Last analysis expected upwards movement for the main wave count which is what we have seen. Price has now made a new high and the alternate wave count is invalidated.

I have just the one daily and one hourly wave count for you today.

Click on the charts below to enlarge.

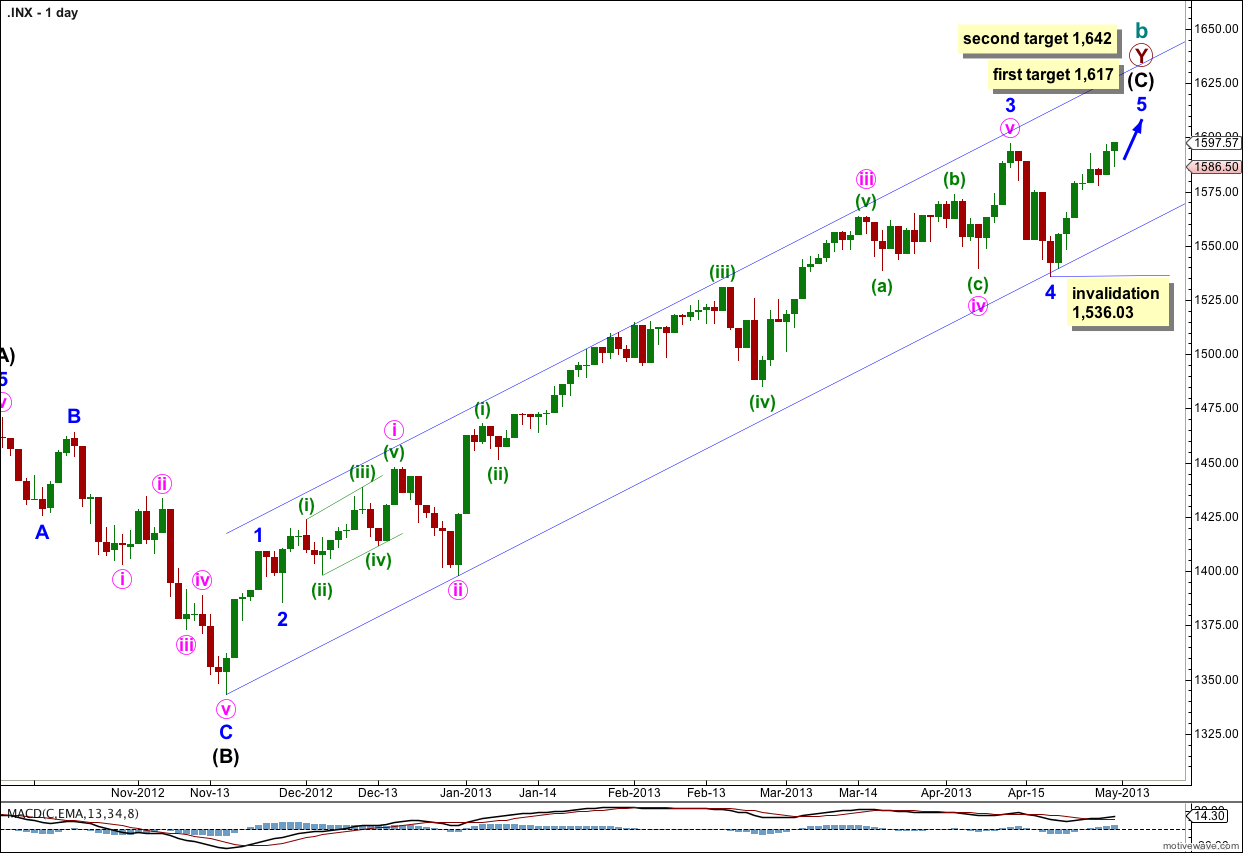

This upwards trend is an incomplete structure and we should expect to see further upwards movement. I have adjusted the targets to fit better with the structure as seen on the hourly chart.

I have redrawn the channel. Draw the first trend line from the start of intermediate wave (C) to the low of minute wave iii within minor wave 3. Place a parallel copy to contain all this upwards movement. So far this channel shows very closely where price is finding support and resistance and should continue to do so.

I have adjusted the wave count within minor wave 3 to fit better with MACD as an indicator of momentum. This labeling also has better Fibonacci ratios.

Ratios within minor wave 3 are: minute wave iii is just 1.7 points longer than 2.618 the length of minute wave i, and minute wave v is 4.72 points short of equality with minute wave iii.

Ratios within minute wave iii are: minuette wave (iii) has no Fibonacci ratio to minuette wave (i) and minuette wave (v) is 0.69 points short of equality with minuette wave (iii).

Within intermediate wave (C) minor wave 4 is over and minor wave 5 is underway. Because there is no Fibonacci ratio between minor waves 1 and 3 I would expect to see a ratio for minor wave 5.

Looking at the structure of minor wave 5 on the hourly chart it looks like it may be longer than equality with minor wave 1. The next expected ratio would be at 1,617 where minor wave 5 would reach 0.382 the length of minor wave 1. If price continues upwards through this first target the next target is at 1,642 where minor wave 5 would reach 1.618 the length of minor wave 1.

Within minor wave 5 no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement below 1,536.03.

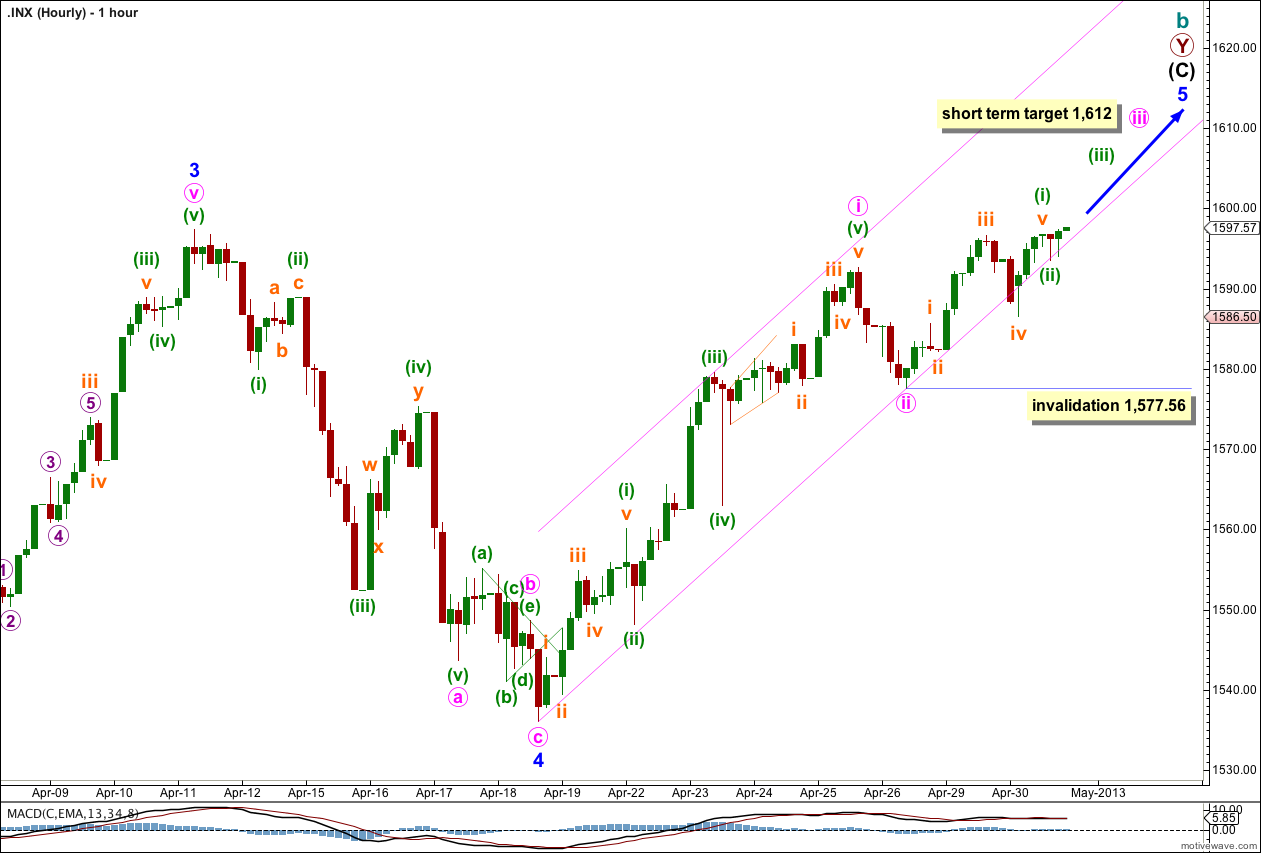

I have moved the degree of labeling within minute wave iii down one degree again. Momentum has failed to increase so the middle of this third wave has still not yet passed.

I have redrawn the channel on the hourly chart also. Draw the first trend line from the start of minor wave 5 to the low of minute wave ii. Place a parallel copy upon the high of minuette wave (iii) within minute wave i. So far downwards movement is finding some support about this lower trend line and may continue to do so.

Within minute wave iii minuette wave (i) is complete and minuette wave (ii) is probably complete. We should see an increase in upwards momentum tomorrow as the middle of this third wave unfolds.

At 1,612 minute wave iii would reach 0.618 the length of minute wave i. When we have the end of minuette waves (iii) and (iv) within minute wave iii I will use another wave degree, minuette degree, to refine this target so it may change.

Within minute wave iii if minuette wave (ii) is incomplete and continues lower it may not move beyond the start of minuette wave (i). This wave count is invalidated at minute wave degree with movement below 1,577.56.

S&P 500 will be at 1,700 on Halloween

Commentary: Sam Eisenstadt weighs in with a new forecast http://www.marketwatch.com/story/sp-500-will-be-at-1700-on-halloween-2013-05-01?dist=tbeforebell // looks like Sam has the same ideas

I am interested in your reasoning for labelling Minor wave 4 (blue) the way you have. Why not label minute wave 1 (pink) where you have labelled minuette wave 1 (green). This would enable minute wave 2 to be labelled where you have put minuette wave 2 and minute wave 3 and 4 where you have labelled minute wave 1 and 2. I cannot see any rules/guidelines that would prevent this labelling which would mean we are about to enter into the 3rd wave of the final fifth wave rather than the third wave of the third wave of the final fifth wave. Just interested in your reasoning for the labelling. Thanks!

Like this: Alternate Idea

You’re right. That would fit quite nicely. It fits with momentum too very well. The original target would work well with this idea; at 1,602 minute v would equal minute i.

Honestly. I think the only reason why I have the count I do and not this one is I changed the labeling for pink i to end at 1,592.64 and got stuck there. It has such nice rations.

If I don’t see momentum increase this could be why.

They have the same invalidation points at 1,577.56.

Yes. That is exactly what I was trying to say. Glad that you cannot see it being invalidated in any way. Seemed to have a good look for me so that is why I asked the question.

Sorry for the late reply but I had to go out all afternoon. Thanks very much for your reply and doing the chart. I was rushed when I sent thaat message hence why I did not provide the chart. Thabks Lara!