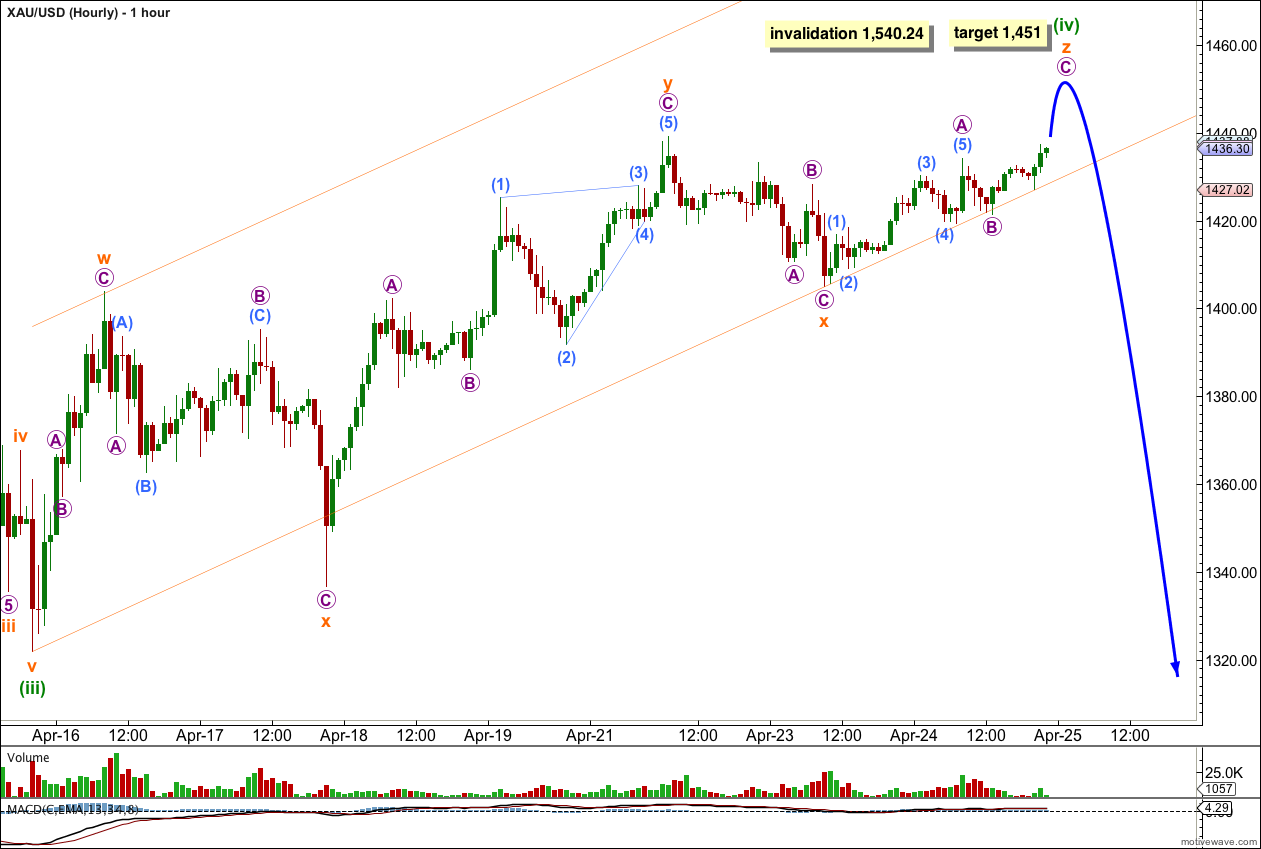

Last analysis of gold expected it was likely that a fourth wave correction was over and price should move lower. However, it was also stated that without a clear five down and a new low we could not eliminate the possibility that the fourth wave correction may continue. This is what has happened. Price remains below the invalidation point at 1,540.24 and the wave count remains valid.

Click on the charts below to enlarge.

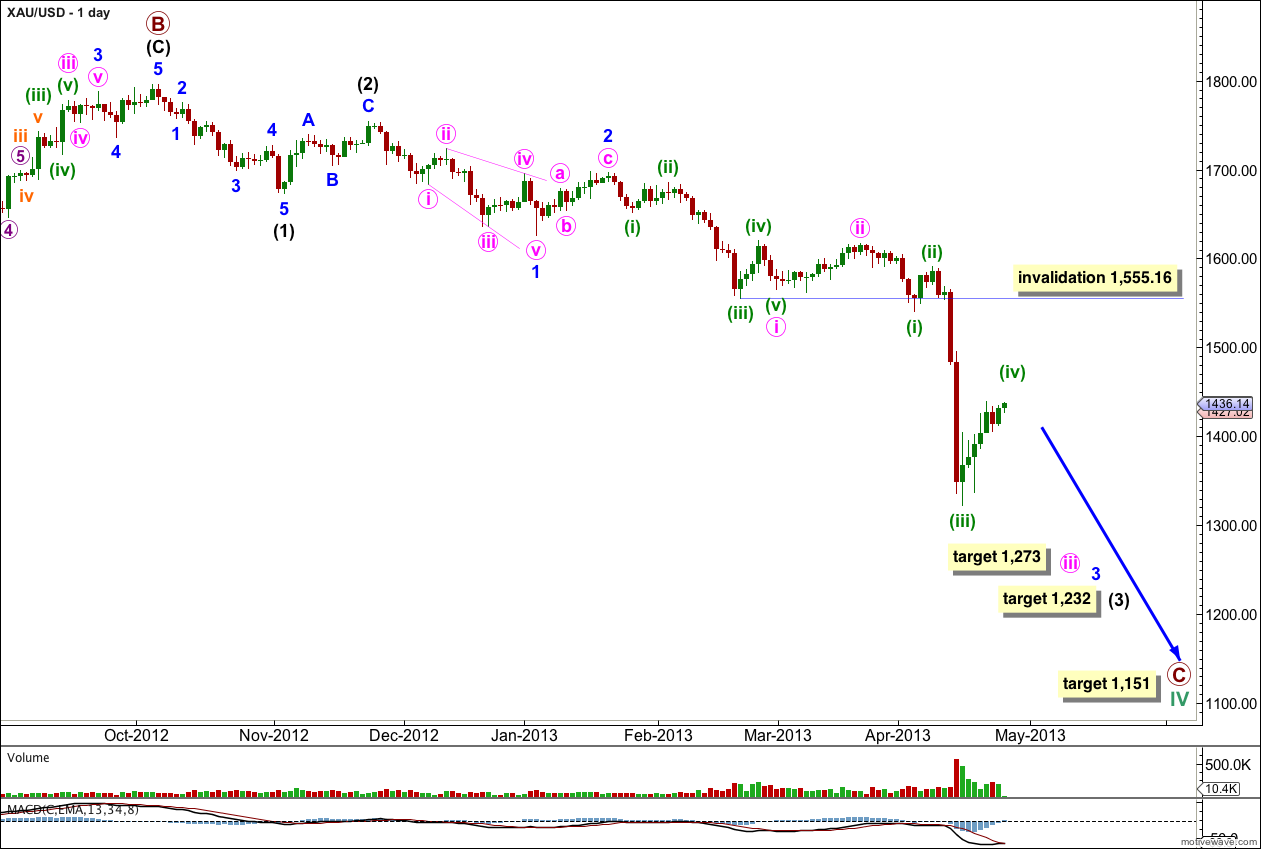

This daily chart focuses on the new downwards trend of primary wave C.

Within primary wave C intermediate waves (1) and (2) are complete. Intermediate wave (3) is underway and may have just passed the middle of it.

Within intermediate wave (3) minor waves 1 and 2 are complete and minor wave 3 may have just passed the middle of it.

Within minor wave 3 minute waves i and ii are complete and minute wave iii is nearing its end.

At 1,273 minute wave iii would reach 2.618 the length of minute wave i. This gives us a short term target zone of only $6 which should be met within the week.

At 1,232 intermediate wave (3) would reach 4.236 the length of intermediate wave (1).

At 1,151 primary wave C would reach 1.618 the length of primary wave A.

When minute wave iii is complete then the following correction for minute wave iv may not move back into minute wave i price territory. This wave count is invalidated with movement above 1,555.16.

There are thirteen possible corrective structures. This is the crux of the difficulty with Elliott wave analysis. Which structure will unfold? When is it over?

I have looked at several different possibilities for this fourth wave correction and each possibility concludes that it cannot be over. I expect some more upwards movement.

The best fit in terms of subdivisions is a rare triple zigzag structure.

Within the first zigzag of the triple, subminuette wave w, micro wave C is 1.69 longer than equality with micro wave A.

Within the first subminuette wave x there is no Fibonacci ratio between micro waves A and C.

Within the second zigzag of the triple, subminuette wave y, there is no Fibonacci ratio between micro waves A and C.

Within the second subminuette wave x there is no Fibonacci ratio between micro waves A and C.

Subminuette wave z is incomplete. At 1,451 micro wave C within subminuette wave z would reach equality in length with micro wave A.

We may draw a best fit parallel channel about minuette wave (iv). So far most movement is contained within this channel, only the first subminuette wave x overshoots the channel. When this channel is clearly and strongly breached by downwards movement we shall have an indication that minuette wave (iv) is over and minuette wave (v) is underway.

Minuette wave (iv) may not move into minuette wave (i) price territory. This wave count is invalidated at minute wave degree with movement above 1,540.24.