Last week’s analysis had a short term target for some upwards movement at 89.21 to 89.41.

Price has moved higher and so far is 0.23 above the target. But the structure is incomplete. I have calculated a new target for you this week.

Click on the charts below to enlarge.

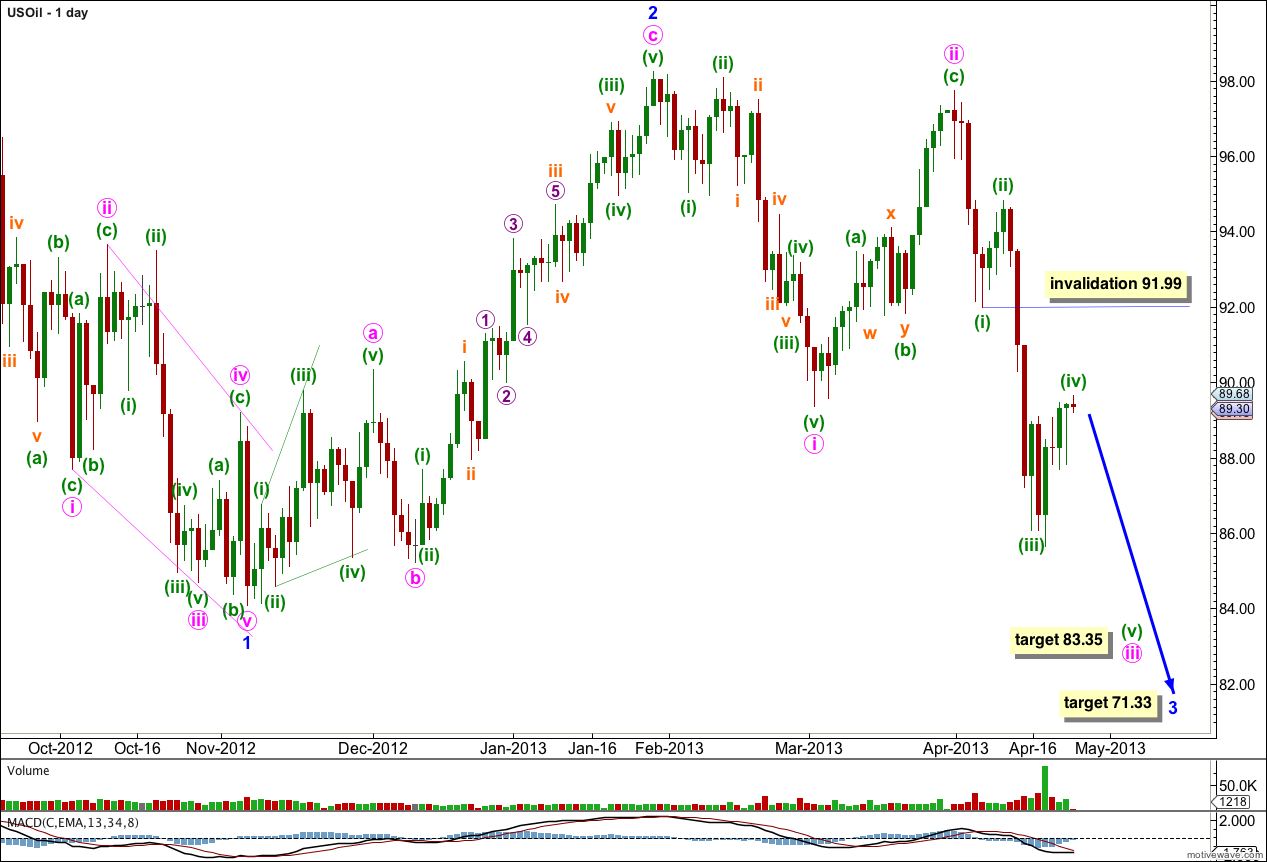

This wave count sees US Oil in a third wave downwards at intermediate degree, within a primary wave C down.

Within intermediate wave (3) minor waves 1 and 2 are complete.

Within minor wave 3 minute waves i and ii are complete. Within minute wave iii minuette waves (i), (ii) and (iii) may be complete. Recent movement may be minuette wave (iv). Minuette wave (iii) was 0.54 short of 1.618 the length of minuette wave (i). I would not expect to see a ratio between minuette wave (v) and either of minuette waves (i) or (iii).

Minuette waves (i) and (iii) both lasted four days. Minuette wave (ii) lasted a Fibonacci three days. So far minuette wave (iv) has lasted six days. If it continues for another two days it would have lasted a Fibonacci eight.

Minor wave 3 must make a new low below the end of minor wave 1 at 84.07.

At 71.33 minor wave 3 would reach 1.618 the length of minor wave 1.

Minuette wave (iv) may not move into minuette wave (i) price territory. This wave count is invalidated with movement above 91.99.

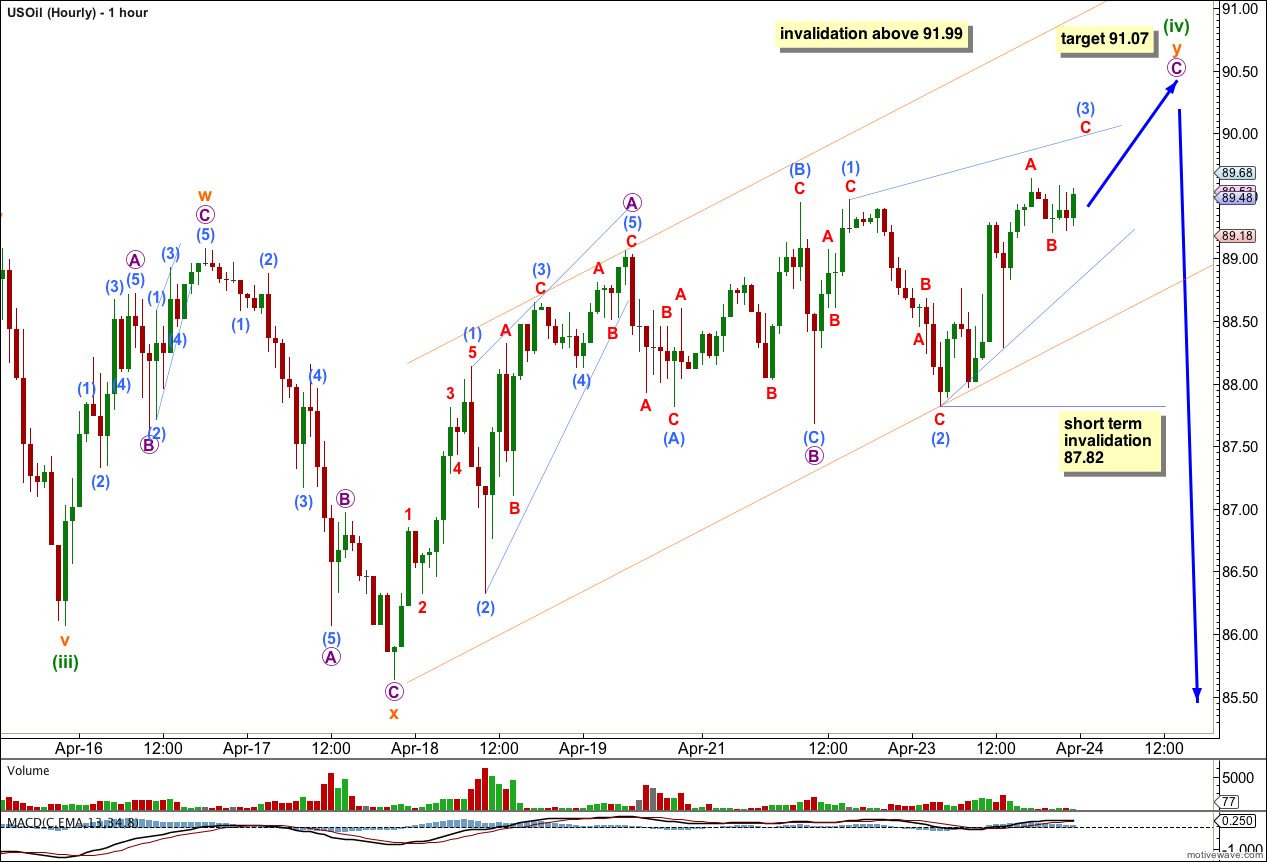

So far the structure within minuette wave (iv) has the appearance and behaviour of an expanded flat, but the subdivisions of a double zigzag.

The key is the upwards movement labeled subminuette wave w. This cannot be seen as a five wave structure. It subdivides into a three.

Within the second zigzag labeled subminuette wave y micro wave A subdivides into a leading contracting diagonal. Micro wave B is an expanded flat. Micro wave C so far looks most likely to be an ending diagonal because within it submicro wave (1) subdivides on the fifteen minute chart as a zigzag.

Within an ending diagonal all the subwaves must subdivide into zigzags. This is the only time you would see a third wave labeled as anything other than an impulse. Within an ending diagonal it must be a zigzag.

Within the ending diagonal of micro wave C submicro wave (4) should overlap back into submicro wave (1) price territory, and may not move beyond the end of submicro wave (2). This wave count is invalidated with movement below 87.82 before the structure of micro wave C is complete.

At 91.07 micro wave C would reach equality in length with micro wave A. This target may be two days away.

When micro wave C ending diagonal is complete we should expect new downwards movement for minuette wave (v).

Draw a channel about subminuette wave y as a best fit. When this channel is clearly breached by downwards movement then expect that minuette wave (iv) is complete and minuette wave (v) downwards has begun.