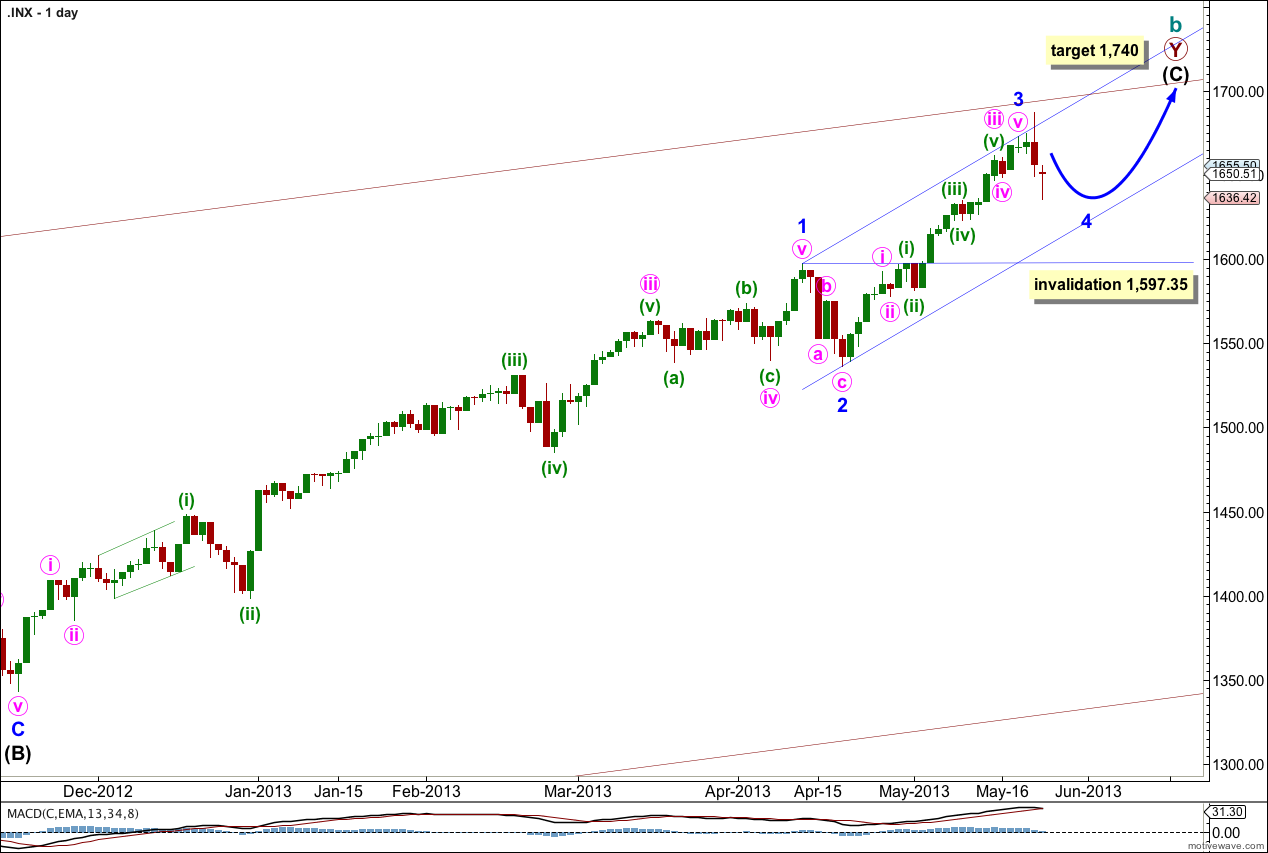

Yesterday’s analysis expected price had entered a fourth wave correction and should continue with choppy overlapping movement for another few days. Sideways movement for Thursday’s session was expected and is mostly what has happened.

This correction is most likely incomplete.

Click on the charts below to enlarge.

Within intermediate wave (C) minor wave 1 was extended. Minor wave 3 is showing an increase in momentum beyond that seen within minor wave 1.

Minor wave 3 may now be complete. There is no Fibonacci ratios between minor waves 3 and 1. This means it is highly likely we should see a Fibonacci ratio between minor wave 5 and either of 3 or 1.

Minor wave 3 is shorter than minor wave 1. Minor wave 5 would be limited to no longer than equality with minor wave 3 because a third wave may never be the shortest.

At 1,740 intermediate wave (C) would reach equality with the orthodox length of intermediate wave (A). When minor waves 3 and 4 within intermediate wave (C) are complete I will use calculations at minor degree to add to this target so it may change or widen to a zone.

Minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement below 1,597.35.

I have redrawn the parallel channel about intermediate wave (C) today using Elliott’s first technique. Draw the first trend line from the highs of minor waves 1 to 3, then place a parallel copy upon the low of minor wave 2. Expect minor wave 4 to find support at the lower edge of this channel. The following fifth wave may end midway in the channel where it intersects with the upper maroon trend line.

The very wide maroon trend channel shown here is copied over from the monthly chart. We may find this movement ends as it finds resistance at the upper trend line.

Lower movement completed a five wave structure for minuette wave (c) before price turned higher to begin minute wave x.

There is no Fibonacci ratio between minuette waves (a) and (c) within the expanded flat of minute wave w. Although minuette wave (b) is over twice the length of minuette wave (a) (which is unusual) and minuette wave (c) is longer than 2.618 the length of minuette wave (a) the subdivisions of this structure fit perfectly and rules are met. It is a slightly odd looking expanded flat correction, but it fits.

Minute wave x has no upper limit, it may make a new high above the start of minute wave w at 1,672.84.

Minor wave 4 is unlikely to be over in just three days. It is most likely to continue for at least another two days, and maybe another four days.

Minor wave 4 may unfold as a double flat, double combination or possibly (least likely) a contracting running triangle. The purpose of all these structures is to take up time and move price sideways so I am expecting very choppy, overlapping sideways movement overall for the next few days.

Minor wave 4 may find support at the lower edge of the parallel channel drawn on the daily chart and copied over here.

IF we push under EMA(13) .. we could test 1600 // the NYMO will give a the divergence we need back up