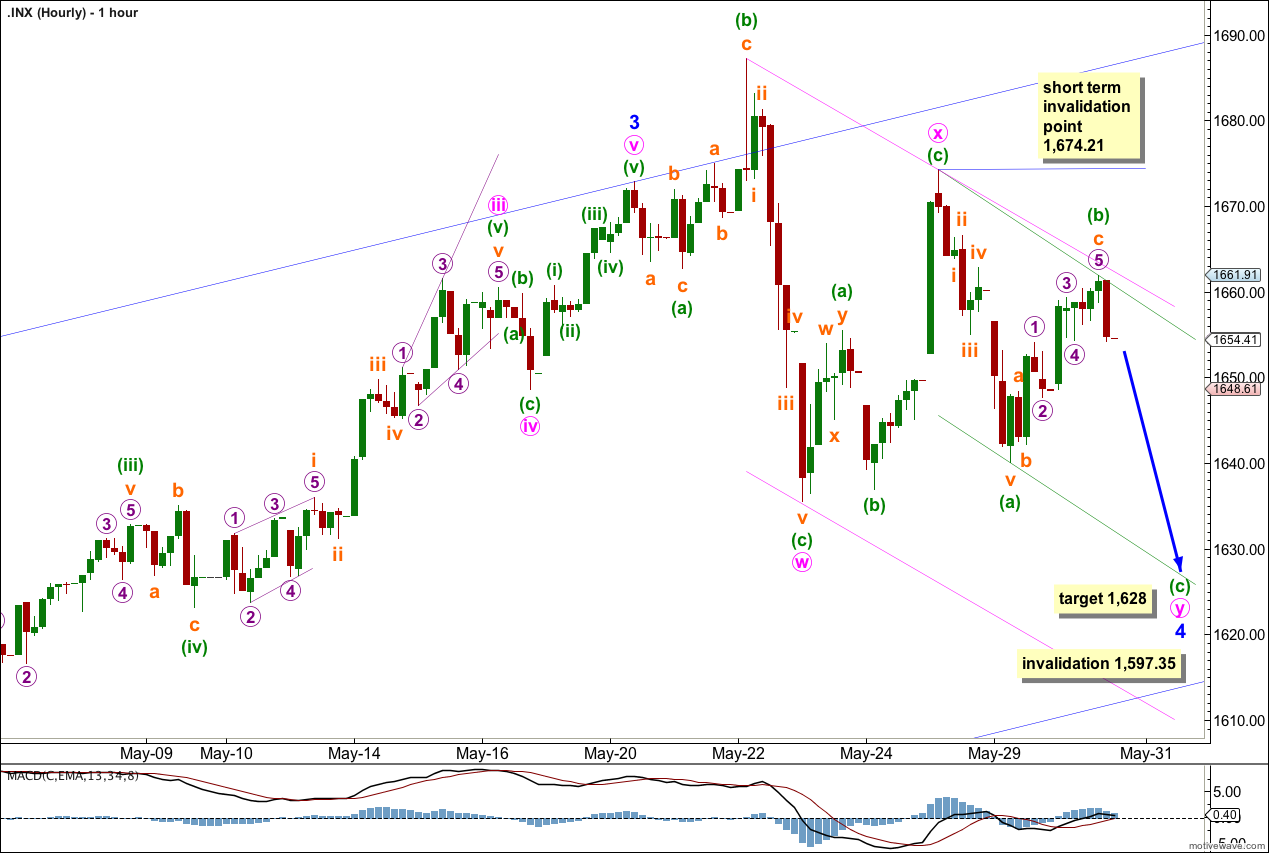

Minor wave 4 still looks like a typical double combination: expanded flat – X – zigzag. The second structure in the double labeled minute wave y is unfolding as a zigzag and is incomplete.

Within minute wave y minuette wave (b) moved higher. This upwards movement has a corrective count of seven, and the upwards movement extended subminuette wave c within it.

Within minuette wave (b) subminuette wave c still has no Fibonacci ratio to subminuette wave a.

Ratios within subminuette wave c are: micro wave 3 is just 0.38 points short of equality with micro wave 1, and micro wave 5 is just 0.25 points longer than 0.618 the length of micro wave 1.

At 1,628 minuette wave (c) would reach equality with minuette wave (a). Minuette wave (c) must subdivide into a five wave structure, either an ending diagonal or an impulse. It may find support at the lower edge of the smaller green parallel channel containing minute wave y. Minuette wave (c) should take about one more session to complete. This would see minor wave 4 in its entirety over in a Fibonacci eight days.

Within minute wave y zigzag any further upwards movement of minuette wave (b) may not move beyond the start of minuette wave (a). This wave count is invalidated in the short term (before minuette wave (c) downwards is complete) with movement above 1,674.21.

The invalidation point remains the same. Minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement below 1,597.35.

A Falling Wedge (bullish) could fit your sideways movement and with only 6 more points down into June 10 a key date from the APEX http://thepatternsite.com/fallwedge.html

AND give NYMO time to make a bullish divergence

Could a new (x) Wave up into Wave (z) down closer to your 1597.35 area work?

It’s possible, but the probability is very low. Triples are rare.

Also, if we did see a triple unfold their purpose is to move price sideways and take up time, not to deepen a correction. So we wouldn’t expect too much more downwards movement.

I’m analysing the five minute chart to see if minuette wave (c) within minute wave y could be complete or if it should move price a little lower yet.

*bit closer

I think you are very close to the end…

We are looking at the end of Feb. lows 1485.01 and the end of Apr. lows 1536.03 trendline.

http://scharts.co/11ulnXk

NYMO -81.22 is with the BULLS game plan now….

IF we can get a big closer to 1600 area it would be the last leg of our expanding Triangle (1750 target)

Sweet day … UP and back DOWN into your 1633 target area.

Thanks!!!

Yes, I’m really stoked with that analysis.

The only question now is… is it over? (that fourth wave correction that is)

Looks more like a setup for a head fake breakout http://scharts.co/18Cg3tz into Futures LOD 1640.25 this morning … 1670 KEy