Last analysis expected it was most likely we should see overall downwards movement which should be choppy and overlapping, for another one to two sessions. This is not what happened. Price has moved higher so the probability the correction was brief and is over has increased.

I have two hourly wave counts for you today with the main wave count having a higher probability.

Click on the charts below to enlarge.

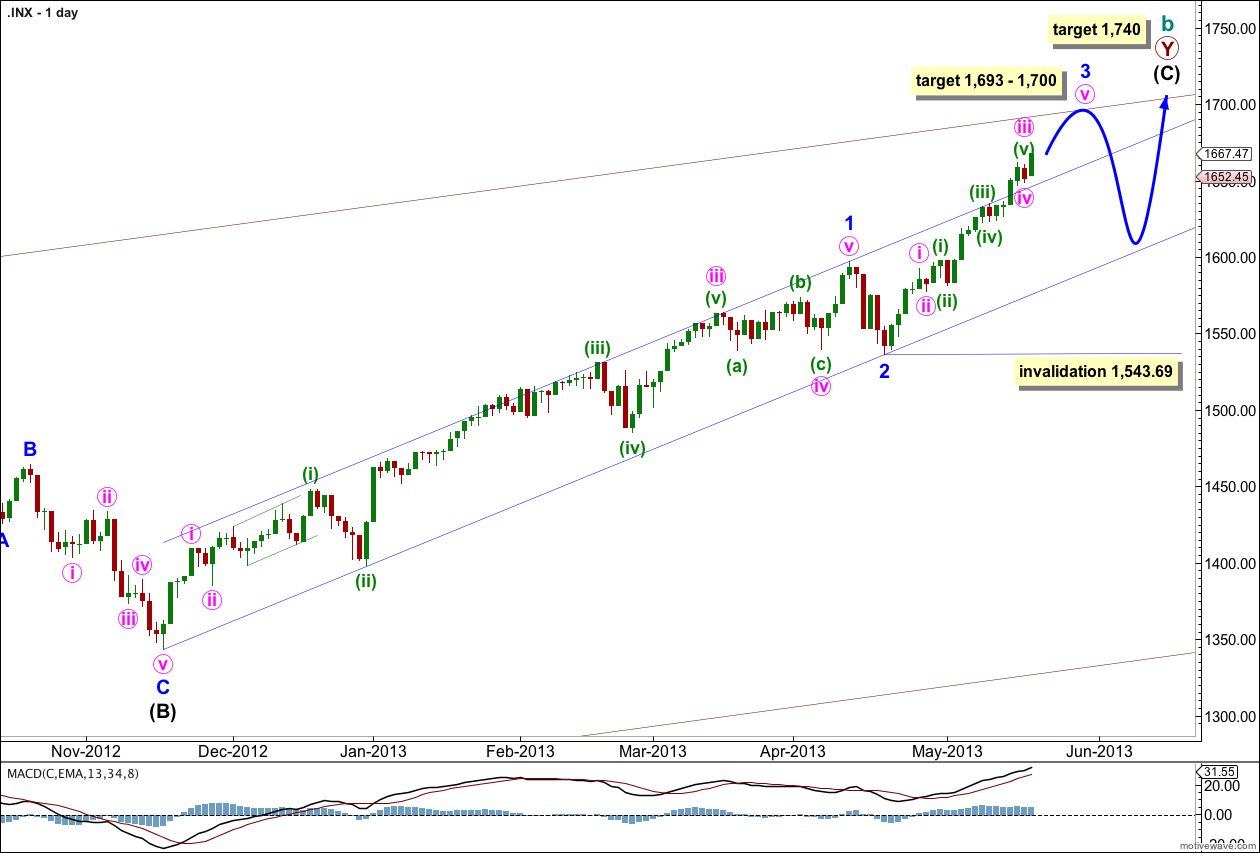

Within intermediate wave (C) minor wave 1 was extended. Minor wave 3 is showing an increase in momentum beyond that seen within minor wave 1.

So far within minor wave 3 minute waves i and iii may be complete. Minute wave iii has no Fibonacci ratio to minute wave i.

Minute wave iv may been over at the end of Thursday’s session and minute wave v may have begun on Friday. Alternatively, minute wave iv may be incomplete as a flat correction but this is less likely. The alternate hourly wave count looks at this possibility.

This wave count requires an end to minor waves 3, 4 and 5. Minor wave 3 is unlikely to be extended also and would most likely be 0.618 the length of minor wave 1. This is achieved at 1,693. At 1,700 minute wave v within minor wave 3 would reach 0.618 the length of minute wave iii.

Minor wave 5 would most likely be equal in length to minor wave 3, or it may be 0.618 the length of minor wave 3. If minor wave 3 is shorter than minor wave 1 then minor wave 5 would be limited to no longer than equality with minor wave 3 because a third wave may never be the shortest.

At 1,740 intermediate wave (C) would reach equality with the orthodox length of intermediate wave (A). When minor waves 3 and 4 within intermediate wave (C) are complete I will use calculations at minor degree to add to this target so it may change or widen to a zone.

Within minor wave 3 if we move the degree of labeling all down one degree and are yet to see a minute wave ii correction then minute wave ii may not move beyond the start of minute wave i. This wave count is invalidated with movement below 1,543.69.

The very wide maroon trend channel shown here is copied over from the monthly chart. We may find this movement ends as it finds resistance at the upper trend line.

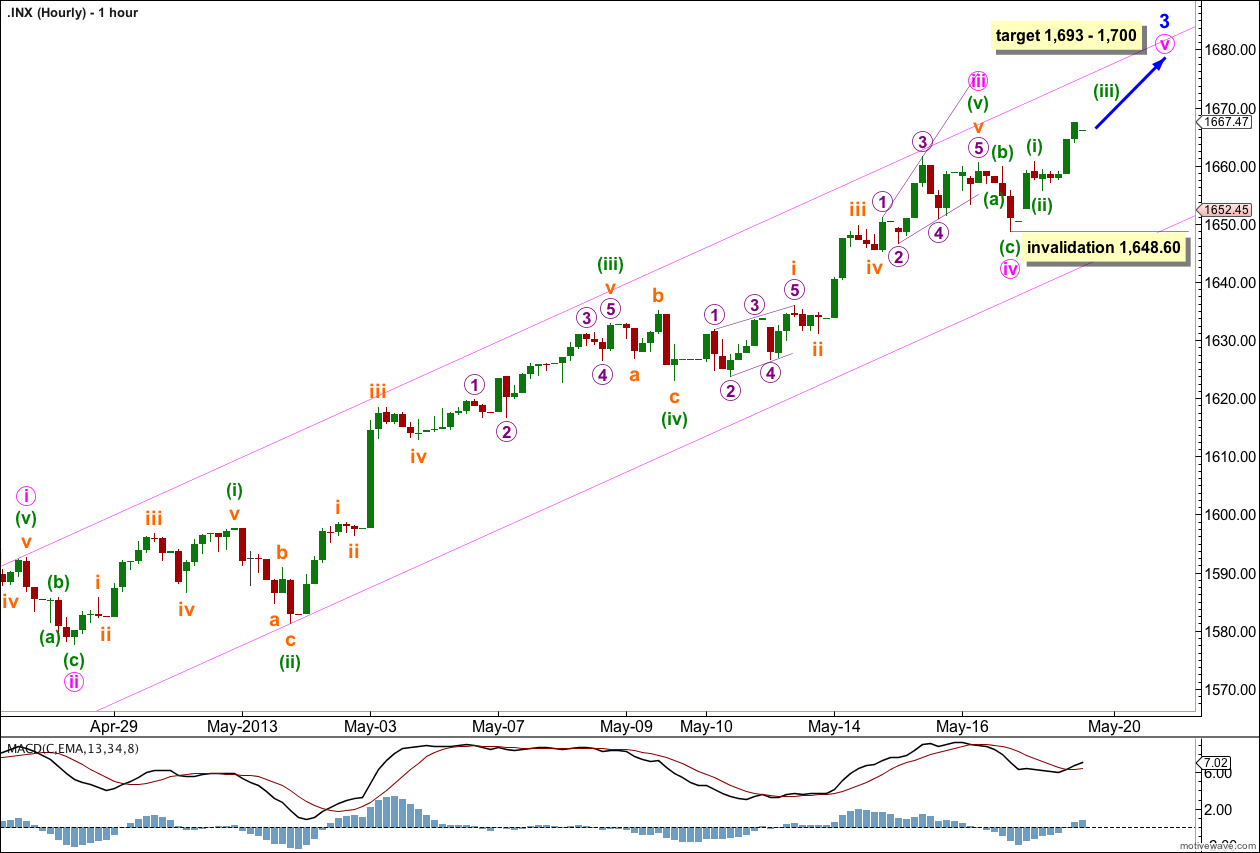

Main Hourly Wave Count.

It is possible that minute wave iv ended at the end of Thursday’s session and minute wave v has begun. On the five minute chart minute wave iv subdivides nicely into a zigzag structure with no Fibonacci ratio between minuette waves (a) and (c) within it.

There is a little alternation between minute waves ii and iv. They are both shallow zigzags but there is alternation within them. Minute wave ii was a 27% correction of minute wave i, and within it minuette wave (a) is longer than minuette wave (c). Minute wave iv is much shallower at 14% of minute wave iii and within it minuette wave (c) is much longer than minuette wave (a).

So far to the upside we do not have a clear five on the hourly chart so we cannot confirm that minute wave iv is over and minute wave v is underway. We may have clarity in one more session. However, this main wave count does have a higher probability than the alternate below.

At 1,700 minute wave v would reach 0.618 the length of minute wave iii.

Within minute wave v no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement below 1,648.60. If this wave count is invalidated with downwards movement on Monday or Tuesday we should use the alternate below.

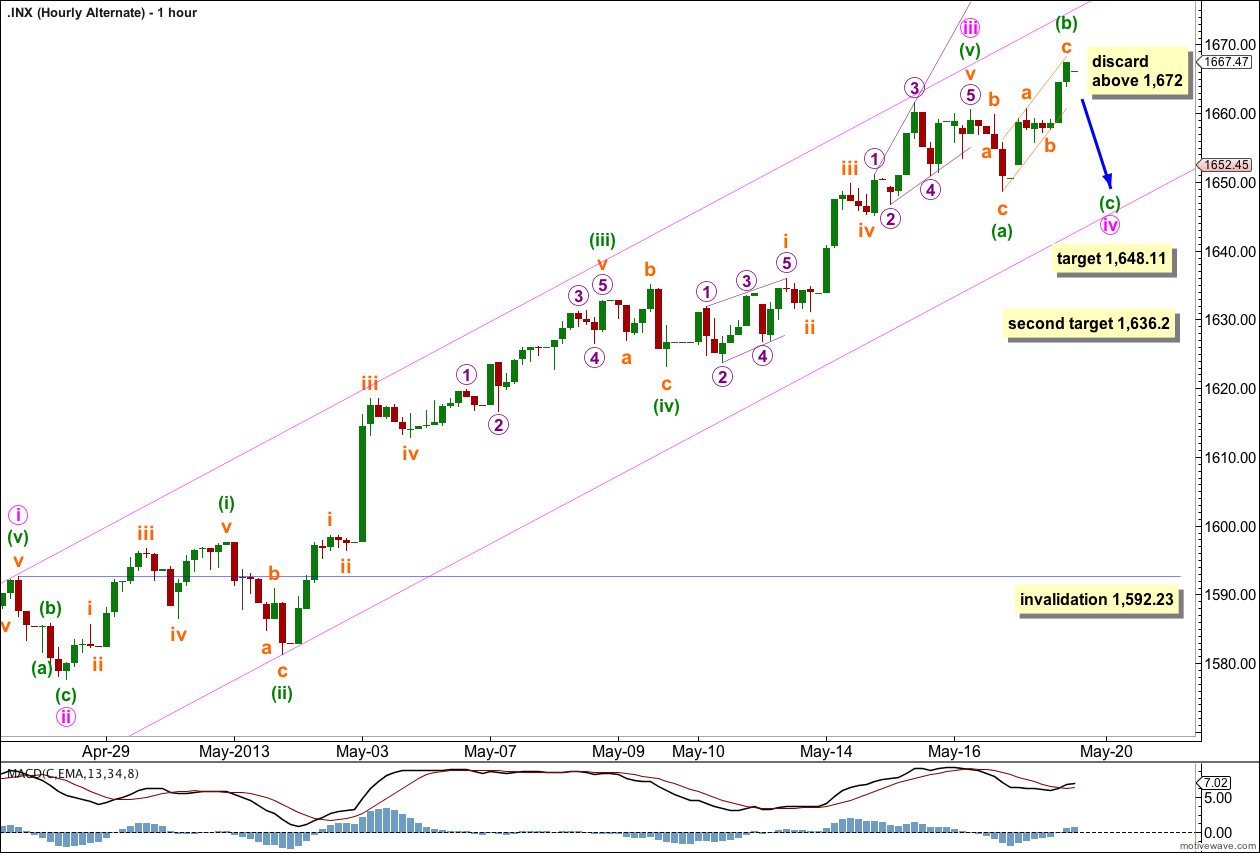

Alternate Hourly Wave Count.

Because so far to the upside we may have a three wave structure this may be minuette wave (b) within minute wave iv if it is continuing further as an expanded flat correction.

An expanded flat requires minuette wave (c) to move substantially beyond the end of minuette wave (a) which indicates the second lower target would be more likely. At 1,636.2 minuette wave (c) would reach 2.618 the length of minuette wave (a). At 1,648.11 minuette wave (c) would reach 1.618 the length of minuette wave (a) and would end just below the end of minuette wave (a).

Within an expanded flat correction there is no maximum limit to the length of a B wave in relation to its A wave, but a B wave longer than twice the length of the A wave is so unlikely that at that stage the wave count should be discarded. At 1,672 minuette wave (b) would reach twice the length of minuette wave (a) and any movement above that point would see this wave count discarded.

Minute wave iv may not move into minute wave i price territory. This wave count is invalidated with movement below 1,592.23.