Last analysis expected a little more downwards movement from Apple before a correction. Price has not move lower. Price has moved higher but remains below the invalidation point.

I have considered various alternatives for this most recent movement down from the high at 465.75. I expect we are still in a new downwards trend which should increase downwards momentum over the next few weeks to months.

Click on the charts below to enlarge.

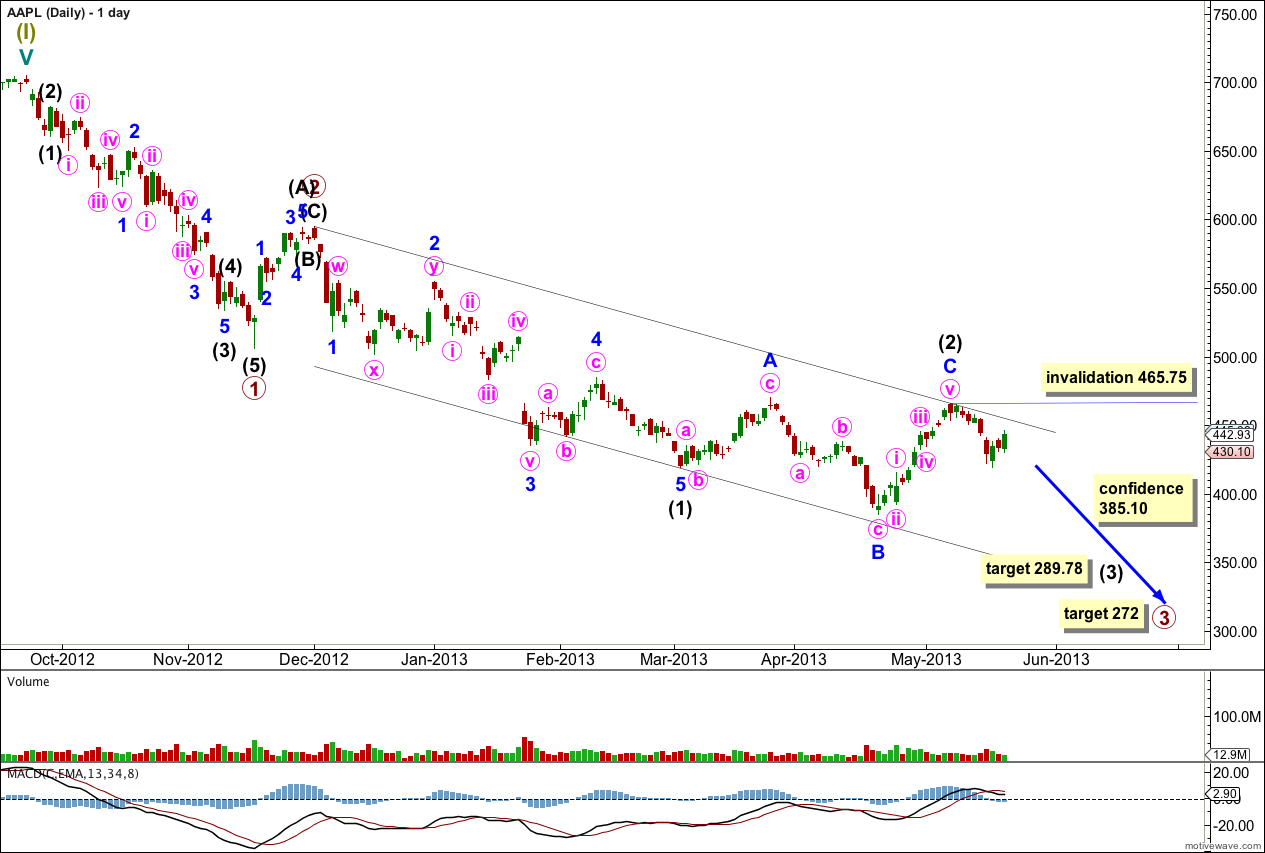

This wave count expects a five wave impulse for a cycle degree wave a is unfolding to the downside. Within the impulse primary waves 1 and 2 are complete. Primary wave 3 is extending. Within primary wave 3 intermediate waves (1) and (2) are complete. Intermediate wave (2) failed to move above the high of minor wave A at 469.95 and has completed as a rare running flat.

Within intermediate wave (2) minor wave C is just 2.17 short of 1.618 the length of minor wave A.

At 289.78 intermediate wave (3) would reach equality in length with intermediate wave (1). When there is more structure within intermediate wave (3) to analyse I will add a target calculation at minor degree for it to end, so this target will probably change.

At 272 primary wave 3 would reach 1.618 the length of primary wave 1. This long term target is still months away.

Within intermediate wave (3) no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement above 465.75.

I have considered various possibilities for this downwards movement from the high labeled primary wave 2. What is most clear is that the middle of primary wave 3 has not yet passed because we have not seen momentum increase beyond that seen for primary wave 1. Primary wave 3 cannot be complete.

When this next five wave impulse labeled primary wave 3 is complete we shall have to consider that may be the end of cycle wave a as a three wave zigzag if super cycle wave II is unfolding as a big flat correction. I will consider that alternative at the appropriate time if it remains a viable alternate.

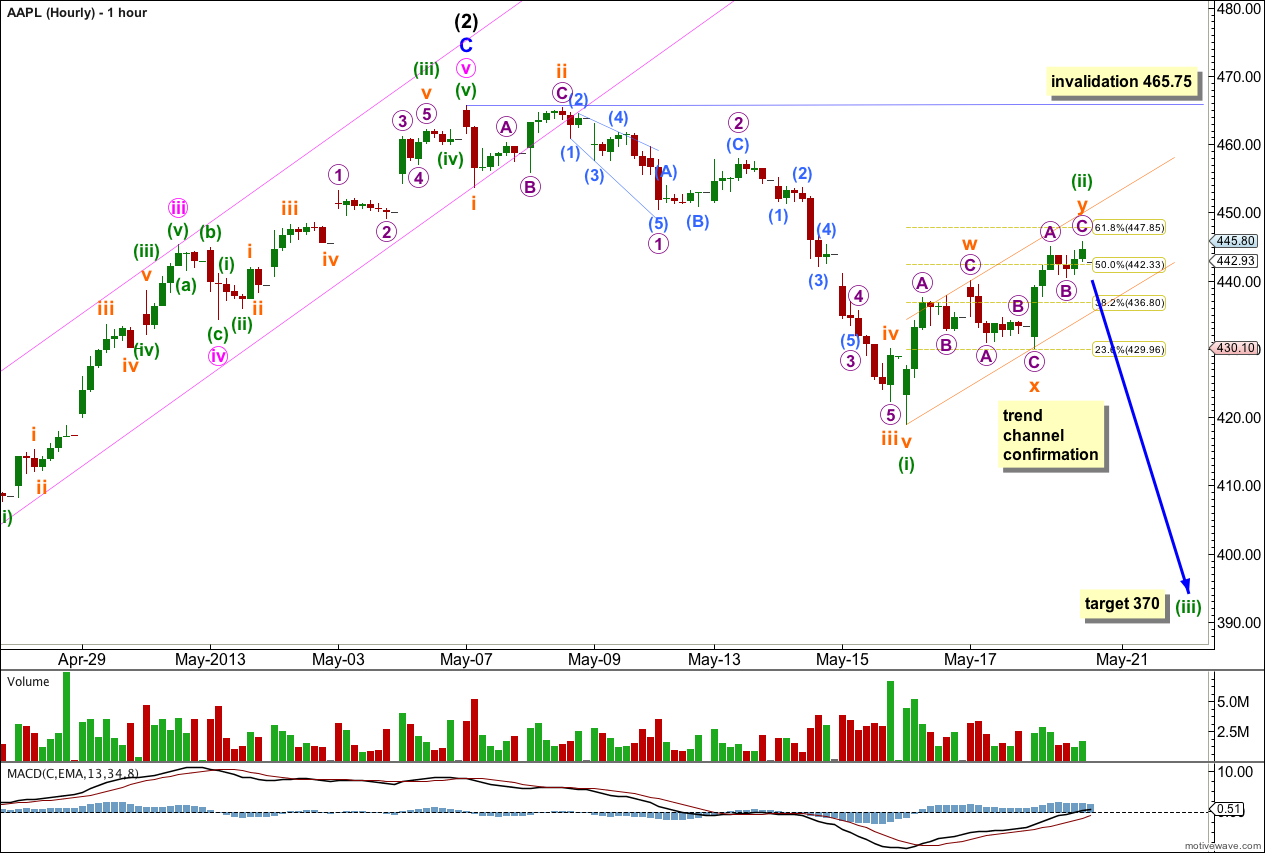

The breadth and depth of this upwards movement indicates it is a second wave correction to follow a first wave down.

The first wave labeled minuette wave (i) can be seen as a five wave impulse.

Ratios within minuette wave (i) are: subminuette wave iii has no Fibonacci ratio to subminuette wave i, and subminuette wave v is 0.95 short of equality with subminuette wave i.

Ratios within subminuette wave iii are: micro wave 3 is 0.43 longer than 1.618 the length of micro wave 1, and micro wave 5 has no Fibonacci ratio to either of micro waves 1 or 3.

Ratios within micro wave 3 are: submicro wave (3) has no Fibonacci ratio to submicro wave (1), and submicro wave (5) is just 0.53 longer than equality with submicro wave (3).

If minuette wave (ii) moves any higher (and it may) then it may end just a little above the 0.618 Fibonacci ratio at 447.85.

Movement below the parallel channel which contains minuette wave (ii) upwards would provide trend channel confirmation that the correction is over and third wave downwards should have begun.

At 370 minuette wave (iii) would reach 1.618 the length of minuette wave (i). If minuette wave (ii) moves higher then this target must move correspondingly higher also.

Minuette wave (ii) may not move beyond the start of minuette wave (i). This wave count is invalidated with movement above 465.75.